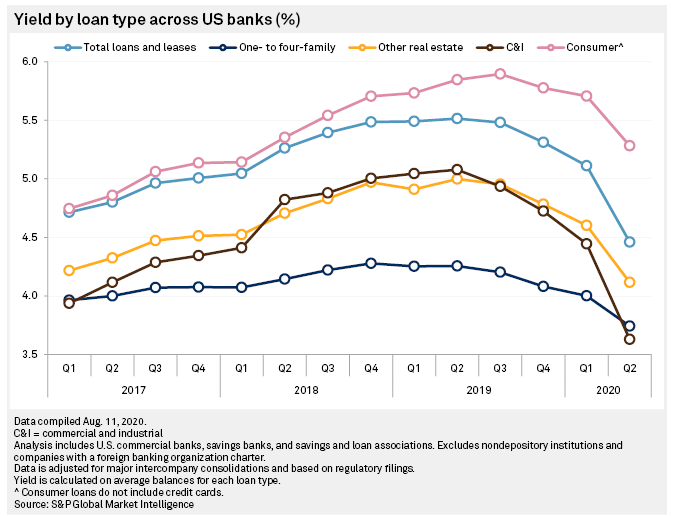

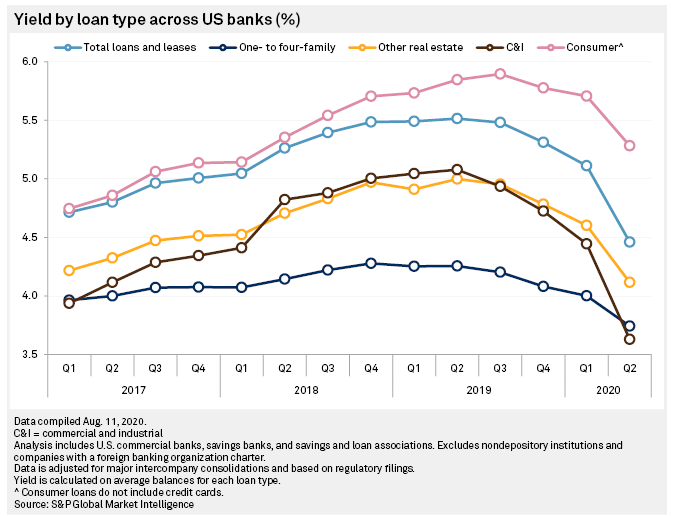

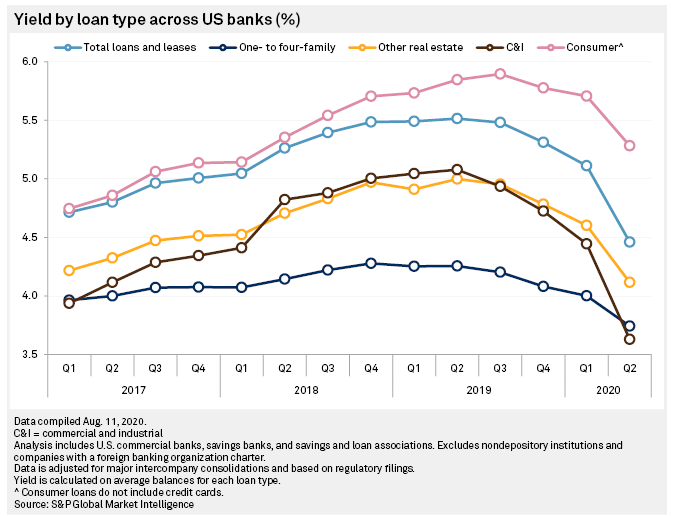

Bank margins plummeted in the second quarter of this year as banks struggled to find lending opportunities outside of the low-yielding PPP loans. The banking industry net interest margin (NIM) dropped 42 basis points in Q2/20 from 3.16% to 2.74% – the largest percentage drop in history. The roughly $520B in PPP loans that banks originated in Q2 weighed on the industry’s loan yield (which carries a rate of just 1%). However, all loan types witnessed a similar decrease in yield, as shown by the graph below. The PPP loans are in the C&I category, where yields declined from 4.44% to 3.63% QoQ.

How Community Banks Protect NIM

While community banks will work hard to lower deposit costs over the next few quarters, how should bankers optimize yield on their loan portfolio? Solely seeking higher-yielding credits translates to smaller average loan size, lesser credit quality, shorter lifetime value, fewer relationship cross-sells, and, ultimately, lower profitability. Instead, community banks need to differentiate themselves from the competition – luckily, community banks have defensible and lasting competitive advantages compared to many other financial institutions.

