Every Banks Needs to Take Another Look at a Digital Wallet Strategy

The recent popularity of stablecoin and tokenized deposits have forced banks to take another look at a wallet strategy. Even if you are not planning to issue a stablecoin or tokenized deposits, the fact that these instruments are separate from a bank’s core means any other bank can capture these products into a digital wallet. While the digital wallet used to be about payments, it is now about general banking. In this article, we look at digital wallets and propose a strategy that your bank may want to employ.

Digital Wallet Background

Wallets can be the home screen for money. Where retail and small business customers used to reach for a physical card, or open their mobile banking application, they now turn to their digital wallet. The rise of the virtual debit and credit card started this trend as double-clicking the side button on a phone was easier, and more secure, than reaching for a physical wallet.

The digital wallet trend started back in 2011 when Google introduced the first digital wallet building on PayPal’s popularity of digital payments. By 2016, Apple, Samsung, and Starbuck each had significant popularity with their respective wallets. By 2017, many banks considered having their own digital wallet in order to exert more control but decided against it as the value was not there to justify the management of another banking application.

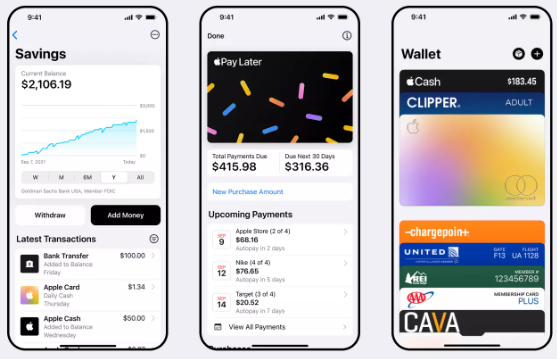

However, by 2020, the Apple Wallet (below) showed banks the “art of the possible” with its game changing interface and notifications. Using their Apple card, customers, for the first time, could see their card balance, credit availability, activity, monthly spending trends, next payment due date, savings account information, interest earnings, handle autopay, get offers, receive notifications, lock card, and do this while being able to monitor the usage of other family members you might have given the virtual card to. The user experience set a new bar for banking.

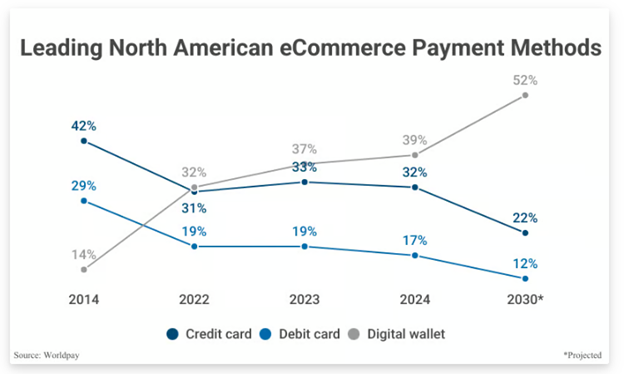

At present, there are 4.3B digital wallets with 57% of U.S. adults using them in 2024. By the end of last year, digital wallets composed 32% of point-of-sale transactions, the highest on record. According to WorldPay/FIS, physical debit and credit card usage is expected to decline while the use of digital wallets is expected to increase over the next five years from 39% usage to 52%. For those under the age of 30 years of age now, that usage is already 73% and we expect that usage to go well into the 90% range by 2030.

The Digital Wallet as a Strategic Banking Concept

In the past, too many bankers considered the digital wallet as a “wrapper” to a card product instead of a complete platform. This truncated the strategic thinking of many banks. From a pure strategic point of view, a digital wallet allows a bank another avenue to build out a digital experience to augment their digital banking platform. For banks that want to differentiate themselves and get more creative with banking product, the digital wallet provides that platform outside the constraints of their mobile banking platform provider.

Banks can now have a lower cost structure and more technical freedom than relying on their core system provider or their digital banking vendor. This concept opens up a new realm of possibilities for digital delivery and a differentiated customer experience. Banks that want to issue a stablecoin, tokenized deposits, analytics, step-up payment authorization or additional services, can all build bespoke functionality within a wallet for a fraction of the cost and time.

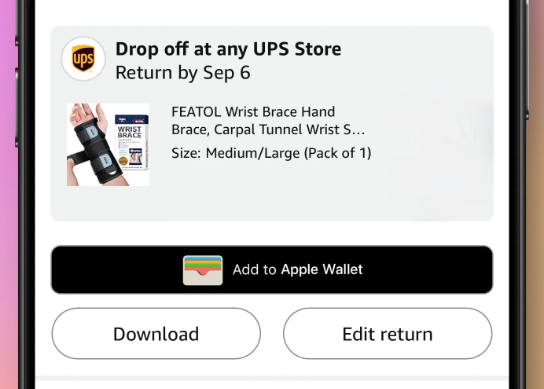

By way of example, this week Apple released functionality whereby you can track Amazon returns telling you the closest location to drop the return off at and allowing you to track the return through to credit to the customer’s account (below).

