The AI Stack for Bankers to Master Gen AI in 2026

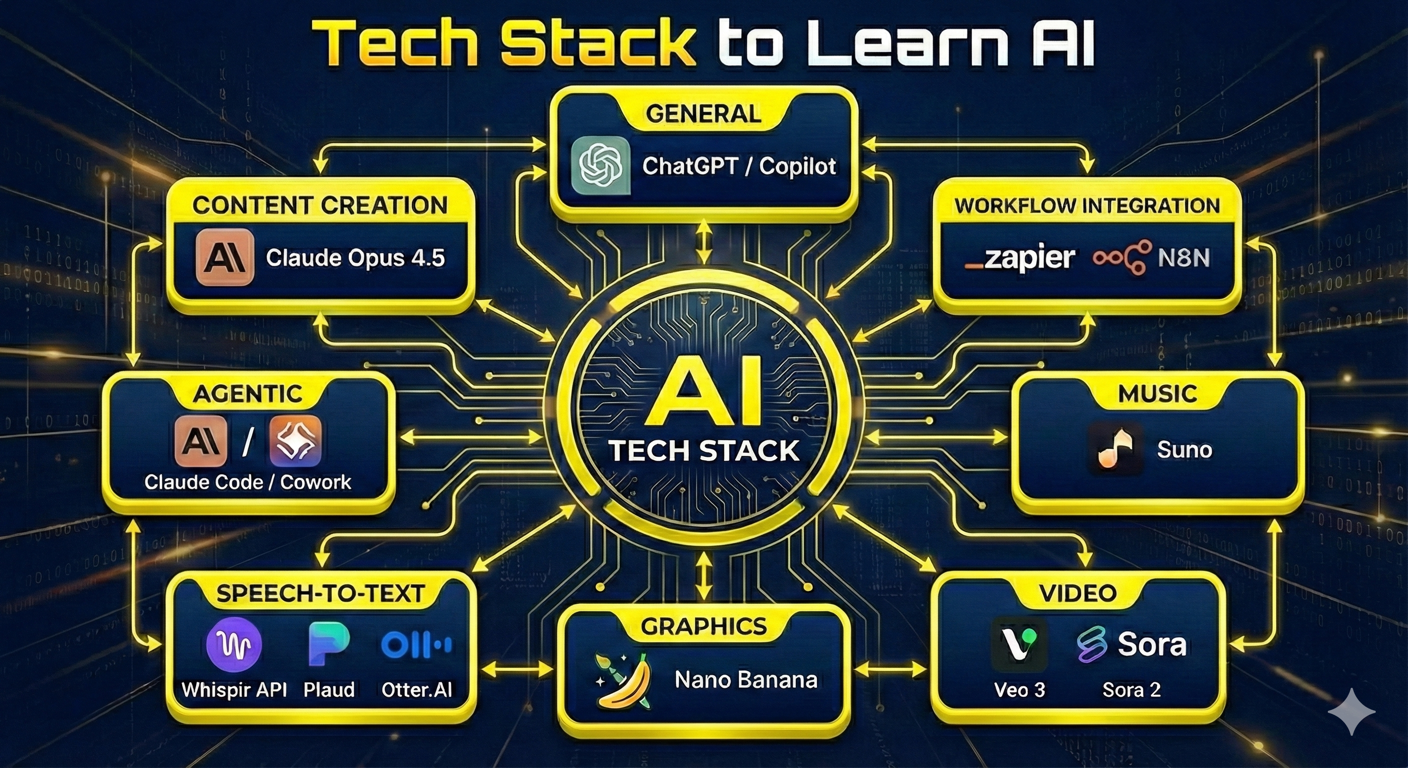

If there was ever a skill to learn in banking in 2026, it’s artificial intelligence. It is impacting every facet of banking from Amortization to Zero-balance accounts. Since it is likely your bank restricts AI, it then falls to you to learn it on your own to help inform your bank on its use. In this article, we focus not only on the best AI stack to to promote your personal education, but key concepts that should remain timeless to help your bank.

