Here is a Better Way To Stress Test Borrower Financials

Every community bank has a set of financial statement reports and ratio analyses to assess underwriting and credit risk. The advent of credit spreading software such as CreditQuest has made this job very easy. However, few banks take the extra step of modifying their reports and analysis based on the current economic cycle and market projections to stress test borrower financials. In this article, we help banks move away from the continuing reliance on using the same ratios regardless of expected future challenges for the borrower and the bank.

The Steps to a Better Way to Stress Test Borrower Financials

The first step in this exercise is to consider market projections for economic activity such as GDP, inflation, the housing market, labor market, and interest rates. The table below shows a recent composite forecast of private economists. While these projections are expected outcomes, banks must set bands (above and below) the forecast to stress-test their underwriting assumptions and test ratios based on unexpected events.

The second step in this exercise is to assess which economic forecasts will strain the borrower’s credit quality and the bank’s balance sheet and earnings. Here, we are looking at forecasted levels that show rapid change or deviation from historical norms. We are also looking at projections that appear to be invalid based on economic theory or local conditions.

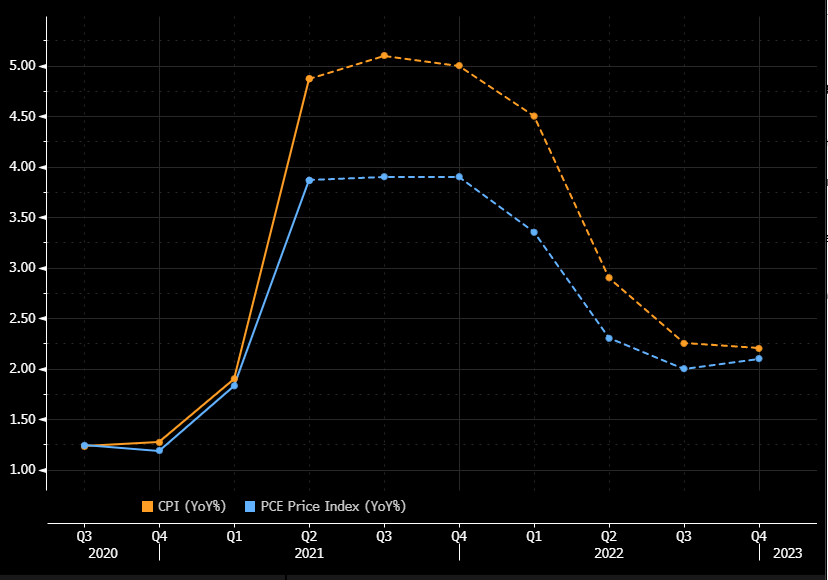

For example, the graph below shows two indicators, CPI and PCE. The high forecasted peak and then a rapid decrease may warrant further stress testing. For example, what happens if inflation does not normalize in 2022 and stays elevated through the forecast period? Can the Federal Reserve control inflation over a medium period of one to three years?

