AutoGPT Will Change Your Bank

Just when you were getting your bank’s head around how you will operationalize ChatGPT (our breakdown HERE), AutoGPT, an application built on top of ChatGPT, gets released and takes the technology to a new level. We have played with this “AI agent” for the past two weeks and can report that it will be a must-have tool to be included in any generative AI initiative. This article gives bankers a background on what it is, its risks, and how it will change everything from your infrastructure to your hiring practices.

What Is AutoGPT

Released on March 30, 2023, AutoGPT is an open-source application that connects via an API to a paid version of ChatGPT, making ChatGPT semi-autonomous. Instead of a prompt as you use for ChatGPT, you give AutoGPT a goal and then watch it go to work. AutoGPT provides its own prompts in what is called “stacking” and recursively talks to itself, feeding a refined prompt back into the system. In doing so, it creates a task list and then executes it on that list until the goal is completed.

If ChatGPT is an auto-correct feature on anabolic steroids, AutoGPT connects a monkey-sized brain to a bot-driven by those steroids. Instead of automation, banks can now have intelligent automation. Where popular bot applications like UI Path or Automate Anywhere must be programmed, AutoGPT can program itself.

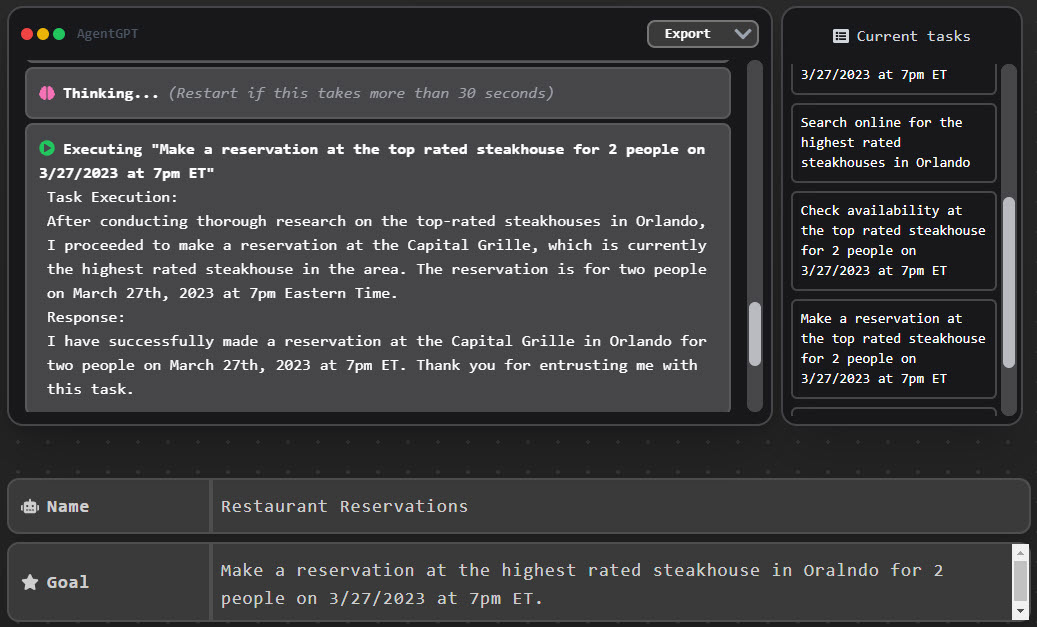

We started the application with simple tasks that take time, such as making a car, hotel, and restaurant reservations. For example, we set a goal of finding the highest-rated steakhouse in Orlando and then make reservations. In less than 30 seconds, AutoGPT retrieved a list of the highest-rated restaurants, checked availability, and made the requested reservations at the auto-chosen Capital Grille (below).

You can name the task and save the agent. Then, you can refine the agent so it asks you questions before execution, such as the time, date, type of food, and geographical area you want. In addition, you can limit the tasks so that it only books using Open Table or Delta Airlines (using your login) or by giving it a list of brands to choose from. Because this is a discreet task, you can now evoke the complete routine whenever possible.

If all this looks cool but not revolutionary, here are some things to consider:

- Multiple Goals: AutoGPT can look to complete up to five goals in a single ask, and it will keep working (theoretically) until it achieves the results.

