Easily Avoid This Loan Pricing Mistake

The FOMC’s recent hawkish pivot and indications of multiple rate hikes in 2022 have created market volatility and an increase in longer-term interest rates. In a period of rapid change (or high volatility), we see about 50% of banks fall into a common trap of mispricing their commercial credits. This loan pricing mistake does not stem from mispricing credit risk, liquidity risk, or operational risk. Instead, this mistake results from a lack of attention to the market or loss of market intelligence, but it can be easily corrected.

Better Loan Pricing – Adjusting Pricing to Market Movement

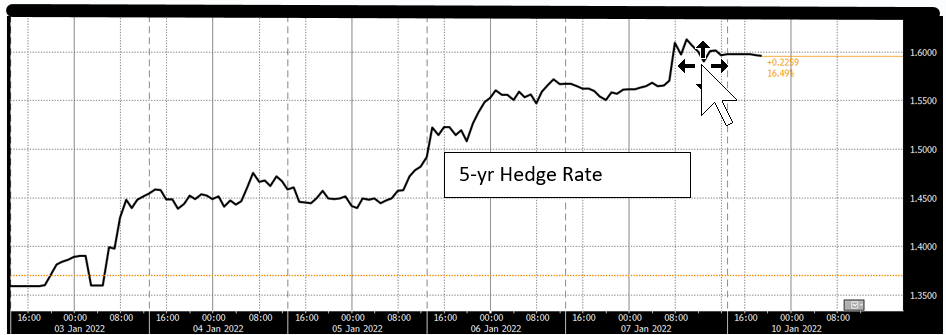

In times of rapid interest rate changes, some banks find themselves pricing off-market. The graph below shows 5-year interest rates over 5 days – rates increased by almost 25 basis points over a very short period. Many lenders are inclined to honor loan rates that they quoted their borrowers only a week ago, under the impression that other competitors will do the same. This assumption has many negative implications for banks.

The 5-year hedge rate is a proxy for a bank’s cost of funding for that period. By retaining a fixed-rate loan when longer-term rates are rising, lenders are effectively decreasing their expected NIM over the life of that loan. The only way to avoid this loan pricing compression between the start of the loan closing cycle and loan booking is to quote the loan as a spread to an index, even if that loan is an on-balance sheet asset that is not meant to be hedged or sold in the market.

Let us consider an example of a loan we are currently documenting: we are working with a bank that quoted a borrower a 5-year fixed rate on November 10, 2021, at 3.98%. The loan is scheduled to close on January 14, 2022. Between November 10th and the time of this writing, interest rates for 5-year fixed loans increased by 45bps. If the bank decides to retain its quote to the borrower and not adjust based on an underlying index (which is the current plan), the bank’s NIM is expected to be 45bps lower over the life of that asset. Had interest rates not moved, and the borrower asked for a 3.53% fixed-rate (45bps concession), we believe that the bank would not agree to such a rate. However, that is exactly the concession that the bank is giving the borrower by not pricing the loan to market on the day of closing.

Some bankers will retort and state that interest rates may also decline, and in the long run, the bank is neutral because some loans will close when rates are falling, and the bank will realize a higher NIM. But there are two major flaws with this argument. First, we are currently in a rising interest rate environment, and waiting for rates to ebb can be very painful for many banks. Second, if the borrower agreed to a 3.98% fixed rate but interest rates decreased, what would the average borrower do? Some borrowers are rate insensitive or do not understand market pricing, but those borrowers are rare and typically do not represent the borrower that many banks target. But most borrowers are more sophisticated and will ask the bank to reprice a loan when market rates decline.

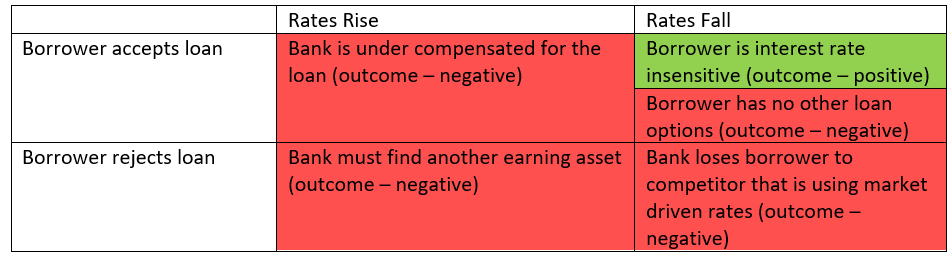

The table below describes the four possible scenarios where the bank does not reprice a loan to market, and rates rise or fall, and the borrower ultimately accepts or rejects a loan. By not adjusting loan pricing to reflect market-driven interest rate movement, a bank can only create value (or be in a positive outcome) if a borrower is not aware of interest rate movement or is price insensitive. While this scenario may occur some of the time, it cannot occur frequently enough to build a business model and sustain a loan portfolio. Every other outcome for the bank is negative. The table below shows a color-coded outcome for the bank (green – positive and red – negative).

Conclusion

In summary, a bank is almost always in an inferior position by not re-quoting the loan rate with market movement. Giving a free option to the borrower has an economic cost and is a common loan pricing mistake.

The argument that, over the long term, with rates moving up and down, a bank would offset some loans made above market rates with some loans made below-market rates is specious. By analyzing the possible scenario outcomes for the bank, we conclude that banks are almost always better off by adjusting their pricing to an index that moves with interest rate volatility. We believe that banks must adjust their rate quotes to reflect daily volatility up to the date that the loan is booked.