10 Capabilities that Every Account Opening Platform Should Have

Perhaps no piece of technology connects to building franchise value better than the ability to allow your retail and business customers to open accounts online. While the integration of agentic and generative AI may ultimately create more value, for now, account opening stands supreme as one of the most important customer-facing technologies a bank can leverage. An account opening platform reduces the reliance on the costly branch channel while extending your bank’s service footprint, allowing you to scale. Account opening technology enhances the customer experience, provides a bank with product management flexibility and a instills a better digital marketing to conversion connection. In this article, we outline 10 capabilities to consider for any financial institution seeking a new account opening platform. This list should save you time and help your bank achieve better outcomes.

The Background of Account Opening

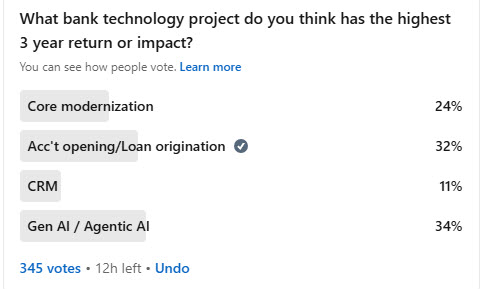

In a recent poll of bankers, outside of the future of AI, account opening and loan origination are two pieces of technology that can have the largest impact on a bank.

Having a modern account opening platform allows the bank to both better penetrate its footprint and expand its service area through digital means. Without digital account opening, banks create too much friction for themselves, as they must grab customers’ attention digitally only to prompt them to come into a branch to open an account.

Online account opening enables you to capture a potential customer’s attention digitally and then seamlessly convert that attention into fees and balances.

If you are finally getting around to digital account opening or looking to upgrade your current platform, we lay out ten critical criteria to consider when conducting vendor evaluations.

-

Self-service Account Maintenance

Ironically, one of the most essential features of account opening is often overlooked. Once an account is opened, customers will want to change information, attributes, and configurations. Given the frequency of these changes, banks need to provide the ability to make these changes online in a self-service manner to boost the customer experience while keeping costs low for the bank. A modern account opening platform should allow your bank to handle a target 80% of current account maintenance use cases, including name, address, and beneficiary changes.

-

Federated Application Capability & Adaptive Workflow

The future in banking is to have a single platform where customers, or potential customers, can choose their products and then apply once for every product to include loans, sweeps, transaction accounts, IRAs, HSAs, fiduciary accounts, and treasury – without re-entering the same information. This capability enables banks to display the appropriate questions, forms, and workflows based on product type, customer segment, or state.

To pull this off with elegance, banks need to incorporate financial needs analysis with account opening workflow so that you can help determine which products might be the right fit for a consumer or small business when opening an account. Product bundling options should be robust enough to enable the technology to identify ways to engage and incentivize customers to achieve greater convenience and increased wallet share for the bank. This feature alone will boost cross-selling, upselling, and, in turn, profitability.

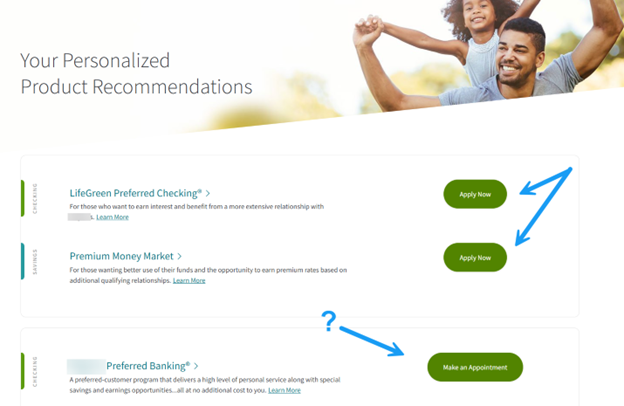

Below is an example of a bank that is in need of an upgrade to account opening. Their customers apply separately for each product instead of combining the accounts in a single application. They also require you to set an appointment and speak with a live person for preferred banking, as they believe that this human touch is necessary for effective cross-selling. Their platform lacks the capacity to make recommendations, as cross-selling would be a more efficient approach.

Another aspect of adaptive workflow is its impact on compliance and fraud. Applications that get scored with a higher risk score should undergo more designed friction to prevent bad actors from taking advantage of the bank. As such, account opening workflow should be able to adapt to evolving fraud threats, ensuring robust security measures are always in place.

-

Cross-Platform Framework

A single front-end code base and workflow allows a bank to use account opening across all channels. While some account opening applications have different workflows, capabilities, and user interfaces by channel, it is preferable to have a single codebase, such as React Native, Ionic, Node.js, or Flutter. This architecture allows for faster future development while delivering a uniform account opening experience across digital, branch, call center, and indirect channels, maintaining brand consistency and user familiarity.

In terms of workflow, account opening platforms must be able to facilitate account openings even when applicants are not physically present, streamlining processes for remote or distributed teams. This means having the ability for staff to open up the account on the customer’s behalf and handle document requests and validation via email, SMS, or RCS (HERE).

The other aspect of this is ongoing support. Bankers should be able to pull up a current session and shadow or co-pilot applications with customers in real-time — in the branch or remotely — to reduce abandonment and improve accuracy.

