Here Is a Comparison of 6 Bank Pricing Strategies

Unfortunately, bank product pricing is essentially an afterthought in our industry. Few bankers study bank pricing, and few apply quantitative rigor to pricing optimization. We often price products and services without regard to cost, we price small loans against competition that also has pricing wrong, and we pay little attention to our products’ perceived value or price elasticity. The lack of a data-driven pricing strategy is one major reason why most banks produce under their cost of capital. This article details bank pricing strategies and highlights some pricing concepts to lay the groundwork for better price optimization.

Get a Pricing Position First

First and foremost, it is crucial to establish a clear pricing position before selecting a strategy. The two are different. A pricing position is where you want to be in the market relative to your competition. Pricing position is closely related to your brand as it is an important signal to the market. Pricing strategy, on the other hand, is how you want to execute that pricing position over a period of time to achieve certain objectives. Without a defined pricing position or strategy, your bank cannot hope to create value through pricing. By having a clear understanding of the pricing position for each product and, ideally, for the bank as a whole, bankers can take control and be proactive in driving profit.

Regarding a pricing position, your bank needs to decide what it wants to be known for in the short and long term. Further, it must proactively determine how it wants to position each product or product bundle. Here, a bank essentially has six choices.

Banks can price their product at a premium, be low-cost/high deposit rate providers, or price in the middle. A bank may decide to be the low-priced provider to start to gain market share with the strategy of increasing it later. A bank may also choose to segment its customer base and price some product tiers low and others high in a hybrid or multi-pricing approach. Finally, a bank may decide to forgo a pricing position and price either randomly or dynamically off factors such as interest rates, demand, supply, or price sensitivities. Dynamic pricing is often tied to a behavior pricing strategy where you want to keep your competition guessing and your customers price-focused ready to pounce when you change the price to their favor.

When deciding pricing position and strategy, ten factors must be understood, including cost, how the competition is pricing, a bank’s brand value, the economic/societal environment, laws/regulations, the bank’s objectives, the product’s objectives, the perceived customer demand/behavior, the customer’s price sensitivities, and the supply of the product.

Why Banking is Unlike Any Other Industry

At this point, it is essential to highlight four significant banking differences that are rare in other industries.

The volume/price dynamic — If you are a manufacturer, when you sell a widget, you sell and price a single widget. When you sell a loan or a deposit, you sell a product PLUS a volume. More complicated is that this volume can often vary, as with a deposit. As such, unit pricing and yield management are more difficult than they are in other industries.

Average life/price dynamic – Once you buy a widget, its quality is set. However, once you purchase a loan or a deposit, the borrower’s and the bank’s position must be taken into account. Should a bank’s capital deteriorate or the deposit customer take on more risk, the relationship changes. This relationship often impacts pricing, as many troubled banks have found out. A bank needs to price not only the product now but in the future since that loan or deposit stays on the balance sheet for an average of almost six years.

Opaque Inputs—When you produce a widget, you are relatively certain of your costs. However, when you price a loan, the cost of that loan can change over time due to the average life/price dynamic previously discussed. Compounding this problem is that this change may not be transparent. Banks have a hard time knowing exactly their allocated credit or branch cost for any given product. This lack of transparency in cost inputs is another reason many banks underprice their products and services.

Infinite demand – Money is different. If you are selling a good, demand is often finite. Price water or electricity at zero, and there is only so much every household can utilize. Price credit at zero or deposits at a high enough rate, and demand goes parabolic to near infinity. As John Maxfield, the famous bank failure historian, often says – “bankers often need to impose their own supply curve on the market.”

