When Will The FOMC Lower Rates To Help Banks?

Through most of 2025, the Fed Funds futures market has been predicting multiple imminent interest rate cuts by the Federal Reserve. Many banks have bet their budgets on a lower cost of funds and better credit performance. While this market was consistently forecasting rate cuts just a few months in the future, those cuts did not materialize, and the same market still expects cuts as early as September of this year. It is important for bankers, and borrowers, to reconcile and understand the disconnect between one of the best predictors of future short-term interest rates (Fed Funds futures) and the actual path of short-term rates (controlled by the Federal Reserve Open Market Committee (FOMC)). There are two germane explanations for this disconnect: probabilistic modeling and policy change inertia.

Probabilistic Modeling

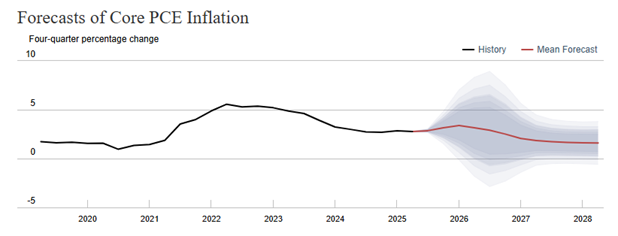

One major difference between the futures market and the FOMC’s own forecasts and actions is the weighting attributed to probabilistic outcomes. Single outcome predictions are rarely accurate. Instead, the Fed Funds futures market is the collective insight (and money) of various probability outcomes. As an example, below is a graph showing the New York Fed DSGE model that forecasts core PCE inflation (a similar explanation holds for GDP growth, real natural rate of interest, and unemployment rate). This model is similar to how Fed Funds futures trade in the market – while the model shows core PCE expectation of 3.4% in Q4/25, there is also a 10% probability that core PCE may be as high 6% and a 10% probability that core PCE may be as low as negative 5% (and all probabilities in between are shown in the shaded lines). The market is determining future PCE, GDP, and Fed Funds based on wide dispersion of outcomes.

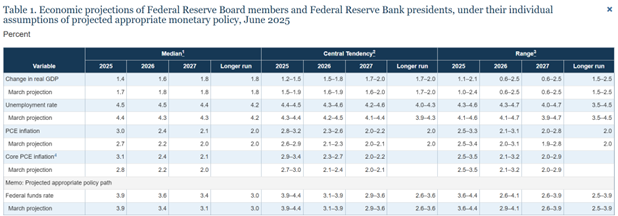

The FOMC projections and motivation for action do not work like a probabilistic model. Each member of the FOMC submits one projection of the most likely outcomes for GDP, inflation, and unemployment rate for each year from 2025 to 2027. Each FOMC participant bases projections on information available at the time of the meeting. Further, these projections represent each participant’s assessment under appropriate monetary policy and the absence of further shocks to the economy. Therefore, the FOMC projections are not probabilistic. For 2025, the FOMC’s June median core PCE projection is 4.1% (an increase of 0.3% from March) and unemployment rate is 4.5% (an increase of 0.1% from March). Therefore, by their own projections (which are not probabilistic) the FOMC is forecasting an environment that would not require changes in interest rates. The FOMC is forecasting one outcome of the economy, which currently does not call for monetary easing.

FOMC Policy Change Inertia

The market is indifferent to repricing probabilities day-to-day (or even second-to-second). When inputs change, the market immediately reflects those changes. The FOMC is slower to forecast and act. FOMC meetings are discrete events that occur eight times annually, and emergency actions are exceedingly rare. Further, the FOMC wants to avoid taking incorrect directions and having to reverse policy. Therefore, the FOMC will wait longer to reprice its projections.

Given FOMC own June projections (shown below), and the public testimony from the Chairman and other voting members, it appears that the case for lowering interest rates is not conclusive at this time. Barring shocks to the economy, the FOMC is not ready to pursue easier monetary policy. The FOMC’s median, central tendency, and range for inflation and unemployment rate dictate for interest rate stasis. In other words, FOMC members are more comfortable waiting for further economic data at this time before acting.

Application to Your Bank and Your Borrowers

We advise our lenders and borrowers that currently, the conviction of the FOMC is not to lower short-term interest rates (based on public statements). The FOMC will lower interest rates under the following conditions: 1) slowing economic growth or recession, 2) low inflation, 3) labor market weakness, 4) financial market instability, or 5) tight credit conditions. None of these conditions currently exist. While the market prices in the possibility of any of these conditions developing in the future, currently the FOMC is concerned about rising inflation and this skews monetary policy decisions to the upside, and not for easing. In fact, given the post-pandemic economic development, the FOMC has stated that persistent high inflation is a challenge to their credibility of the dual mandate, and further, most politicians recognize that high inflation is an erosion of living standards.

It appears to us that the FOMC is expecting higher probability that the US economy, with the stated agenda of the new administration, will result in higher inflation, and thus, higher interest rates over the course of the next few years. Notably, two additional participants (total of 7 of 19) see no interest rate cuts at all in 2025.

While forward interest rates are a poor predictor of the future, banks must manage their balance sheet using a probability weighted outcome for future interest rates. Taking interest rate risk is almost always a poor decision.