How to Build a Bank Website For AI Agents

At present, we track 150+ AI agent platforms that households and business can use right now to manage banking products. While the public is currently focused on booking travel, restaurants and events, soon they will be using agents to optimize their banking. These agents can now compare different banking products, to include researching fees, and then open an account in under ten minutes. In a few short years, this will be common, and banks will need to transition from a mobile-first and a customer-centric view to an agent-first positioning. We discuss this potential journey of how to adjust your website for AI agents.

Why Build a Bank Website for AI Agents?

With the rise of autonomous agents acting on behalf of users—whether individuals using AI assistants or businesses employing agents to manage finances—banks need to rethink their digital architecture. The solution? Dedicated, agentic AI-specific websites designed for intelligent systems to access, interpret, and act upon banking services efficiently. While you may not want to build this now, you may want to make your current website more AI-friendly.

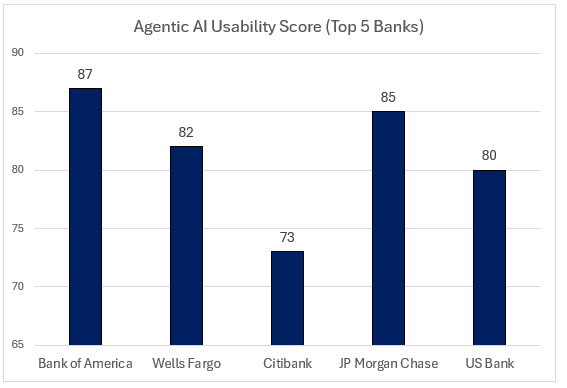

We developed an accuracy-based framework to have agents crawl various bank websites and rate the website on a scale from 0 to 100 with 100 signifying the fact that the website contained enough information to evaluate various transaction, savings and money market accounts and then the agent could successfully complete the opening of a single account.

If your score was under 50, it meant that the bank had no ability to open an account. The first 50 points was dedicated to collecting enough information about an account (various available products, fees, terms and conditions) and the second 50 was about the account opening process.

Most national banks scored relatively well. Community banks, not so much and the majority of banks can still not open an account digitally.

The Problem with Today’s Bank Websites

Current bank websites are designed for human navigation. They are often visually rich, overly segmented, and laden with JavaScript-heavy elements, carousels, overlays, and personalized UI tricks that, while helpful for human users, confuse or completely block AI agents trying to interact with them.

Here are a few common issues:

- Dynamic Content Loading: Many key pages load asynchronously or depend on scroll actions. Agents looking for account features, product comparisons, or contact information may not see critical content rendered easily on the page.

- Confusing Page Layout: One bank we encountered had a difficult to use calendar to specify your birthday that crashed the agent. Another bank had a “Subscribe to newsletter” feature next to account opening that the agent interpreted as a requirement leading the agent away from the account opening process.

- Multi-Click Navigation Paths: Agents struggle with layered menus and forms that require complex decision trees or cookie acceptance modals just to find basic service information.

- Poorly Structured Data: Product details are often embedded in HTML in inconsistent ways, with no clean machine-readable schema for account fees, rates, or service tiers.

- Authentication Silos: APIs or MPCs are either unavailable or tightly gated, with no standard way for authorized agents to retrieve data or trigger actions without reverse engineering the user interface.

These constraints limit the productivity of AI agents, leading to poor outcomes for users trying to automate bill payments, account openings, or financial planning using AI.

Introducing Agentic AI-Specific Bank Websites

In the next two years, banks must decide if they want to have a single website for customers and agents, have a specific website for AI agents, or provide all product information and account opening through an API or MPC so an agent can make a secure connection instead of scrapping the screen for information.

To support the emerging ecosystem of intelligent agents, banks may decide to deploy a parallel digital surface—dedicated domains or subdomains—built specifically for AI-powered agents. Think of these as the “API/MPC-forward, agent-readable” versions of your retail and business banking websites.