Bank Pricing Strategies

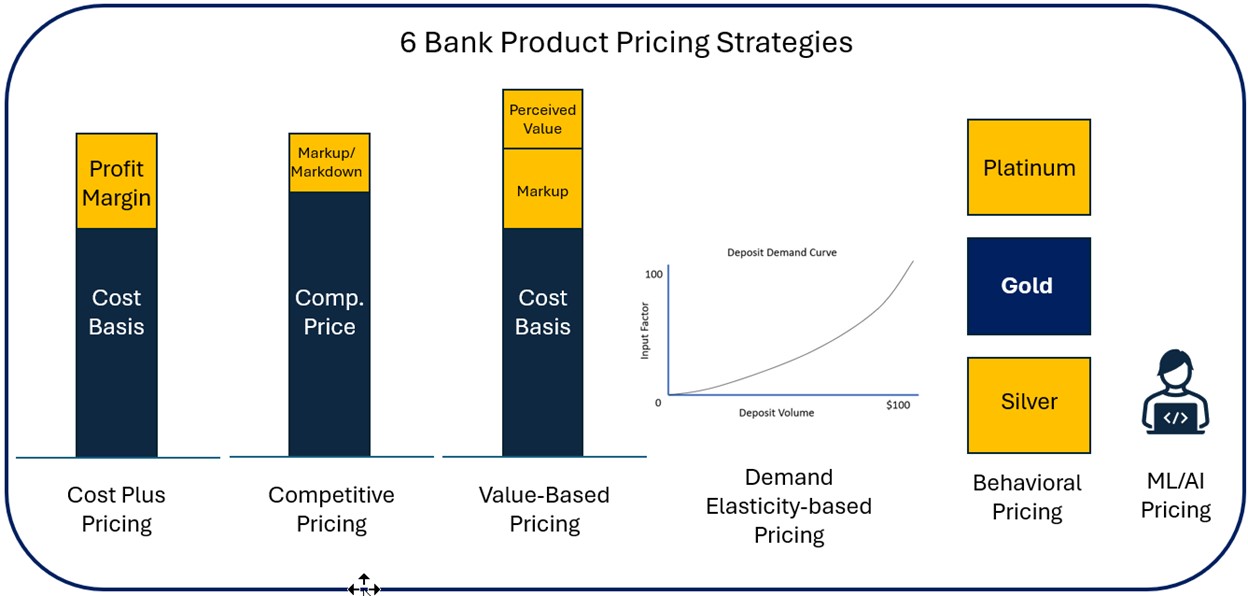

After learning about their pricing challenges, position, and strategy factors, banks can consider one or more of these six common bank pricing strategies. In many cases, banks will want to triangulate between multiple methedologies to arrive at a hybrid pricing strategy.

Cost-plus Pricing

Cost-plus pricing is the second most common approach when it comes to bank pricing strategies behind competitive pricing. Cost-plus pricing is a methodology that sets the price of a bank product by adding a fixed margin or percentage to the cost of producing or providing the product. The cost can include various expenses, such as operational, funding, capital, risk, and taxes. The margin or percentage can be based on the desired return on equity, return on assets, or market share. We always recommend starting with cost-plus pricing to form the lower bounds of your pricing options.

For example, the average business transaction account costs a bank $142 annually to include operational risk. Many banks price this account to generate $162 per year in fees to cover the cost plus enjoy the deposit balances.

The pros of cost-plus pricing are:

- It is simple and easy to implement.

- It ensures that the bank covers its risk-adjusted costs and earns a profit.

- It protects the bank from unexpected changes in costs or demand and is generally perceived as “fair.”

The cons of cost-plus pricing are:

- A cost-plus pricing methodology is devoid of strategy. It ignores the customer’s willingness to pay and the value they perceive from the product.

- It does not account for the competitive dynamics and market conditions.

- It may lead to overpricing or underpricing the product and losing customers or revenue.

Competitive Pricing

Competitive pricing is the most common methodology banks use when pricing loans, deposits, or fee services. This has historically worked well in our industry due to the homogeneity of bank products. When banks don’t differentiate their product, then as long as your competition is rational and you face a similar cost structure, competitive pricing can work as an operational tactic.

Here, the price of a product or service is based on the prices of similar or substitute products or services offered by competitors in the market. This method is commonly used by banks to attract and retain customers, especially for products or services that have low differentiation or high competition, such as loans, deposits, or credit cards.