Four Attributes Providing Competitive Advantage

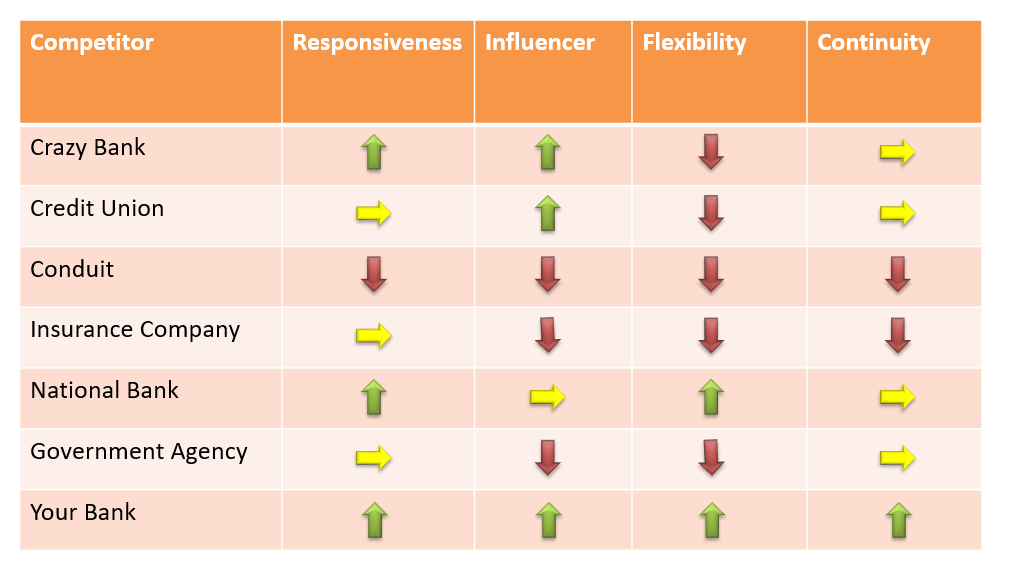

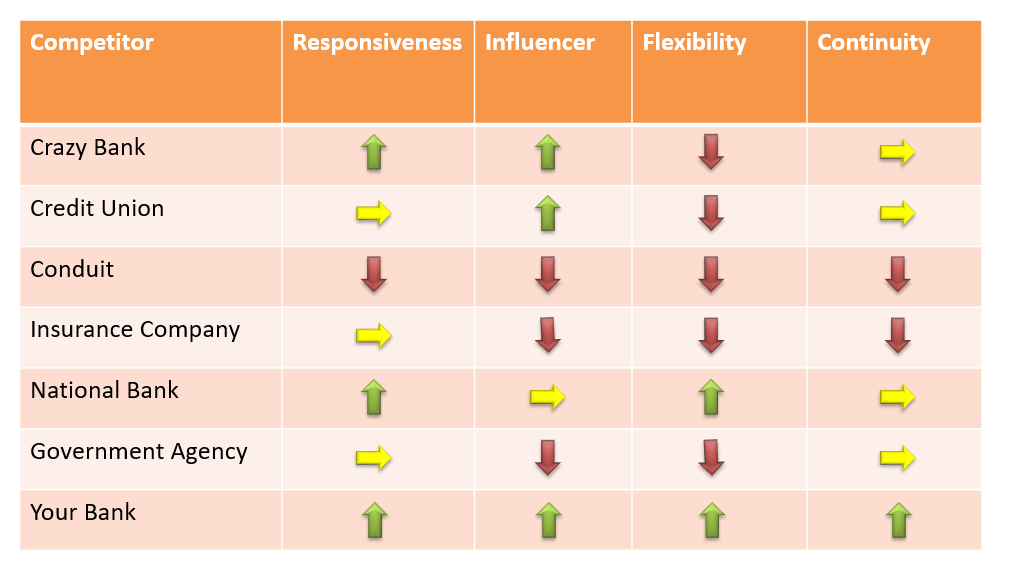

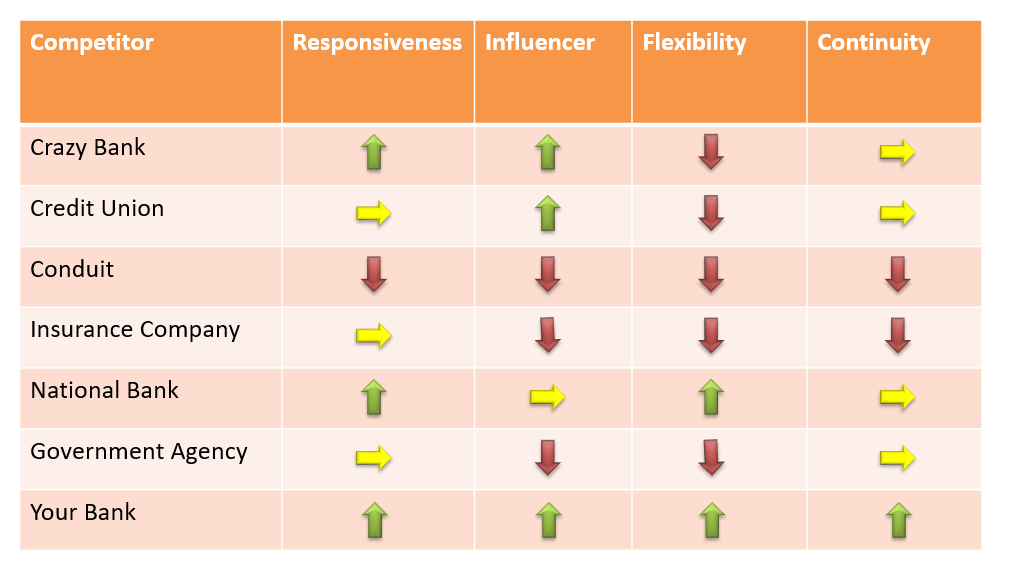

We feel that community banks have four significant attributes that can be successfully used to differentiate their brand against competitors in the market. Borrowers find these four attributes valuable, and borrowers are willing to pay above market rate to purchase these attributes. But community banks must understand what these attributes are, why borrowers find them valuable, and explain to borrowers how these attributes are delivered to clients.

Community banks that can effectively differentiate themselves from competitors on these four attributes and deliver these attributes consistently to customers will succeed by being able to achieve above-average NIM. The table below shows the four attributes and the possible positioning of these attributes against six conventional competitors.

Responsiveness: This is the time a bank takes to accomplish an action that has an impact on the customer. That action can be the time to underwrite a credit, to produce a term sheet, to draft closing documents, or to fund a loan. Here community banks have a distinct advantage against much of the competition. Being smaller and nimbler, community banks can typically react faster than credit unions, conduits, insurance companies, and government agencies. Especially in these uncertain times, borrowers value certainty and a quick decision-making process. Community banks should benchmark timelines for each of the tasks listed above based on competition in their market. At the high-performing end, we work with banks that can produce a term sheet within a business day of receiving the necessary borrower financials, take four business days to underwrite and approve a CRE or C&I credit (subject to necessary appraisals), take one business day to generate internal loan documents and can fund a loan within five business days from acceptance of the term sheet. On the other end of the spectrum, we see community banks that take three to four months from a commitment to funding. Your biggest competitors for this attribute are the regional and national banks that have become very quick to commit borrowers and fund loans, as long as the loan fits neatly in their lending “box.”

Influencer: This attribute describes how the borrower can advocate and be heard for their credit needs. If the borrower can sit down and describe their business plans and needs to the decision-maker of the bank, or take the credit officer on a tour of the factory, then the influencing factor is high. Here community banks have a large advantage over most of the competition, but credit unions and some national banks may also have some power in this attribute. Community banks excel at understanding their borrowers because they are so close (geographically and communicatively) with their borrowers. Borrowers like the local nature of a community bank decision-making framework and community banks need to broadcast this attribute to their customers and prospects. Since the impact of Covid19 is different region by region and county by county, understanding the local effect of the pandemic is an especially big advantage for community banks.

