The Changing Distribution of Bank Product Demand

In business and banking schools an often-taught principle is that the demand for banking products is normally distributed. A bank would set its product and price, some people wouldn’t care, others would care a lot and the bulk in the middle is where a bank would focus its sales and marketing resources to convince them to take a loan or open a deposit account. The problem is that this was never really true for banking and is not true now but for different reasons. Understanding this distribution of demand can be the key to selling more banking products.

The Normal Distribution in Theory

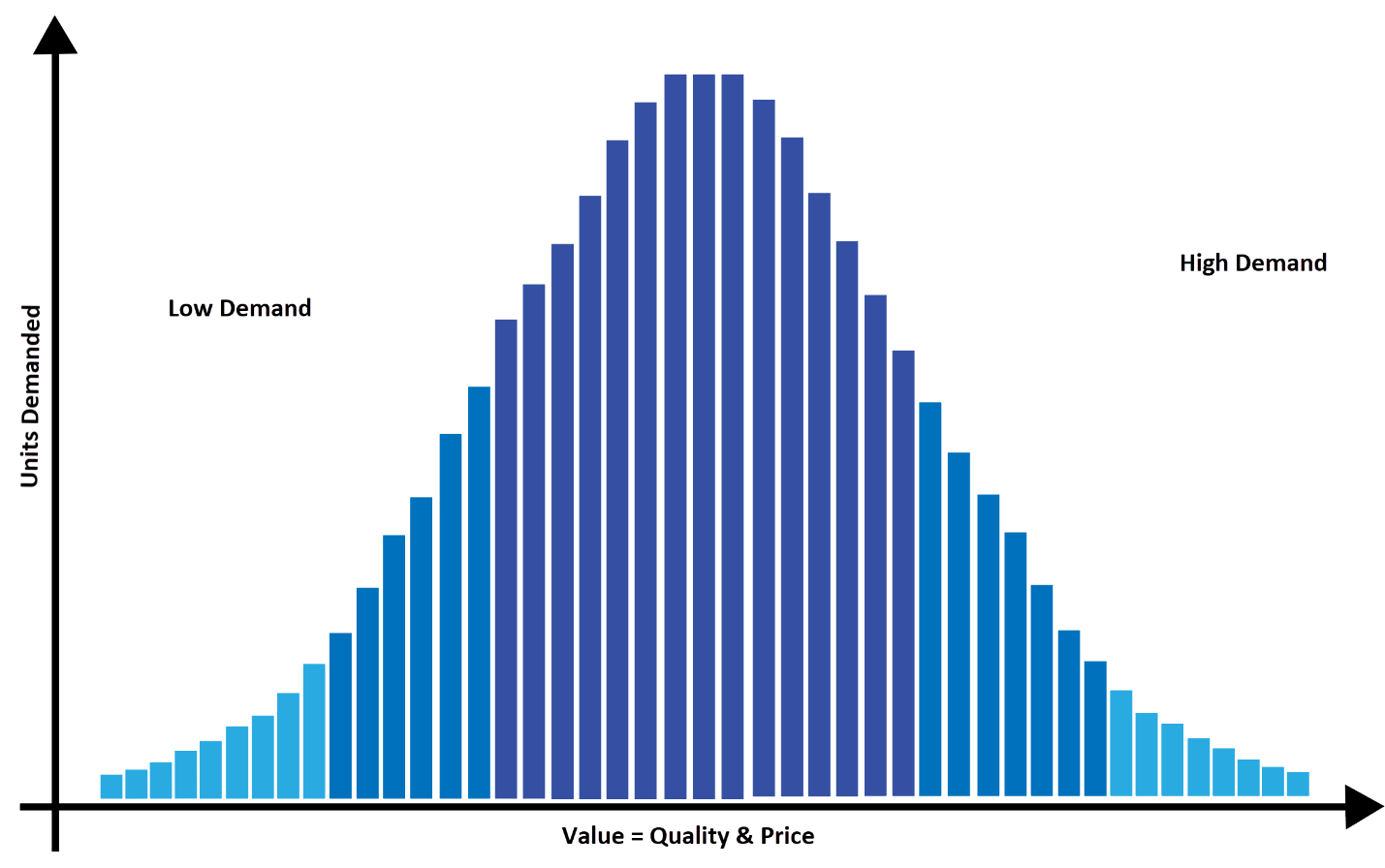

The Gaussian, bell or normal distribution is a tidy concept, popular in economics and business classes where a seller would put forth any given value proposition, such as a checking account, and there would be a portion of the population that would be high-demand, automatic buyers. On the other side, there would be a similar population that would be low-demand customers that probably wouldn’t care. That leaves approximately 68% of the people in the middle that are potential customers with a little work. The theory is a nice fit, but it never really applied and applies even less so today.