The pros of using competitive pricing are:

- It can help the bank gain market share and increase customer loyalty by offering competitive or lower prices than its rivals. Marketing is easy if you offer a better deposit rate or a cheaper loan.

- It can help the bank avoid price wars and maintain profitability by matching the prices of its competitors.

- Competitive pricing is operationally easy and takes little research or quantitative analysis.

The cons of using competitive pricing are:

- It can reduce the bank’s profit margin and limit its ability to invest in innovation or quality improvement by lowering its prices too much.

- Competitive pricing cedes all price positioning and strategy to the competition and makes a bank dependent on its competition for managing volume and profit.

- Competitive pricing undermines a bank’s brand value and differentiation by making its products or services more similar and interchangeable with those of its competitors.

Value Pricing

If you are a bank focused on product management (HERE), then value-based pricing is likely your best pricing strategy as it aligns price with value and serves to drive product improvement to increase engagement, customer satisfaction and profitability.

Value-based pricing in banking refers to setting prices for products and services based on the perceived value they provide to customers rather than solely on cost or market-based pricing. This approach focuses on understanding what customers are willing to pay for the benefits and unique features of banking products and services, such as convenience, security, rewards, and personalized services.

Pros of Value-Based Pricing in Banking:

- Value-based pricing increases profitability as it allows banks to charge higher prices for products and services that provide greater perceived value.

- Encourages the development of products and services that truly meet customer demands.

- Helps differentiate products and services in a competitive market by highlighting unique value propositions and strengthening brand loyalty.

Cons of Value-Based Pricing in Banking:

- Determining the exact value customers place on intangible benefits can be difficult.

- Customers may perceive value-based pricing as expensive if not clearly communicated.

- Perceived value can vary widely among different customer segments, making it challenging to set a standardized price. Competitive and environmental conditions must be monitored.

- Potential for ethical violations and regulatory risk if value monetization is discriminatory.

Demand Elasticity-based Pricing

This pricing strategy (HERE) has been our traditional favorite, particularly as it relates to deposit pricing, because it allows for pricing optimization. Price elasticity-based pricing is a method of setting prices for banking products or services based on the estimated responsiveness of customer demand to changes in price. Price elasticity measures how much the quantity demanded of a product or service changes when its price changes. A product or service is said to be elastic if a small change in price leads to a large shift in demand and inelastic if a significant change in price leads to a slight change in demand.

If a bank lowers its money market rate by 1% from 3.50% to 3.465% and volume decreases by 2%, then the elasticity is -2. Bankers can continue experimenting to find the elasticity at various rate levels and then definitively set their prices based on their desired profit and volume. Bankers can optimize their deposit pricing when their margin times their price elasticity equals -1.

The pros and cons of price elasticity-based pricing are:

- It can help banks optimize their revenue and profit by charging different prices to different segments of customers based on their sensitivity to price.

- It can help banks capture more market share and increase customer loyalty by offering lower prices to price-sensitive customers and higher prices to price-insensitive customers.

Cons:

- It can be challenging to measure and estimate the price elasticity of demand for banking products or services, especially in dynamic and complex markets.

- It can be costly and challenging to constantly monitor and update the price elasticity estimates and adjust the prices accordingly, as customer preferences and behaviors may change over time and in response to various factors such as interest rates and bank failures.

- Price optimization only currently works for a single product in isolation effectively. Cross-price elasticities are hard to assess and calculate. Change the pricing for money market accounts and the demand for certificates of deposits and savings are also impacted which is ignored by the calculations.

