Making the Instant Payment Decision

Most banks have still not committed to RTP® or FedNowSM for their commercial customers – a bank’s most significant single profit driver. Most banks ignore instant payments or are still worried about fraud. The irony is that of the estimated $25 trillion in B2B payments in the U.S., 33% are still made via check that contains more than $8B of fraud per year. Check fraud is up some 84% and is only going to go up. Meanwhile, the cost of processing checks will continue increasing for banks and businesses. These trends are occurring at the same time the market is seeing the rise of instant payments. We have not seen a shift in payments on this scale since the introduction of ACH in the mid-70s. Because of this confluence of events, banks need to make a proactive decision, as item processing and profitability are inextricably linked.

Why Payments Matter

For the bank, the correlation between transactions processed and profitability is exceedingly high – approximately 82%. The more transactions a business processes, the more fees the business generates for the bank, the more balances it keeps, and the longer that company stays with the bank. Analyze a monthly transaction log, and you can accurately predict the customer’s lifetime value. Payments generate value. If a bank cedes payment processing, it will be hard to get back.

The Current Payment Challenge

Business customers move money in a variety of ways, including check, wire, cards, and ACH, in descending order of efficiency. The problem is that in each of these cases, the money and the payment message move separately, creating even more significant inefficiencies for all parties.

Usually, the payer initiates or “pushes” a payment to the payee once there is evidence of an obligation to include an order, invoice, receipt of goods, or contract. The payer enters this information into an accounting or accounts payable (AP) system (either manually or electronically). The payer then does the same in their banking platform, and the money moves within 0 to 3 days, depending on the channel.

Conversely, the payee receives the payment at their bank, manually enters or imports it into their accounting/accounts receivable (AR) system, and reconciles the payment and the obligation. For electronic payments, in approximately 80% of the cases, the payment data (invoice, remittance, etc.) is delivered via email or regular mail. The payee has to send the invoice, the payer has to receive it, the payer has to send a payment, and the payee has to settle the payment and reconcile the account receivable.

It is essential to realize that it is this process that is the reason why checks have stayed around so long. In the above workflow, the payer can send the check and the invoice together by putting them both in an envelope and sending them off. The process is archaic and costly, but both the payer and the payee save on the reduced time it takes to reconcile the two parts of the payment process.

The process is inefficient not only in terms of manual effort but also in the impact on cash flow. The payer, the payee, and the bank do not have a clear idea when the money will move, and so payment funds are sitting underinvested by one or all the parties.

Why Instant Payments Will Change Businesses and Banks

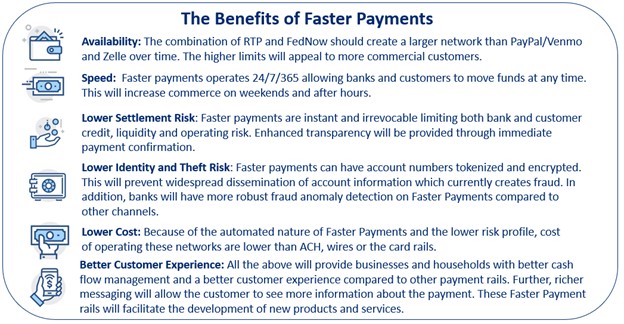

Most banks and businesses will focus on the “instant” aspect of RTP and FedNow payments. Getting funds there within 15 seconds or less is appealing. But how important is the instant movement of money? It is unclear, but if you need the money, it is essential. It is also crucial if you need a particular product or service instantly, and the seller will not extend credit. How often does this happen? Not much. From survey and polling data, payees and payers say that they will use instant payments because of their speed about 20% of the time. However, speed is only part of the allure of RTP and FedNow.

While speed is sexy, the instant confirmation and transference of data is the primary game-changing nature of instant payments. Many banks and most businesses have overlooked this aspect of instant payments – they are about to realize it in the coming year.