Optimize the System Not the Tool

It’s likely that you or your bank are thinking along a single dimension when it comes to AI. Your goal isn’t to use the best model, but the best model for a given task. The conclusion that you will quickly come to at the end of this article is that your bank may need multiple models to accomplish enterprise-wide tasks. By learning multiple models, you will get a feel how various models work, what they excel at and where they fall short.

That said, we will explore the concept of when the next best model is sufficient to accomplish a task that is good enough not to provide the benefit of another model.

We evaluate a variety of models against real banker work from content creation to financial analysis to determine what is the right model to train yourself on that might be applicable to an enterprise application. In addition, we will also provide some tips, pricing, and links to the recommended models.

Best All-Around Model: ChatGPT

As banks modernize their operating environments, the case for adopting a single, enterprise wide general AI model, such as ChatGPT or Microsoft’s adaptation, Copilot, has never been stronger. If you can only learn one platform or have one application at the bank, Copilot is likely it. The platform provide a consistent, secure, and highly capable foundation for generative AI across the entire institution, enabling every business line to work from the same baseline of intelligence while still tailoring use cases as needed.

Microsoft Copilot, for example, already demonstrates measurable productivity and ROI within real banking environments. Banks routinely see 347–480 hours of time savings per month, translating to $35,000+ in monthly value, even before broad training or workflow optimization was introduced. Because Microsoft has built ChatGPT into common Microsoft tools such as Word, Excel, Teams, Outlook, and others, adoption is quick and productivity, immediate.

Beyond productivity, a standard model creates a safer and more scalable governance structure. Internal AI Governance Programs already classify ChatGPT powered copilots as formal GenAI systems, requiring oversight of usage, risk rating, privacy controls, and model change management. Choosing a single primary model simplifies this oversight dramatically. Instead of managing fragmented tools and inconsistent risk profiles, the bank manages one vetted platform with unified controls, auditability, and enterprise grade security.

Interoperability is another powerful advantage. Copilot combines a bank’s internal Microsoft 365 data with the ChatGPT 5 class foundation model to create a unified intelligence layer capable of supporting retrieval, drafting, analysis, and automation across business units. This alignment reduces the “tool sprawl” risk noted in governance research and increases the reliability and consistency of AI powered output across teams.

Finally, adopting a bank wide model builds cultural and strategic coherence. When every employee works from the same AI foundation, the institution accelerates learning, standardizes best practices, and ensures equitable access to modern productivity tools. Banks that have deployed Copilot enterprise wide observe rising adoption curves and rapid normalization of AI assisted work, with some regional banks achieving 75% adoption within weeks when paired with focused enablement efforts.

The UK government did its own 20,000 employee study with equally impressive results and material time savings (HERE).

In short, selecting ChatGPT or Copilot as the enterprise standard model provides a stable, governed, and future proof backbone for AI across the bank. It enables widespread productivity gains, strengthens compliance and risk management, and ensures that every business line benefits from a shared, continuously improving intelligence engine. For institutions preparing to scale their AI capabilities responsibly, there is no more strategic first step.

However, the future is multi-modal, so there are a variety of other models to try, at least on your own.

Most Like You: Claude Opus 4.5

The problem with ChatGPT is that it has its own stilted personality. It loves the em dash, its list-heavy, overly polite, very-heavy, too consistent in its sentence length, makes use of parallelism too much and is generic in tone. Sure, you can train those characteristics out, but few banks do.

Claude Opus, on the other hand, matches a professionally casual syntax nicely. The model will quickly adapt to everyone’s tone and writing style, making it immediately usable. It often gets content right on the first try without heavy editing. This factor helps bank adoption and productivity and might be the best model to start with.

This model is smart, efficient, easier to prompt than ChatGPT and another good all-around model that can be used for finance, coding, agents, presentations, spreadsheets, and deep research. API integration is as strong as the other models and its reasoning model is different than both Gemini and ChatGPT often providing a unique perspective.

This also makes Claude a good secondary model for banks using Copilot.

