Using Gen AI for Bank Strategic Planning – Part II

In Part 1 (HERE), we explained the why and how to use generative AI (Gen AI) for bank strategic planning. We highlighted how Gen AI changes the planning process and provided sample prompts. In this article, we cover the remaining five steps and detail how to build a Monte Carlo model to test your initiatives.

Let’s continue to the next step in using gen AI for bank strategic planning.

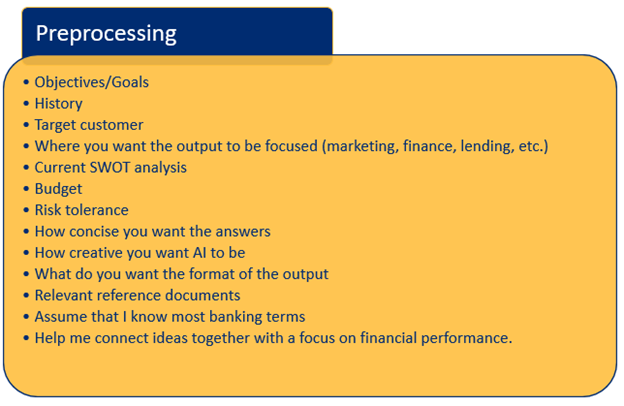

Step 2: Create Custom Instructions – Pre and Post-Processing

One of the advantages of using AI for bank strategic planning is that you can feed in a set of standing instructions that you can improve over time. You can create a custom set of instructions relevant to every prompt for Gen AI models. This standing instruction set is helpful if you have many questions for the application or want to use the large language model strategically in the future.

Here, you can provide background on the bank, provide any limitations you want, and describe how you want the output to look.

If you are using an enterprise version and you feel comfortable, you can also upload other reference documents like past strategic plans, consulting reports, industry analysis, call report data, and the websites of both your bank and your competitors.

The goal here is to give the Gen AI application a relevant context to answer your questions better.

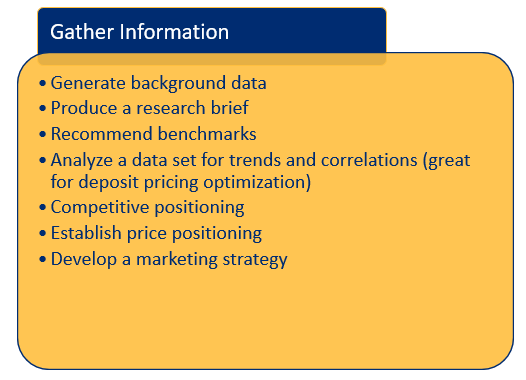

Step 3: Using Gen AI for Gathering Information

Gathering information is where Gen AI shines. It takes a human 5 hours to read, analyze, and summarize 7,500 words of data and text. It takes AI about a minute. In this phase, you want to use AI to generate a research brief. You may want to start by asking your AI agent what relevant information should be gathered to make a given strategic decision. Conversely, you may know precisely what information you want to gather and ask it to go to work.

For example, you can feed each business line’s financials for the last ten years and ask which economic indicators correlate most to your bank’s performance. From there, you can ask it to project financial performance forward based on the Bloomberg consensus economic indicator estimates.

You also may want to leverage AI to look at your competitor’s websites and compare your offerings to theirs with the output of identifying potential new products. Since pricing sheets are often public for banks and can be found on a bank’s website, one common task is to have AI compare your product pricing to another bank and uncover the differences.

Suppose you have a new product, such as instant payments. In that case, you might ask your Gen AI agent to detail all the payment-heavy industries in your geographic area if you want to formulate a strategy for promoting the product next year.

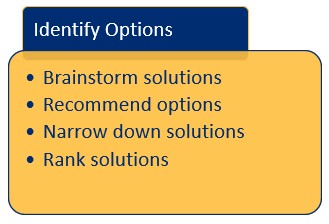

Step 4: Exploring Options

Exploring strategic options is where a GPT platform excels.

