Stop Talking About Demographics In Banking

How many “How to Market to Millennials” sessions or “How to Attract Gen-Z” have you sat through? Chances are you were wasting your time focusing on demographic segmentation. Every generation is indeed influenced by different environmental forces such as – war, protests, smartphones, social media, or crypto — but there is little evidence that shows human behavior has fundamentally changed over time. You have undoubtedly seen every major news outlet headline that millennial home buying is down. However, if you adjust for income, affordability, and general falling homeownership rates, millennials buy homes at almost the same rate as every other generation. Holding the traditional view of demographic marketing not only doesn’t help banks, but it also hurts.

Demographic Marketing Can Be Insulting

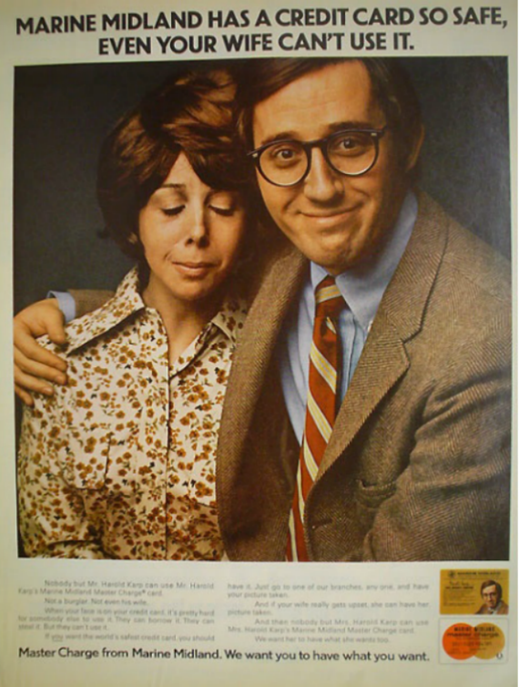

The concept of stratifying your customers into economic, racial, gender, or age cohorts is not only archaic but a hallmark of a lazy marketer. The concept of treating all Gen-Z, race, or gender the same harks back to the Mad Men era. In days of yore, you researched consumer feelings and chose a message that would appeal to the largest common denominator. Then you would hit people over the head with the message repeatedly. Such tactics produced this gem below from Marine Midland Bank. It was not only too broad in scope to be effective—but was alienating, insulting and sexist.

The minute you lump all women, African Americans, Latinos, or Gen-Zs together, you are not only wasting your marketing dollars, but you will end up insulting the large portion of the demographic that doesn’t fall into your preconceived notion. Not all Gen-Z are comfortable with technology, are over-entitled, move jobs often, or are environmentally focused. They might be more vocal about their feelings on social media, but as a group, the 67 million Gen-Zs are a little different than the 10-to-25-year-old cohort from 1971.

The Research Data on Demographic Marketing

HomeEquity Bank, ad agency Zulu Alpha Kilo and Brainsights, a neuroscience research firm showed various content to over 300 participants and analyzed brain activity. As participants saw the content, their brain waves were recorded every two milliseconds. The analysis looked at the emotion the content evoked, the level of attention, and the memorability of the content.

Sure enough, older participants reacted more than younger participants but not the way most expected. The study produced four key findings:

- Age-based stereotypes insulted those over 55 years of age. Boomers, in particular, do not want to see images of helplessness, having problems with technology, frailty, confusion, and fumbling. When Boomers were portrayed as youthful, active, and capable, attention, emotional connection, and memorability increased.

- Content with nostalgia increased attention, emotion, and memorability in ALL age groups, not just those over 55 years of age. The more uncertainty, the more nostalgic images resonate.

You Are Wasting Your Time With Demographic Based Customer Personas

One of the biggest problems with demographic marketing is that it lulls you into thinking you know your customer. Banks create customer personas based on age and build an elaborate profile based on their biased stereotypes about that age cohort. What banks end up with is a complete misconception about how their customers and prospects operate. Not only is this a waste of time, inefficient, and often ageists, it is usually ineffective.

There is a Better Way Than Demographics

It was one thing when you only had mass media to leverage. For that matter, if you don’t care about marketing return, then a mass-market Super Bowl ad targeted at 25-year-old men who like beer and talking dogs makes sense.

However, in this age of data, for a much better return, you can target a niche and jump your conversion rates well into double digits. Why design a single “campaign” when you can micro-target a variety of segments at just the cost of changing a tagline and visuals?

During an election, presidential candidates often run 10,000 different ads with a variety of headlines, graphics, and messages to reach people who care about various issues such as education, law, and order, gun control, or job creation. U.S. political ads are some of the most sophisticated in the world, and no modern presidential race would ever think of wasting money on targeting a particular age group.

