How to Lend on Virtual Real Estate in the Metaverse

Most bankers have a hard enough time lending on real estate, let alone real estate that is not physically there in the “metaverse.” However, before you decide that you NEVER would lend on a virtual property, consider that the world is changing. Thinking about how you would lend on virtual real estate is an interesting thought experiment that may expand your horizons and make you a better banker.

The Metaverse Explained

The metaverse is already here. Any representation of reality that you can move around in real-time can be considered a metaverse. Virtual worlds are prevalent in video games like Roblox, Madden NFL 22, Fortnite, Minecraft, and Call of Duty. Some applications are rendered with such realism (see Real Racing 3 below) that it is hard to distinguish from live video footage.

The metaverse comes to life in multiple dimensions with every application using 3D goggles such as Quest or Oculus. Here you can move around and interact with people and objects, complete with hepatic feedback. Most bankers are used to the virtual worlds of using Zoom, WebEx, or other video-conferencing applications. WebEx brings together video, audio, and chat adds tools such as filters, and presents it all to a user in an augmented form of reality.

For some, the metaverse portends a dystopian mess that confuses the difference between fantasy and reality. For others, it’s a brave new world of opportunity. As usual, the truth likely lies in between the two views.

What is Real and What is Value

Before you decide on how real the metaverse is, consider the concept of value. The only accurate way to determine value is to know what someone will pay for something. The artwork in our header called the Everydays – First 5000 Days is a non-fungible token (NFT), or digital art on the blockchain by Beeple and was recently auctioned off by Christie’s, selling for $69M. Now, you can argue if it is worth $69M to YOU, but it is impossible to argue that it is not presently worth $69M since there was just a live transaction.

We can present a case either way to justify the price. On the one hand, Mike Winkelmann never sold a print for more than $100 before he started to create digital work under the pseudo name of Beeple. Or, you can view it as you get to own an undisputed original work, one of the few carbon-neutral pieces that took thousands of hours to build by an artist who was the first to usher in the next chapter of art history. If you could own the last painting by Leonardo da Vinci or Shakespeare’s only known live portrait, you would likely have an easier time justifying the price.

Of course, bankers love cash flow to justify the price.

The Value of Metaverse Real Estate

If you have a virtual world, it makes sense to have virtual real estate. Few bankers would argue the value of a virtual world if it generates game sales or upgrade fees as players buy special fuel, weapons, clothing, or secret powers. The world of Minecraft has generated $238M to date, so it’s clearly worth tangible value. However, that is Web 2.0.

Web 3.0, or the rise of defi and blockchain as we recently described (HERE), presents a whole new virtual set of opportunities. For starters, you can definitively know who owns that world as there is an immutable record on the blockchain for all to see. Better, you can now break apart that world and distribute ownership so various parties can own a plot of virtual real estate or a room. You can attach certain rights like voting on rules of this virtual world or the distribution of revenue and connect those rights to that virtual land.

Even better is that this virtual real estate is more liquid than most investments. You can freely trade this virtual real estate without a central authority such as a county or title company, and you can exchange it from any country at any time of day.

If that is not enough, the best part of this is that you can recompose that virtual real estate for other applications. That is, you can use your land from one metaverse and transfer it to another. For example, you can create a bank that helps finance objects and use that same bank in various worlds to finance various aspects of the metaverse. The risk of geolocation is now partially mitigated.

Tomorrow, Facebook, Twitter, or Instagram can decide to “deplatform” you or kick you out, and the value of your historical posts and followers will be instantly lost. In Web 3.0, that is not the case. Authority is decentralized and egalitarian. This decentralized structure helps protect the value of virtual real estate as you have to worry less about zoning, eminent domain, politics, and new taxes impacting the value of your holdings as you do in the physical world. On the blockchain, those that have the most to lose have the largest vote. In a virtual world on the blockchain, everyone’s interests are aligned, unlike the physical world.