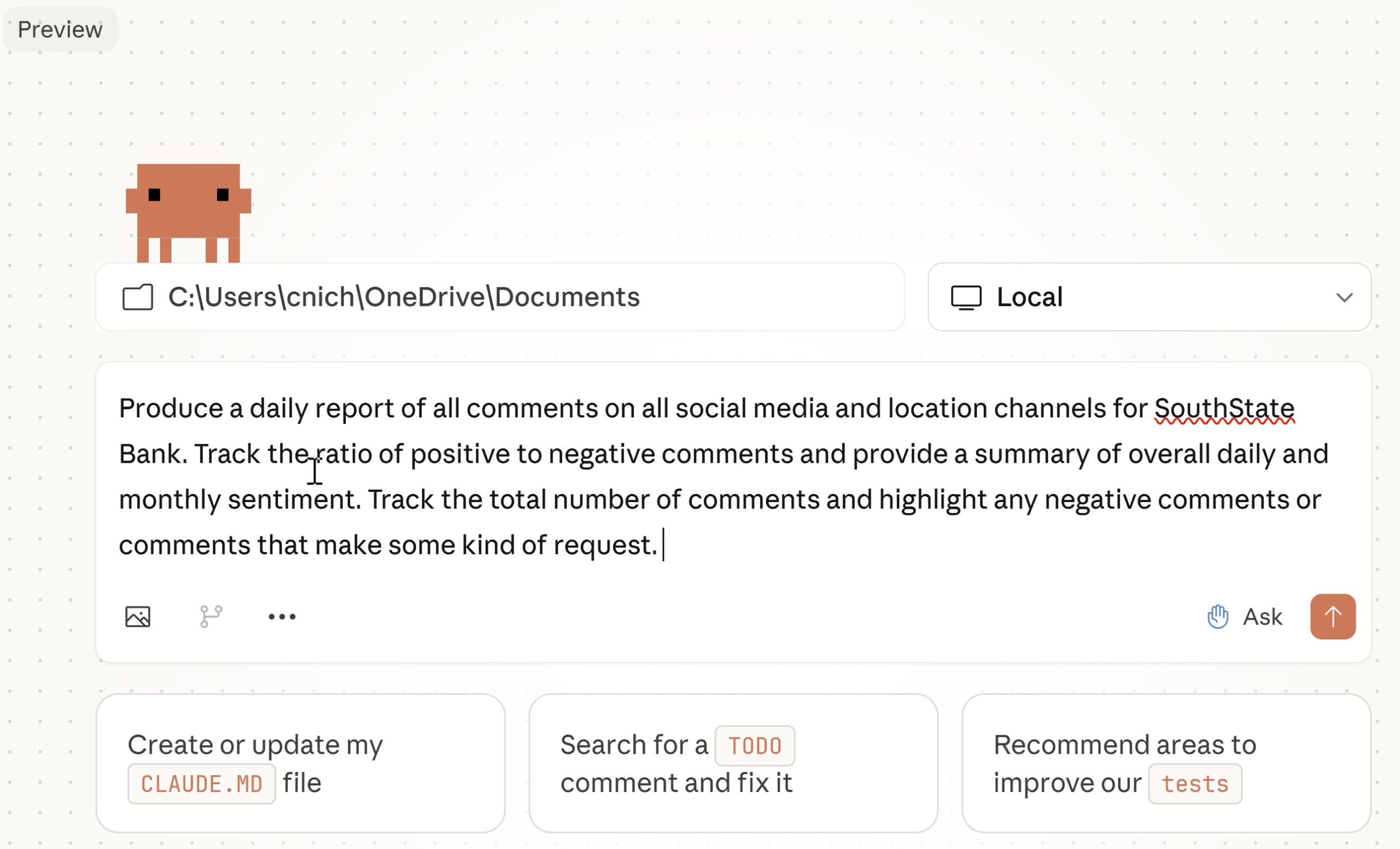

Best General Agentic Model: Claude Code

In the last month, Claude Code, and it’s no code version, Claude Cowork, has become the main character.

Where ChatGPT and Claude Opus are general purpose large language models, Claude Code is the marriage of a reasoning model and a coding agent. Claude Code uses Opus 4.5 and then has its own frameworks for creating and deploying code. It takes some intermediate technology knowledge but well within the realm of a business line developer to create and manage agents.

For example, using Claude Code you can create five-year business line budgets based on historical performance, create a widget that sums up social media and website comments about the bank, or automate notifications such as updating a CRM system for event attendance.

