How Banks Can Compete for Loans Against Insurance Companies and CMBS

Community banks have solid competitive advantages when competing against insurance companies (primarily life insurance companies or “Lifecos”) and commercial real estate securitization conduit lenders (CMBS) for commercial borrowers. Unfortunately, some bankers are not positioning their services correctly to explain why borrowers should do business with their community bank. Some bankers even use fatalistic arguments that they cannot compete against Lifecos, and some lenders immediately refer long-term, fixed-rate lending opportunities to Lifeco competitors. We feel that community banks have various competitive advantages for cost of funding, structuring, the local market and product knowledge, and ongoing service flexibility. However, for a borrower to make an informed decision, a lender must correctly differentiate and position the community bank’s commercial lending service.

Commercial Real Estate Market Background

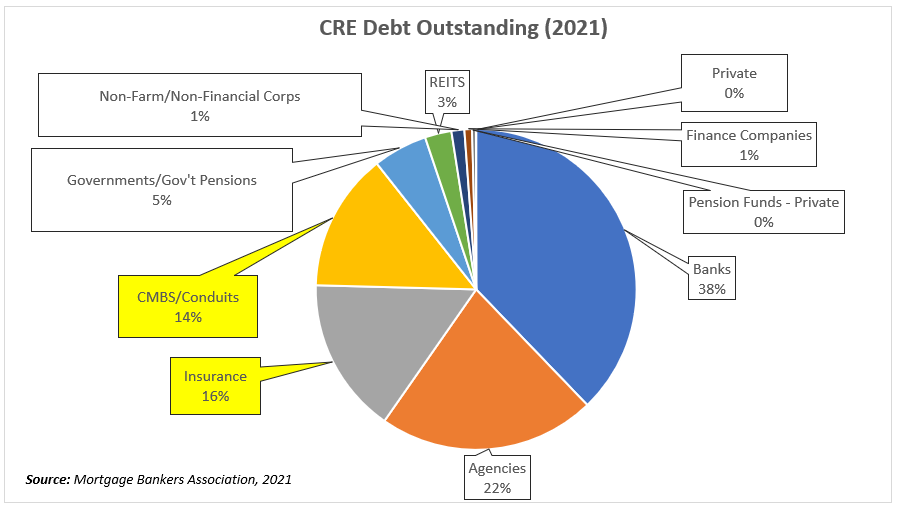

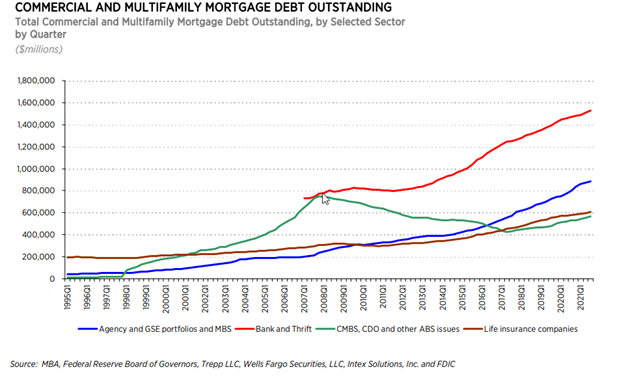

The commercial mortgage-backed securities market is driven by banks and investment banks that underwrite credit and place them in “conduits.” Conduits are separate legal entities that are created for the sole purpose of aggregating debt and equity for specific deals. For 2021, conduits composed about 14% of the outstanding market, according to the Mortgage Bankers Association (MBA), or $564 billion. Insurance companies, by contrast, compose 16% of the market, or $636 billion. While both channels paused in 2020 to better understand the impact of the pandemic, both channels came roaring back in 2021 and are up over 60% year-over-year.

Both channels present formidable competition for banks. That said, banks can still easily compete.