Recent Metaverse Transactions

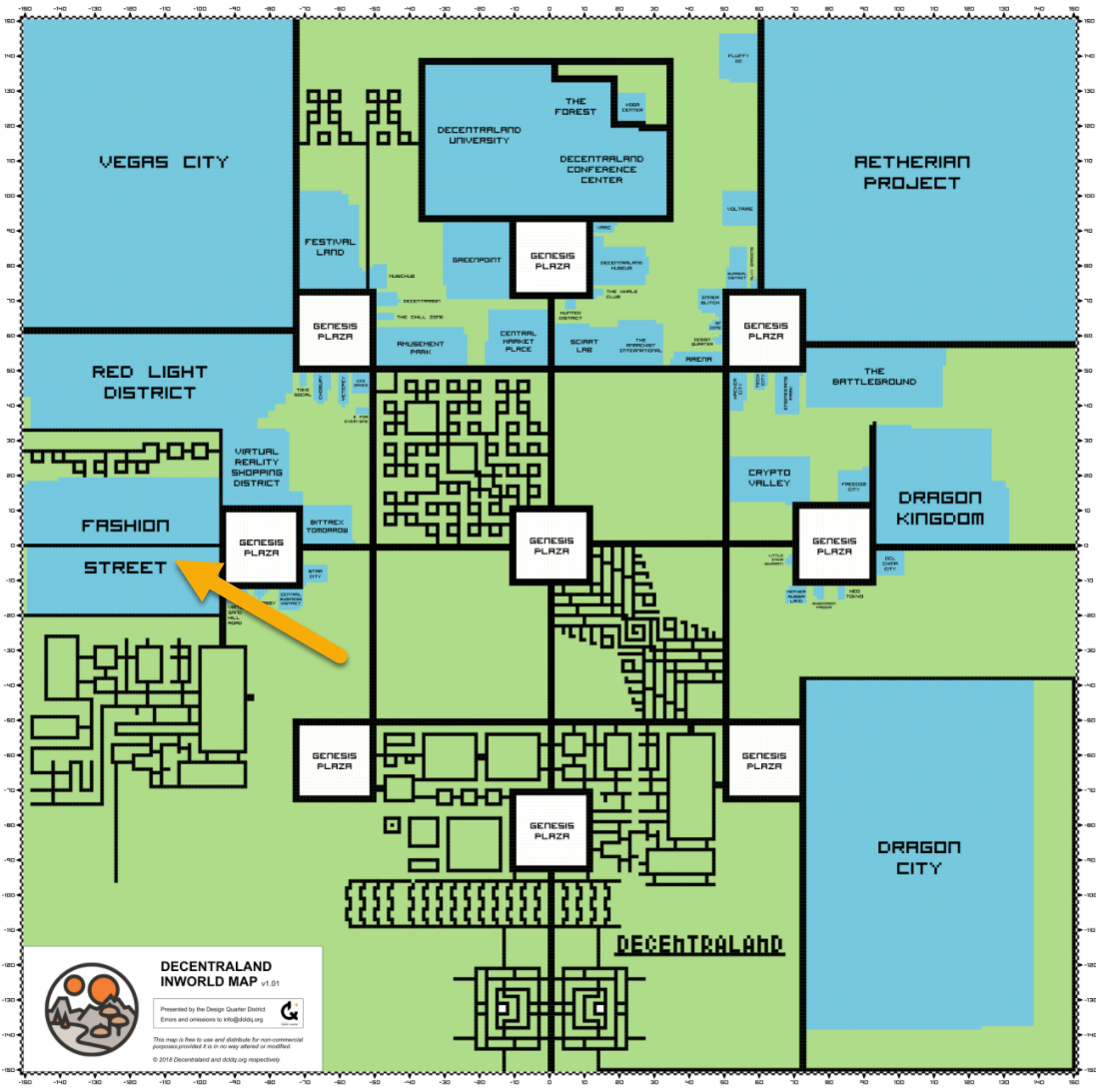

The market for virtual real estate is commonly thought to be more than $1T. Decentraland is one such world selling virtual real estate. Launched in 2017, Decentraland is a 3D realm built on the Ethereum blockchain. Atari just announced they would open a real casino there next May in the Vegas District. Other brands are close to establishing residence in Crypto Valley, Music Hub, the Museum District, the Design Quarter, or the venues of the many virtual conferences.

Earlier this year, the Metaverse Group purchased a plot of land there for 618k Mana (a second layer cryptocurrency built on top of Ethereum), or about $2.4M at the time of transaction. That is approximately equal to the average home price in San Francisco or New York City.

That land that was purchased is composed of 116 parcels right in the middle of Decentraland’s Fashion District, dubbed the Fifth Avenue of the virtual world. One parcel of land in Decentraland is equal to 52.5 square feet making the purchase equivalent to over 6,000 square feet of land, or about a 67% discount to what land goes for in the Union Square area of New York or San Francisco.

Those 116 parcels are in the process of being marked up and sold to a variety of brands, so Decentraland’s players can wear limited edition Nike shoes, Gucci shirts, Moncler jackets, carry Louis Vuitton backpacks while sporting Prada sunglasses. Consider that non-branded shirts are selling for the equivalent of $40 in Decentraland. Selling a $100 Gucci shirt that can last forever doesn’t seem too far of a stretch.

If a brand buys a parcel for $210k (short and long-term leases are also available), customize the code for another $40k, has a 98% profit margin on their virtual goods, they only have to sell 26k shirts so that both the Metaverse Group and Gucci more than 10x their money. With 155k players and growing, a healthy return on investment seems more than possible.