Claude Code and Claude Cowork are perfect for scaling workflow at bank marketing departments. Shoot a video and Claude Code can take snippets and add copy to create multiple posts for each social media channel to include LinkedIn, Tik Tok, X, YouTube, streaming channels, and Instagram. Claude Code is also excellent for creating landing pages.

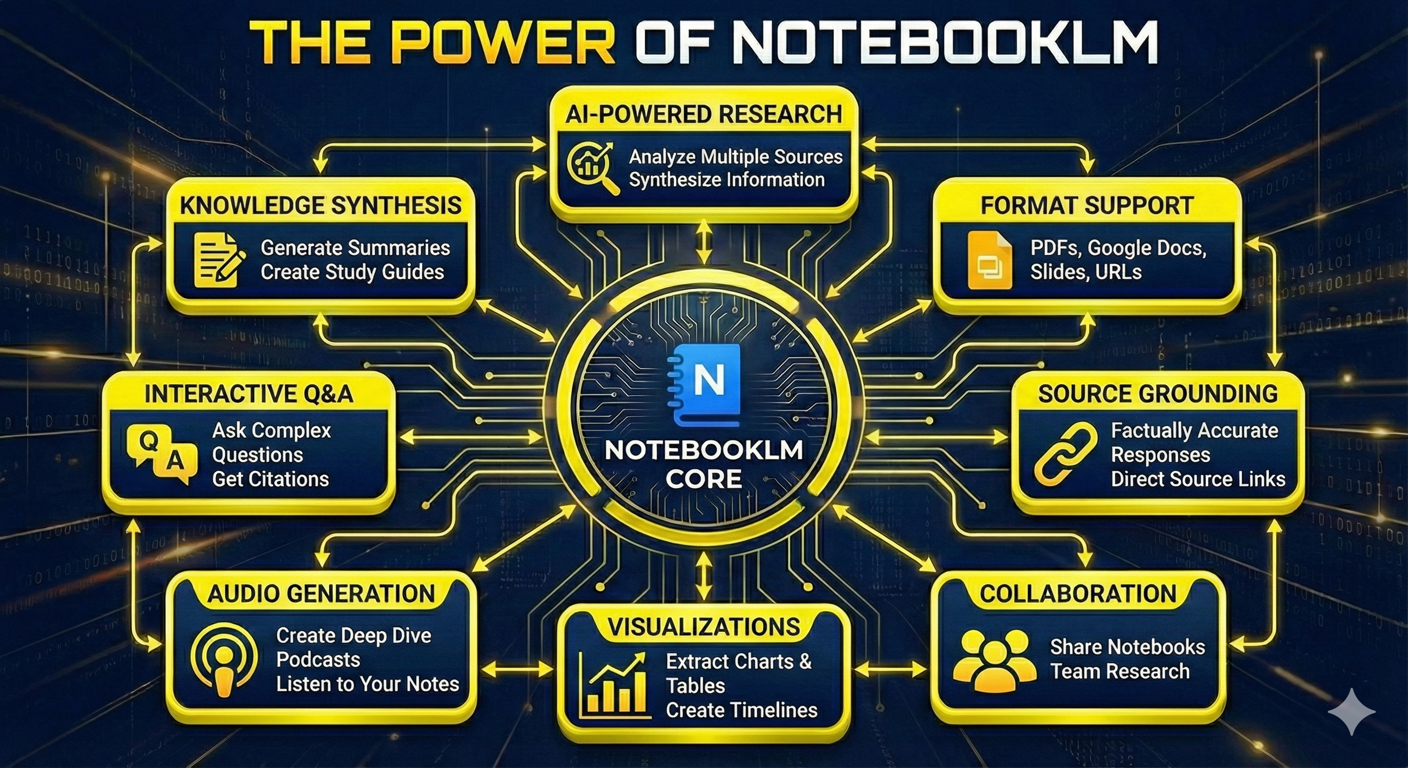

Learn Anything: Gemini + NotebookLM

If you need to learn a subject matter quickly, there is no better combo than Google’s Gemini LLM and its companion, NotebookLM.