Behavior Pricing

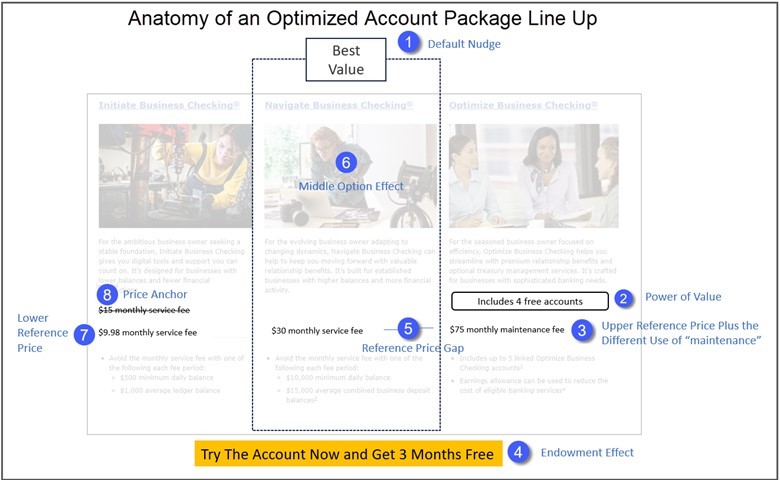

Once banks have a feel for where they should be pricing certain products, we are big fans of overlaying a behavioral price strategy to increase sales from the observed or predicted behavior of customers. This approach leverages academic research and data analytics to understand how different customer segments respond to various pricing strategies, enabling banks to optimize their pricing to maximize profitability and customer satisfaction.

An example of this is our favorite three-account package bundle (HERE) tactic. Here, we incorproate eight behavioral pricing techniques.

Pros of Behavioral Pricing in Banking:

- Behavioral pricing is based on actual decisions. The method increases profitability by tailoring products and services to specific customer segments and situations.

- Maximizes revenue by charging prices that reflect customers’ value of products and services.

- Creates more competitive and appealing pricing strategies that can enhance customer loyalty.

Cons of Behavioral Pricing in Banking:

- Determining behavior can be quantitatively complex, particularly when some customers react irrationally.

- It may alienate some customers who feel they are being manipulated or directed away from their preferences.

- Behavioral pricing is often more difficult to defend against concerns about fair pricing practices.

Machine Learned and Gen AI Pricing

While machine learning (ML) has helped banks set pricing for the past decade, the approach only took off with national and regional banks in the last two years. Generative artificial intelligence (Gen AI) is the new tool on the block, helping banks with both pricing analysis and analytics. These technologies can identify patterns and trends in customer behavior, market conditions, and other relevant factors to set dynamic and personalized prices.

The game-changing element here when it comes to bank pricing strategy is how banks are starting to use Gen AI to make machine learning more accessible.

