How Banks Are Using AI for Document Intelligence

Banks are full of documents. Each document contains an extensive array of data. Just keeping track of non-disclosure agreement terms is a huge task. Then there are vendor contracts, employment agreements, statements of work, loan documents, financial statements, tax returns, deposit account documents, policies, and an array of similar applications. The challenge is that most of the data in documents are “dark data” or unstructured data that is hard to find, analyze and manipulate. In this article, we detail the state of document intelligence for banks and highlight how it leverages the latest in artificial intelligence (AI) and workflow automation.

What to Look for in A Document Intelligence Platform

There are three ways to take unstructured data in a document and turn it into an asset of material value. One way is to manually extract and transfer the data to a structured database or spreadsheet. This method is slow, costly and prone to error.

The second way is to scan the document, use object character recognition and then query the document for specific data. The problem is that the error rate will be high unless you are familiar with the document’s structure. Pulling data off a tax return has a low error rate while pulling data off an attorney-prepared loan document is more challenging.

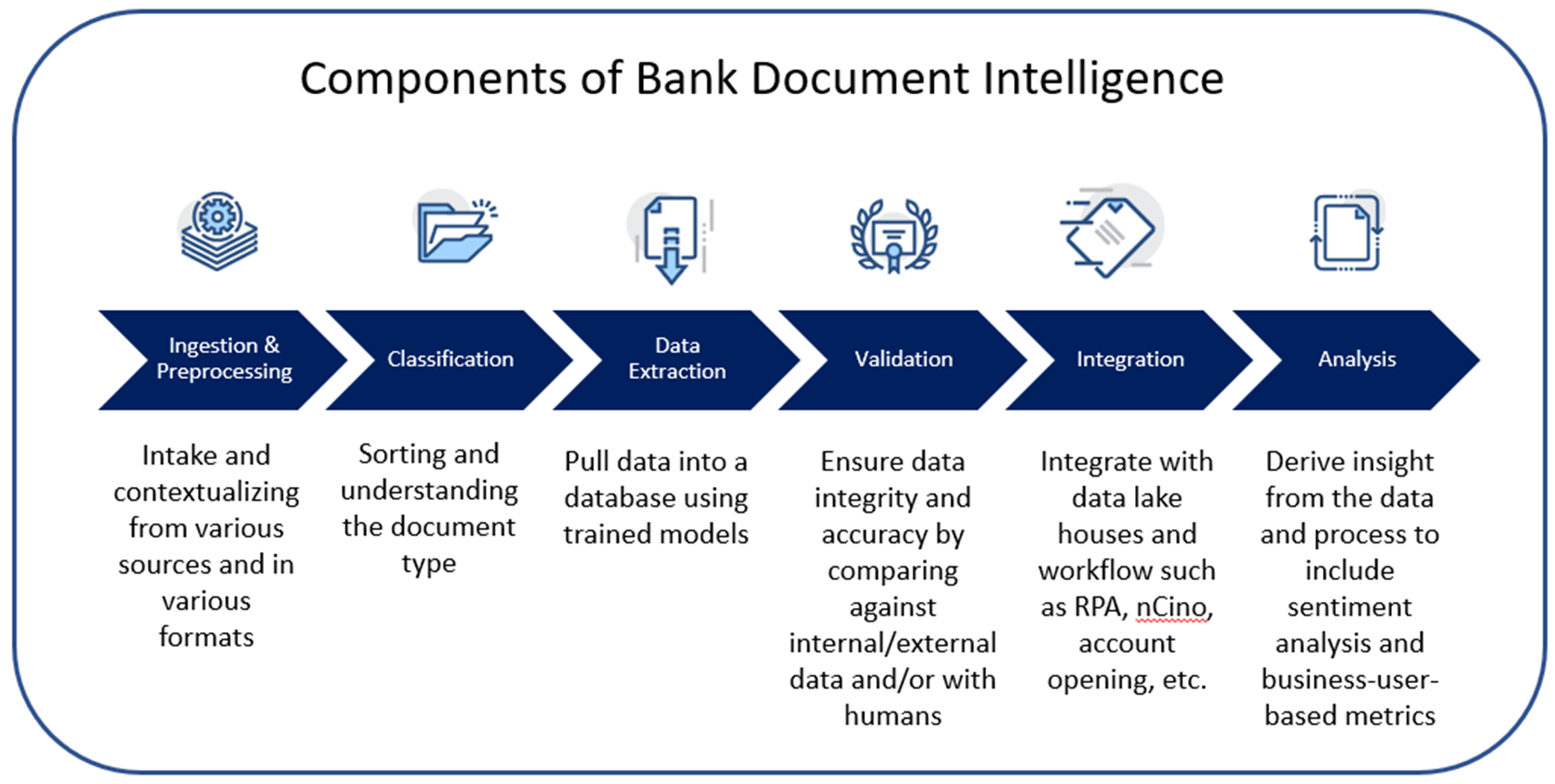

The third way, which has now become state of the art at banks, is to ingest the document and utilize artificial intelligence and machine learning to understand the document. Banks can now pull a pretrained model off the shelf and put it to use immediately, such as an application that can read receipts for an expense report or train the model to understand specialty documents such as a vendor contract.

Documents that are a picture and not in digital form, documents where texts are tilted, and even some wording that is out of focus can be handled with fantastic accuracy. Most applications are good at “normalizing” the data, so all dates, addresses, and numbers appear in the same format.

In addition, most document intelligence platforms add a layer of “schematization” that helps encode the data to the right place using a consistent data model. Thus, when looking for names on a particular type of document, the intelligence understands which name goes to what counterparty and is able to return both the field type and the target data in a format that is consistent with the bank’s data model so that it can easily be used in their data lake house that we have discussed over the past couple of weeks (HERE and HERE). For example, not only are payee and payor matched up correctly, but the name string is consistently in the format: Title, First Name, Middle Name/Initial, Last Name, and suffix.