Last year, a Wharton study (HERE) tested the generation of product ideas and compared MBA students at a top-tier university with ChatGPT 4. The conclusion was that AI-generated more, higher-quality ideas at a greater rate. Last year, in a survey by Microsoft and LinkedIn (HERE) of 31,000 workers, 75% of employees were using Gen AI for work, and “Being more creative” was the third most popular use case behind general productivity and being able to focus on the most critical work. Interestingly, 83% of respondents in the study said AI allows them to “Enjoy work more.”

While using AI for gathering data is a function of speed and scale, using Gen AI to explore strategic options for the bank is a function of reasoning and shows off the model’s power; ask Gen AI to “Come up with multiple options and solutions for improving net interest margin (NIM) next year and it will provide 14 options ranging from loan structuring (more variable pricing), selling more business loans (to include equipment and asset-based lending), deposit marketing (increase it), and cross-selling fee-based services (more treasury management promotions) among them.

Bankers can follow any question up with additional constraints such as “Narrow down this list of strategies to those that have the potential to generate at least $1 million in revenue without increasing by loan loss allowance or risk profile.”

For bankers who are thinking about M&A, you can describe your bank and ask it for a recommendation on whether you should acquire within your state or move to another state. It will provide the pros and cons for each state and likely conclude that you are better off staying within your state in the short-term but better in the long-term by going to another state. While you are at it, you can feed call report performance data and stock price information and get a list of ranked recommendations for the best value.

The possibilities are endless, but expanding your option horizon, ranking your options, and narrowing down your options are all excellent use cases for Gen AI.

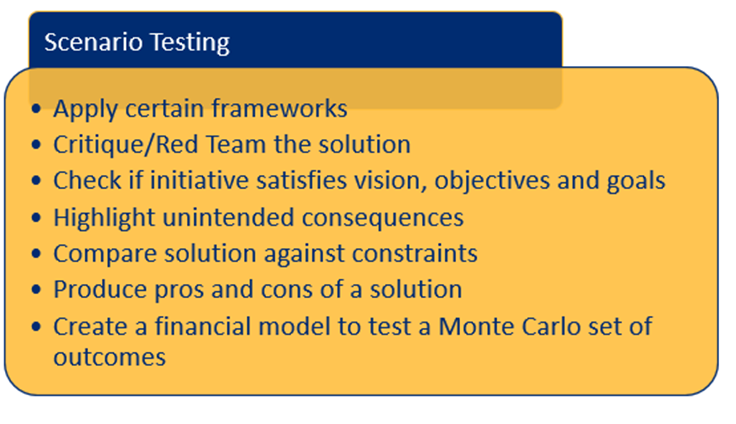

Step 5: Scenario Testing Using Gen AI

Bankers already do a good job at everything previously mentioned; AI does it faster and often more accurately. However, if it is one area of the strategic process that bankers underinvest in, it is around testing the proposed strategic options. When it comes to using AI for bank strategic planning, testing a strategic initiative scenario can be resource-intensive. Gen AI can not only save time but also greatly improve the quality of output.

When we talk about scenario testing we mean to both quantitatively and qualitatively test each idea to see if it stands up and to improve the probability of getting the initiative approved. Gen AI can help place the initiative in a common framework a bank uses, can raise unintended consequences, access risk, de-risk an idea and uncover overlooked upsides.

One area where AI for bank strategic planning can be helpful is to apply certain frameworks to solutions to better understanding them through that given lens. For example, some banks rank their strategic initiatives using the Cynefin framework, made popular by Harvard Business School and the Department of Defense, that looks at the complexity and stability of organizational efforts.

Currently popular is Simon Sinek’s Golden Circle paradigm that tries to understand the “Why” and then the “How” in every initiative. Using a CSD matrix (certainties, suppositions, and doubts) for initiatives is also instructive to bank strategic planning as it underscores your solid, and not so solid assumptions underlying your expectations.

In a similar fashion, AI can help present your bank’s strategic efforts in various formats, including a traditional Pro/Con list, OKR structure (objective and key results), SMART goals (specific, measurable, achievable, relevant, and time-constrained), a balanced scorecard rating, or OGSM (objective, goals, strategies, and measures).

