1Q 2023 Loan Pricing Update

2022 will go down as one of the worst years for community bank loan mispricing when viewed on a spread basis. Rapidly rising rates crushed performance as many banks held a fixed rate constant and/or booked a fixed rate loan at a misguided level. Even though many loans were booked at below-par value (more information HERE), increasing margins helped drive significant revenue resulting in one of the best years for an initial risk-adjusted return on capital. In this article, we provide a loan pricing update and highlight some critical areas where banks can improve.

How We Collected the Data

The data was culled from our approximate 100 banks that utilize Loan Command and looked at relationship profitability pricing in 4Q on a spread and risk-adjusted return on equity basis.

ROE Targets Moved up in 2023

As was the theme for most of 2022, the target risk-adjusted return on equity increased from 15% at the start of 2022 to 24% at the beginning of 2023. The lag in most banks’ cost of funds, combined with only a slight uptick in credit risk, made projected cash flow improvement some of the healthiest on record. Banks that were able to fix the rate for the customer and hedge into a floating rate saw the most significant increase in performance due to both improving margins and improving credit risk.

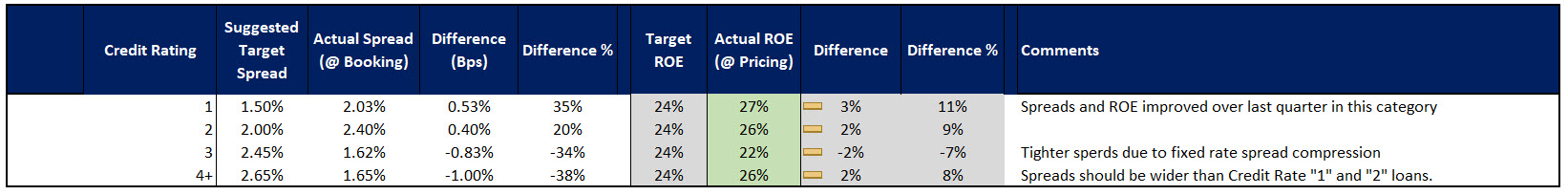

Loan Pricing Update Based on Credit

In times of a pending recession, what banks want is to win higher credit quality deals and let the others go to competitors. Unfortunately, last quarter, they did the opposite. Banks largely priced credits with a grade of “1” or “2” correctly but chose to compete for grade “3” and grade “4” credits.

What ends up happening is that banks lose more of the higher quality credits to regional and national banks and then get adversely selected for the riskier credits. The result is a credit-skewed portfolio to the negative. This asymmetric pricing explains why many community banks go terminal during a downturn.

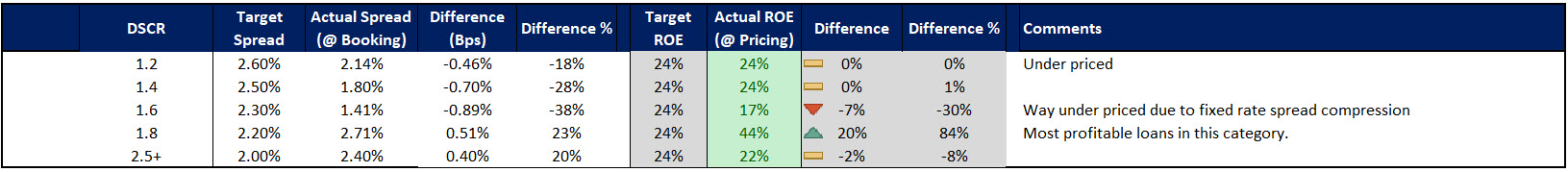

Unfortunately, we saw the same behavior last quarter regarding using debt service coverage. Banks had tight spreads on loans with 1.2 to 1.6x debt service coverage (DSCR) but likely lost quality deals above 1.8x coverage as their spread was too high.