Andrew Kiguel, the CEO of Token.com, the holding company for Metaverse Group, spent 20 years in investment banking focused on real estate at Stifel and Credit Suisse and underwrites these investments similar to physical real estate. When asked to justify the price, Kiguel said it was all about cash flow and footfall traffic. He pointed out that a recent music festival brought in 50,000 visitors. Roblox and Fortnite have thrown events and have seen upwards of tens of millions of participants – it’s hard to get that traffic in the physical world.

Before you dismiss the metaverse as just for kids, we point out that 85.2% of users are over the age of 18, with 23% between 25 and 34 years old and 15% 35 or older.

Of course, you may not want to buy or lend on virtual land without a third-party validation, so luckily, there is a new cottage industry of virtual appraisers that can help provide supporting data and highlight the risks, as well as give you insight into development activity. Should you want to buy land in Decentraland, for example, you can get a Dappraisal and can also hire architects (Voxel Architects), builders/premade buildings (Ogar), and designers to help build on the land. There is even a Zillow for the Metaverse (Parcel).

Decentraland is just one of many spaces. New York-based Republic Realm, a team composed of physical real estate brokers that focus on trophy properties, just purchased land in The Sandbox for a record-breaking $4.3M. Other spaces include Cryptovoxels, Somnium Space, Upland, and others. Spotselfie takes a different approach and overlays a virtual world on top of a physical one. You can purchase, and one day finance, space where you can advertise or sell advertising to produce revenue. By pointing your phone’s camera (soon to include wearables) at a building, you will see a graphical augmentation of reality complete with your ad space.

The Risk of NFT Lending

Oddly, the risk of lending against metaverse property is almost identical to physical property. From a credit risk perspective, most current lenders (non-bank) target “the threes” – or, 35% loan-to-cost and 3x debt service coverage with some needing 5x.

In addition to the normal credit risks, there is a risk of fraud, potential regulatory changes, price volatility, fair lending, and technical issues with the structure of the property/blockchain. Like physical real estate lending, most of these risks can be sharply mitigated by proper due diligence and underwriting if done correctly. The huge advantage in the Web 3.0 is that the blockchain is comprised of composable code. Banks can create their lending module “on chain” and reuse the code for various applications.

The lending code handles underwriting, representations, warranties, terms, and conditions, servicing plus foreclosure and collections. Unlike the physical world, banks can automate legal processes such as disclosures, payment notifications, late notices, late fees, and foreclosures. The transaction and processes around the lending are then validated by miners and available for all to see and audit. Virtual properties are held in escrow via the code and released to the borrower upon full repayment. When non-payment occurs, the electronic escrow automatically releases the property to the bank after the proper notifications and cure period.

Unlike physical real estate, there is a material risk of hacking. Undoubtedly, you will hear more about theft in crypto and the NFT market. Any fast-growing market will attract a criminal element, such as we have seen in energy, technology, or biopharma. However, here is the thing that most observers fail to realize – there are some of the best minds in this space right now, many with a background in cryptography. Cryptographers are really good at cybersecurity.

Off the blockchain, hacks and fraud may not result in a monetary loss and are often not disclosed. The owners of many hacked networks don’t even know they are hacked. On the blockchain, any hack or fraud will not only result in an immediate monetary loss but will be there for all to see. Those two elements provide a considerable incentive to quickly iterate the broken blockchain code to shore up vulnerabilities. Transactions on the blockchain, be it crypto, artwork, or virtual real estate, will evolve to be far safer than the physical world.

Putting This Into Action

Have the regulators opined on metaverse lending? Not even close. Will your bank be lending any time soon on virtual real estate? It’s doubtful. Is there a bubble in metaverse real estate? Maybe.

Regardless of the answers to these questions, the rise of the metaverse should be on every banker’s radar. While it is easy to dismiss this new paradigm, that would be a mistake. It is hard to argue there isn’t value in metaverse land and buildings. It may not be what everyone thinks it is, but it is likely greater than zero.

Virtual property confers status, provides a location, has clear title, and generates cash flow – just like physical property. The leases for a virtual property are very similar to physical property, but they are just on the blockchain. Better than real property, the virtual property is likely more liquid, likely has better growth prospects for the foreseeable future, and has the potential to access a global market around the clock.

The talk at banking conferences around metaverse lending is almost identical to the discussions we used to have about cryptocurrency just five short years ago. Most bankers dismissed cryptocurrency back then with nearly identical arguments they are using again for metaverse lending. However, some banks did their homework and embraced the crypto asset class. It is no surprise that some of these banks now trade at some of the highest multiples in the industry despite not having regulatory clarity and taking the reputational risk that the asset class could potentially be inflated (like most asset classes these days).