Digital Wallet Security and Usability

Digital wallets present some clear advantages over the physical wallet or the mobile banking app. Banking apps are fantastic for statements and checking balances. Wallets are for doing: paying, proving, and receiving. If your bank only competes inside a traditional banking app, then you run the risk of not competing for everyday spend.

Unlike a banking app, a digital wallet is event-driven and contextual. It can handle payments with a tap, QR code, link, or SMS request for payment. Most digital wallets allow for a two-tap experience for any payment. Compare that to the click path inside a banking app that would take an additional validation and an average of seven taps to effect a payment.

Apple Wallet shows the path: real-time, rich alerts, transaction graphics that are instantly legible, clean receipts, and frictionless tokenized credentials. Your wallet should strive for the same qualities:

- Instant, visual confirmations: merchant name, logo, map, amount, category, and the ability to add notes or attach receipts.

- Actionable notifications: one-tap dispute, split payments, payment date adjustment, mange spend limits or change payment rails.

- Delight without clutter: Focused UI, large tap targets, fewer decisions. A digital wallet is designed for a payment experience, not a bookkeeping session.

Here are other additional advantages:

Easy Presentment: Just as customers now reach for their physical wallet, more customers reach for their digital wallet to leverage near field communication (NFC) capabilities for tap-to-pay. What used to take 30+ seconds to get your physical card out, swipe/tap and pay, now takes less than 10 seconds. For ecommerce, the digital wallet contains contact information so completing merchants’ forms and verification exchanges are now instant with a digital wallet. The poetry of a wallet lies in their context and speed:

- The digital wallet is context aware. It can pick up an NFC signal and automatically bring up the relevant payment capabilities.

- They launch from the lock screen, watch, or tap – no hunting for an app.

- They reduce checkout to one or two biometric taps.

- They present exactly what is needed in the moment: the right card, the right account, the right offer.

Security: Instead of handing your physical card over with the account number, signature, and CVC visible, the digital wallet tokenizes the account information and ties it all to both the device and biometrics. In addition, there is the underlying device hardware offering additional security that many banking applications do not take advantage of, but digital wallets do. Combine a digital wallet’s structure with your bank’s existing controls (behavioral analytics, velocity checks, step-up auth.), and you get higher security with fewer steps than traditional banking app workflows.

Control: In addition to tokenized credentials, digital wallets can handle a variety of payment controls to allow banks to provide purchase card-type controls to every customer for multiple payment types.

Rail-aware routing: The digital wallet can become an easy place for a bank to allow for a manual orchestration layer. If your bank has not developed an automated payment hub that seamless routes different types of transactions, then a wallet allows a better customer experience to allow the manual orchestration.

Real-Time Payments (RTP) and FedNow have dramatically altered the cost landscape for banks. Instead of losing money on every check, banks are converting customers to the instant payment rails within their digital wallet and promoting pay-by-bank. This provides the bank with a cheaper cost structure, while providing the customer with real-time payments and always reconciled account. If that is not to the customer’s liking, they can still utilize a debit or credit card all inside the digital wallet at the point of sale.

Compliance: A digital wallet also has the advantage of being capable of a compliance-first approach. KYC, sanctions screening, travel-rule data (when applicable) and transaction monitoring can all sit in your orchestration layer and interact with a given wallet. The wallet is then used to simply carry the user’s consent and credentials.

Data and Analytics: Wallet interactions generate high-intent, real-time signals (where, when, what). Banks can use these signals to power smarter offers, manage credit risk, generate loyalty, and provide financial advice all closer to the moment of spend.

Architecture: Unlike many banking applications, a digital wallet can be built out in a composable and modular form. Features like bill payment, subaccount control, subscription management, dynamic controls and step-up payment authentication can be added without risking a bank’s primary banking platform. Being able to push app updates also allows banks to better A/B test new features and then methodically role advances out instead of being forced to release all at once.

The Growing Popularity of Pay-by-Bank

Over the last two years, pay-by-bank has increased in usage. Now, the customer can enter in their routing and bank account number into a wallet to be used as its own payment rail settled by the instant payment networks or ACH. Legitimized by Walmart and now enabled by Plaid, Fiserv and others, any merchant can now largely bypass the card rails and save themselves an average of 2.5%. While pay-by-bank can be enabled in the individual apps of merchants such as Walmart and Starbucks, as the rail becomes more popular, usage is migrating into a digital wallet.

