How to Choose a Hedge Provider as a Bank

Last week we wrote about loan-level vs. balance sheet hedging for community banks and provided our loan proposal generator (HERE). We compared and contrasted the two strategies and sized the market for community banks. We also shared a table that summarized the two strategies. In this article, we will discuss what community banks should look for in a hedge provider, specifically in a loan-level hedging program.

How Your Hedge Provider Can Be Relational

A community bank may transact one or only a few balance sheet hedges over many years. Therefore, balance sheet hedges are transactions, and a community bank is not seeking a partner but a provider with the best execution and solid reputation. However, by design, loan-level hedging is a recurring service, and community banks must be thoughtful in choosing a provider. While community banks may recognize many benefits of using a loan-level hedging program, they need to select a safe solution for themselves and their borrowers; otherwise, risks will outweigh any benefits.

Why Community Banks Use Loan-Level Hedging

We need to consider the potential benefits of a loan hedging program for community banks. In talking to community bankers, here are the main reasons community banks have chosen a loan-level hedging program:

- Improved Credit Quality: Banks can stabilize the borrower’s debt service coverage ratio (DSCR).

- Eliminate Interest Rate Risk: Eliminate margin compression when interest rates rise.

- Meet Competitive Pressures: National and larger regional banks are specifically targeting better borrowers for seven, ten, or 20-year fixed-rate loans.

- Protect Existing Loans: Average commercial term loan prepayment rates are 25% per year without a hedge but only 3-5% per year with a hedge.

- Cross-sell: Locking borrowers into longer-term loans creates a stickier relationship with more opportunities for upselling and cross-selling.

- Lending Discipline: Hedging programs make loan pricing more transparent and force bankers to exercise sensible pricing methodologies.

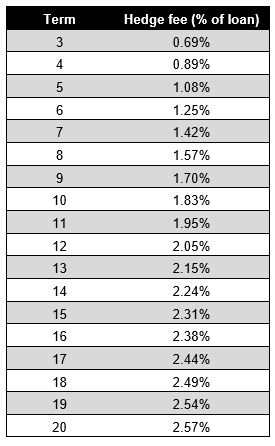

- Generate Fee Income: Hedge fee income for commercial loans can range between 25 to 200bps+ of the loan amount (below), and the fee is commonly recognized immediately in the period received.

Criteria for Choosing a Hedge Provider

The first decision a community bank must make in choosing a hedging program is if they will subject their commercial customers to ISDA documents. Most community banks do not have a large universe of customers and prospects that would embrace complex and esoteric documentation. The ISDA master agreement, Schedule, and confirmation (all required for a simple commercial loan hedge) can be more than 60 pages long and is heavy legalese. Despite being voluminous, the document does not define the method to calculate the cost of hedge prepayment, potentially leading to lender liability, legal expenses, and dissatisfied borrowers. Borrowers should hire legal counsel with specific derivative knowledge to review ISDA documents. Banks take additional legal risks if the borrower’s counsel, steeped in derivative knowledge, is not involved. Alternatively, various programs and platforms do not use ISDA documents and rely on more straightforward documentation. As long as the borrower wants a simple cap, floor, or swap on a commercial loan in US dollars, and that borrower is not speculating on interest rates, alternative documentation can be anywhere from one to five pages, with a simple formula for calculating the prepayment consequences of a swap. The advantages of simpler documentation are that more borrowers are willing to use the product, and the community bank has lower legal liability by using documents that borrowers can read and understand.

Second, community banks should use FDIC-insured institutions as hedge providers, and the hedges must be structured as qualified financial contracts (QFC). FDIC regulations afford QFCs certain rights and protections that will accrue to the hedge end-user (a community bank or a community bank borrower) if the hedge provider fails and the FDIC becomes the receiver. We see substantial risk to community banks in dealing with non-FDIC hedge providers or those not offering QFC protection – think Lehman Brothers.

Third, we believe that community banks should avoid vendors that require service exclusivity. Certain services and products require substantial setup costs, integration costs, and upfront resources, but providing a hedging solution is not that type of product. We believe that community banks should choose a path that offers the most operational flexibility. While the vendor’s services may be optimal today, business or economic changes may require a different approach in the future. Further, since the loan-level hedge may be around for 10 to 20 years, community banks must understand their obligation to the hedge provider for a long tail, even if the initial service is discontinued. Therefore, community banks must understand who is responsible for servicing these hedges after the initial service contract is terminated.

Fourth, community banks can quickly assess the health and safety of the hedge provider by considering one simple ratio – the derivative leverage ratio. Hedge providers will not typically disclose a full assessment of their derivative portfolio; however, every bank is required to disclose information that can be used to calculate the derivative leverage ratio, which is the ratio of total notional volume divided by tangible equity. This capital ratio is used to assess the possible riskiness of a hedge provider. More sophisticated entities can handle a higher ratio because they possess the systems and managerial sophistication to manage the risk. One rule of thumb is that any derivative leverage ratio over 20 requires an expert understanding of derivatives and risk management (typically found at the national banks).

Lastly, and most importantly, we believe that community banks should seek a consultative relationship for loan-level hedging. Loan-level hedging requires commercial loan understanding and the various nuances of commercial loan structuring and pricing. The hedge provider should be a team member working with community bank lenders to deliver a tailored solution for the borrower. Unfortunately, many large swap desks act as a counterparty that executes the swap but do not want to (or are prohibited from) working closely with the community bank in a consultative manner.

Conclusion

There are some substantial benefits to community banks in using loan-level hedging. Like every vendor analysis, community banks must understand how to assess the vendor’s capabilities and the benefits and risks for the bank and borrower.