Intelligent Agents Will Change Banking

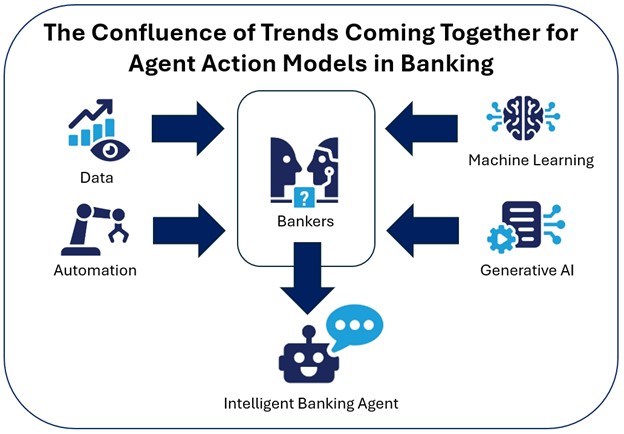

Intelligent agents, or “agentic AI,” are poised to change the face of bank operations. At the same time, banks are striving to figure out how to employ generative AI (gen AI) in their operations; part of the answer lies in the intelligent agent. Like how the Internet and smartphones changed banking, these autonomous reasoning models will be built to accomplish specific tasks. In this article, we explain what these agents are, how banks are starting to use them, and how banks will be using them soon.

What Is an Intelligent Agent?

Agentic AI is a derivation of a “large action model” that we discussed HERE. At the core of an intelligent agent is a reasoning engine. This is a radical difference from what banks have deployed in the past. In the past, chatbots and robotic process automation (RPA) have been deterministic and rules-based. Intelligent agents can now take context, execute the best action, and make decisions following established principles. These agents can take on more complex tasks than chat and RPA bots, allowing banks to gain efficiencies and better anticipate customer needs.

While a gen AI application can manage data and knowledge to be conversant, the intelligent agent leverages gen AI to turn suggestions into action. Using an intelligent agent starts with a question or command from an employee, customer, or other agent. The intelligent agent interprets the question or command and then references a bank’s goals and policies to formulate a response.

As the response is formulated, it can be informed by machine learning to learn from past actions. The agent decides on the best course of action and then seeks the approval or refinement of a banker. Once approved, the agent utilizes the prescribed workflow and connectivity to accomplish the task. Agents move from the process of case management to solving the cases. This augments banker productivity, making them more efficient and providing customers a better experience.

It is important to note that prior to large language models, a developer not only had to predict every question but also had a set number of canned responses to evoke. Now, every interaction is personalized and driven by the context and the data. Customers and bankers are being communicated within the language they use and best understand.

It is also worth noting that intelligent agents can leverage structured data, such as the data in your CRM or core system, AND unstructured data, to include emails, webinar transcripts, problem cases, and conversation history. Part of the intelligent agent’s power is the model’s retrieval capabilities of augmented generation, or what we call “RAG.” RAG allows the agent to leverage both structured and unstructured data to optimize the path forward best.

Up to this point in our evolution in banking, we pulled data using a straight vector search. We looked for the data and retrieved it from a specific place, such as a set of balance fields in the core system. Because of gen AI, we can retrieve data based on a knowledge graph. The intelligent agent can look through the customer’s unstructured data for clues about balances, interested products, sensitivities, and historical desires. This data can help inform the best path forward, which is likely better than most bankers can. We can’t tell you how often we have seen bankers not take the time to review calling notes or operational activity in the CRM before trying to solve a problem or make a sales call.

An Example: Dropping Deposit Rates

Recently, the Fed moved down its target Fed Funds rate, and banks are in the process of dropping their deposit rates. The current methodology is to change rate by product category. However, every customer is different. Each customer has different rate sensitivities, products, lifetime values, and needs. Utilizing an intelligent agent, the banker puts the agent in motion to lower rates by an optimized amount.

