Post Fed – A Lending Tactic For The Yield Curve Inversion

This week the FOMC increased the Fed Funds rate by 75 bps, as expected to the 3.75% to 4.00% target range. The Effective Fed Funds rate jumped up and should stabilize at 3.83%, as did the 1-month term SOFR, to 3.79%. The futures market now expects close to average odds of a 75bps increase in Fed Funds rate for the next FOMC meeting on December 14th (HERE) and about 60% odds of a 75bps hike by January. This has caused more of a yield curve inversion and is a prime opportunity for community banks to use a loan hedging program to offer fixed-rate loans for 20 years. In the process, community banks can earn a higher adjustable rate than the fixed rate the borrower pays, generate upfront fee income, eliminate future interest rate risk, and help protect the borrower’s cash flow by stabilizing debt service coverage ratio (DSCR) for extended periods.

The Yield Curve Inversion

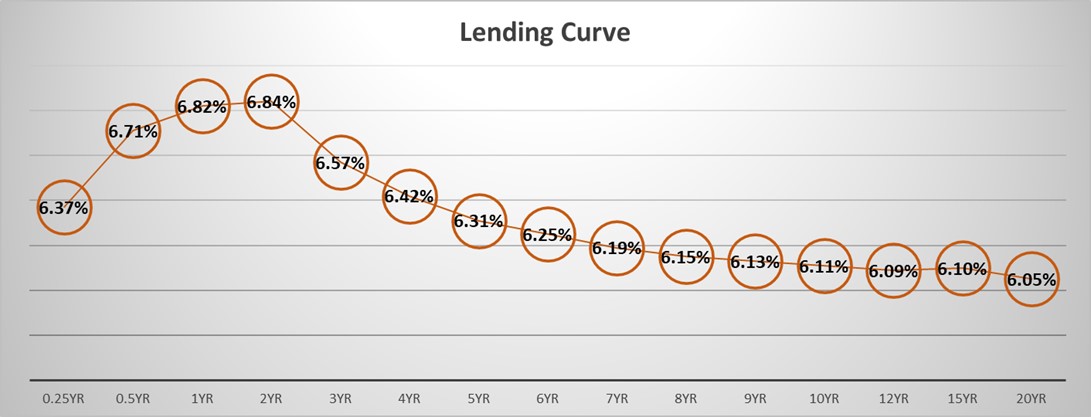

From a lending perspective, the graph below shows the lending curve from three months to 20 years and demonstrates the average commercial loan rates for different repricing terms. While individual commercial loans are priced non-uniformly depending on credit quality, loan size, cross-sell opportunity, and overall relationship, the curve below assumes a $1mm, bankable credit with a risk-adjusted return on capital (RAROC) of 15%.

There are a few essential takeaways from the graph above for bankers looking to retain existing borrowers and generate new business.

First, the short end of the curve is higher than any other point on the curve after four years, and after the expected hike in December, the short end will be the highest point on a fully inverted curve. Therefore bankers will make more net interest margin (NIM) on adjustable-rate loans than on fixed-rate loans. This is how you take advantage of a yield curve inversion to increase the profitability of your customers while doing the same for the bank.

Second, banks currently showing borrowers loans in the three to five-year portion of the lending curve are up against multiple undifferentiated competitors and are showing a higher rate than borrowers can obtain for 10 or 20-year fixed-rate loans.

Third, the ability to offer ten to 20-year loans without a repricing trigger can differentiate a bank, enhance credit quality, lengthen and deepen the relationship, and make that particular customer more profitable. Most importantly, because the lending curve is inverted in the longer end, the borrower can pay less (or the bank can earn more) than when lending in the two to five-year portion of the curve.

This all has an impact on credit as well. Keep a borrower with a floating or adjustable rate, or structuring a fixed rate balloon all create refinancing risk. Should the borrower’s situation fit, it is far better to increase pricing, term out the loan over a more extended period, and fix the rate while the bank enjoys a floating rate.

Pricing on ARC Hedged Loans

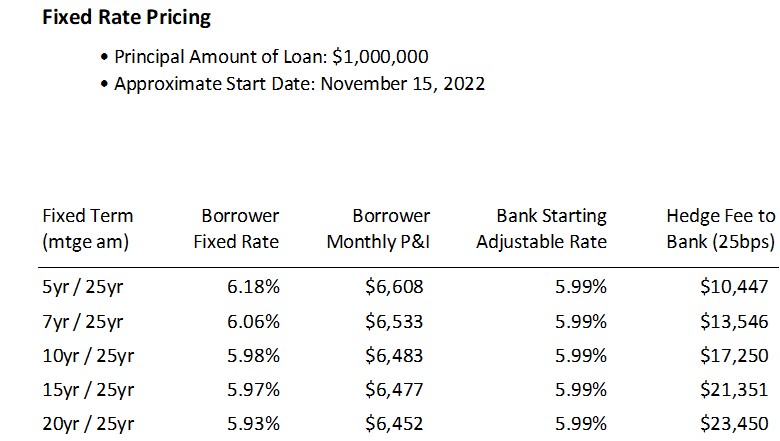

The table below shows what banks can earn in the ARC program vs. what borrowers pay using P&I payment for a 25-year amortization schedule on a $1mm loan. The borrower’s interest rate and the monthly P&I payments show the curve’s inversion after five years.

The table above shows that by hedging a commercial loan, community banks can earn about the same starting adjustable rate as the fixed rate a borrower is paying. However, hedging the loan allows community banks to generate hedge fees between 1.0% and 2.4% of the loan amount and eliminate interest rate risk. In today’s competitive environment, offering a 10, 15, or 20-year fixed-rate loan can help banks differentiate from the competition, provide a higher level of service for customers that have alternative competitors’ options, and create a longer, deeper, and more profitable relationship.

Conclusion

Banks that have lending products that can satisfy borrowers’ needs for seven to 20-year fixed-rate loans will have a competitive advantage and will be able to generate higher profits. In the current interest rate environment, the ARC program may be an excellent solution for better-quality customers that can benefit from longer fixed-rate terms. At SouthState Bank, we find that the ARC program enables us to differentiate our loan offering from most banks, we show customers that we can provide a service that some other lenders cannot offer, and we compete less frequently for that same borrower’s business.