The Real Historic Distribution of Banking Demand

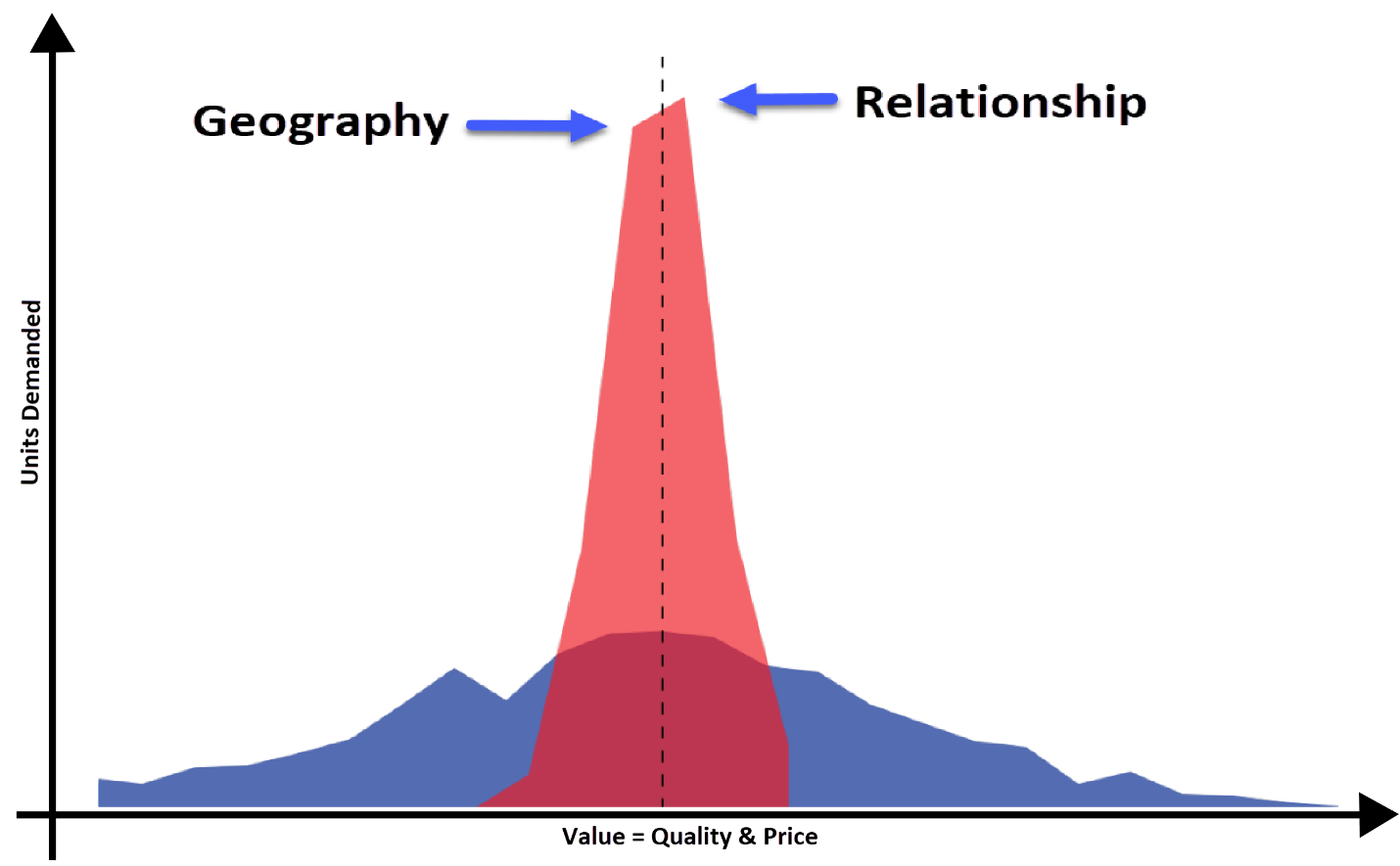

Banking product demand has historically been about two things – geography or relationships. Either you lived or worked near a branch or you knew a particular banker that sold you to come bank with him or her at whichever bank they were at. As such, instead of the normal-like distribution in blue below, you get the distribution in red. This is a much different distribution of customers and has a couple of ramifications for banking.