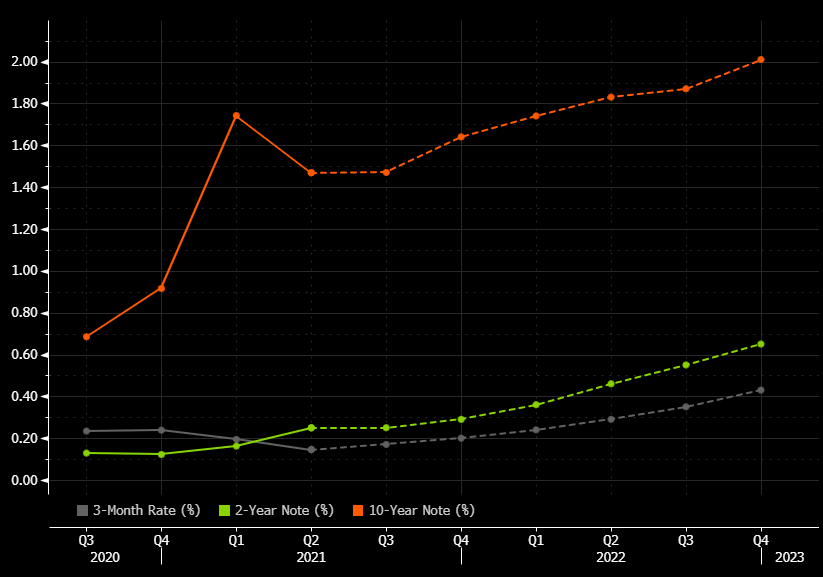

Another example of a projection that warrants additional stress testing is shown in the graph below. The market’s projections for nominal yields for 3-month T-Bills, 2-year Notes, and 10-year Notes show only modest increases. However, when we consider the forecast for expected inflation, we can calculate real yields (nominal yields minus expected inflation). Real yields are forecasted to remain negative into 2023, even though GDP and other market indicators show a normal and healthy economy. This is a severe aberration of expected economic theory that bankers must question and stress-test. For example, if real yields are expected to be just zero but not negative, and inflation projections are correct, then the 3-month T-Bill would be 2.2% and not the 0.43% forecasted at the end of 2022. That may make a big difference in the bank’s projected cost of funds (COF).

The third and final step is to evaluate the financial statement of the obligor in the context of projections and stress testing. The primary objective is to measure cash flow and valuation of collateral based on projected and stress-tested economic indicators.

The checklist for underwriting analysis is as follows (in order of importance):

Cash Flow Changes: Bankers must question and understand any material changes in revenue, profit, capital expenditures, debt, working capital, and depreciation/amortization that impacts cash generation and cash on hand.

Capital: Bankers must be able to quantify how much capital has been invested and how it has been used. Is the borrower a good steward of capital? What returns were produced compared to other competitors in the industry?

Revenue: Where does it come from, and what is the quality? Bankers need to have a clear picture of the different lines of businesses, the cost to produce each dollar of revenue, and the sensitivity of that revenue to interest rate or economic changes. One key question is in what areas where will future growth be generated and what are the risks to that future growth. Has past revenue growth come from acquisitions or from organic sources?

Expenses: Is the company efficient, and what percent is variable vs. fixed and how fast could the company adjust its expenses in a slowdown?

Operating Risk: What are the inherent risks in the industry? Bankers should be able to identify and understand the top three. In a similar fashion, analysts should know that if a failure in operations is going to come, where is the most likely cause. Is the company exposed to foreign currency changes, interest rate risk, regulatory changes, or shifting consumer demand?

Equity: Bankers should clearly understand the capital structure and the shareholders and know exactly who has a claim on the equity. This includes any compensation structures or option packages.

Fraud: If the borrower did want to commit fraud, how would they do it? Looking back over the downturn, there was a common theme that good companies got into trouble and then tried to cover it up. These cases usually revolved around phantom revenue that was not there or phantom assets. Sometimes it was a result of nothing more complicated than creating false financial statements that bankers never questioned. The theme here should be – trust but verify. This means pulling tax returns from the IRS directly and using auditors to check revenue receipts. There is more technology than ever these days so leveraging point of sale terminal outputs, Internet of Things-type sensors, plane/drone/satellite imagery, and web analytics it is easier than ever to gather more trust in financials. Some banks request access to borrower’s Google Analytics account so they could see directly the website traffic and e-commerce activity that was taking place.

Implementation

Bankers need to analyze and conduct credit stress testing of the obligor’s financial statements based on the current economic cycle and the expectation of economic and business changes in the future. This is especially important in unprecedented times and during economic inflections points – both of which we are experiencing today. Credit analysis is complicated and can be even more challenging when stress testing borrower financials is required around expected results. However, every bank must understand the credit risk it takes and the economic return around the expected and unexpected outcomes.