The fact that the payer gets an instant confirmation that the payment is sent AND received is critical as the payer can reconcile their cash position in real time. Using instant payments, businesses, non-profits, and governments can schedule payments to control cash flow like never before. The payee, conversely, gets instant confirmation of the payment receipt and 100% availability of funds. Payment balances are now automated and occur in real time.

Then, there is the reconciliation of the AP/AR process. Since instant payments can contain money movement and a robust message, supporting documents – a receipt, invoice, order, remittance, or contract – can travel together in one electronic packet. Businesses no longer have to manage the payment against a document delivered by email or mail. This is a considerable increase in efficiency. While it is true that you can do this with extended remittances with wires and you can also do this with the CTX and CCD+ functions of ACH, those functions are limited, cumbersome, not automated, and not ubiquitous.

One huge advantage of instant payments is the Request for Payment (RfP) functionality. Here, the payee can initiate the payment process with a payment request while being able to attach the data or invoice behind the payment. Now, the payer doesn’t have to take the time to initiate the transaction, making payment more manageable. The payer can go into their accounting, AP, or banking application, agree to the payment, and set the time of the payment.

Instant payments also have the advantage of being able to have real-time communication with multiple parties as part of the payment. This is another cash management-altering innovation. Using a Request for Information (RfI) message, a payer can ask a payee for additional information about the transaction, or a payee can provide further information regarding the transaction. Maybe the payer needs a breakout of taxes, or perhaps the payee was only able to ship a partial order. Further clarification of payment occurs in an estimated 15% of payment transactions, and now all that information will be together in a single payment record.

Currently, this information transfer takes place via phone or email and is separate from the payment, thereby creating an incomplete payment record. This information transfer also often occurs after the payment is processed, causing additional risk for the payer.

The Competitive Bank Advantage

If you want to get new profitable customers, offering instant payments is one path forward.

EVERY seller does not want to worry about getting paid. Name a business, other than the collection firms, that likes doing AR collections. Wouldn’t every payee want to control their cash flow when cash goes out the door? Doesn’t every business want to reduce the operating cost of reconciling their AP and AR positions?

Banks with these capabilities will be at a competitive advantage to win customers, fees, and balances. What business will want to worry about sending a check, given the instant payment alternative? What bank will want to be stuck processing decreasing check and wire volume against a backdrop of rising cost and fraud? Once checks and wires get cannibalized by instant payments, what will a bank have to provide to their retail and commercial customers?

How Do I Control Instant Payment Fraud?

Since money moves instantly and are “good funds” available for the payee to use immediately, there is a fear that fraud will be high in the faster payment channel. The irrevocability of a payment scares many.

While there is and will be fraud, we contend that it will be far less than almost every other payment channel. Since the payment channel was invented in the age of data and machine learning, the channel has one of the best sets of fraud and risk tools available. Banks will score both the sending party AND the receiving party plus the transaction to determine the probability of fraud. This doesn’t happen now in any other payment channel.

The vast amount of data in the message gives rules-based and machine-learned fraud tools a plethora of data to score. Fraudsters will have to be much more sophisticated and not only have to forge a much more significant amount of data but will need to season the receiving account and understand the sender’s normal payment flow. While criminals will rise to the challenge, instant payments limit fraud from the lazy or less educated criminals that currently have easy pickings forging checks.

It is also important to note that most payment fraud emanates from outside the payment system. It’s the criminal creating a synthetic ID and walking into a branch, it’s the social engineering that convinces a controller to send a wire to a fraudulent account, and it’s the text scam that convinces the small business owner to remit payment to an unknown account to satisfy some fictional obligation.

Because instant payments operate over a trusted network and are end-to-end, money movement and messaging take place over a closed system. Not knowing where that check came from or how long that receiving account has been opened has created this material risk factor in banking that has been consistently exploited. Limit controls, dual approval, multifactor authentication, and behavioral analytics that are all leveraged for ACH and wire payments also apply to instant payments but with the added benefit of more data and more trusted parties. Criminals will not be able to send funds to a foreign bank that has not been vetted by either The Clearing House or the Federal Reserve.

