Planning For The Future Path of Short-Term Interest Rates

The FOMC lowered the Federal Funds target range to 0.00%-to-0.25% in March of 2020, and it has remained there since. But now, the market is convinced that the FOMC will raise rates in 2022 through 2024 to better align short-term interest rates with expected market conditions. This pivot by the FOMC has bankers, and customers, rethinking how in the next few years credit will be priced, cost of funds (COF) will change, and asset-liability committee (ALCO) decision will be made. In this article, we will share a framework to help lenders recognize and analyze the possible future path of short-term interest rates to be trusted advisors to their clients. We will look at four predictors of future interest rates: 1) the FOMC dot plot, 2) composite economic forecasts, 3) NY Fed modeling, and 4) historical context.

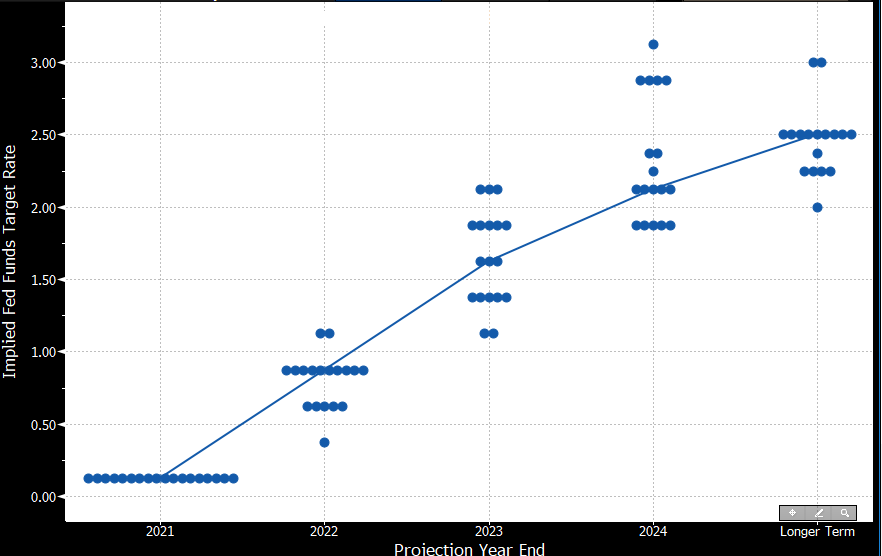

The Latest Dot Plot

The US Federal Reserve “dot plot” is a chart summarizing the FOMC’s outlook for the Federal Funds rate (see the latest chart below). Each dot represents the interest rate forecasted by one of the 18 voting and non-voting members of the committee. The plot below signals each member’s outlook for the path of interest rates based on expected future economic conditions. FOMC members wish to raise interest rates by about 75bps per year until the Federal Funds rate reaches 2.50%.

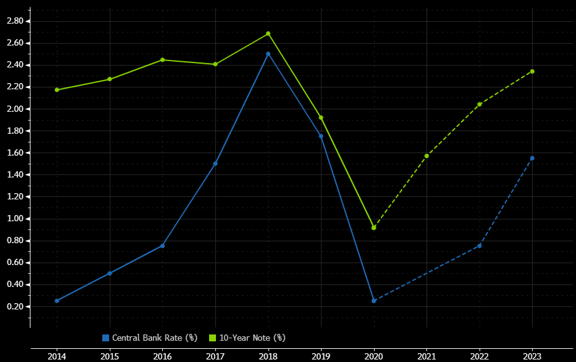

Composite Economic Forecasts

Bloomberg financial services poll dozens of economists working at banks, dealers, and private forecasting firms. Their economic projections are then averaged, and the Federal Funds rate and the 10-year note rate forecast are shown in the graph below. The estimates are in line with the FOMC’s dot plot and show approximately a 75bps increase per year through 2023.