Flexibility: Flexibility describes the potential of the bank to work with a borrower even if the relationship does not fit perfectly into the bank’s business model or if the relationship changes because of credit issues. This is a fundamental attribute that community banks must not squander. One of the identified competitors is “Crazy Bank.” What we identify by this term are banks that make non-rational credit decisions. Many of these banks are currently sidelined by the economic recession. These same banks cannot be as flexible now because of credit mistakes made over the last few years and are now revealed by the economic slowdown. Healthy community banks can still be flexible working with borrowers in good times, and current tough times. Community banks are working with existing and new clients to help them make it through a very challenging economic environment.

Continuity: This characteristic describes the consistency of the relationship between borrower and lender. Here again, community banks can have an advantage. Borrowers like to deal with lenders that understand their business and with whom they have a comfortable rapport. Borrowers do not want to educate a new lender on the job every couple of years because the bank is fond of rotating employees, or worse yet, because of employee turnover. National banks are notorious for this mistake for middle-market lending. Further, if the economy in a specific geography takes a downturn, national banks, insurance companies, and conduits have the luxury of re-allocating capital to other geographies that demonstrate better returns (as was again the case with certain lenders in this pandemic). However, for better or for worse, community banks are tethered to a local community and do not move to other states. This certainty of relationship and consistency creates substantial value for borrowers, especially in difficult economic times like today.

Conclusion

While many community banks emphasize their superior service as a differentiator, few can define what that service is. Community banks that can demonstrate to customers their excellence in the four attributes described above can obtain above-market pricing for the same products and services. We see community banks gain 25 to 50 basis points higher margin by differentiating effectively on these four attributes. These attributes give community banks significant pricing advantages over many of their competitors.

Tags:

Published: 08/25/20 by Chris Nichols