Loan Pricing By Lending Category

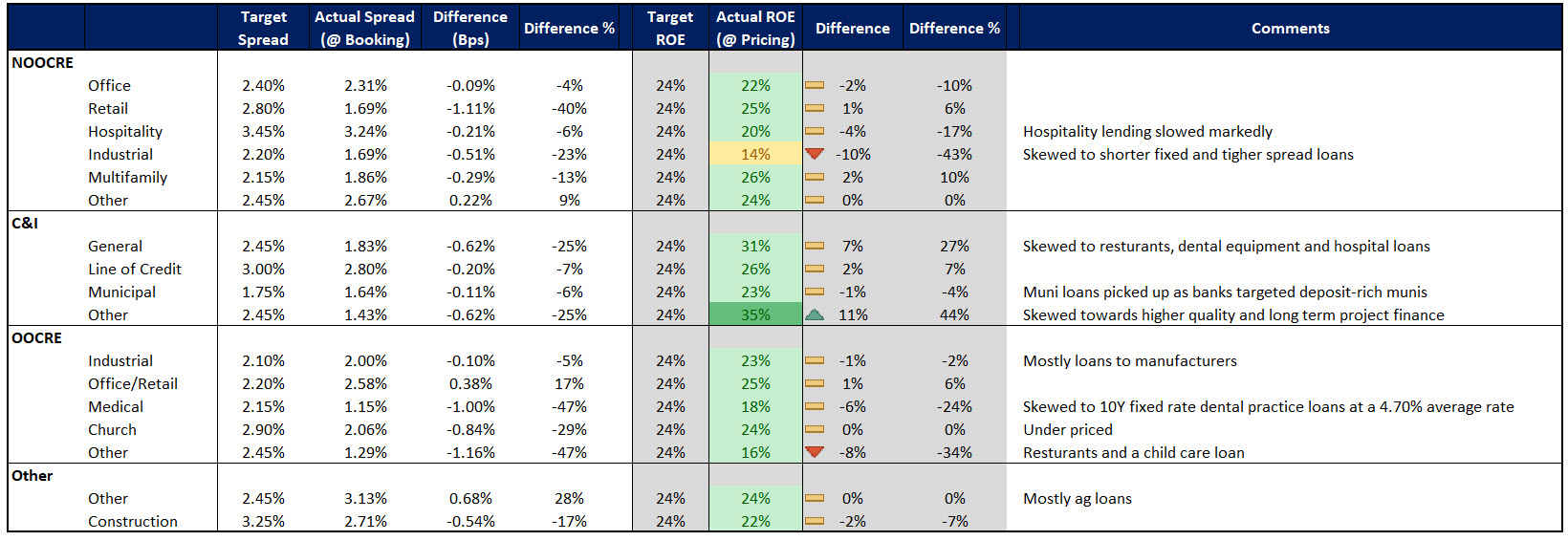

Last quarter, banks generally did a decent job at pricing their lending sectors correctly, plus getting the return on equity (ROE) that they needed. Non-owner occupied commercial real estate (NOOCRE) industrial remains the most competitive sector coming in at an average 1.69% spread and a 14% ROE.

The other ultra-competitive sector was owner-occupied lending backed by real estate to medical professionals. Not only did banks offer record-tight spreads, but they held fixed rates constant, particularly for dental practices. This lost banks a considerable amount of value.

Multifamily is the other call-out. Here, banks are still pricing lending opportunities ultra-competitively despite a massive amount of new supply coming online in many markets. It is as if banks are failing to look forward to supply, demand, and absorption statistics when setting loan pricing. Hopefully, this will correct itself in 2023.

In a similar fashion, NOOCRE Retail and loans to religious organizations closed the year, being competitive for the risk. While some of these were credit tenant deals, a vast majority were not and did not justify the tight spreads.