The agent would then look at the customer’s current rates and products, reference the goals of maintaining balances within a certain rate level, and suggest a set of rates for each customer based on the current projected rate sensitivity. If a customer has used the term “basis points” in any of the past conversations, the agent would denote a certain level of sophistication and adjust the rate accordingly.

Should the customer call, email, text, or go to the app to complain, the complaint routes to another intelligent agent that pulls the data on the customer’s account to include profitability, products, and rate. The agent then checks the suggested rates against other customers and the bank’s goals and recommends another set of rates based on the sentiment of the complaint. The intelligent agent will also inform the branch or relationship manager and recommend that they get involved. The agent will keep working with the customer to optimize the results against the goals of increasing customer satisfaction, maintaining balances, and improving profitability.

To recap, the agent is based on the idea of connecting actions and data with agentic reasoning. Instead of a banker executing an action like dropping a rate in mass, the intelligent agent can react step-by-step, further refining its choices and navigation as more data and context unveils itself.

This is just one example. In reality, millions of other variations exist where the customer wants additional products, can move over additional balances from other institutions, or threatens to leave the bank. The above example could have played out with thousands of different permutations.

The poetry here is that despite the complexity and variability, the reasoning engine can balance multiple challenges by optimizing several variables.

The Transformative Architectural Change of Intelligent Agents

For the past ten years, banks have been automating workflow as they digitize products and processes while deploying bots to handle process automation. Banks or third parties would spend months to years building applications that suggest the next best product, analyze client defection, optimize rates, or manage customer engagement.

In our rate adjustment example above, a programmer would have to flow chart each permutation, making a dialogue flow for each path. The business line would have to know all of the questions that are going to be asked by the banker and the customer before they’re asked.

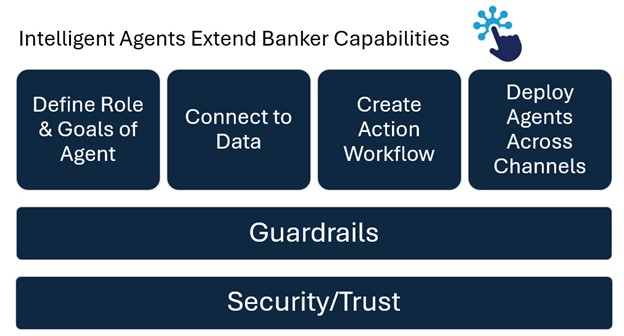

This is the big unlock. The intelligent agent operates on a no-code basis and lets bankers and customers modify the path on the fly to move into areas where no path was contemplated. Should the customer want to change their address during the rate notification, the agent can quickly accomplish that since it has those capabilities resident. Should the customer inquire about what will happen to rates during the next expected Fed cut, the intelligent agent can provide an intelligent answer appropriately.

Now, these intelligent agents sit on a platform that is often referred to as a “BOAT” or “business orchestration and automation technology application.” Banks can use these intelligent agents to roll out automation in days with little specific technical expertise. Generative AI unlocks this power and will reduce existing companies, products, services, and applications to a set of features that any bank can quickly deploy. Business line bankers can now use natural language to build and test an agent. These agents often have built-in test scripts that allow them to come up with their own scenarios and then chart how they would answer each scenario.

This is a step function of change that is before us.

Bankers are currently testing intelligent agents that can be customized, personalized, built, tested, deployed, and monitored in days. Companies like Salesforce, ServiceNow, IBM, HubSpot, and others have been beta testing with banks and are ready to move these platforms into production over the next several weeks. RPA companies such as Microsoft, SAP, UIPath, Automation Anywhere, Appian, and SS&C Blue Prism will likely follow suit.