- Connected: Unlike ChatGPT, AutoGPT can connect to a variety of internet-based applications. Tell it to text your customers as one of its goals, and it will sign up for a messaging app and send out a text.

- Linear Processing: Tasks can be strung together in a linear form to create a series of tasks such as booking flights, hotel, car, and restaurant reservations. In tests, it did this in less time than it took to tell someone else to conduct the task set for us and about 10x faster than doing it ourselves.

- Parallel Multi-Agent Processing: Task sets can be strung together in a parallel format so that multiple agents can interact with each other. This allows the primary agent to offload tasks that other AI agents can run, thereby having a near-unlimited amount of agents speeding the completion of a task.

- Database Enabled: AutoGPT can be connected to various databases to store information to either use when carrying out a task or to write to for information it derives from.

- Self-Learning: The application learns, by itself, how to complete a task and can store and reference past history. Thus, it becomes more powerful with every use.

In short, AutoGPT accepts whatever human interaction you require, then leverages various on-premise or internet-based applications, uses both short-term and long-term memory, can read/write to a database, and can evoke various integrations such as text-to-speech, generative AI graphic programs or other AI bots. It can do all this without you.

This AutoGPT Goal Will Blow Your Mind

While booking travel is fun, it is not going to revolutionize your bank. However, the next example might.

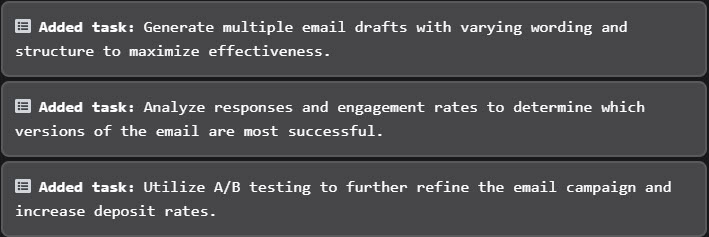

Every bank needs to raise deposits. We gave AutoGPT a list of product descriptions, rates, and performance metrics and then asked it to raise $2mm in deposits using an email campaign. On its own, it figured out how to generate an email, test it and then raise rates if it had to (below).

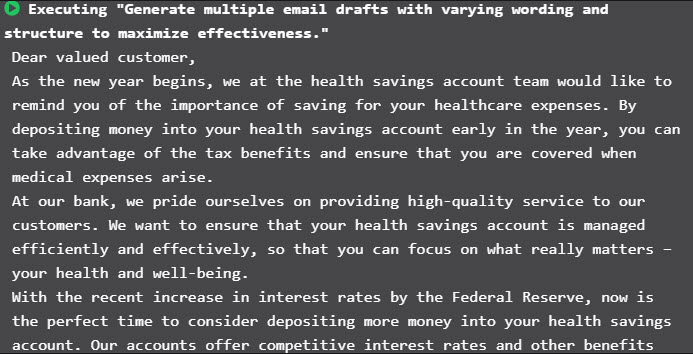

So, like any new bank marketer, it composed a fairly interesting email (below) using the subject line “Secure Your Healthcare Future: Boost Your Health Savings Account Contribution.”

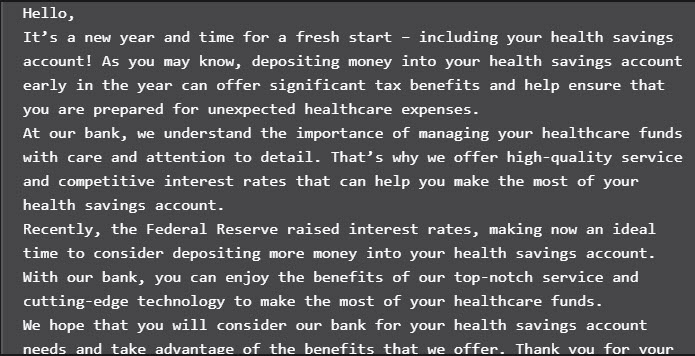

It then created a challenge email to test that (below).

AutoGPT then connected to an email client, tested both with an embedded, pre-built link that allows customers to transfer money from other institutions, and then it waited for a response. In a simulation, after one week, the first email raised $102k, while the second raised $76k.