-

API-First, Configurable Architecture

Any new account opening platform should have an API-first approach with designs on instituting a model context protocol (MCP) standard. This ensures your account opening platform is agentic AI-ready while offering high configurability. With this structure, the financial institution can self-administer and tailor the platform to its unique needs, innovating rapidly with little to no vendor dependency to make changes.

An account opening platform needs to integrate, at a minimum, with a bank’s core CRM, fraud, KYC, and eSign partners. It should also integrate with a bank’s data lake, cyber fusion application, and third-party vendors that may have product enhancements such as loyalty points, insurance, or promotions.

Include smart dashboards, case queues, and workflows for staff to resolve edge cases, escalations, and manual reviews. For example, if a KYC exception exists, the platform should automate the appropriate document requests to resolve the exception, eliminating the need for a banker to manually request them.

-

Two-Way Data Flow and Prefilled Information

The account origination process can be daunting, taking upwards of 45 minutes for customers to provide the information. The goal is to get basic account opening down to less than five minutes and commercial account opening under 15 minutes. To accomplish these benchmarks, banks need to utilize their existing first-party information from the customer’s documents, the bank’s core, and the CRM system while integrating third-party information such as from Plaid, MX, Fincity, or others.

Equally important, account opening data needs to flow back to the core, CRM, and/or data warehouse.

-

Customizable Customer Experience

An account opening platform should be fully customizable, incorporating the bank’s look and feel while also meeting the bank’s compliance and accessibility standards.

-

Certified Core Integrations

Vendors for this technology should not only have experience with your core but preferably be certified with that core by the core provider. Being certified allows for rapid deployment, typically within 60 to 120 days, without the additional cost or overhead of a core provider’s statement of work. Without certification, core providers will likely charge an additional integration charge and take six to nine months to integrate, test, and move into production.

-

Multi-Applicant Support for Business Accounts

An onboarding solution should support unlimited applicants and joint accounts, accommodate complex business structures, and allow for layered approvals, ensuring seamless onboarding for entities with multiple stakeholders. This requirement is perhaps one of the most defining attributes between account opening providers, as most either cannot handle commercial accounts or just handle simple business structures.

-

Native Document Generation and eSignatures

An account platform should automate the creation of necessary documents, taking into account complex content presentment rules based on products, jurisdiction, and risk. This workflow should incorporate eSign capabilities, thereby expediting the account opening process.

-

Conversational AI and Agentic AI Integration

The future of account opening will be through a combination of AI agents and conversational questions. What is a structured process now will soon become an unstructured process, where the bank’s conversational AI will ask for the missing information needed to open the account and display the right fields at the right time to facilitate account opening.

Putting The Account Opening Selection Criteria Into Action

The ideal account opening platform for banks must be adaptable to embody the bank’s unique branding while adhering to strict compliance and accessibility standards. It is essential for vendors to possess certification with core providers, enabling swift deployment within 60 days and avoiding additional costs. Platforms should effortlessly handle multi-applicant support for business accounts, accommodating complex structures and ensuring smooth onboarding with layered approvals.

Moreover, the platform should automate document creation, considering intricate content rules based on products, jurisdictions, and risk, and incorporate eSignature capabilities to streamline the process. As we look towards the future, the integration of AI agents and conversational AI will revolutionize the account opening experience, making it an intuitive and dynamic process where information is gathered and displayed seamlessly.

By implementing these components, banks can provide a more efficient and user-friendly experience that meets modern standards and anticipates future innovations. This strategic approach not only enhances operational efficiency but also significantly improves customer satisfaction, setting a new benchmark in the banking industry.

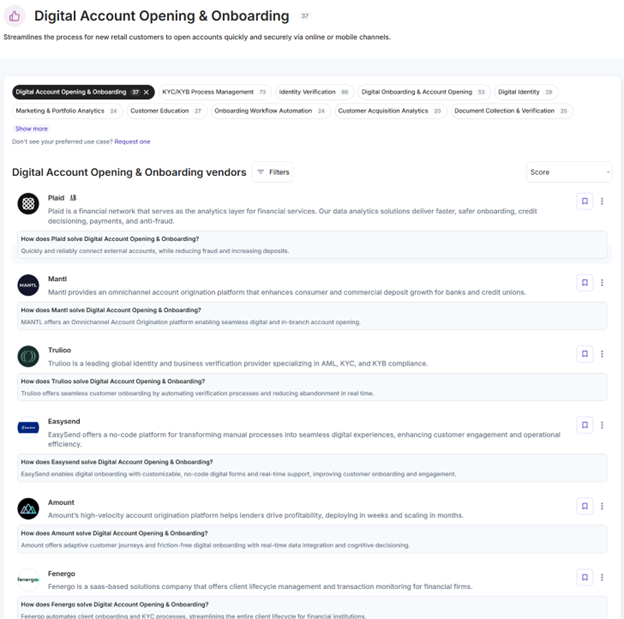

There are two vendors, in our opinion (and we get no compensation or value for saying this), that best fit the criteria we laid out – Enable and Prelim. Of course, there are others, approximately 37, and the best selection largely depends on what your bank wants to accomplish with onboarding and account opening. To see the universe of vendors and supporting vendors that you might consider, click the graphic below and check out our curated list on Compass.