How To Prepare For The Risk of Stagflation in Banking

We recently posted an article (HERE) about how the Federal Reserve is bursting the everything bubble, and this will cause pain for some banks in the form of interest rate, credit, and liquidity risk. One of the likely outcomes of this tightening cycle is stagflation, which will cause cash flow constraints for borrowers and create credit risk for banks.

Stagflation is defined as high inflation (likely accompanied by higher interest rates) and a stagnant economy (low or no growth). This combination is toxic for the banking industry and especially for real estate projects. Further, stagflation is uncommon, and few bankers working today have any experience with how destructive it can be since it last occurred in the 1970s.

Stagflation and The Credit Issue

Significant credit risk with floating or adjustable-rate loans is created by repricing risk. Unless the loan is fixed for the entire amortization period, lenders cannot predict the loan payment amount; therefore, cash flow to service debt is at risk. This is a problem for underwriting when interest rates are expected to rise – the current interest rate environment.

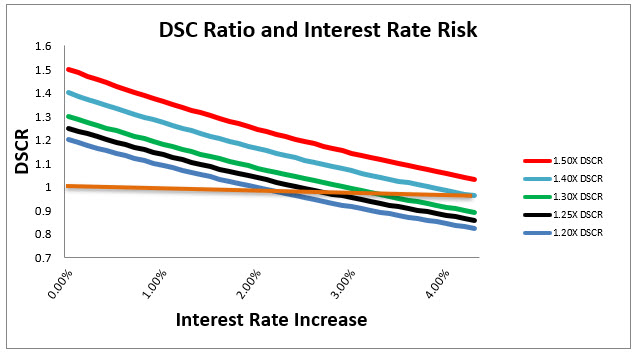

Banks stress test the debt service coverage ratios for various interest rate levels. Traditionally banks have stressed interest rates to 4.00% above current rates. However, because short-term interest rates are projected to be 2.00% higher within one year, stress testing cash flows with a 4.00% increase represents only 2.00% above the market-expected rate. Nonetheless, even at 2.00% above the market expected rate, many loans originated today will not cashflow above 1.0X.

The graph below shows DSCR for five loans and charts the impact of rising rates on DSCR assuming a floating-rate loan or an adjustable-rate loan at repricing. Most banks’ minimum DSCR by credit policy is 1.20X, and under that assumption, a credit that starts at 1.20X DSCR falls below 1.0X cash flow if interest rates increase by 1.90% – this is a level that interest rates are expected to reach by March of 2023. The math shows that to withstand a 4.00% interest rate increase (which is only 2.00% above interest rates expected in a few months) and still cash flow above 1.0X, a loan must demonstrate 1.40X DSCR at inception.

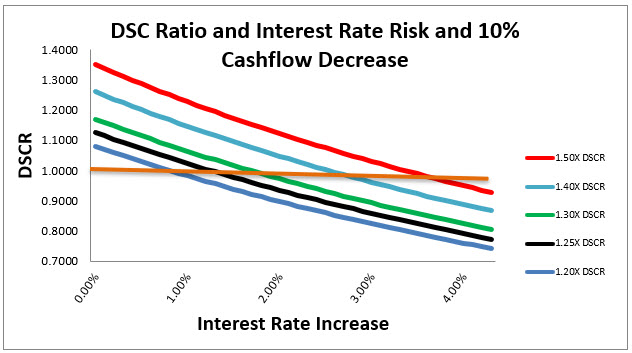

However, the analysis above is incomplete because stagflation is both a rise in interest rates and a decrease in economic activity. Historically, banks have stress-tested cash flows by using 10% and 20% decreases in NOI or EBITDA. The 10% decrease represents a recession, and the 20% decrease represents a severe recession.

The graph below shows DSCR for the same five loans and charts the impact of rising rates and a 10% decrease in cash flow. Assuming a 10% decrease in cash flow, a loan that starts at 1.50X DSCR falls below 1.00X when rates rise just 3.30%.

Finally, using a 20% decrease in NOI or EBITDA, a loan must start at 1.78X DSCR to withstand a 4.00% increase in interest rates and still cash flow at 1.0X.

Conclusion

After 14 years of easy monetary policy, the current shift to increasing short-term interest rates and quantitative tightening will lead to a massive change in the markets, not just for interest rates but also for credit risk. Obligors showing less than 1.50X DSCR will be most at risk for community banks. Unfortunately, most banks are not actively seeking and pricing credits at such high cash flow levels, especially for real estate projects. After years of everything bubble, when credit risk was not a significant consideration, the possibility of stagflation will change the credit outlook for real estate-based lending.