There is also typically an “enrichment” layer to many of these applications where information can be appended. Google’s Document AI, for example, can pull data from Google Maps. Others have access to KYC, OFAC, and identity validation databases.

Most good platforms provide an extractable “confidence score” that rates the data intelligence job. Getting this score allows banks to decide when to involve humans, such as for scores below 90%.

Using these tools, banks can process documents accurately at scale, saving a tremendous amount of money and unlocking this dark data and turning it into useful intelligence.

The Advantage of Using Document Intelligence

The advantage of using AI for document management in banking is threefold. One is that the AI can learn the meaning of the terms and values contained within the document. After training, AI can figure out and extract all the note rates on a set of loans, no matter if it is called a “loan rate,” “interest rate,” “index rate,” “coupon rate,” or “rate of interest,” or anything else.

The second thing it can do is to understand the context of the data and form “key-value pairs,” or associations. This is critical for standardized forms in that it can read the name of the field and the input, whether typed or handwritten.

The third thing that document intelligence does is applies the ability to “contextualize” meaning from the document beyond what is written. Thus, if you are using document intelligence to review social media posts or survey results and a customer discusses “trouble opening an account,” the AI can infer that it is talking about a deposit account, not a loan or merchant credit account. While this is easy to do with a structured document such as a driver’s license or loan application, it becomes harder to do with an invoice, purchase order, or commercial loan document termed “highly variable documents.”

Data and insight from the model can be extracted and routed through workflow such as robotics process automation (such as UI Path or Automation Anywhere) or can be utilized in business process automation platforms such as Salesforce, nCino, or Service Now.

