Fee Income In Lending Is Crucial For Banks

Historically, community banks have relied on net interest margin (NIM) instead of fee income to drive return on equity (ROE). In contrast, larger banks have emphasized non-interest income rather than NIM to boost ROE and revenue. For example, 40% of JP Morgan’s commercial banking revenue is derived from fee income, and JP Morgan’s commercial banking division is composed of middle-market and commercial real estate (CRE) lending. Community banks have overlooked fee income because of the lack of analytics on how fee income translates to revenue and profitability. We used a RAROC model and ran various scenario analyses for a typical community bank loan based on different loan terms, with and without fee income, and we show that community banks’ commercial loan performance would significantly benefit by generating just 25bps in additional fee income.

Industry Comparison of Fee Income

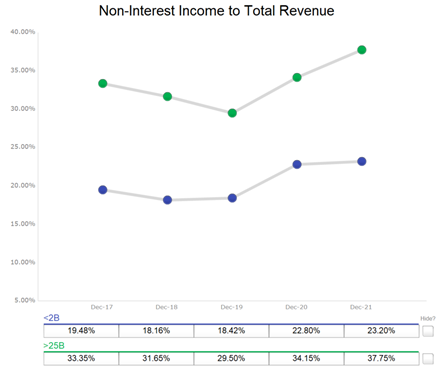

Larger banks have historically operated on thinner NIM but higher fee income. The graph below compares fee income (non-interest income) to total revenue from 2017 to 2021 for banks over $25B (81 largest banks) and banks under $2B (4,004 community banks). On average, the national banks generate 62% more fee income as a percentage of total revenue.

Loan Term, Prepayment Speeds, and ROE Impact

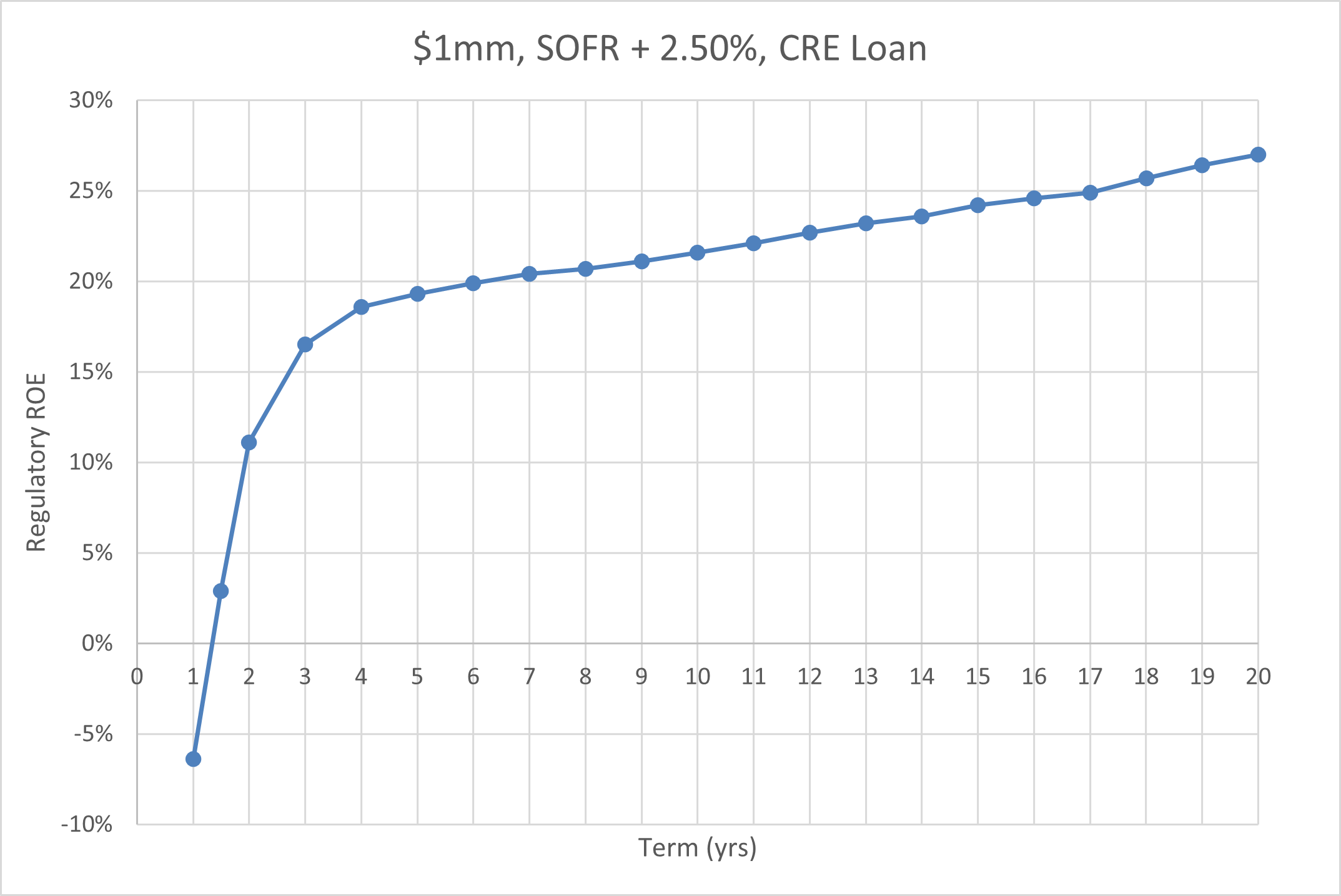

Commercial loans amortize and prepay, and these two parameters change loan profitability. Shorter-term loans, higher amortization speeds, and faster prepayment speeds all change the ROE of a typical commercial loan. The average community bank must replace about 50% of its loan portfolio every year, and this rapid loan prepayment decreases a bank’s ROE. The graph below shows a $1mm, SOFR + 2.50% CRE loan, assuming an average acquisition and maintenance cost, 1.25x debt service coverage, 75% LTV, and no other revenue.

