Help Your Lenders With Our Loan Proposal Generator

Competition is intense, and every bank is looking for a competitive advantage. Better products, faster service, or insightful advice can translate into additional loans, better credit spreads, or extra fee income. Sometimes just a graphics tool can help a banker win more loan business. At SouthState, our commercial lending teams use an online proposal generator, and we make that same app available to any community bank. In this article, we step through why it works and how you can get it.

Why The Loan Proposal Generator Works

Our online proposal generator is an easy-to-use tool that allows lenders to create, save, update, print, and share standard formatted PDF presentations with borrowers. This presentation comes before the term sheet and gets borrowers talking about structure rather than pricing. Lenders can also view proposals generated by colleagues to understand market pricing in order to achieve greater consistency across the organization.

Touchpoints are critical in sales, including loan sales. Every time a lender contacts the borrower, the contact creates an opportunity to demonstrate superior service, impart market information, offer expert advice, or increase mindshare. But borrowers do not typically want to see pages of print. Our customized presentation in PDF format is graphic-rich and straight to the point. A lender can re-generate the presentation as often as needed and share with the borrower (or keep it as a learning tool and store it to file).

Research shows that borrowers find graphics 70% more persuasive than typed information. This means that even when a lender talks to a borrower and presents a written letter of intent (LOI), the chances of a successful sale go up substantially if the lender can deliver a graph-rich PDF presentation with the bank’s logo and customized to the borrower’s name and lending needs. Therefore, having the PDF presentation at the banker’s fingertips anytime they want to generate it and share it with as many borrowers as possible increases loan production.

In addition to providing another branded piece of collateral material for both the bank and lender, the Loan Proposal Generator produces a presentation that accomplishes the following items:

- Provides various structural options for the borrower to validate which best fits their rate view and their asset-liability position.

- Provides live rates and spreads to make it easy to compare various options

- Provides various monthly principal and interest payments to help borrowers decide on loan structure

- Provides both historical rates and projected rates to provide borrowers better context for their rates and payments

How The Loan Proposal Generator Works

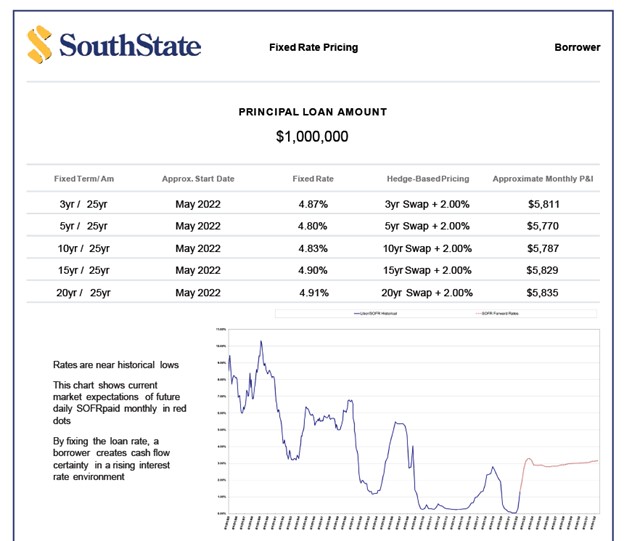

We have created a customized and downloadable presentation that lenders can use as a marketing tool or part of a term sheet or letter of interest. This personalized presentation shows pricing options, possible prepayment scenarios, historical rates, and the market’s expectation of future rates. The customized presentation can be tailored to specific borrowers, loan amounts, amortizations, and terms. It can also be used to show forward starting rates (for construction through perm or locking in a forward-starting loan). This is presented in a professional and concise format with your bank’s logo on each page.

To gain free access to the Loan Proposal Generator that we built for our ARC program, that you can use for various loan structures (with or without ARC), go HERE for access. A video explaining the app can be found HERE. A portion of a presentation for our bank is shown below.

We use our proposal generator for the ARC program, but it can be used to price other fixed-rate loan products. A customized presentation is emailed or downloaded with a click of a button for the lender to share with the borrower. Rates are updated daily, and the banker can even calculate hedge fees (an excellent way to drive non-interest income).

Why Now?

A glance at the pricing sheet above from the app demonstrates that the yield curve is flat, and a borrower pays virtually the same loan rate on a three-year fixed and 20-year fixed. Further, the yield curve is inverted between three and ten years. The yield curve makes the five-year fixed-rate term loan less competitive for banks and less appealing to borrowers. To sell a five-year fixed rate to a borrower, banks have to price more competitively or offer looser credit structures. Bankers should consider that in the next few months, assuming the rate hikes in the forward curve, floating-rate loan coupons may be higher than 20-year fixed rates. This information is essential for lenders to know to help them position their loan products for optimal results.

Conclusion

An online loan proposal generator is one of the least costly tools your bank can offer lenders. It is easy to develop, and the return on investment (ROI) is immense. Our customized online proposal generator is available to bankers to use, and we will even train your lending team on how to use it. Further, if you create an online proposal using our app, upon your request, we will run your loan scenario through our RAROC loan pricing model to give you a view of the risk-adjusted ROE for the loan and show how you may enhance ROE through optimal loan structures.