Is Your Bank Operating At The Right Capacity?

As we have discussed before, your bank is a manufacture of credit, liabilities, and fee services. Whether you know it or not, you have a certain production capacity for each. In today’s current environment, some banks are running at full and even overcapacity while some banks are operating at a 50% utilization level. The question that comes up is – is your bank operating at the right capacity and how much should you be pushing on the gas to increase production? In this article, we take a look at the math and the concept behind designing, and managing, capacity utilization using a framework known as “Total Effective Product Production” (TEPP).

Using TEPP At Your Bank

TEPP is a production metric that banks can use to quantify their effective capacity of successfully producing any given bank product. It might be loan underwriting, it could be deposit account opening, or it could be treasury management. It doesn’t much matter as for each product or services your bank has a finite production capacity. If you are under capacity, resources sit idle and are not efficiently utilized. Produce near, or over capacity, and risk is likely to be increased thereby potentially causing more long-run harm.

The formula to calculate TEPP looks like this:

Here, TEPP equals your bank’s available (C)apacity for any given product times (P)erformance times (U)tilization times a (R)isk factor.

A Loan Underwriting Example

If you have one credit analyst and they can underwrite one credit per eight-hour period, then you have a one credit per day maximum capacity.

Of course, it is rare that they can devote the full day to underwriting as the analyst likely has reporting, regulatory, department administration, and personal time. For the average bank credit analyst, this non-underwriting time averages three hours per day. Thus, this effectively adjusts capacity to five hours of true availability.

Unfortunately, our analyst has a life and takes time off, gets sick, and goes for training. In addition, the bank is closed for holidays, hurricanes/disasters, and random events such as pandemics, power outages, and other events that cause the bank not to be open or lose worker productivity. As a result, the actual utilization of total capacity is yet another adjustment factor.

Key Concept: Adjusting For Risk When Determining Operating Capacity

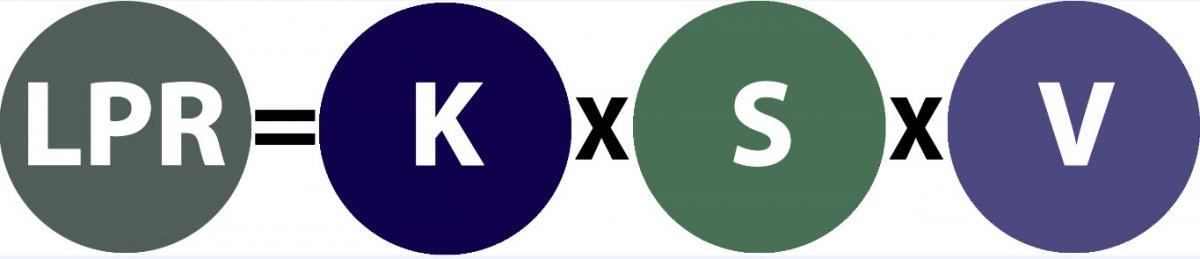

Finally, there is risk. This is where it gets interesting. While we will go into this calculation in the future, the concept is that the risk factor is a function of your Capacity, Performance, and quality control. This concept is a derivation of what we wrote about regarding how banks destroy themselves by growing earnings (HERE). One way banks take on more risk when growth stresses capacity. Every loan contains two elements of risk – kinetic operational risk and stored risk. The “Loan Production Risk” calculation can be seen below and can be modified for any bank product.

The (K)inetic operational risk is the risk that comes out right away during the manufacturing process. This could be as simple as a missed section of underwriting where the underwriter has to go back and redo work. This, of course, takes not only extra time from the analyst but also extra time from the supervisor. Calculation errors, bad information or insufficient information are also all factors in the loan process where productions have inefficiencies creep in.

Then there is (S)tored risk that dwarfs kinetic risk. This is the risk that has yet to be monetized either because of the very nature of the credit (it has yet to be repaid) or because of errors in production that are not caught. This could also be a wrong calculation, a fraudulent appraisal or just a lack of analysis regarding a certain risk such as missing debt that was not included in the debt service coverage calculation.

Finally, there is a risk (V)olatility factor. This is an adjustment to both the kinetic and the stored risk calculation. This adjustment is basically an error factor that takes into account the overall risk of the entire production line. If you are approving treasury bonds to purchase, then there is no adjustment as that is a standardized, risk-free endeavor by definition. However, if you are approving large subprime housing on a property with environmental challenges, then that is a much riskier endeavor, so any sub-optimal analysis has a chance to have a greater current impact or catastrophic future losses.

