Here is a New Idea to Blow Up Your Bank’s Strategic Planning

If you are like 90% if banks out there, chances are your strategic planning process is not all that effective. Chances are your strategic planning process is a good budgeting exercise, but a poor driver of strategy. It likely your current strategic plan contains something about growth, geographical expansion, and digital transformation. You could exchange plans with another bank, and neither sets of shareholders would know the difference. Further, if you skipped the planning effort this year, it likely wouldn’t make a difference, which is always a sign of an unneeded process. If this sounds like it could be your bank, read on as we have another idea for you that could radically transform your bank.

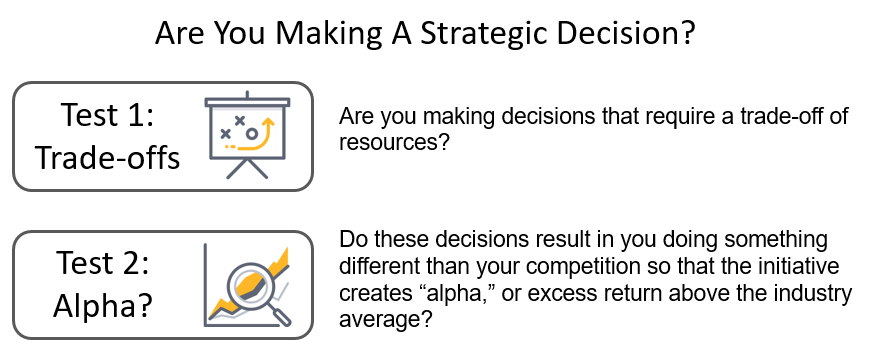

The Elements of a Good Plan

Before you conclude that you need to blow up your strategic planning process and start fresh, first you must test your current process. Last year, we highlighted how strategic decisions is the act of making trade-offs between resources in an effort to produce “alpha” or the ability to earn more than your competitors. We discussed how strategic decisions are not a strategy and highlighted the three areas of strategic planning in banking that are most likely to move the needle. If your planning process looks something like this process and you are producing results, then you are in the 10% of banks that are doing this right. In this case, there is no need to try another process.

However, if your strategic planning sessions are still about how much growth you want, if you are going to open a new branch or if you are going to acquire another bank, then likely you are not able to come up with a vision to create a differentiated financial institution. If this is the case, then we have another approach for you to try.

The Incubator Approach

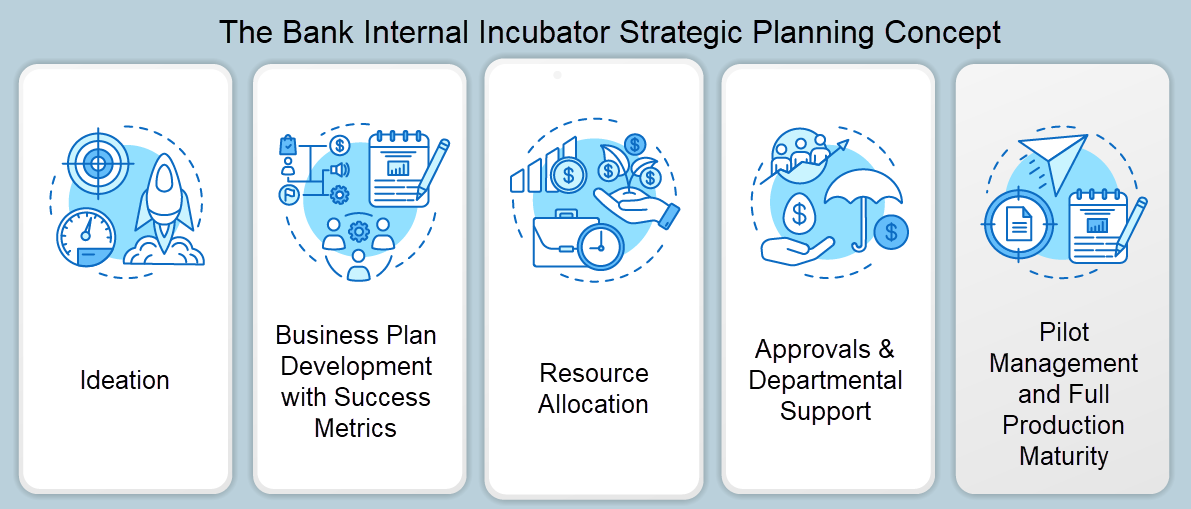

The concept of the internal bank incubator is to turn the strategic planning group into a group that oversees a series of new initiatives and start-up ideas within the bank. This Incubator Board would set the objectives of what they want to accomplish – goals, criteria, growth expectations, available resources, general direction (deposit growth, loan growth, etc.), and then let any employee come with an idea to accomplish the stated objectives.

The Incubator Board is then responsible for helping choose the best ideas to fit the objectives and then help those idea leaders to refine their idea. The Board can provide guidance in the creation of a business plan and set what short, and long-term success looks like. They can provide both the capital and the internal resource support (marketing, risk, operations, etc.) while also helping get the required departments supporting the effort. Finally, they then support the leader to bring the idea into a pilot program. Should the effort be successful, the pilot program then moves out from under the incubator board’s management and into the appropriate department.

A bank would have five to forty of these “experiments” going at one time, some of which would fail, and some of which would succeed. Some would fail or succeed fast, and some would take years. The critical point here is that this construct automatically instills the notion the bank will experiment their way to success, and failure is not only an option but necessary to figure out what doesn’t work.

The Board acts like venture capitalists providing more resources to those projects that are succeeding, helping those that are faltering get back on track, and then phasing out the ideas that don’t work.

These controlled experiments have reduced compliance and risk requirements so leaders can get to market faster and is in-line with the concepts we wrote about around preventing the “Vanilla Effect”. Each initiative strives to get the minimal viable product to a limited market where the effort can be controlled, and risk limited.

The Outcome of the Incubator Model

If done correctly, a bank will end up with a portfolio of ideas that gets validated by the market. What you also get is an engaged employee base that, over time, will bring new ideas to the group because that will be the surest path to success within the organization.

The bank not only gets motivated employees but employees that teach themselves how to innovate. The bank gets to develop a set of tools and a process to foster innovation, and strategic planning starts to take care of itself. The strategic planning group of the bank no longer has to be smarter than their competition or have the ability to see the future; they only have to have the management and leadership skills to motivate and support other employees to lead initiatives.

The end result is a “bottom-up” and market-tested process that will likely produce better results at a lower risk than the traditional strategic planning process that could take years.

If your bank has a top-down process that works, then why go through the effort. However, if you think your strategic planning process can be improved, try setting the direction and then let the Incubator Model take over. Even if you are willing to try a slimmed-down version of this model with just two or three initiatives, then that is likely a positive step towards helping the bank develop both a more effective strategic process but a more innovative culture.

All your other strategic metrics should then fall into place. Growth, culture, relevancy, and the customer experience will all take care of itself.