How Banks Can Compete Against Insurance Companies and CMBS

Community bank lenders need to understand how their institution’s loan offerings compare to insurance companies and CMBS conduit lenders on the parameters listed in the table below.

| Solution Parameter | Differentiation |

| Price | Community banks have a cost advantage when competing against insurance companies and CMBS lenders. Historically and over the long term, community banks’ cost of funding is 50 to 150 basis points (bps) lower than the swap curve. However, insurance companies and CMBS conduit lenders fund their loans at the institutional cost, essentially the swap curve. This cost advantage arises from the lower costs of retail and commercial deposits at community banks. Community banks do have an overhead cost disadvantage, but this disadvantage disappears as the bank’s average loan size increases. |

| Upfront fees | Many community banks are not charging loan origination fees, but some community banks are able to obtain 12.5 to 25bps. However, many Lifecos and conduit lenders are still charging high fees, and for a brokered loan, the borrower could expect to pay 1 to 2% at closing. These numbers can vary greatly. Many community banks are able to offer zero-cost closings and generate hedge fee income that provides 1.00 to 2.00% of upfront, non-amortized income. The best selling feature is that the borrower does not pay the fee upfront or out-of-pocket and instead pays a slightly higher loan rate. |

| Prepayment costs | Here is where the community banks have a superior solution when competing against insurance companies and CMBS lenders. Prepayment penalties can be burdensome on Lifecos and conduit term loans. We have seen prepayment costs that can run up to 35 to 40% of the loan amount. Bank loans can be structured to be more flexible. In today’s rising interest rate environment, community banks successfully sell prepayment provisions that allow the borrower to receive a fee if interest rates are higher and the borrower sells the property. |

| Guaranties | Many borrowers are not averse to offering personal guaranties on debt. However, for some borrowers, this is a real issue. At some lower LTVs (generally 65% or lower), many Lifecos and conduits do not require personal guarantees. We are seeing banks respond to this challenge by accepting limited guaranties (a percentage of the loan amount spread between owners), expiring guarantees (when LTV falls below a certain level), or taking cross-default protection (where the borrower has multiple and disparate properties financed with the bank, and this can be even more powerful leverage for the bank than a personal guaranty). |

| Restructure Flexibility | Community banks have a large competitive advantage here against insurance companies and CMBS lenders. Community banks can offer a single close construction through perm loan, thereby eliminating the competition of the take-out loan from Lifecos. Community banks are also structuring accreting loans, standby LOC, multiple draw term loans, and asset-based financing that Lifecos and conduits are not equipped to match. The more structure and flexibility required for the borrower, the better the fit for a community bank. |

| Ongoing Servicing | Lifecos and conduit lenders have a low service business model – these lenders close large deals and intend to have little contact with the borrower and no interest in amending terms and conditions after the loan closes. For borrowers that are 100% certain that after origination, they will never want to touch their loan terms, the Lifeco model may work well. However, for borrowers that anticipate amendments, prepayments, business changes, property sales, or possible loan assumptions and assignments, the community bank offers much more flexibility. |

| Covenants | Banks can be very flexible on structuring covenants and reps and warranties that make sense for the specific borrower and global situation. Lifecos and conduits lending criteria are strict – if the loan does not fit the “box,” then accommodations or exceptions are not typically made. |

| Term | Lifecos and conduit lenders offer terms for 5 to 20 years. We work with community banks that routinely extend credit out to 20 years and eliminate the interest rate risk (and credit risk, for that matter) through a hedging program. Community banks can utilize the same risk mitigation tools as their competitors. |

| Speed to Close | Typically insurance companies and CMBS conduit lenders take months to close, and their officers cannot be sure of pricing or terms until the entire underwriting and approval are complete. This has led to frustration for borrowers who show up at closing to terms and pricing they did not anticipate. Community bankers can work diligently to expedite approval, doc prep, closing, and funding. Good community bank lenders also understand what the bank will approve, and the final structure and pricing can be communicated to the customer in advance. |

| Amortization | Some community banks are reluctant to offer amortization terms greater than 25 years. Lifecos and conduits will accommodate 30-year amortization periods for certain loans (typically 65% loan-to-value (LTV), general use property, and improvements with a useful life longer than the am term). On mortgage-style amortization, the LTV difference between the 25 and 30-year am, assuming a reasonable starting LTV of 65% to 75% is insignificant because most of the principal reduction happens in years 5 through 20 when the LTV and the credit risk is already lower. The math favors 30-year am with lower starting LTVs. |

Conclusion

A lender’s top job is to understand the borrower’s financing needs and propose solutions that make the most sense for that customer. The community lender’s task is also to differentiate the community bank from the competition, explain the pros and cons of each financing alternative available, and then use appropriate analysis to make an objective recommendation to the borrower. If a bank wants to better compete against insurance companies and CMBS lenders, then consider the information in the table above – this may result in your bank’s ability to win quality loans at acceptable margins.