Here is the Cost and Risk of Lending Optionality

Optionality is defined as a state in which choice or discretion is allowed. In finance, optionality is an asset (has value) for the person who can exercise the option, while the person who gave the option has the liability. Selling options for above their value can be a profitable business for banks and brokers, but giving away options is a money losing proposition. Unfortunately, those bankers who do not properly value and price options are decreasing their institution’s profitability and long-term viability. In commercial banking, lending optionality occurs for liquidity, credit, or interest rates.

Liquidity Option: An example of a liquidity option is the depositor’s ability to withdraw funds without cost or for cost representing less than the option value. In contrast, borrowers hold the option to prepay assets. This example of a two-way asymmetrical liquidity option is common at most banks, and this was the primary cause of several high-profile bank failures in 2023.

Credit Option: Lenders realize the unfavorable circumstances of a loan workout, and this leads to the largest credit option in banking – the ultimate credit option is the debtor’s ability to “hand the creditor the key to the building” and convert a secured loan into an equity stake. Credit options have other forms: for example, a borrower’s ability to prepay liability and refinance at a cheaper rate when credit quality improves and retain or extend financing when credit quality deteriorates. We witness this credit option diluting certain banks’ equity value with every recession.

Interest Rate Option: There are numerous ways some banks extend free interest rate options to borrowers and depositors. For example, quoting fixed-rate loan pricing before loan closing is a free option to the borrower. Even though most loans take weeks or months to close from the time a term sheet is issued to loan funding, some bankers quote a loan interest rate and leave it unadjusted through the closing process. In the weeks that it takes to fund a loan, interest rates can move substantially. Some bankers will argue that 50% of the time, the bank will gain an advantage and 50% of the time, the borrower will gain the pricing advantage. However, this is not the reality in a competitive environment. If rates rise between the term sheet and closing date the borrower is motivated to take the rate initially promised. If rates fall during that period, the borrower will ask the lender to reprice to market or threaten to take business elsewhere.

Another example of interest rate lending optionality is a lack of prepayment protection on loans. Whether the loan is fixed rate or floating rate, the borrower retains the right to prepay the facility. The only time banks can exercise this right is during a credit event. This prepayment optionality cannot be avoided, but it can be offset with a charge (fee or penalty). We witness that many bankers are willing to generate credit without sufficiently robust prepayment protection on commercial loans or waive that prepayment protection when confronted by prepaying customers. This outcome hurts banks in the following ways: on fixed-rate loans borrowers prepay when rates drop and extend duration when rates rise (we have seen this play out through many cycles), and on floating-rate loans borrowers prepay when rates rise and extend when rates fall.

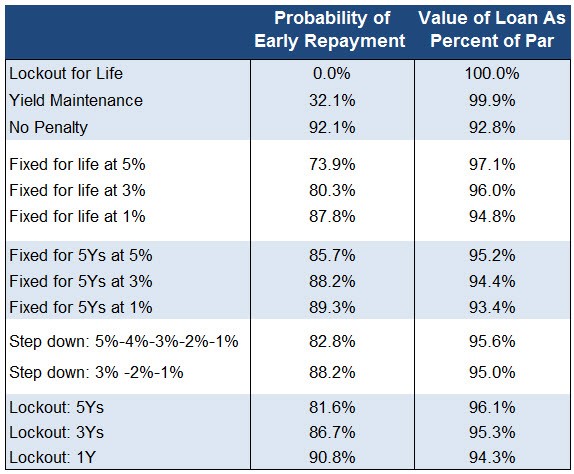

In a competitive market for commercial loans, every feature that can preserve credit quality or maintain pricing can be valuable to the lender. Many community banks will market their fixed rate loans based on the simplicity of the prepayment provision, and this starts by understanding the value that each provision creates. This can be summed up by the table below that looks at the probability of repayment and the net value of a ten-year commercial loan over up, down, and flat interest rate cycles:

How Lending Optionality Hurts Banks

Bankers cannot eliminate their customers’ lending optionality. But they can, and should, charge for that option value. The issue that most bankers face is the difficulty of quantifying option value for liquidity, credit, and interest rates.

Another way to look at the chart above is on a net interest margin (NIM) basis. Our research has convinced us that between liquidity, credit, and interest rate options held by customers, the average community bank at present is reducing net interest margin by 50 to 75 basis points. This reduction represents 23% of the average NIM for community banks. For fixed-rate loans with poor prepayment provisions, we estimate that interest rate optionality reduces the average community bank NIM by 32 basis points on five-year loans, and 43 basis points on ten-year loans. The higher rates go, the longer they stay up and the more volatile the market is, the higher the potential erossion to NIM.

Liquidity optionality is a common, but manageable, risk in the industry. This risk arises infrequently and only when other events precipitate scrutiny of a bank’s viability. Liquidity optionality is a low frequency but high impact event in banking. Credit optionality should be easier for commercial banks to manage. The biggest protector against credit optionality is to identify low credit risk borrowers, resulting in lower credit option value held by the obligor. These relationships obviously come with lower margin for the bank, however, banks must price relationships factoring the excessive cost of credit optionality.

A Specific Example of Option Neutralization

The easiest and most direct way for community banks to neutralize the value of interest rate optionality on commercial loans is to include prepayment provisions. The loan term, structure, relationship, and competitive environment should dictate what form that prepayment provision should take. However, management must create a framework that allows lenders to quote commercial loan rates considering and valuing the option value. In other words, lower loan rates corresponding to lower prepayment option value held by the borrower, and conversely, higher loan rates corresponding to higher prepayment option value held by the borrower.

After years of empirical research and questionnaires we believe that there are two acceptable prepayment provisions for community banks to utilize to neutralize interest rate optionality in loan prepayment provisions. First is a declining balance provision. This provision is common and simple to use. For a near neutral option value, the provision must start the declining balance with the percentage equal to the loan term. For a three-year loan, the bank must charge 3,2,1 percent of the loan amount for each year of prepayment, for a five-year loan, the bank may charge a 5,4,3,2,1, and so forth.

The second acceptable prepayment provision for community banks is a symmetrical breakeven provision. This provision trues up or creates a neutral cost/benefit for a prepayment based on interest rate movements. From an interest rate movement perspective, the bank and borrower become indifferent to prepayment whether rates are higher or lower. The provision better aligns with both the lender’s and the borrower’s interest rate sensitivity, and it is a standard provision at most national and larger regional banks that offer long-term fixed-rate financing.

Conclusion

Bankers need to be able to quantify and charge for the benefits of lending optionality held by their customers. Without charging for this option value related to liquidity, credit, and interest rate risk, banks are diluting their profitability and long-term viability. The easiest place for community banks to start to neutralize option value is prepayment protection on commercial loans. We estimate that proper prepayment protection on commercial loans can increase bank profitability by an equivalent of 32 basis points NIM on five-year loans, and 43 basis points on ten-year loans. For more information on how to sell prepayment provisions to borrowers, be sure to check out a past blog HERE.