How to Lock a Forward Rate on a Loan

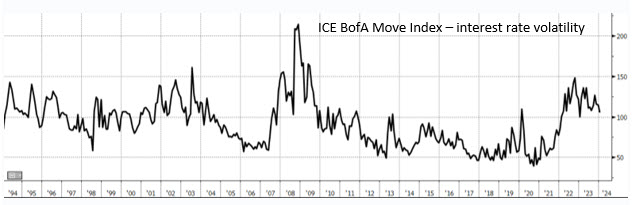

A forward rate lock allows lenders to deliver a known loan rate on future borrower financing. This strategy is used for various reasons discussed further in this article. Recently, larger lenders, including Bank of America, JPMorgan, Goldman Sachs, and Wells Fargo, have announced that they are seeing an elevated appetite for forward rate locks on loans for future anticipated commercial borrowings. This elevated interest in rate locks results from the high volatility of interest rates and an inverted yield curve. The 10-year treasury hit just over 5% in October 2023, and interest rate volatility is the highest since the great financial crises, as shown in the graph below (ICE swap volatility index).

Forward Rate Lock Tools

National lenders have been using locks for decades, and these instruments can take many forms. Borrowers want certainty of rate for future financing costs, and lenders want to protect themselves from interest and credit risks. The forward rate lock allows a win-win outcome for both borrowers and banks. As we have discussed before (HERE), one common lending mistake is for lenders to hold a rate constant during underwriting. If rates fall, the borrower often gets the lower rate. If rates rise, the bank eats this cost often not knowing that there is a negative mark-to-market value on the loan from Day One.

Forward rate locks can be achieved with Treasury locks, collars, caps, and swaptions, but the most prevalent instrument is a forward starting swap. The forward-starting swap has some significant advantages over alternatives as follows:

- It is the simplest to explain and document,

- It does not require an upfront fee,

- It is the most cost-efficient for borrowers to purchase and

- The current inverted yield curve creates a cheaper forward financing cost than a spot-starting loan.

Current Applications for Forward Rate Locks

Borrowers use forward rate locks for various reasons, including funding mergers/acquisitions, purchase and sale agreements, construction periods, and locking the economics of an underlying deal during the due diligence and underwriting process. Community banks that use our ARC hedging program have used forward rate locks for the following scenarios:

- Community banks use forward-term loan commitments to offer single-close construction through permanent financing. This technique reduces credit risk to the borrower and can increase the profitability of the relationship by maintaining a stabilized and longer-term facility. But this application also prevents competition from national banks after the construction and stabilization.

- Community banks also offer forwards to poach customers from other banks. This application involves offering the customer a new loan where the initial period mirrors the pricing on the original loan at the previous bank. The bank builds a forward, which is typically the more profitable portion of the loan for the bank. This allows the customer to retain the economics of their original loan and still make the switch to a new lender.

- Another interesting forward technique that we see community banks deploy is locking in an existing customer on a new loan without refinancing the existing loan. The forward loan commitment starts after the existing loan is set to terminate. Again, the customer retains the remaining economics, but the bank builds additional terms, fees, or spread on the backend.

- Many community banks we work with use forward locks to accommodate standard closing and due diligence steps such as title, appraisal, and loan documentation.

- The most interesting technique in today’s market is to forward rate lock loans by simultaneously appealing to borrower’s fear and greed and taking advantage of the inverted yield curve. Today’s five-year loan commitment is 6.40% at a 2.40% spread, but that rate decreases to 6.36% for a 1-month forward, 6.20% for a 6-month forward, and 6.13% for a 12-month forward. This yield curve inversion creates greater demand for forward-starting loans because it decreases the borrower’s debt service costs.

The only caveat to these forward rate lock techniques and tools is that community banks must not take undue risk without compensation. At SouthState Bank, we use forward rate locks through the ARC program without taking the interest rate and funding risks.

Conclusion

Specific borrowers will always require forward rate locks, and national, regional, and community banks will accommodate those needs without taking that risk on their own balance sheets. However, the current interest rate combination of high volatility and an inverted yield curve is driving increased demand for forward rate locks. If your bank does not have an efficient tool to offer forward rate locks, we can share our proven strategy at SouthState Bank with your management team.