Once an initiative is in the proper framework and the correct format, bankers can use AI to help them critique the initiative or highlight the weaknesses in the effort. Usually, bankers build out a simple financial model forecasting the cost and return on any given strategic effort. By uploading that model to a gen AI’s code interpreter (e.g., using Github Copilot or the Code Interpreter dropdown in ChatGPT), bankers can now get a Python version (or you can turn it into a Visual Basic add-in to Excel) of the model that can then be tested. Bankers can now ask for the variables to be varied within a range and produce a desired set of outcomes. Profit, for example, can be graphed as a distribution so you can see the range of possibilities.

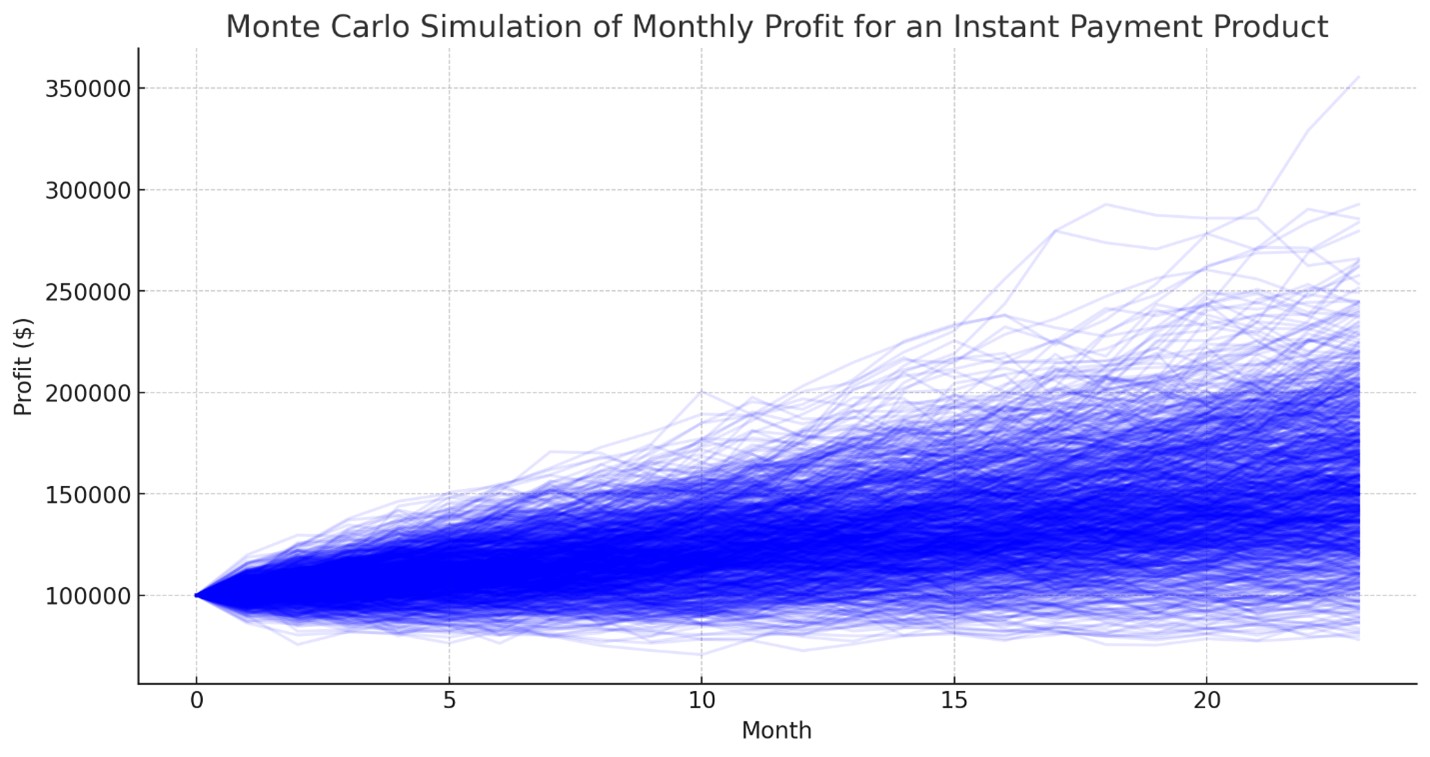

Bankers can now look at the stochastic or probability-based distribution (below) of outcomes given a set of inputs. In this manner, bankers can better understand how interest rates, real estate values, credit, and other variables could impact their initiatives. What used to take a trained analyst weeks to put together can now be democratized to the line of business with about three hours of training and a gen AI tool. The power is incredible, and the result is a much higher level of sophistication, accuracy, and understanding for each strategic initiative.