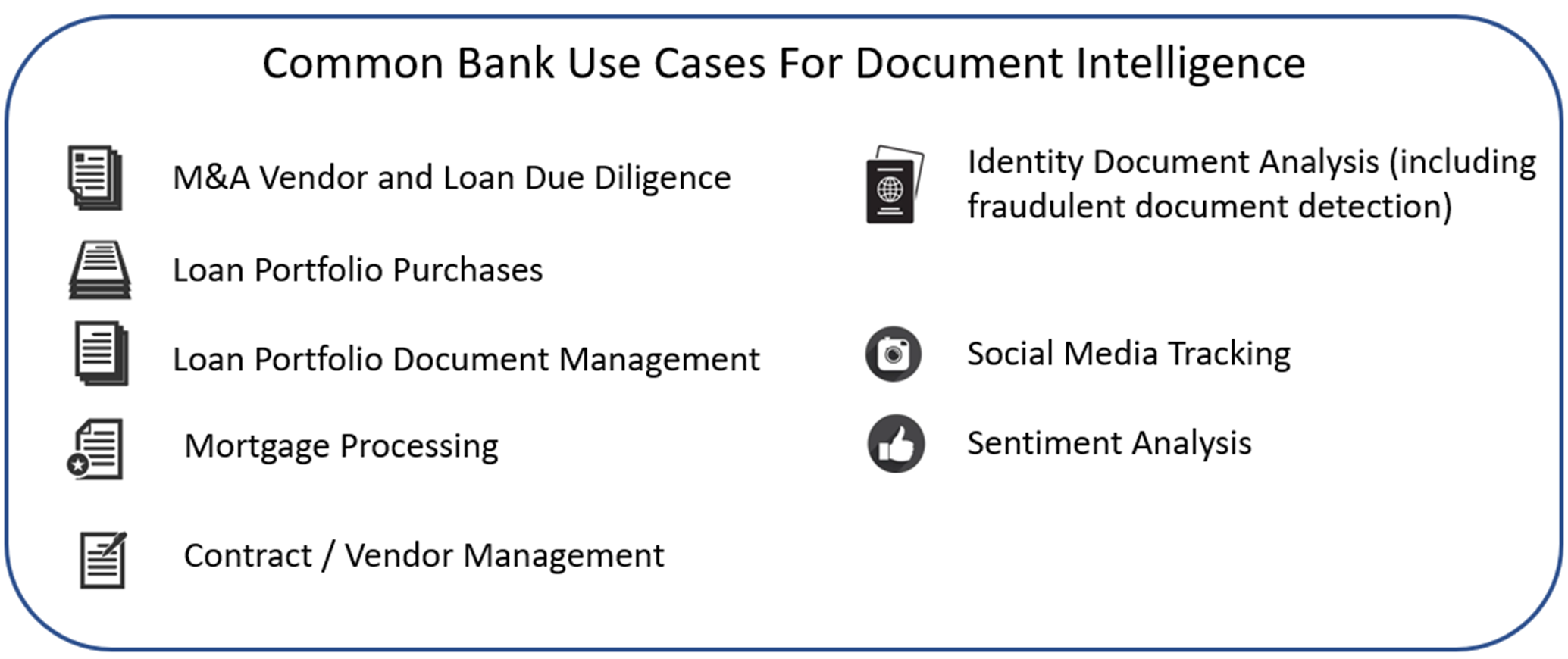

By combining document intelligence with workflow automation, banks can take giant strides in automating certain tasks like vendor management. Banks can now input the contact person for a vendor and answer a couple of questions, and then the automation does everything from requesting the documents to collecting them, validating them, and then analyzing them to ensure compliance with policies. As financials, SOX reports, insurance certificates, and other documents need updating, the workflow automatically reaches out to collect, process, and analyze the documents saving the bank hundreds of hours of time.

Various Other Use Cases

Banks first used this level of document intelligence for online account opening as the more sophisticated platforms were able to take any driver’s license, passport, military ID, permanent residence card, birth certificate, certificate of naturalization, or certificate of citizenship and extract the required data from it to validate an account holder’s identity.