Setting Capacity Based on Risk

Given the above, your bank now has a framework for setting and managing production capacity. As a rule of thumb, banks want to run at about 75% to 85% of capacity. This level leaves enough slack in the system to ensure a high level of quality assurance while providing for production problems. During 2004 thru 2006, we bear first-hand witness to banks that ran at near 100% of capacity, had problems, knew they had problems, but never had time to correct those problems until it was too late. Needless to say, those production problems had terminal consequences.

The riskier the product, the more excess capacity that should be left in the system. You can run at near capacity opening checking accounts, but you cannot with wire activity or the underwriting of $10mm loans. Unlike true physical goods manufacturers, production capacity at banks has that stored risk component that needs to be taken into account.

Managing Production to Increase Operating Capacity

Unfortunately, most banks don’t have a standardized bank product production process. The more variability there is in the product the more excess capacity should be built into production. A product like residential mortgages is much less variable than office construction loans. As a rule of thumb, the lower the variability there is in the bank product the more linear production changes are. For mortgages, adding 10% more production may take 15% more effort when operating around 80% of capacity.

However, adding 10% more construction loans may take up 50% of capacity which may be enough to cause a material impact on customers. Furthermore, banks that are operating at capacity in a variety of areas further suffer inefficiencies. Frontline operators such as credit analysts may need compliance, legal or risk resources that might be tied up on an M&A transaction or loan workout. Stressing operations near capacity can result in sequencing issues as production lines compete for scarce resources. This further causes inefficiencies in bank product production.

Putting This Into Action

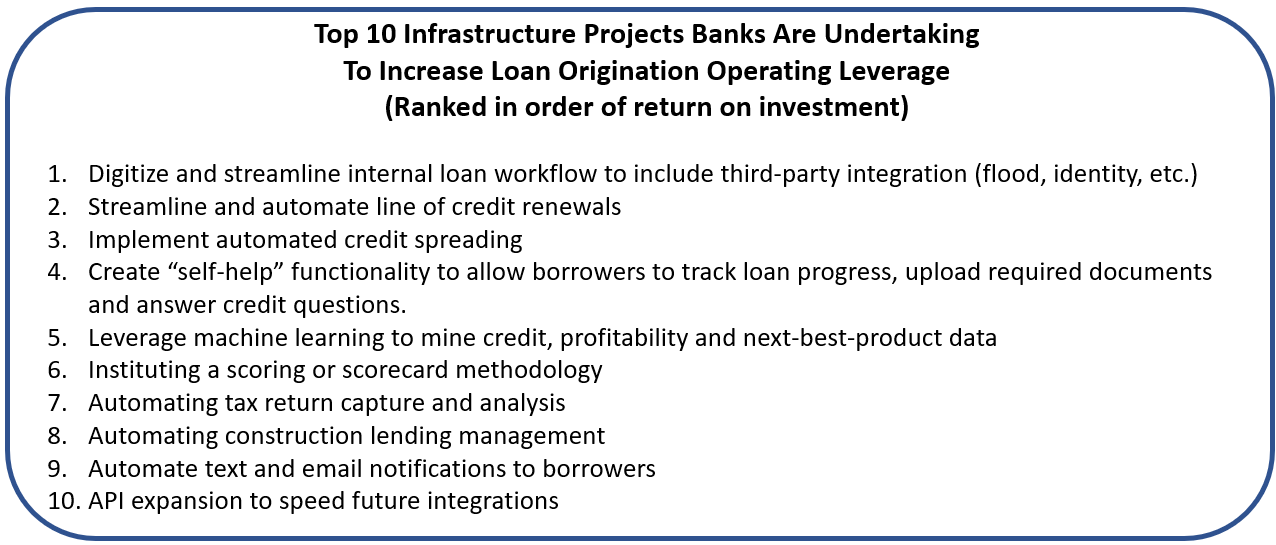

Having a certain amount of excess capacity provides the bank not only a margin of safety but also allows for having multiple objectives such as training and taking advantage of opportunities that crop up. Understanding your bank’s operating capacity for key products can help your bank become more efficient while controlling risk. The TEPP framework can provide management with the tools to know when to add more personnel, more automation, or when to rework any given process.

As banks strive for greater efficiency and start to employ greater amounts of technology to workflow, understanding the elements of TEPP can bring a discipline that few banks currently have.