Political campaigns have found it far more effective to target a psychographic or sociographic segment with a laser focus on intent, behavior, or belief alignment.

Banks can now produce content, display ads, retargeted ads, sponsored content, and email offers to target distinct populations like:

- Young medical professionals looking to buy their practice

- Stay-at-home dads looking to leverage their time

- Grandparents looking to help their grandkids to save for college

It is About Intent Not Demographics

More important than your demographic composition is your intent or buyer behavior. Market to women in mass and make a generalized pitch about mortgages, and you will likely get less than a 2% response rate. Target households or individuals that are just starting to look for a home, and your response rate could be greater than 30%. Today, it is about doing your homework and finding potential customers at the inflection point where they are just starting to achieve a goal.

This is nothing new. Google has become one of the world’s most successful companies because they allow advertisers to serve ads to users looking for a particular product or service. Banks have just been slow to the game. Luckily, this is changing.

Here are some approaches to anticipatory banking:

- Use basic data that every bank has access to and apply some simple analytics. Then any intern with a spreadsheet can work wonders. Banks can start with the data that they already have and key off balances or similar products. A simple reminder email to contribute to your 401k or health savings account if you have not in the past year can garner a phenomenal return. The same can be done for commercial accounts that utilize their lines of credit for non-seasonal draws. These accounts are either running into problems or are growing in a positive fashion and likely need more banking services.

- Once you have the basics down, banks can graduate to appending their data with information from social media. Banks can leverage Facebook, Instagram, TikTok, Pinterest, and Twitter to target a whole range of target customer personas based on psychographics, not demographics. Some of these platforms already have the basics of intent deciphered, which is categorized as “behavior data” so banks can target “new couples” or “business owners” looking to accomplish certain goals. Other platforms can be monitored to look for potential customers mentioning particular actions, such as transferring banks, saving for a vacation, tax planning, or looking for a home purchase.

- Taking this tactic to the next level, banks can also leverage specific brand influences such as Starbucks, Whole Foods, BMW, and Home Depot. These brands associate with being more open to certain bank products. While your assumption might be that these brands are markers of wealth—which would mean a greater proclivity to open a checking account—you would only be partially correct. Wealth and brand only account for a certain attribution, as users of Kroger’s, Planet Fitness, Sonic, Costco, and Tough Mudder are also heavier-than-normal users of banking products.

Brand correlations are just one of many dimensions that banks can leverage. Data can be purchased, collected, or integrated from social media.

Where to Buy Data

Banks can augment customer data or prospect emails with a large array of up-to-the-minute data that go beyond demographic information. Depending on the quantity and quality of data you want, it usually costs banks between $0.05 and $4.00 per profile with a median price of around $0.25. Instead of demographic data, data can be purchased that leads to intent. Knowing which customers have brokerage accounts, for example, makes the target more than twice as likely to want to save for retirement no matter the age. Twenty-somethings with equities or crypto have almost as much interest in building a retirement account as a random 40-year-old.

The data sets available to banks are almost unlimited to include affiliations, social media, psychographic, finance, purchase, or ownership data. Banks often turn to purchase consumer and commercial data, including Acxiom, Nielsen, Experian, and others.

Banks Can Still Do Better

Monitor debit, credit card, and check usage. And take note if you see a homeowner make significant purchases with contractors and home improvement stores after more than five years of homeownership. If that event occurs, chances are they are getting ready to trade up. Correlate that activity with deposit balances, and banks can get amazingly accurate at predicting the need for additional banking products.

The same is true for renters. While other banks are busy targeting millennials, you could be looking for renters with rising balances and a series of Home Depot purchases, no matter how minor. Statistically speaking, that customer has dreams of owning a home.

The Community Bank Advantage

American Express now collects over 3,000 pieces of data on each of their millions of targets. Their data models are some of the best in the industry. However, the problem is that JP Morgan Chase uses the same data with similar data models. Like having a hammer when everything looks like a nail, every marketing effort looks like a major-metro household looking to save for retirement to a large bank.

Community banks can leverage their local knowledge of their customer. Using social media and content sponsorship, they combine this knowledge with data and social media to be hyper-effective. Community banks are perfectly positioned to understand the nuances of their market better and turn local data into actionable intelligence.

Putting This Into Action

In the age of personalized, data-driven marketing, demographics mean little. When a person wants to switch banks, it doesn’t matter if they are a 60-year-old married man or a 19-year-old suburban woman. If your bank can educate itself on deciphering intent, you can distance yourself from the competition that is still sitting in PowerPoint presentations about millennials.