How To Optimize Workflow Given The New PPP EZ3508 Form

The release of the new Paycheck Protection Program (PPP) Forgiveness application 3508EZ (EZ Form) will cut down on processing time for both the borrower and the bank but merits a quick review in order to optimize processing efficiency. If you are a fintech, or a bank creating their own technology, the EZ Form threw a major curveball as you had had to restructure your code and workflow to figure out if an applicant qualifies. In this article, we highlight several items to consider when building the EZ Form into your new process.

The EZ Form

While not terribly different, if a borrower is self-employed without employees, did not reduce staffing hours/employee compensation by 25% (in normal operations), or had reduced operations as a result of COVID-19 and still kept compensation at 75% of normal then they could file a streamlined the application form that removes the need for adjustments. The Form that did take the average business about 80 minutes to complete, now takes around 30 minutes. For banks, the EZ Form cut processing time by a little less than half.

This reduced time is significant as any business that can qualify for the EZ Form will opt for it as the application requires fewer calculations and less documentation. While we are still collecting data on the number of borrowers that will qualify (tune in next week), we currently estimate that approximately 30% of the PPP population will.

Changes To The Workstream

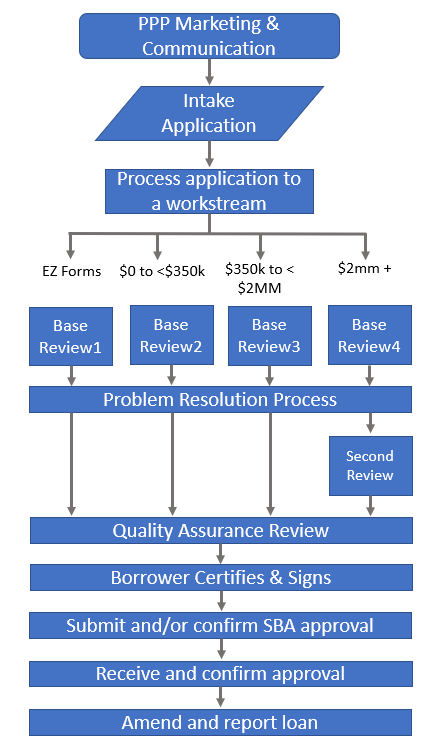

Because it is a different application and reduced process, many banks, created a separate channel to allow for specialization. With a reduced need to check through various leases, mortgages, and utilities, less experienced staff can be utilized, and that staff can likely process applications faster than the other three channels. As such, by pulling these applications into a separate workflow, not only are resources more efficiently allocated, but overall throughput can be increased without the larger loans acting as a constraint or bottleneck.

Once in the workstream, the base review can be simplified with the bulk of the effort directed at just verifying payroll. This Base Review contrast with loans above $2mm that may only have 60% of their loan amount supported by payroll and the banker will need to sift through the many mortgages, lease, and utility documents covering up 24 weeks.

What emerges is a revised workstream similar to the diagram below.

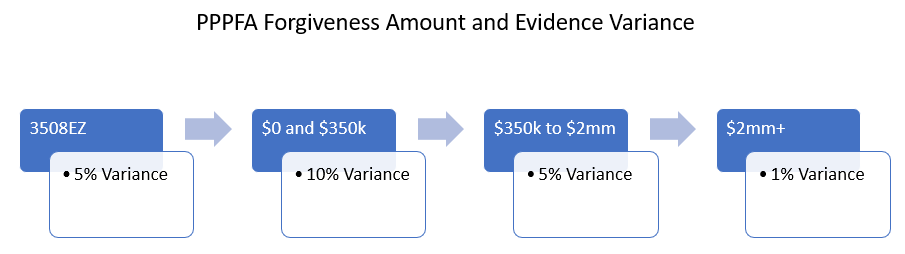

Adjusting Variance

One key aspect to note here that is getting overlooked at many banks we spoke with is that because the statistical variations of outcomes are reduced, a lower variance amount can be applied. In other words, because there are fewer adjustments, fewer calculations, and a more straightforward process, discrepancies should be reduced. More borrowers will have more concrete and unequivocal support for their requested forgiveness amount. Thus, because of this reduced expected variance, banks can reduce their tolerance from a mode of 10% to around 5%. This process adjustments serve to decrease a bank’s risk without sacrificing throughput speed.

Marketing and Communication

One major change the EZ Form does is serve to confuse both borrowers and bankers even more. To counter this impact, banks need to plan on increasing training for both borrowers and bankers. Banks will need to update their website (take ours for example ), update their process, and train their borrowers not only how to complete the EZ Form application, but how to label the file or submission to reduce confusion for bank processing.

Staffing Model

While we will update our staffing model next week once we have some hard data from a universe of borrowers, it is important to note that EZ Forms will come in faster than our last staffing model predicted (HERE), and banks should prepare accordingly. Because of the faster preparation time and less reliance on utility expenses that tend to come throughout the month, banks can expect more applications at the start of each month, particularly after a fiscal quarter-end.

Expected ROA and Putting This Into Practice

The PPP Forgiveness process was already more complicated than the PPP origination process. The addition of the EZ Form, while a net good, complicates processing for the industry but will ultimately serve to reduce aggregate transaction costs. Hopefully, some of the above helpful tips will help to reduce your processing cost more than average.

Reducing cost is critical as, over the course of this program, the risk-adjusted return on assets has dropped from an enticing 4.4% to now below 1.8% for banks with an automated process and below 1.3% for banks without due to the higher processing costs and a longer set of expected cash flows.

Since we are not yet done with all the changes and process refinements, it is hard to tell where we will end up from resource allocation, risk, and profitability point of view. However, one thing is clear – the complexity and scale of the PPP Forgiveness effort is crammed full of traps and quagmires ready to burn bank resources at a time when available resources would be better deployed finding a permanent capital solution for many of our customers.