Many document intelligence platforms are low or no code platforms enabling line staff to utilize. One of the most popular use cases is the indexing of loan documents, particularly government forms. Most applications are already trained with pre-built “parsers” that can read and interpret forms like a W-9, 1040 (with all schedules), 1099s, bank statements from all US banks, HOA statements, payroll stubs, investment statements, financial statements, and more. This application alone turns the bank’s documents into a treasure trove of data. Not only does this make underwriting faster and more convenient for the customer, but each loan application also generates an average of five or more leads for additional business. Other bank accounts, other partnerships, and other assets all come to light easily ripe for better cross-sell and customer profitability.

Another good, more cutting-edge application is for parsing and contextualizing contracts. Analyze a contract, and many out-of-the-box applications can pull the name, parties, agreement dates, renewal clauses, governing law, termination date plus terms, cost structure, and parties.

Our Live Use Case That You Can Use

A current problem faces banking with the cessation of Libor. Many banks have hundreds of adjustable loans priced off the Libor Swaps curve. While most of these loans have “fallback language” where a banker can give notice and change the index, the current rapid increase in rates will force many borrowers to require a restructuring. The sheer size of this effort presents a challenge for banks.

To meet this challenge, we are in the process of building an application to automate this process. The application analyzes a loan’s documents, determines the structural elements that need to be changed, and then educates both the lender and borrower on these insights. The application then provides a portal for the borrower to submit their preference for structural changes and then generate a terms amendment for the loan for the bank and borrower to sign electronically. The application returns all the data and documents back to the bank (contact us if this application interests you).

This challenge and solution is the perfect example of the flexibility that technology allows a bank and a showcase of how man and machine can work together to achieve the best of all possible worlds.

Cost, Business Model, and ROI for Document Intelligence

The business model for many of these document intelligence platforms vary. Some are subscription-based, and a bank would pay on an annual basis. Here, a typical charge for a bank would be around $1,000 per month. Other models charge per document, so scanning a US Passport, as an example, costs $0.30. Still, others charge for bulk pages, so scanning 1,000 pages might be around $250 for intelligent processing.

Like data lake houses, much of this technology is “on-demand,” so banks only pay for what they are using. This makes this technology highly affordable to banks of all sizes.

A typical return on investment example can be had for loan document review. Checking existing loan documents to validate terms, conditions, and included language takes an experienced human approximately 40 minutes per file. Using document intelligence, this can be done in less than 30 seconds and at an average cost of about $24 per file. This is 80x faster, and if you assume that a loan due diligence expert has a salary of $100k, that is an approximate 330% return.

Most Popular Document Intelligence Platforms For Banks

In addition to Google (currently the best general application), many banks are using Microsoft’s Form Recognizer (the best for tabular data), Amazon’s Textract, Docugami (most straightforward to use), IBM’s Cloud-Pak, Ephesoft, Eigen, Alkymi, and others. In addition, many RPA platforms, such as UI Path and Automation Anywhere, have document intelligence built within their platforms.

Since most of these applications are API-driven, banks can build their workflow and then plug multiple document intelligence platforms in to apply the platform with the best accuracy and/or the lowest cost for the type of job.

Putting This into Action

Document Intelligence solutions extract information from textual data, primarily documents, for analysis and workflow automation. Because the return on investment is so great, bank executives should consider modernizing document management as an ongoing strategic initiative. Because of its many use cases, the decision should be the order of priority of how banks leverage AI-enabled document intelligence. Bank executives may want to test out a stand-alone point solution and evolve it into a more platform approach.

For document intelligence, technology is evolving rapidly, so banks must look for a vendor or vendors that can grow. Since different platforms have different strengths, it is also critical for bankers to be clear on the requirements and conduct detailed proofs of concept (POCs). Then, bankers should assess the overall quality and efficiency of the solution, the flexibility of the solution to efficiently handle various formats, the ease of training and retuning, support for “human in the loop” workflows, and the user experience.