Gemini remains the best model for having an in-depth conversation as it has one of the largest and most persistent memory archives of any model. Ask it questions about what blockchains are best for a bank stablecoin and it can go on for hours teaching you the ins and outs of various chains, opportunities, and risks as it pulls in available information from across the web.

NotebookLM, on the other hand, is best for when you want to limit your analysis to a set number of documents such as your bank policies, regulator guidance, or historical financial statements. Documents can be linked and uploaded to be then analyzed without data from the internet interfering with the answers.

Powered by Gemini, NotebookLM is the best single model at present for providing a secure and private repository of board and management information to be queried instantly should anyone have a question on division financial performance, earnings trends, or growth numbers. There is no more, “I will get back to you” as management will have the total sum of information plus instant analysis at their fingertips.

Another favorite use case of ours is to have Claude Code log in to earnings calls, create transcripts and denote bank trends and bank earnings highlights. You can then ask – what is each bank’s AI or stablecoin strategy and get a comprehensive breakdown.

If that is not enough, with a single click, you can turn multiple documents into a podcast, infographic, briefing book or presentation. One of my favorite uses is to review and summarize podcasts and YouTube postings while it checks for certain content such as a bank name or certain product.

The Best in Graphics: Nano Banana Pro

We have all been frustrated by ChatGPT’s misspellings or omissions of words when creating graphics. Gemini’s Nano Banana Pro model nails it almost every time (note graphics herein).

The model is the best for making presentation or blog content graphics, social media thumbnails, logos, or diagrams. While it is not perfect, it remains the most skillful model at producing professional grade images for all areas of the bank.

I would not call it enterprise-grade due to text inconsistencies. But for creative work, internal presentations, visual brainstorming — it’s unmatched.

The Best in Video: Sora or Veo 3

Take an image and turn it into a hyper-realistic video or animated short, Veo 3 is one of the best models for the task quickly followed by OpenAI’s Sora 2. What used to take professional equipment and knowledgeable production, now takes an exceedingly small fraction of the time for next to nothing. Either of these models will likely handle 80% of your bank’s video needs from highlighting your branches, making a montage of your employees or handling product demonstrations.

2025 ushered in the first time where a bank can create a set of characters that can be consistently used in multiple productions. Lighting looks cinematic and you can specify specific camera movements.

If you are in bank marketing or training, these must have apps to leverage your video production.

Best for Voice Recording: Whisper API, Plaud, or Otter AI

Our two main use cases here is recording notes to ourselves on the go or recording conference presentations. Whisper API, Plaud, or Otter AI are the favorites and beat most LLMs due to their specialty construction.

Wisper API and Plaud have proven the most accurate with a nod to Plaud for recognizing speakers from previous presentations and calls. It will then auto label the speakers to provide one of the most accurate records available. Whisper API is also highly accurate compared to alternatives that still struggle with various diction or background noise.

Otter AI is almost as accurate as Whisper API or Plaud but has the advantage of being able to add notes, highlights and pictures during a presentation thereby producing one of the most robust records of an event.

With faster banking, voice-to-text streamlines workflows by letting you dictate notes, which AI can refine into finished memos and reports.

Putting This Into Action: Combine Models

One final concept to consider here is there are also a variety of integration tools such as Zapier and n8n (“Nathan”) that are perfect for quickly integrating various workflows and tools. For example, you can record a presentation, have ChatGPT categorize the information, feed it to Zapier and it will store it in a single repository such as SharePoint or Google Docs. In similar fashion, you can use Microsoft’s Power Automate or agents from Copilot studio to accomplish much the same within the bank’s environment.

Any time you have a task that you repeat, consider using an agent to manage the task. You can build agents in Copilot, ChatGPT, Claude or other applications to review documents for compliance, check brand standards, manage vendor management, or submit marketing content for review.

The future of banking will largely be driven by bankers that can harness multiple models. If your bank isn’t ready for a multi-modal world now, it shouldn’t stop you for gaining the skills needed to work with an optimized tech stack for a given task. Learning how to use each of these tools and understanding the differences in the models will pay huge dividends over the course of 2026.

Keep experimenting and soon you will be matching the tool with the task.