Step 6: Getting Buy In

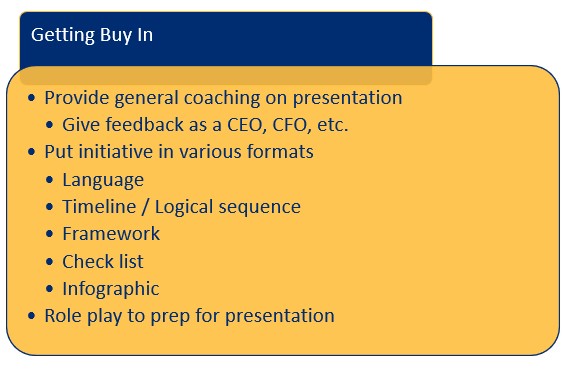

When using AI for bank strategic planning, getting “buy-in” is one of the more novel ways to use AI in the process. Here, you can have Gen AI translate your initiative into a format that best conveys the information to your reader. This may be a separate language, in graphical form, or a certain framework, as previously discussed.

You can ask for general coaching tips about how to present the information, or you can ask AI to take on a specific persona, such as a CEO or CFO.

Disclosing AI

Finally, there is the meta question of how you talk about using AI for bank strategic planning. Do you talk about it, or just have it be one of the many tools you use that you likely don’t disclose now?

The answer is that you should talk about it and learn to work with gen AI until it becomes common and muscle memory. You should reference AI just as you might any other source that you use.

By disclosing your use of AI, you will help educate other bankers while evolving your own process. You may want to say things like, “Here are some items presented by AI that we should consider.” You can also disclose that you used AI to test your initiative and that you added sources at the bottom of the slide to allow easier fact-checking.

Putting This into Action

Using AI for bank strategic planning takes understanding, practice, and patience. This is a leadership moment for most bankers. The banking industry is one of the industries that can best benefit from AI and we need more bankers becoming conversant with the risks and the rewards of the technology. Bankers need to learn, lead and teach others in the organization the path forward.

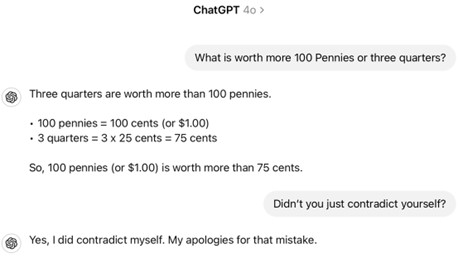

Despite the lofty praise around gen AI, it is important to always remember that it is still not human. The technology still struggles with basic cognitive tasks such as playing tic tac toe (which is one of our tests) or explaining the value of money (below) (another common test of ours as many models have this issue).

However, ask the technology to make a strategic recommendation about going after furniture manufacturers or trucking companies with your current suite of banking products and it will analyze cash flow, growth, financial needs, best product fit and risk with a moderately high degree of accuracy.

Like most other interactions with gen AI, there still needs to be a human-in-the-loop. If used properly, AI will reduce your biases, while you reduce its biases. A human is till needed to add nuance, humanity, and empathy. Bankers will need to further tailor recommendations for specific use cases as the largest deficit with gen AI is it tends not to be granular enough.

Gen AI is just another tool in your tool kit. Using AI for bank strategic planning doesn’t mean you need to use AI for every part of the process and for every initiative. Bankers should at least start experimenting with simple problems and then practice honing their prompts and their process. Overtime, more complex strategic initiatives can be tackled such as using gen AI for M&A.

In banking, there is starting to be a digital divide between banks that are learning about AI and those that are not. This knowledge gap will continue to widen, with AI-conversant banks becoming 30% to 40% more efficient over time, according to our estimation, and creating this “AI class.” Most importantly, without having a working knowledge of these tools, if you are not in the AI class, your bank will start to struggle to attract the knowledge worker that is needed to compete in this age of data and data intelligence.