How Large Banks Are Using Interest Rate Swaps

With an inverted yield curve, borrowers have a pricing advantage to lock in long-term fixed-rate loans, while lenders strongly desire to limit loan duration. One possible solution to this dichotomy is for banks to offer interest rate swaps to hedge individual loans. This article will review domestic banks’ adoption of interest rate swaps. Next week’s article will consider the challenges and possible solutions for community banks to adopt loan hedging programs.

Adoption of Interest Rate Swaps

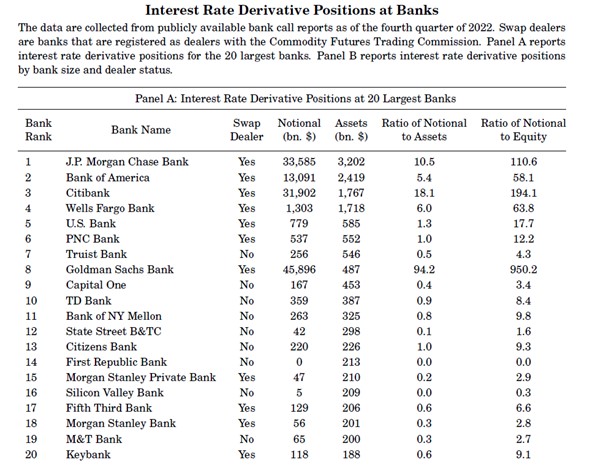

Swaps (banks’ primary tool to hedge interest rate risk on loans) have increased substantially over the last ten years. However, this hedging tool has disparate adoption depending on bank size. A recent paper analyzed domestic banks’ use of interest rate swaps, and we will summarize their findings in this article. In a National Bureau of Economic Research paper (working paper 31166), the authors (McPhail, Schnable, Tuckman) analyzed individual swap positions for the largest 250 US banks. The largest 250 banks in the country hold approximately 83% of all domestic loans. The largest 20 banks in the country by asset size and their interest rate notional swap position at the end of 2022 are shown below.

Notably, the two banks with zero or nominal swap notional at the end of 2022 are now defunct institutions (First Republic Bank and Silicon Valley Bank). This is a testament that, used correctly, interest rate swaps are risk mitigation tools, and when interest rate volatility or liquidity is uncertain, the lack of interest rate hedging may subject banks to unnecessary interest rate, credit, or liquidity risks.

The table above also identifies 11 of the 20 banks with domestic broker-dealers (BDs). BDs use interest rate hedging to mitigate risk on their own bank’s balance sheet related to assets and liabilities, but more importantly, BDs take market orders to enter into derivative positions to help their clients manage risk. Therefore, for the purposes of our discussion, the application of derivatives by BDs is excluded.

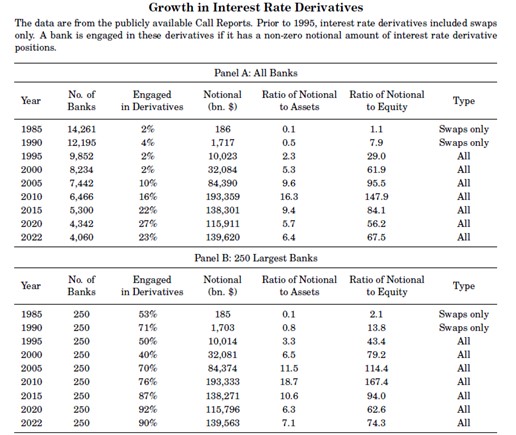

The growth in interest rate hedging adoption is shown in the table below.

The NBER Working Paper on Interest Rate Swaps

Here are the top 10 takeaways from the NBER working paper are as follows:

- The percentage of all banks in the country that use interest rate hedging to manage risk has increased steadily from 1985 to 2022. Currently, 23% of banks use interest rate hedges to manage some risk, up from 2% in 1985. Approximately 1,000 banks are reporting interest rate hedges on their balance sheets. We believe another 500 community banks are actively using interest rate hedging with third-party providers, where the benefit of the hedge is retained by the community bank but reported on the balance sheet of a third-party vendor.

- Of the largest 250 banks, 90% use interest rate hedges. Because these largest 250 banks hold 83% of all loans, interest rate hedging tools are widely used in most of the loan market (banks that control approximately 75% of all loans use hedging tools to help them price more competitively and to mitigate risk).

- The paper summarizes that banks use interest rate hedging tools to bridge a natural risk on a bank balance sheet: borrow short and lend long, which exposes lenders to interest rate risk. Hedging tools on the lending side are indispensable in specific scenarios to help banks manage risk and meet client demand.

- The average US Bank asset duration was around 3.9 years in 2021 (and has increased since then). The question posed by many community banks is when should loan duration become a good candidate for interest rate hedging? We believe (average asset duration and swap usage provide further evidence) that banks should consider hedging instruments when loan terms are three years or more from the contract date to maturity.

- Literature cited in the paper argues that banks’ interest rate risk swap positions are tied primarily to commercial loans. This makes sense since the prepayment provision of a swap can be directly tied to a sizeable asset (a larger commercial loan). Also, the prepayment provision can be transferred to the borrower, thereby aligning cost/benefit and optionality to cancel the swap. Finally, the accounting for such hedges is more manageable than for pools of assets or for consumer loans.

- Participation in the hedging market by the largest 250 has grown significantly. Larger banks that use hedging tools are gaining a competitive advantage in pricing more aggressively, generating more fee income, and decreasing interest rate and credit risks.

- The country’s median asset size of the largest 250 banks is $9Bn. Therefore, the average bank in the largest 250 uses a standard banking model – making loans and taking deposits. This average bank using interest rate hedging has a 55% loan-to-asset ratio, 19% securities-to-asset ratio, and 67% core deposits-to-asset ratio. The average bank using interest rate hedging instruments is larger but is pursuing a similar business model to a community bank.

- Most of the hedging activity at the largest 250 banks is related to fixing the interest rate on loans at borrowers’ request. On average, 80.4% of the swap notional used at the banks involves the bank paying fixed to broker-dealers and receiving fixed from commercial customers. This is identical to the cash flows for the ARC program used at SouthState Bank – the borrower chooses to fix the loan term for up to 20 years, and lenders choose what period to receive an adjustable rate.

- The vast majority of the swap market is neutral, as measured by notional and sensitivity of rate movement. That means the resulting outstanding exposure is almost zero when all swaps are netted (pay fixed is offset by receive fixed). While the total notional at all banks is $94.7Tn, the net notional is only $3.6Bn after netting. This indicates that there are very few speculative positions in the system – for every interest rate position, there is an offsetting and equal position.

- It would appear to us that the banking industry is using interest rate swaps to manage interest rate risk, but there are substantial other objectives in using these instruments. These objectives include the following: mitigate credit risk (repricing risk and stabilizing DSCR), meet customer demand, decrease loan costs to borrowers, and generate substantial fee income. We will delve into this topic in greater detail in a future article.

Conclusion

This working paper highlights the prevalence of interest rate swaps in the banking industry and some of the reasons banks use interest rate swaps. For community banks that are hesitant to use interest rate swaps, we will publish a blog next week to discuss the reasons that community banks have been reluctant to adopt loan hedging and some of the pitfalls that community banks should avoid when using loan-level hedging. We will also outline some loan hedging options available to community banks.