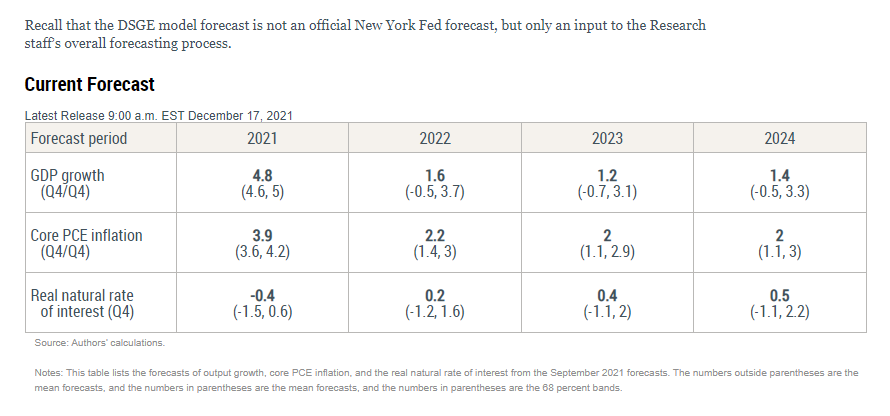

NY Fed Modeling of Interest Rates

We have blogged about the New York Fed’s stochastic general equilibrium (DSGE) model, which generates forecasts for key macroeconomic variables and shows dispersion around the forecasted mean. We are proponents of the model because it has a relatively long history (since 2011), its forecasts are continuously publicly available (we know no other model that can claim this), and the forecasts are probabilistic (since bands around the mean are more critical for risk management than the mean forecast). The most recent outputs of the model appear in the table below.

The interpretation from the table above is as follows:

The real natural rate of interest is the interest rate that supports the economy at full employment and maximum output while keeping inflation constant. FOMC looks to this rate when targeting the federal funds rate. By taking the core PCE inflation and subtracting the real natural rate of interest, we can deduce where the federal funds rate should be to achieve the FOMC’s dual mandate. The table shows that short-term rates should be 2.40% in 2022, 2.40% in 2023, and 2.50% in 2024. Of course, members of the FOMC are not making interest rate decisions simply by following this model, but the model is an input to the overall forecasting process.

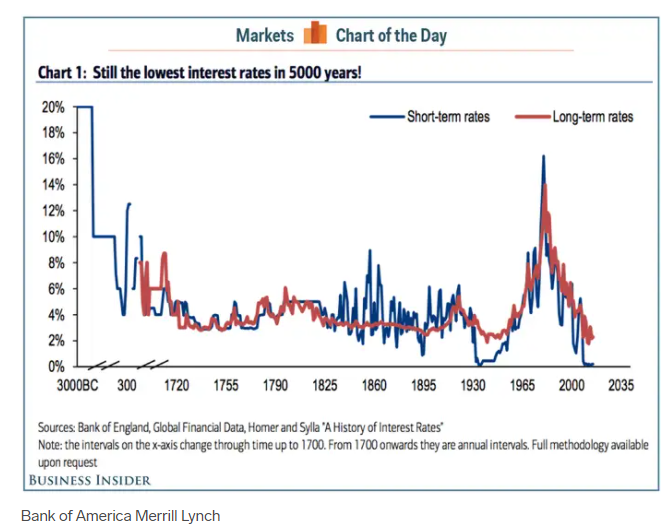

Historical Context of Interest Rates

Interest rates follow both cyclical and secular flows. The cyclical changes usually follow business cycles (recessions and expansions), and the cycle typically lasts 5 to 10 years. Secular changes are much longer and less predictable but are nonetheless observed. The graph below (produced by Bank of America Merrill Lynch) shows short and long-term interest rates over the past 5,000 years. Over this long time period, short-term rates have demonstrated numerous and pronounced secular peaks and troughs. We are currently in a trough, and short-term rates will revert to the mean at some point (perhaps shortly), meaning short-term rates of 5% or greater. In the context of 5,000 years of history, interest rates at zero is an unparalleled anomaly. Only with forecasting hubris would anyone claim that short-term interest rates would remain at zero for an extended period. We are currently living in a unique economic environment, and as that environment becomes more normal, so will short-term rates.

Conclusion

Predicting the future is hard, but giving good advice to clients is what bankers must do daily. Based on the current information, bankers should be helping clients navigate a rising interest rate environment for the next few years, and hopefully, the above charts will help. Interest rates are still low, and long-term rates may remain more anchored than short-term rates, but borrowers may be well advised to expect short-term interest rates to rise by about 75bps+ per annum for the next few years until the federal funds rate reaches 6.00%.