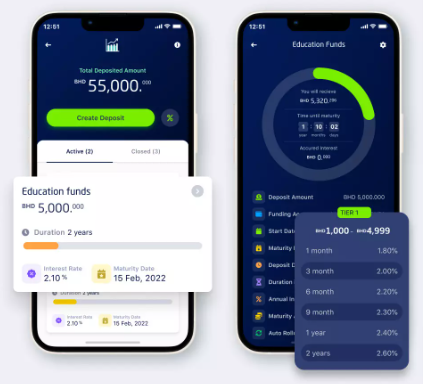

The Commercial Virtual Wallet

Banks are often limited to commercial payment approval workflow by their banking application. In the last three years, commercial wallets have become more common with the advantage of being able to create payment approval workflow. A payment initiated by the controller, for example, will trigger a wallet push notification for the CFO. The CFO can see details of the transaction, see the status of other secondary or tertiary approvals, review payment limits and even make changes as needed.

Since the digital wallet handles completely tokenized transactions and is integrated with both the device and biometric identification, commercial security is enhanced.

For commercial customers, and marketplaces, the wallet can enable instant sub-account transfers, escrow-like flows, and conditional releases. Tasks that are clumsy in traditional apps can be intuitive as wallet actions (Approve release on delivery).

Why Tokenized Deposits and Stablecoins Change the Priority

Since the passage of the GENIUS Act, stablecoins and tokenized deposits are bringing 24/7, programmable settlement into the mainstream conversation. Instead of holding these accounts on your core system, they are held in a wallet at the control of the customer. For that matter, should the bank allow, other digital assets such as tokenized real estate, Treasuries, crypto or other investments could be held in a digital wallet.

This is a radical new paradigm which serves as the major catalyst for banks to take another look at providing or partnering on a digital wallet. Soon customers will be able to both seamlessly “connect” or transfer account balances between banks or between entities to include other wallets. This goes a step beyond open banking and allows customers complete freedom to transfer balances and assets between accounts or institutions.

In a recent mystery shopping test, we transferred IRA funds from a Chase account to Fidelity. Amazingly, because of the IRA requirement, Chase had to do this by check taking and astounding seven days. During this time, there was no record of transfer or receipt to the customer experience. To the customer, the money seemingly disappeared – an unnerving experience.

This problem gets solved with a tokenized deposit transfer. Not only is the transfer in near real-time, but customers will see the complete debit and credit activity to always know the status of their money.

For banks, instead of programming their banking applications, the code and the account / payment can now move as one for both tokenized deposits and stablecoin. Leveraging the blockchain, these digital instruments create efficiencies with smart contracts that are self-executing agreements programmed on the blockchain. A smart contract can specify the rules around approving a payment, issuing, transferring, and exchanging these tokens. They also contain the fees, interest rates and collateral requirements associated with any stablecoin or deposit token.

As more assets get tokenized, banks will increasing want visibility into customer assets and may want to lend against certain assets such as Treasuries or take these tokenized assets as collateral for existing obligations. Having a digital wallet at the bank and having your customers have digital wallets is the first step to being able to view and transfer these assets.

The Role of Agentic AI

Generative AI is allowing robotic processes (agents) to now think. The shopping bot has now become a common use case where the agent is able to make clothing purchases, travel bookings and restaurant reservations. Providing these agents with a digital wallet or giving them access to a digital wallet is one highly likely outcome. In this manner, payment information remains tokenized and controlled by the agent’s owner.

The market opportunity here is massive and just starting. By 2030, we expect agentic commerce to be well over one trillion dollars, and a digital wallet will likely be supporting the bulk of those transactions.

Putting This into Action – A Bank Roadmap

Wallets are becoming the center of gravity for everyday money. A digital wallet moves your bank closer to the payment action and makes it easier for your customer to monitor, manage and effect payments.

Stablecoins and tokenized deposits are likely not a sideshow; they are the gateway to programmable domestic payments and seamless international money movement. The wallet can be an additional platform for banks to expand their customer experience and be able to handle not only payments and identity, but a variety of banking functions and data analytics.

For banks looking to get started in digital wallets, they can build their own wallet for between $50k and $250k with a $100k average. Banks also have a multitude of wallet providers that can be white labeled. From there, banks can:

- Build a wallet MVP as a separate surface to experiment with employee payments.

- Expand to allow card provisioning, spend alerts with rich visuals, simple A2A bill pay.

- Add a savings account.

- Add design elements such as balances, interest earnings, spending limits, notifications, and activity logs.

- Increase payment capabilities – future payments, recurring payments and pay-by-bank functionality.

- Add additional payment rails (ACH and instant payments) and controls.

- Pilot tokenized deposits in a closed-loop internal use case (instant customer-to-customer transfers or marketplace payouts).

- Launch merchant and biller partnerships offering Pay-by-Bank with incentives.

- Offer SMB/corporate features: approvals, spend policies, receipt capture, and programmable payouts (including tokenized options where allowed).

- Release developer docs for selected partners (deep linking into wallet flows, secure presentment).

The monetization of social media has taught us the importance and value of attention. Having a digital wallet makes it easier to garner and keep attention. If you let your capabilities live only inside a traditional banking app, your bank risks losing payments, accounts, and attention. If you build a bank-grade wallet, complete with alerts and graphics tailored to your rails, controls, and customer experience you will own the moment that matters, every day, in two taps.