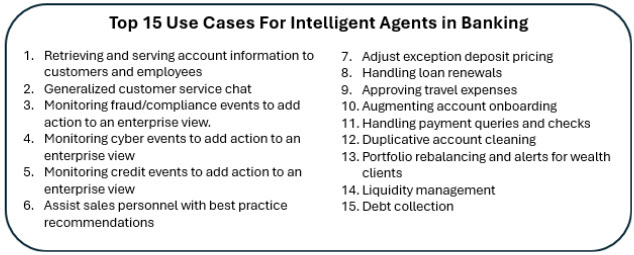

Other use cases abound, particularly in risk management and sales. Agents can follow up with leads, qualify them, and hand them off to bankers. Use cases like service agents that can answer customer questions about treasury management 24/7/365 and quickly elevate to a human banker should it be asked or required. These agents have been transcribing customer conversations on calls and automatically adjusting CRM systems with notes, tags, and tasks.

A customer might ask for information about opening an IRA account during a conversation about their rate adjustment in our example above. The agent could then kick off a video and email marketing materials and ask if they want to proceed with account opening. Should the customer want to open an account, the first intelligent agent would hand it off to an account-opening intelligent agent who would walk the customer through the process. Should the customer want to talk to a banker, a banker can be brought on the line or scheduled for the future.

Intelligent agents transform our tech interactions by functioning independently, driven by goals instead of prompts. These autonomous problem solvers adjust to new information and environments like sentiment or word choice, continually evolving to reach their objectives efficiently. The agents start with goals and defined roles of what it is trying to accomplish before it goes out and locates the required data from multiple sources. The agent then creates its own action workflow to accomplish the task.

In the past, workflow or an RPA bot had to be deployed by channel. Today, these intelligent agents can be incorporated into any channel and can operate across channels. This presents a customer experience that is similar not matter if you walk into a branch, call the call center or access the banking app on a smartphone.

In contrast, RPA, which has been popular with banks over the last ten years, is rooted in fixed parameters, workflows, training data and channel. Intelligent agents in banking thrive in uncertain landscapes, such as changing rates or credit environments, while handling vast streams of fresh data. They in essence, continually update themselves.

They’re the new face of intelligent automation. If you can describe it, intelligent agents can do it.

Utilizing Intelligent Agents for Fusion Action

Banks have many disparate systems when it comes to credit, fraud, compliance, and cyber defense. Next to customer and employee service, one of the largest areas of impact for intelligent agents in banking is quickly bringing different systems together to decrease reaction time in a “fusion” or enterprise-wide approach to risk management.

For example, bad actors may try various stolen passwords to access online banking to see if a bank has multifactor authentication. If it does, these bad actors may try accessing an account via a call center. Should they gain access to an account, they will try establishing another set of credentials to an account and/or to move money, triggering anomaly detection. An intelligent agent can monitor various disparate systems to test for specific known patterns. Once detected, the agent can send a notification to get a human in the loop and automatically freeze an account, thereby preventing damage in seconds.

See an Intelligent Agent for Financial Services Demonstration

Putting This Into Action

In a generation characterized by rapid AI advancement, the trajectory of AI agents promises unparalleled autonomy, which makes them capable of making independent decisions with minimal human oversight. Their potential spans diverse products and challenges, revolutionizing customer service, predicting market demands, optimizing production lines, and more.

Market analysis shows that next year will be the turning point for banks and AI. It’s the moment to embrace the formidable power of intelligent agents at the enterprise’s level.

Intelligent agents can augment every single banker to make them more productive, allowing them to focus on high-impact tasks by removing repetitive work. Bankers can now spend more time focusing on the customer. The extra time allows bankers to not only be more productive but also be more creative, in addition to freeing up time to have a better work-life balance.

Banks should educate themselves and consider deploying these intelligent agents within their organization. The first step is to come up with a hypothesis of value to see where the first place to test this new technology is. Often, it is either in the call center, branch or to augment sales personnel.

Next, it is experimenting with some standalone agents that may help bankers automatically pull data immediately when a customer mentions a product, competitor, or challenge on an audio or video call. After that, it is looking for ways to embed agents in a vast array of processes throughout the bank.