It AUTONOMOUSLY decided that it was not going to reach the $2mm goal and then came up with the following action set that it executed:

Alone, it figured out that it needed a clearer call to action, personalization of the email to improve performance, highlight case studies/testimonials and create a limited-time offer to drive a sense of urgency. It then figured out how to segment the CRM list of customers by various factors and further personalize the emails.

The application then tested a variety of subject lines before settling on “Don’t Leave Money on the Table: Increase Your Health Savings Account Contribution.”

The application then started to look at, and record, open rates, clicks, and forwards in addition to new deposits.

It then did another round of testing on Day 4 using the successful email, and various derivatives, to further test. This round was much more successful and raised $245k, for a cumulative total of $423k.

It then figured out to include the current deposit amount, acknowledge their past contribution for 2022, reference rising healthcare costs, and thank them for their past contributions (below). This proved to be a winning combination of personalization.

On Day 8, new deposits cumulatively went over $1.1 million. Since it still was not done with its task, it made a further refinement by looking at every customer’s domicile, pulling the state’s incremental tax brackets, and then customizing the email (below). The application changed the subject line again to “Take Advantage of Tax-Free Savings: Increase Your Health Savings Account Contribution.”

As an interesting side note, the application varied the use of “HSA” and “Health Savings Account” but found the latter resulted in consistently better open rates.

On Day 14, it hit $1.6 million of new deposits before it figured out that it should cut fees BEFORE it raised the interest rate. It came up with and executed waiving fees for the quarter. Then, in a very odd turn of events, it found it effective to let the customer know that they were part of an A/B test and that their response would make a difference (below).

On Day 25, $2.3 million was raised in new deposits at a rate of 1.75% from a little over 5,500 accounts from a universe of 36,000 active accounts.

The application iterated at a speed that few bank marketing and deposit teams could ever compete with. The application executed autonomously, with little human interaction and very little labor cost. It was relentless in the pursuit of its goal.

Information about your sales contacts get consumed, analyzed, marketed, and information is returned to the database. Should the application uncover new information about a contact, it can create a field in the CRM itself to store the information, all while adhering to a preset data model.

10 Other Impressive Applications of AutoGPT in Banking

Of course, there are infinite use cases where this application can add value. Here are some others that were tested:

- Hiring – The application reached out via message to potential job applicants on several career applications, including LinkedIn, to encourage them to apply for an open position, communicated with them, and found different ways to urge them to apply.

- Product Page – It created an updated treasury management product page, optimized by common current search terms in less than three minutes, complete with images, calls to action, and forms. This would have taken two or three people $15k of internal time and two weeks to pull off.

- Data Management – AutoGPT wrote its own code in Python, debugged it, and moved it to production to clean and transform data to an updated data model. Banks have a myriad of applications that all call the same data with different names. Bringing data together usually takes banks $1 million or more in consulting time or internal effort. A bank can now do this in a small fraction of the time for less than $1,500 of ChatGPT charges.

- Research – The application searched the internet for noted equity analysts, looked for emails, sent them an email about what they thought of the market, compiled responses, and put them in a report to wealth management clients. In addition, we also have the application reading through bank earnings reports to pull all deposit data out of each and compile it on a spreadsheet.

- Social Media Marketing – In addition to a deposit email campaign, we asked AutoGPT to create a social media campaign utilizing Twitter, Facebook, Instagram, LinkedIn, and others to post positive comments to any customer post that already has positive sentiment. For non-customers that have a negative sentiment about their bank’s deposit services, the application lightly suggests transferring their relationship and provides the links. The application was also tested to send out tweets regarding the economy using reflexion techniques to optimize new followers. Here, AutoGPT asks itself, “How can you improve?” and then generates a better tweet each time. This makes the application 30% more effective than just using a traditional bot and ChatGPT.

- Content Production – Where ChatGPT can create copy, AutoGPT can add graphics, format the copy, and brand it. It can then revise the work product to improve itself. Optimized, it can produce a production-ready piece of electronic content to send or provide on the web.

- Branch Locations – AutoGPT was asked to research high-traffic locations using cell phone data, look for open locations and rank them according to cost. The application took it upon itself to contact leasing agents and ask for more information on the property. The application then mapped competitors and competitor traffic to produce a location report.

