How To Increase Loan Revenue by 20% While Decreasing Interest Rate Risk by 80%

At SouthState Bank, we are using a tested strategy to increase loan revenue by 20% and decrease interest rate risk by 80%. We are achieving this result on our better credit quality commercial loans without any gimmicks or confusion to the borrower. We have developed a technique and a loan structure to assist bankers who: 1) are looking for commercial loan growth, 2) want to increase income for the next two years, and 3) believe that interest rates will rise over the next few years. The strategy allows banks to recognize higher revenue and still mitigate long-term interest rate risk. However, the strategy only works with relationship accounts that have long-term financing needs.

Too Good To Be True?

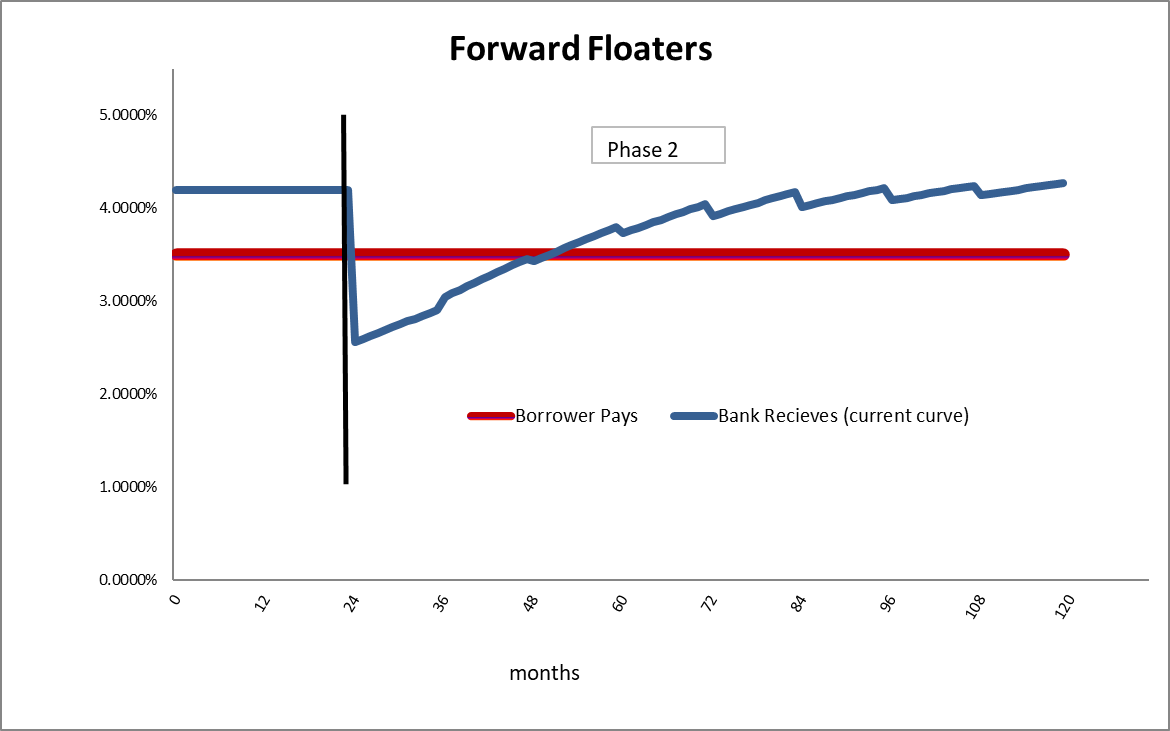

We call this strategy a “Forward Floater,” and we divide the life of a term loan into two different phases. The term of each phase can be customized to the needs of the lender. Many conservative borrowers still desire fixed-rate certainty on term loans, and lenders want a fair yield for a loan while minimizing interest rate risk. The Forward Floater achieves all of those objectives by dividing the loan into two phases as follows:

- Phase 1 is a two-year period (but can be as long as five years) during which the lender is earning a fixed rate yield, and the lender also earns an additional 50 to 75 bps per annum fee yield. This fee is paid to the lender in each year of Phase 1 and does not need to be amortized over the loan term. This extra fee income increases loan revenue by approximately 20% during Phase 1.

- Phase 2 is a five-year to a 19-year period during which the lender is earning an adjustable yield. During this phase, if interest rates fluctuate, the lender’s net interest margin (NIM) is stabilized, and if interest rates increase substantially, NIM will expand. We eliminate at least 80% of interest rate risk on a 10-year commercial loan and decrease repricing risk, thereby mitigating a major credit risk for the lender.

During Phase 1 and Phase 2, the borrower pays the same fixed rate of interest, and the two phases are only apparent to the lender. We use the ARC program to convert Phase 2 to a floating rate for the lender (without using a derivative for the bank or the borrower). The graph below demonstrates the phases and borrower payment versus lender yield for current interest rates.

For the loan modeled in the graph above, the borrower pays 3.50% fixed for the entire 10-year term of the loan. During Phase 1, the bank earns 4.20% fixed (a 20% increase in yield), and during Phase 2, the bank earns an adjustable spread of 2.00% (but that spread is subject to pricing negotiation between the borrower and the lender). The blue line above in Phase 2 is based on the current market expectation of forward interest rates.

Why This Strategy Makes Sense

The strategy makes sense today for the following reasons:

- Interest rates are low, and many borrowers want to lock in the cost of funding their business for longer periods.

- Borrowers now expect longer-term interest rates to rise as the pandemic subsides and are willing to pay a premium for rate protection.

- The lender can lock in a higher yield during Phase 1 of the loan. This is appealing given the low level of short-term rates.

- The lender obtains interest rate protection during Phase 2 of the loan when we expect interest rates to rise as the pandemic ebbs. During Phase 2, interest rate risk is eliminated because the adjustable yield will move closely with the bank’s cost of funding.

- Lastly, the bank can transfer the loan to different collateral should the borrower and bank agree to such substitution. Thereby preserving the structure for future changes and borrower growth.

Conclusion

A tough competitive environment coupled with low-interest rates that are expected to rise creates an excellent opportunity for banks to take advantage of rising interest rates using the Forward Floater strategy. Further, in a highly commoditized lending world, the Forward Floater is a unique structure that may set your bank apart and distinguish your commercial lenders.