Optimizing The Credit Review Process

Once a loan is booked, it needs to be reviewed over time for changes in credit. The problem is that many banks have only one type of commercial loan review. This standard review usually requires approximately eight hours of work from credit, loan administration, and management. When this effort is combined with data expense, the report is produced at a cost of just over $1,000 per credit. If you are one of these banks that only have one type of review, then the good news is that you can save a material cost anytime you want AND have better risk management. Since credit follows a normal distribution, creating a one-size-fits all credit review is incredibly inefficient. In this article, we explore the problem and show how to better optimize the credit review process plus show any bank that is worried about efficiency how to squeeze out better performance while improving the customer experience.

The Solution

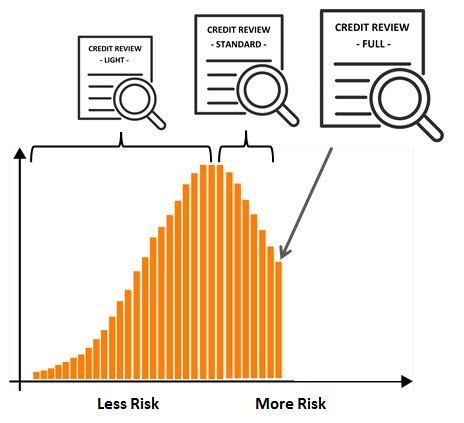

The solution is simply to optimize the review process. While this can look many different ways, the simplest way to start is to create three different types of reviews and then assign each to a specific credit spectrum. If a credit is low risk, has improved, or has not changed, then there is little need for a full review and the credit process should be one of updating numbers and validation. For some banks, in good times, this is 90% of all credits. For the average bank, and for the sake of this analysis, we will assume that credits that fall into the above category compose approximately 70% of the portfolio.

Higher risk credits and credits that have deteriorated then receive the standard review as before. Very complex, risky, or credits that have materially deteriorated get a full review which takes more time and is more encompassing. By assigning each review to your credit spectrum, you get the distribution as graphically depicted above.

The Cost Savings of a Better Credit Review Process

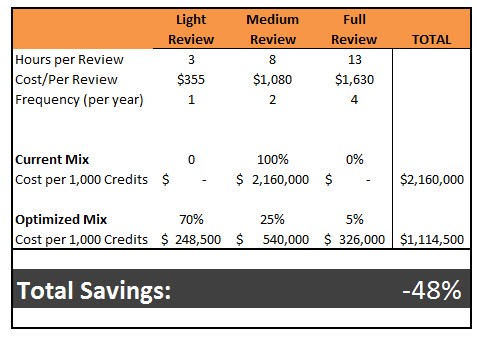

A “Light Review” with the help of third-party data (PayNet, Experian, etc.) takes about three hours of effort and can be done once per year. If you conservatively assume that 70% of an average bank’s portfolio would qualify, that is a cost of approximately $250k per 1,000 credits. Comparatively, a medium or standard review takes about eight hours and is done twice per year. While this currently composes 100% of the average community bank’s credit review process, we can now shift this review to the credits that best warrant that level of analysis. We conservatively estimate that approximately 25% of a bank’s credits fall into this category. Finally, a full review with enhanced re-underwriting takes place and is likely done on a quarterly basis in order to hyper-monitor the credit quality. Here, given the current state of credit quality, we estimate that 5% of the credit relationships would fall into this category.

As can be seen below, this optimized allocation of resources would net a bank more than $1mm in cost savings per 1,000 credits. That is a 48% savings – money that can be better utilized for compensation, fintech investment, or shareholder dividends.

Conclusion

Banks need to reduce their efficiency ratio below 40%, in our opinion, to be competitive in the long run. To achieve this goal, banks need to take dramatic steps to improve processes and resource allocation of effort. Depending on the types of credit, risk profile, and distribution, banks could further optimize and have five or more different levels of reviews. Getting more granular in the review process not only saves costs but also better matches effort with risk. Consider that if you over-allocate resources to quality credits, you get no benefit. The level of risk remains the same. However, this is not true if you under-allocate. Not putting enough effort into risky credits could potentially leave the bank under-reserved and slow to react to changes. We saw this occur during the last downturn, and it will no doubt occur again.

In addition to better cost and risk alignment, there is also the side benefit of being less intrusive to your client and more flexible to their needs since the average light review process requires less effort and information on the customer’s part.