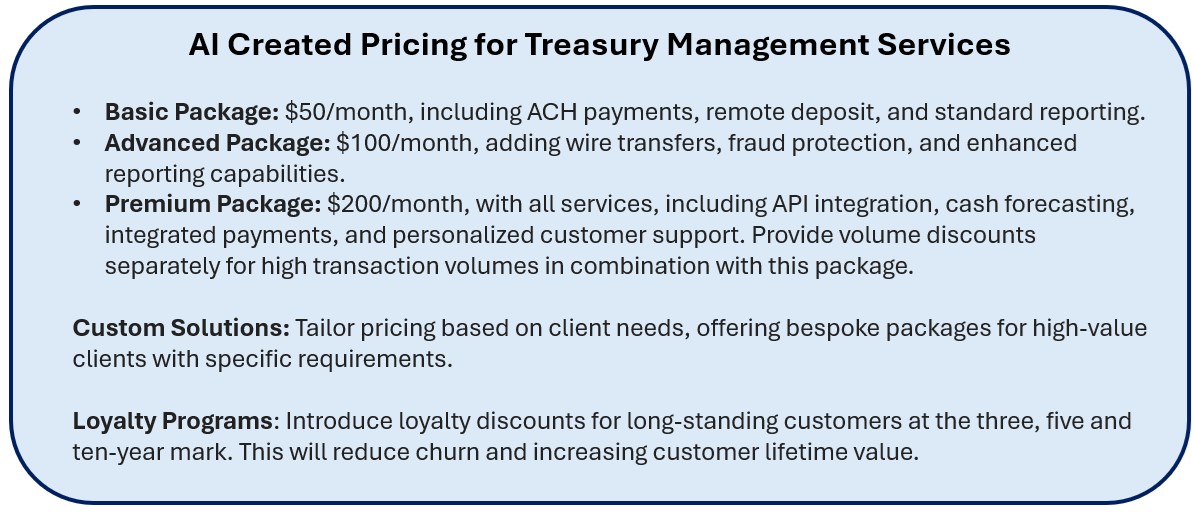

As an example, we focused on treasury management pricing and loaded data from Datos, McKinsey, and Global Finance Magazine and then combined that with publicly available pricing and public performance data from the top 20 banks. We used Gen AI to create a model recommending value-based pricing adjusted for the competition.

Interestingly, it recognized the importance of API integration, real-time payment capabilities, cash flow forecasting, analytics, enterprise resource planning (ERP) integration, and educational webinars as premium value drivers.

A summary of the findings is below.

Pros of Machine Learning and Gen AI Pricing:

- Business line operators can now utilize large datasets to make informed and accurate pricing decisions without the use of data scientists in the fraction of time that traditional analysis used to take. Researching competitors and customer segments used to take days now takes minutes.

- Because of this new level of computing power and control, smaller banks can now offer personalized pricing based on individual customer behavior and preferences. This pricing can be done in real-time and can be customized to items such as interest rates, volatility, and economic data.

- Pricing can now be automated, adjusted, and optimized at scale, frequently providing an additional competitive advantage.

Cons of Machine Learning and Gen AI Pricing:

- AI models are only as good as the data they are trained on; poor-quality data can lead to inaccurate pricing.

- There is potential bias in algorithms if the training data is not representative or if inherent biases are not addressed. Further, outcomes are often opaque, causing additional risk.

- Continuous monitoring and adjustment are necessary to keep up with changing market dynamics and customer behavior.

Machine learning and generative AI pricing can offer significant advantages for banks in terms of precision, personalization, and profitability. However, they also pose challenges related to implementation, data privacy, model accuracy, and customer perception that need to be carefully managed.

Pricing Tactics

In addition to the above pricing strategies, there are a host of pricing tactics, such as bundled/package pricing, promotional pricing, price skimming, penetration pricing, and others. While we will cover many of these in the near future, one merits a call out since it’s fairly unique to banking.

Pack Price Architecture

While most bankers are cognizant of bundled pricing where they price a series of products together such as in treasury management, “pack price architecture” is the art and science of bundling bank products together PLUS adding various attributes. While this is not unique to banking, what is unique to banking is that these attributes are often taken over time.

For example, when a retailer sells bottled water, they can sell packages of bottled water together. This is bundled pricing. When they start varying the size of the bottles, that is called pack price architecture.

Bankers often confuse bundled pricing with pack price architecture, and it is vital to make the distinction. The quantity of product attributes (like the number of payments processed in a month) is often not considered when setting bundled pricing.

When a Treasury Management bundle is sold, it comes with various payment item quantities such as wires, instant payments, and positive pay transactions that vary based on a monthly service charge. As such, this is more complex than bundled pricing alone, such as when you sell a checking and savings account together.

Here, it is a common heuristic to include more services and items to incentivize customers to move to a higher monthly tier. While this often decreases profit margins, it increases lifetime value by extending the customer’s average life and increasing overall dollar profit.

Next Action

This article discusses the foundation of pricing position, strategies, and tactics when pricing bank products and services. We covered some of the most common and effective bank pricing strategies, such as value-based pricing, and highlighted some important pricing concepts particular to banking. Banks may want to take a “fusion” approach and combine methedologies. We have also highlighted the benefits and challenges of using machine learning and generative AI to optimize pricing decisions and enhance customer satisfaction. In the future, look for a deeper dive into specific pricing tactics and learn how to leverage AI to bring sophisticated analytics into every banker’s hands.