Features of an agentic site:

- Minimal and Consistent Markup: Built on clean HTML with standardized schema.org or custom XML/JSON structures to expose relevant data (e.g., interest rates, overdraft fees, wire cutoff times).

- Machine-Friendly Navigation: Flat navigation structures with RESTful links or machine-readable sitemaps for agents to traverse.

- Declarative Action Intents: Publish available actions (e.g., “open savings account”, “schedule wire transfer”) with parameters and expected response models—like OpenAPI for humans.

- Authentication & Consent Handoff: Lightweight OAuth or MPC (Multi-Party Computation) protocols to securely authenticate agents and authorize data access or action on behalf of users.

The other interesting aspect of having an bank website for AI agents is the support around the website. For example, humans often write agent instructions similar to “Find me the best bank treasury management platform for my business.” Asking for the “best,” “top rated,” or “popular” product is common. In these cases, the agent almost always looks for some fashion of ratings or third-party reviews. Cultivating positive ratings on apps, branches, and products can help drive traffic from agents.

How Agents Know Where to Go

Agents need a discovery mechanism to find the appropriate agentic interface. This can be done in several ways:

- Robots.txt and Headers: Use meta tags and what is called “robots.txt” code to include a Agent-Link: directive pointing to the agentic version of the site, much like canonical links for search engine optimization (SEO)9.

- AI Agent API/MPC Directory: Participate in federated registries where agents query a standard directory (e.g., .well-known/ai-agent-endpoints) for endpoints and supported capabilities.

- Standard MPC Handshake: Upon login or action attempt, redirect the agent to a bank’s MPC gateway to handle key exchanges and permissioning.

- AI Agent Mark: Use a semantic favicon or embedded rel=”agent” link to help AI systems identify a trustworthy, AI-specific surface.

The Benefits of Agent-Optimized Access

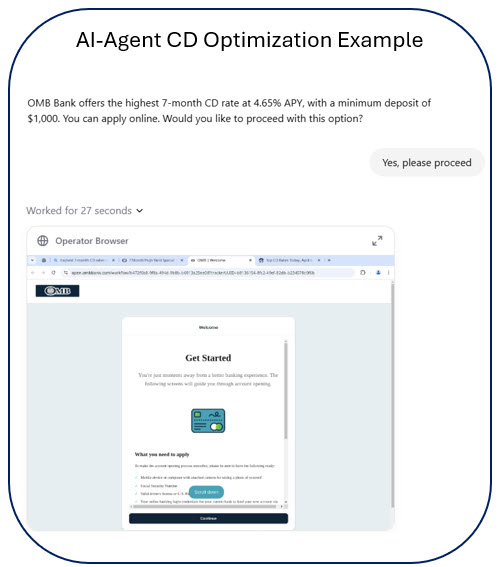

The future of banking looks more agent driven. As more and more providers such as Microsoft, Apple, Open AI and many others release their agent platforms to the public, managing a household’s or a businesses finances is a top use case. It took Open AI Operator 27 seconds (below) to search for the highest 7-month bank certificate of deposit that allows for online account opening and start the account opening process.

Banks that adopt AI-specific interfaces will unlock significant value as they capture a greater share of the business they want to capture.

- Customer Stickiness: Users will prefer banks that “work well with my AI assistant,” especially as agents become default interfaces for personal finance.

- Operational Efficiency: Agents reduce human touchpoints for repetitive tasks (e.g., invoice reconciliation, payment approvals), saving banks and customers time.

- New Revenue Streams: Agentic APIs can become monetizable services—offering real-time credit scoring, fraud detection as a service, or treasury insights to business agents.

- Stronger Security: With a clearly defined agent pathway and MPC integration, banks can better authenticate intent and identity than through screen-scraping bots.

A Smart Future Requires Smart Interfaces

As AI agents move from novelty to necessity, banks that accommodate them will win loyalty, reduce costs, and gain competitive insight into customer needs. It’s not about replacing websites—it’s about adding a new lane on the digital highway, just for machines.

Banks have already learned to be mobile-first. Now it’s time to be agent-first.