The implications are profound but straightforward – there is more demand around geography and relationships than often assumed, there is much less demand outside of geography and relationships, and there are very few “fat tail,” or customers that are outside of the immediate geography and relationships that will stumble upon your bank no matter what the value of your product or service.

The Old Banking Equation for Revenue

Given the asymmetric and non-normal distribution, to grow revenue, the equation was essentially this:

Revenue Growth = More locations + More relationship managers

Add branches and people, and you were likely to grow revenue. This is one reason why banks could get away with relatively low marketing budgets compared to revenue. Your customers were either about five miles around the branch, or your business development officers or branch staff knew them. Marketing helped speed up the sales cycle, but it wasn’t all that effective in generating leads outside of the bank’s immediate service area. Good locations in the community and/or a high-profile management team could offset the need for effective bank marketing.

While this equation was true for almost 200 years in banking, it is now starting to change.

The Emerging Bimodal Distribution

Demand for banking products is becoming bifurcated, and the recent pandemic has sped this trend up. While geography and relationships are still critical, they are less important now and maybe close to irrelevant in the future. Your local department store used to be essential for your purchase of household goods and clothing because of its location, and maybe you knew the person behind the counter, but that has been replaced by a variety of specialty stores and online retailers. No one cares about the geography or relationship when they buy from Amazon.

These days, many of your decisions are essentially single-variable decisions. You want a particular product, or you want a specific attribute of a product, and you go out and find it. This is a result of several trends that are influencing how we make decisions:

- Personalized Marketing: Due to targeted marketing techniques and social media, you are more apt to want a particular product or brand.

- More Service Focused: Sellers have realized that service is a critical component of demand, so storing your preferences, making suggestions, saving your past orders, having rewards programs, easy returns, and quick delivery.

- Value, Process & Technology: A more efficient process, combined with technology, is what allows better service and personalized marketing to bring you greater value at scale.

As a result of the above, it is likely that your bank will be facing demand that doesn’t look anywhere close to a normal distribution. As banking becomes more digitized and more commoditized, demand for bank products and service is likely a bifurcated or bimodal distribution where one factor dominates other factors. The strategic outcome here is that the big middle mass of customers starts to disappear.

When banking was all about geography, banking is a scarce product. You likely had to choose one of five banks near your work or home, and you would select a bank weighing a variety of factors such as location, ease of parking, if they had ATMs, if they would make you a loan or if you heard good things about them. Preferences for banks were multifactorial in nature.

However, if 25 banks can give you an online banking platform and give you most of what you need, then your decision is governed by abundance, and it becomes more likely that your choice of bank will come down to a single factor such as rate, cost, analytics, speed of payments or something else that you care about.