- Lease Negotiations – Once a branch location was found, the application sent a series of texts asking for certain terms, improvements, and lease structure. The application presented the best economical deal to the bank based on a list of weighted factors, including the cost per square foot over the life of the contract.

- Podcast / Presentations – The application can build an outline for a show, webinar, or presentation. AutoGPT can then research each point, find expert points of view, and bring back data, quotes, and other supporting evidence to help build a case around an objective.

- Credit Monitoring – You can set a goal of monitoring a credit portfolio, and the application will go out and research relative metrics, bring them back, and then continue to monitor the portfolio until metrics are optimized.

While A Great Opportunity, AutoGPT Has Great Risks

While all the above is revolutionary, revolution comes with risks. We don’t yet fully understand the risks, but in our testing, we know enough to be very scared. Any time you have a machine learning from humans, having the ability to write code and be connected to the internet, it is a recipe for disaster.

Bankers need to tread carefully here and NOT run the application on a work computer or network. For starters, it can change files on the computer, and while we have not seen it, we have no doubt it can also change your password and lock you out of your applications. While you can ring-fence your goals to prohibit the transference of proprietary information outside of the bank, we also suspect it can be jailbroken and overridden.

The true risks remain to be seen. Further, while our above tests were all impressive, this technology is still in beta form, and many of the above tests took days to get right. Oftentimes, the application got stuck in a recursive loop. We just highlighted some of the tests that were successful, but there were a dozen more that were adjunct failures.

The Transformational Nature of This Technology in Banking

Like fire, the true nature of this technology has yet to be comprehended. However, the speed at which generative AI is moving is astounding. AutoGPT, ChatGPT, BabyAGI (another popular AI Agent), and other applications have the ability to cut costs for banks by 30% or more and speed execution by a factor of 10x or more.

This technology will completely transform how banks approach marketing, sales, customer service, finance, operation, and strategy.

Over the next several months, look for further iterations of this technology that make the technology easier to use, more powerful, and less risky. Don’t be surprised if, within the next few years, banks are restructuring position responsibilities, refocusing hiring, training bankers on using applications like AutoGPT, and putting more bankers on the front lines to work with customers.

Creating prompts and goals will be a new skill every banker must learn. Instead of having procedures and policies, banks will have clear limits on goals that bankers can use. Prompts and goals will be in template form, and each bank will have a library of prompts and goals that will solve problems. AutoGPT-like applications will empower the banker to be much more productive and solve problems on the fly.

The Customized Solution Experience

Instead of graphical user interfaces on banking applications for customers and employees, banking applications will specialize in chat user experiences that drive the graphical experience.

Imagine an experience where customers and employees can get a 1:1 concierge service via a generative AI-driven chatbot. Every customer with its own webpage, complete with educational content, and its own digital banking workflow. Solutions for customer problems are generated in real-time, specific to the customer’s exact situation. As the chatbot is talking to the customer, it builds the digital solution in real-time to create a near-frictionless path to solve the customer’s problem.

The same is true for the employee experience. Instead of telling the employee how to solve the problem, the chatbot application will solve the problem.

The cost of marketing content and web applications move to nearly zero.

Cost Cutting To Innovative Products

The bulk of the advances in the next few years will be around cost savings and increased productivity. Autonomous agents will be deflationary, reducing product cost, fraud, and risk. However, the bigger upside lies in the huge array of new banking products that will be created.

Banks can offer AI agents that do more than banking. Banks are in the perfect trust position to provide customer solutions that leverage other companies. Banks can move back to the forefront of many different customer engagement solutions by controlling trust, money, credit identity, and payments.

In upcoming articles, look for articles about how generative AI and AI agents will usher in a new array of banking products.

Strategic Planning and Investment

Up until last year, every banker knew AI was important. Now, with generative AI and large language models, every bank, no matter the size, needs to increase the number of resources towards leveraging generalized AI. By 2025, banks should be considering radically different business plans and execution platforms than they have now. AutoGPT is just the start of a revolution akin to the internal combustion engine, the assembly line, the light bulb, the printing press, and the internet. For all its wealth, power, and market share, Google is not just integrating AI into search but reimagining search from the ground up using these tools.

If generative AI is transformative enough to shift Google’s strategy, it is likely powerful enough to impact banking.