Loan Pricing Update Based on Loan Size

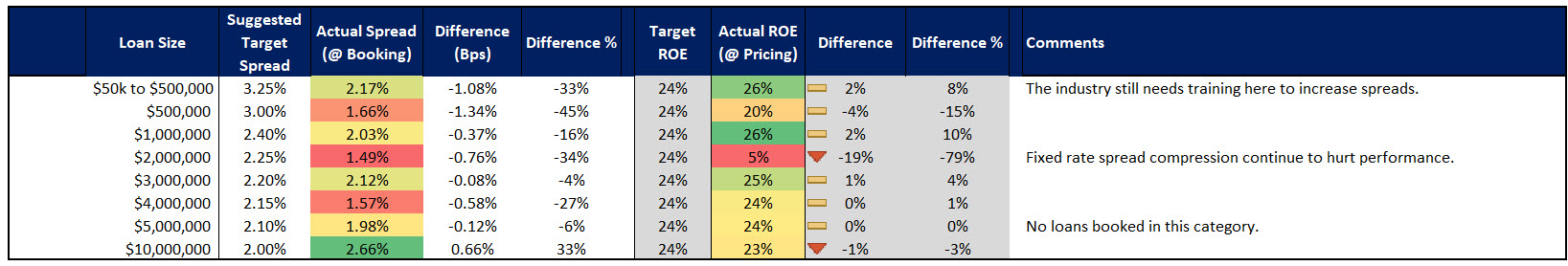

The single largest mistake most banks make when it comes to loan pricing is that they underprice their smaller loans. Loans below $500,000 can make up 30% to 60% of a community bank’s loan production, driving down the average relationship profitability. Last quarter was no exception, as spreads came in at an average of 2.17% when they should have been above 3%. Luckily, banks were innovative about loan structuring and lucky in that the floating-rate loans increased in value as rates rose.

The other notable problem area is loans around $2mm in size. Here most banks gave away rate locks for free and ended up with a sub-1.50% spread and a 4% ROE. Unfortunately, this was the largest category of loans.

On the other side of the spectrum are the larger loans. Here, competition is fierce, and it is challenging to get a spread north of 2.15%, which is the target average for most banks. In this case, profitability is more about structure, and banks should strive to increase the maturity of their loan to give the most extended set of cash flows possible protected with a yield maintenance provision.

Alternatively, banks that dip below 2.00% in spread should be doing so for the relationship and, as such, should be able to garner profitability from other fees and lines of business. By bundling products, the average return on equity can often double as not only does profit increase, but lifetime value lengthens, thereby resulting in greater lifetime profitability.

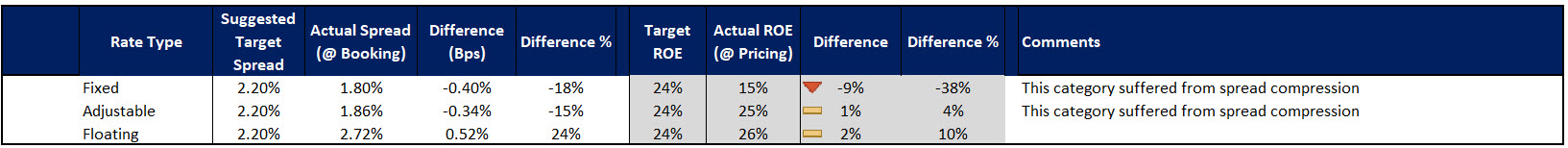

Loan Pricing Update By Structure

Finally, fixed-rate loans performed the worst last quarter, followed by adjustable. Floating rate loans and loans hedged to floating rates performed the best in spread and ROE.

Other Lending Data Points

There are a couple of other loan pricing update data points that we would like to highlight. One is C&I revolving lines increased usage slightly from 36% to 37%, while CRE lines of credit increased from 42% to 43%. In terms of data analytics, this is usually the first sign that the economy is going weaker. Not that this is a significant movement, but we are watching this metric. Once revolving line usage gets to 15% above the normal seasonal limit, either the economy is really good or, more often – about to get worse.

The percentage of SOFR-based loans also increased in 4Q and now composes about 70% of the floating rate market for commercial real estate and almost 50% for C&I.

Putting This Into Action

This article was designed to help banks better understand the nuances of pricing and provide a loan pricing update of where the market ended in 2022 and started in 2023. We expect to target spreads and ROEs to move slightly in lockstep with credit risk and margins. While margins will likely be expanding at a different pace than they did in 2022, they will remain healthy for banks that can control their cost of funds.

Look for credit risk to play an increasing role in loan structuring and pricing, and we look to publish our data on the credit outlook shortly.