What This Means For Banking

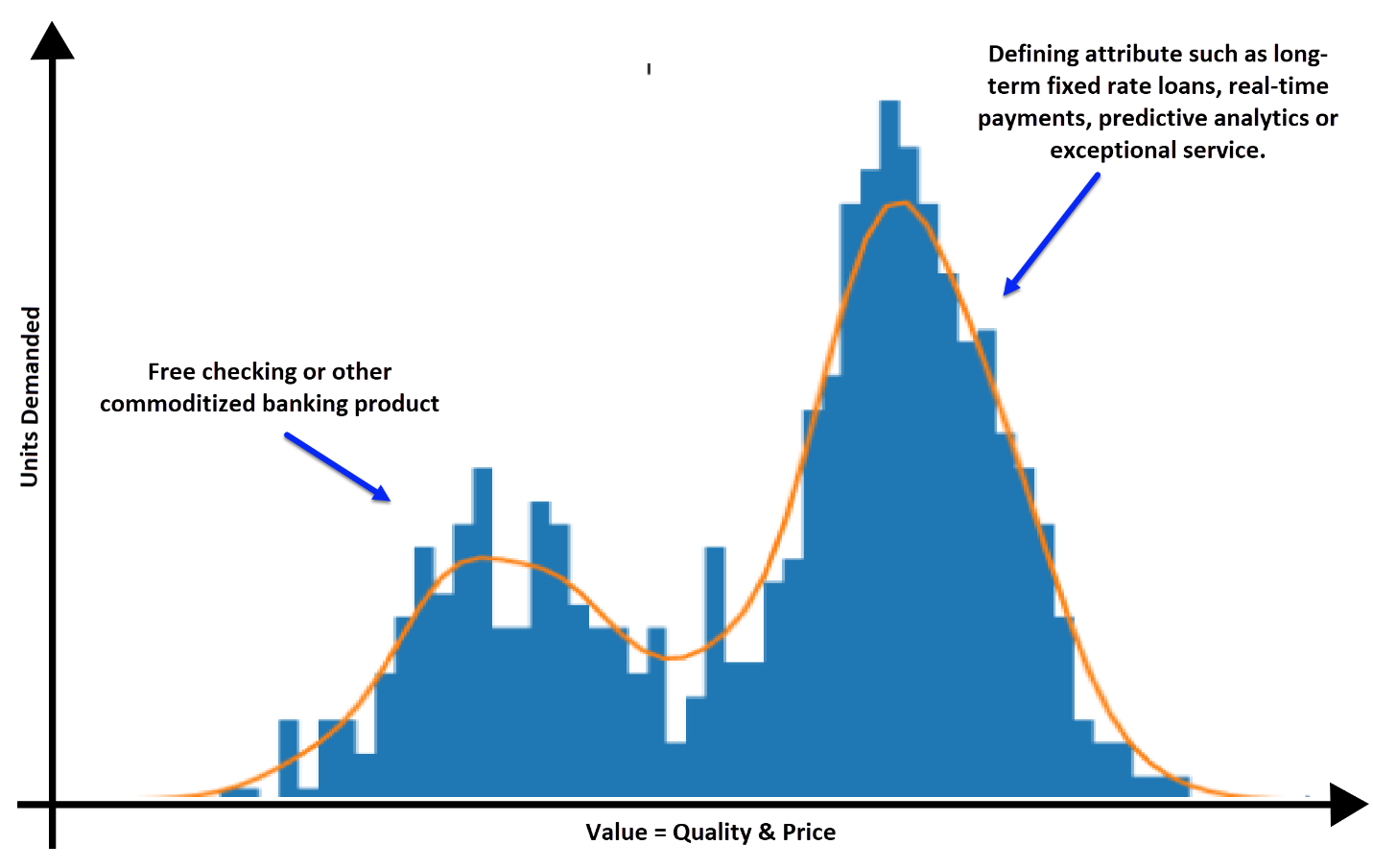

This bimodal demand structure will start to look something like the below.

For the near term, banks can get away with selling commoditized products like a simple free checking account or a five-year fixed-rate commercial loan. These buyers will demand products on the lower end of the value chain, which also means lower margins. As geography and relationships become less important, this battle for the customer will be all about lower-end price and limited service. This runs counter to the community bank model of high service and wider margins. Competition from national banks, fintechs like Venmo, or potential banks like Walmart/Amazon will be the main competition and will continue to squeeze community banks out of this sector. It will be only a matter of time before regional banks like PNC, Fifth Third, and Bank of the West go more national as their online offerings can scale quickly across the country.

Community banks will increasingly find that their basic banking products uncompetitive and the hump on the left will disappear with each generation.

The larger customer cohort will be higher up in the value food chain and will be from customers demanding a particular attribute from their bank. The first bank that can make tax filing seamless would be an example of that. Banks that can facilitate consumer-to-business payments are another. For a community bank, understanding and targeting a non-geographical customer niche or niches will be the winning strategic positioning. Community banks will find their business model and customer base shifting from the left mode to the right mode in the chart above. Banks will have to spend more resources on marketing to find the niche customers that care about their products over a wider geographic area. Here, relationships may matter, but it will be less in person.

Banks that can facilitate human interaction digitally via video conference, chat, voice, and provide a healthy dose of education plus advice, will emerge as the winning business model.

Community banks that cannot track this shift in customer demand will perish.

The future will mean that product attributes become more important as a differentiating factor, and both geography and relationships will matter less. This is why we are fans of reworking your branch strategy, segmenting your customer base, enhancing customer service, investing in technology to deliver those products and services while increasing your investment in marketing to reach those particular customer niches.

The more banking products get commoditized, the more it will pay for banks to differentiate themselves through products and specific formalized service enhancements such as better analytics and faster processing. The shift to a bimodal customer demand model will demand that banks change their strategy, business model, products, and marketing. The key to success is to come up with a creative solution and then find those customers at a broader scale to use that product. Banks that can adapt to this shift will produce an above-average return while banks that can’t get acquired by banks with a modern approach.