Lean Six Sigma and PPP Forgiveness SBA Submission Improvements

As any lean six sigma practitioner will tell you, banks need to continuously define problems, measure against benchmarks, analyze, improve, and control their PPP Forgiveness application process. With a couple of thousand applications processed over the past five weeks, we are improving our process daily. In this article, we focus on the back end of our forgiveness manufacturing process and discuss SBA rejection rates. Getting an application rejected by the SBA adds 15 to 30 minutes of time to each application as bankers need to go back and solve defects.

Benchmarking

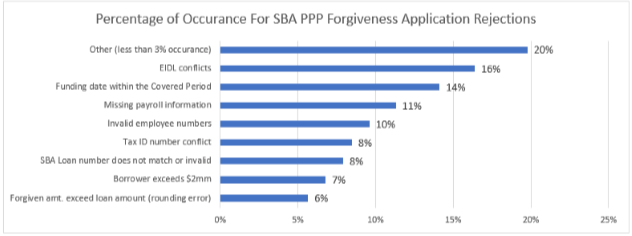

Our SBA acceptance rate now exceeds 81%, and are target remains at 95%. As we look to improve our process, we analyze how rejections occur and then track back where in the process we can fix the problem. Below are the most common PPP Forgiveness application problems that most transmitting banks either have solved or are well on their way to solving. Each one of these issues represents a way to improve processing efficiency banks can improve marketing, processes, or technology to help boost efficiency and allow for lower rejection rates.

Process Improvement

As we look to improve the process, most of the solution is to improve the technology so that the application handles more validations and quality control. The SBA is introducing new functionality around EIDL loans so that that issue will solve itself shortly. However, having a Funding Date within the Covered Period is an easy one to fix. While we tried to have humans check for this error and we tried better educating the borrower, in this case, it pays to include a validation check in the software.

In some cases, it is simply a matter of having another review and check in the system so that you have two sets of eyes to ensure you have complete payroll information or valid employee data. In other cases, the problem isn’t big enough to invest in slowing down the process or investing in added technology so better marketing and borrower education is often the answer.

As your bank transmits its PPP application to the SBA, you can use the above data to improve your process in order to get better throughput than we do.