Loans with one year expected life have negative ROE – this makes sense since the customer acquisition cost cannot be recouped with such a short revenue stream. That standard commercial loan takes about three to four years to reach an acceptable ROE. Yet the average community bank loan term is only two years using the expected term, amortization, and prepayment speeds.

Why Fee Income Is Important

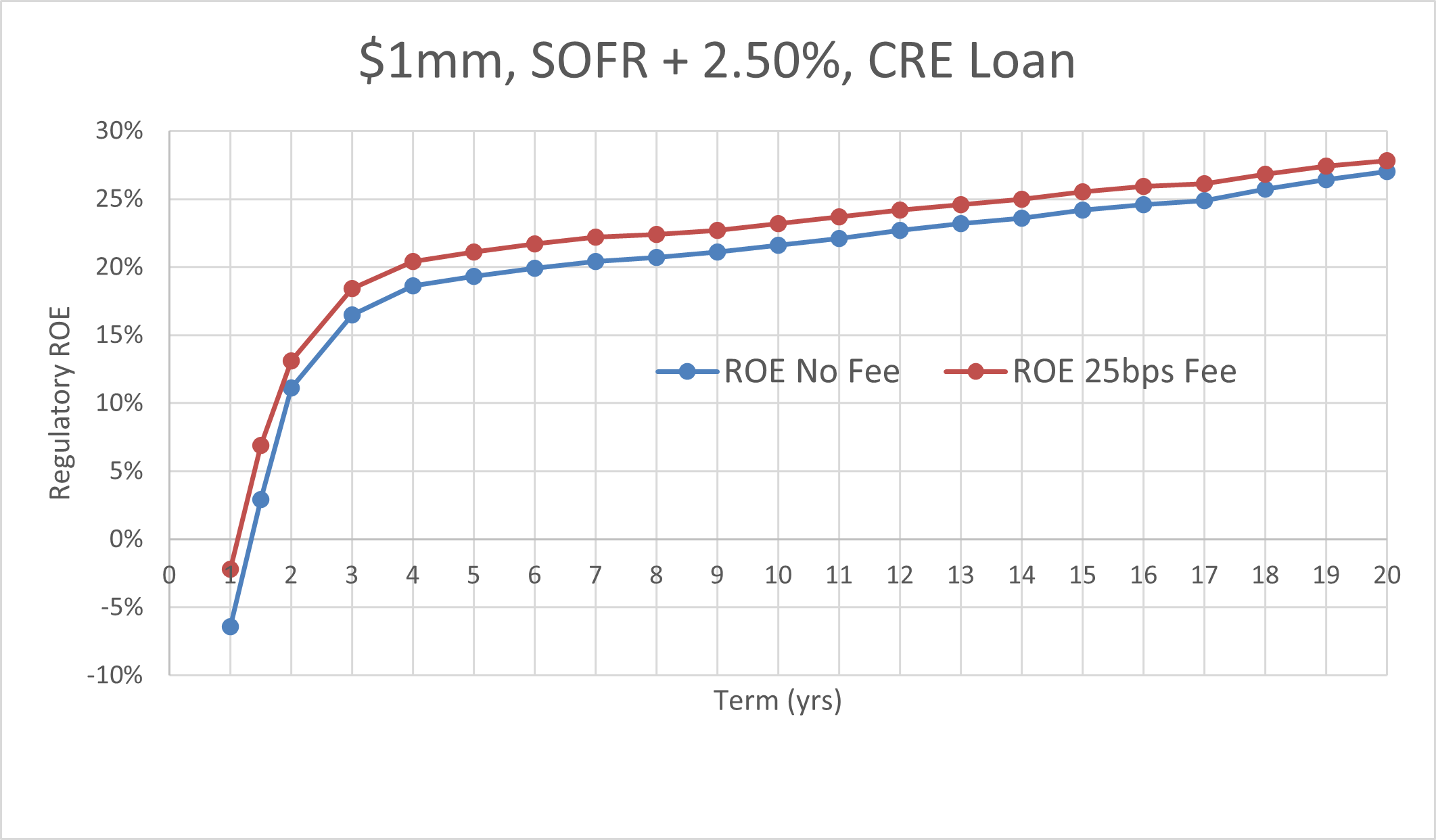

Fee income on commercial loans is compelling because it magnifies the value of the fee over the life of the loan, but the more significant benefit of the fee is recognized in the early years of the loan. Non-interest income can make shorter loans more profitable. The graph below shows the ROE on the same $1mm loan but compares that ROE with a loan that generates 25bps in hedge fee income.

While the borrower would pay the same rate on either loan, the loan with the 25bps hedge fee earns the bank an immediate one-time fee (but a lower NIM). The loan with the fee generates a higher ROE assuming any loan term. However, the impact of the fee is more significant in the first few years of the loan (4.00% higher ROE in the first two years). The hedge fee helps banks with shorter loan portfolios or those with higher prepayment speeds. Given a choice, community banks should prefer a fee, but banks with shorter loan terms or higher prepayment speeds can benefit more.

Conclusion

Historically, hedge fees have mainly been the domain of national banks. However, community banks can also generate hedge fee income, and the amount of these fees can make a marked impact on community banks’ performance. As loan prepayment speeds increase, the benefit of hedge fees multiplies, generating higher returns. Community banks should be looking for every opportunity to generate fee income, and hedge fees on commercial loans make sense in many instances, especially in today’s interest rate environment.