Generating Profitability – Fees and Balances

Capture the payment business of a commercial customer, and their balances are likely to average around $900k, or 31% higher, compared to a business that doesn’t process their primary payments through your bank. Being able to build operating balances is the main driver for most banks. These balances are positively convexed and long in duration. These balances usually get larger as rates go up (and the economy gets more robust). These non-interest rate-sensitive deposits drive a tremendous amount of value for any financial institution.

Then, there are fees for which many banks are planning to build instant payments into their account offerings and assume that incoming transactions will be free since it build needed balances. Outbound or send transactions are priced between $0.25 and $2.50, with most banks around $1.00 after a set of minimum send transactions included in their account packages.

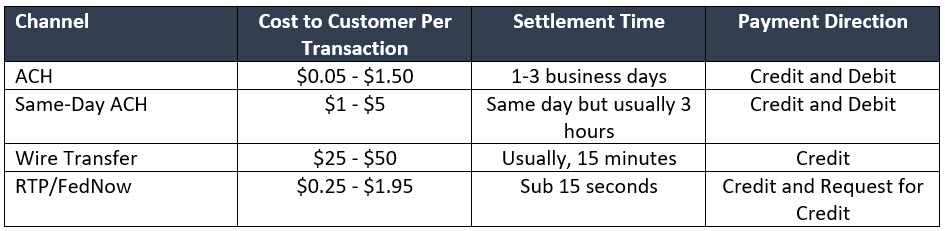

A comparison of incremental fees is below for comparison.

Payment Innovation Will Drive Larger Value

Operating balances and transaction fees are the tip of the iceberg for banks. The real value will be driven by the myriad of innovations stemming from instant payments. For example, payment messages will quickly involve providing payment details that will result in banks being able to move money into virtual or actual accounts. For example, payments that include taxes will enable the bank to transfer the tax liability into a separate account for easier cash management. This creates a benefit for the business but is also a massive benefit for the bank since the bank will have greater asset-liability insight.

Being able to automate the escrowing of funds, supporting earned wage access, integrating payments into accounting systems, point-of-sale integration of instant payments, providing better data analytics to customers, making projected cash flows more accurate, and allowing more context-based payments are just some of the innovations that are already in the works. Banks can charge for each or receive the benefits of greater deposit performance. Just as the invention of the credit card germinated an array of profitable products, instant payments will do the same.

The Next Step For Your Bank

If you are part of the 4% of banks that already have a solution or have a solution for send and receive in process, then you are well on your way. However, if you don’t have a solution or part of the 11% of banks that receive instant payments only and have not committed to send, then you have various choices to compare.

As a correspondent bank, we are just one of many solutions that allow you to not only send and receive transactions but also manage your transactions 24/7, plus your funding balances. With no major upfront costs, no long-term contract or commitment, and some of the most competitive fees you will find, we are an easy choice. However, we are not the only choice.

Many community banks will be going to their core providers and will want to handle the 24/7 management themselves. There are also a variety of fintechs that can provide instant payment services.

No matter what your choice, it is crucial to consider your strategic and tactical options to optimize this rare time that you can differentiate your institution.

The ability to get instant confirmation of payment and the inclusion of robust data within the payment communication framework will provide a considerable advancement in payment operations. Expect a new focus on payments for the next several years until payments fade to the background. The more payments get integrated and embedded in every product, the more payments will eventually become almost invisible, as it does for Uber. Instant payments will spawn a variety of new products and new payment enhancements that will be for the benefit of banks, payees, and payers.

Join Our Waiting List

We have an instant payment product that includes both RTP and FedNow, coming out shortly. We will start to talk to banks about it next month. To hold your place in line and create the option (but not the obligation) to utilize our instant payment platform, please register below, and we will contact you with more information. Clients will be onboarded, in order, based on their timeframe and based on this list. Once registered, you will be sent more information and will be contacted for a demo, plus receive an overview of pricing, timing, and product roadmap.

To sign up your interest, click below: