This Bank Business Model Is About To Be A Problem

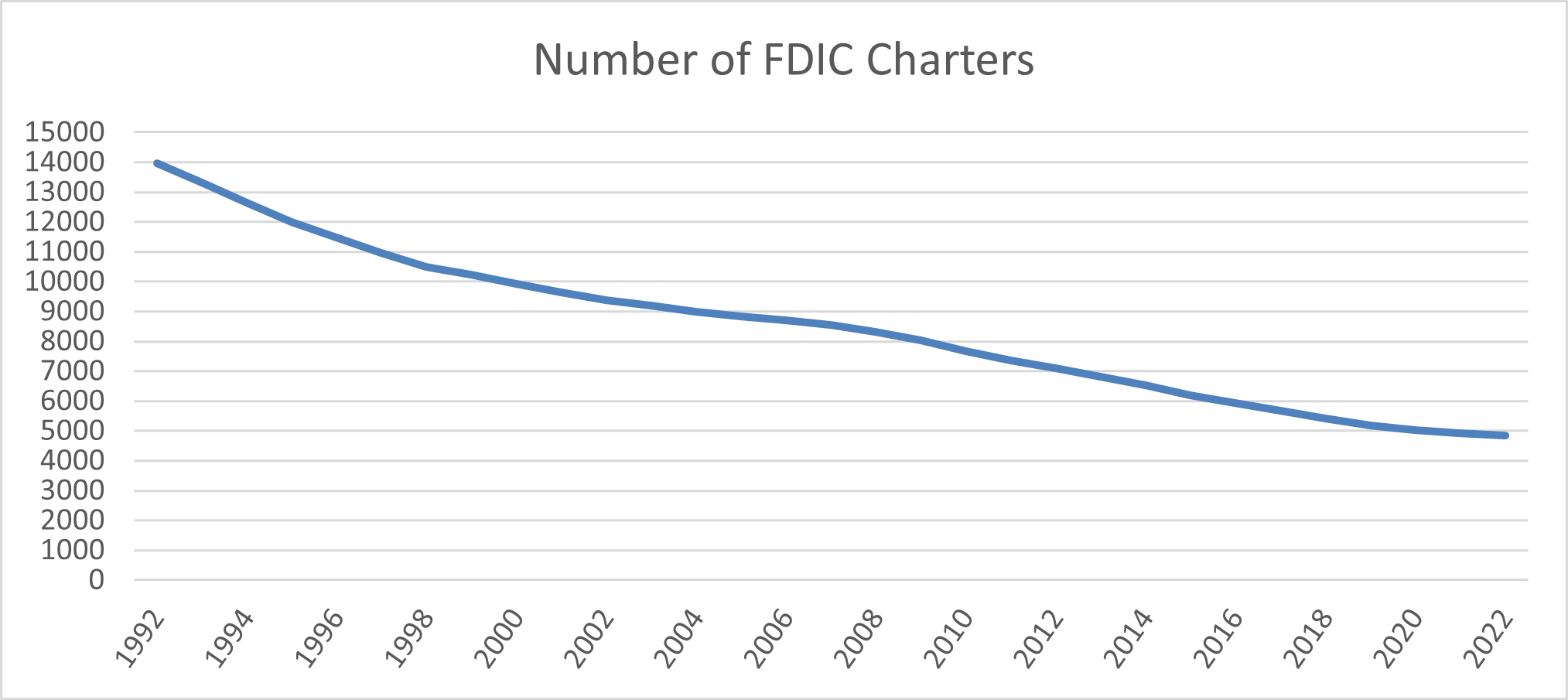

In the last 30 years, the total number of bank charters has declined by 65% (as shown in the graph below). There are many reasons for this industry consolidation. We believe that the most significant factor driving consolidation is that banks tend to underperform using a risk-for-pay bank business model, and banks that have properly developed and implemented relationship banking are acquiring pay-for-risk financial institutions.

Relationship and Pay-For-Risk Bank Business Model

Pay-for-risk banking focuses on assessing and underwriting risk and capitalizing on opportunities where risk is overpriced. Unfortunately, this bank business model can only be as successful as your dumbest competitor.

Further, since the pay-for-risk business model relies so much on credit, it is highly sensitive to changes in credit. Higher rates and less liquidity could stress this model, given where we are in the business cycle.

Relationship banking is misunderstood by some. Most community bankers already think that they emphasize relationship banking, but that may not be the case. The end of the pandemic may be a tipping point where relationship banking will become paramount for survival.

Relationship banking focuses on a consultative approach with customers, selling services and advice based on the customers’ particular situation and needs, and adapting those services when the customer’s financial or business lives change. The relationship banking approach is premised on high-touch service and product cross-sell. Despite many community banks wanting to embrace the relationship banking model, it is not easy to execute well. Some banks believe that they are relationship-driven but unwittingly revert to risk-for-pay products. Other banks attempt to deliver relationship banking but fail because they may not understand what is involved and how to differentiate from competitors effectively.

The Data On Banking

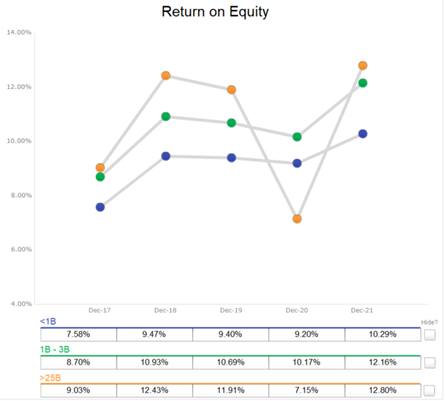

The graph below shows the ROE for all US banks divided into three asset sizes (under $1B, $1-3B, and over $25B). The industry ROE is not spectacular, but more importantly, over 50% of banking institutions generate profits below their shareholders’ cost of equity.

Market valuations now demonstrate that banking is being transformed from a risk-for-pay to a safer, more predictable, and more commoditized industry. Relationship banking is one of the best-proven bank business models for banks to outperform competitors and create value for shareholders. The graph below shows current price-to-book ratios across industries. The market is valuing banking similar to utility companies. The result is that banks have a small margin for error, and risk-for-pay models do not work for predictable and commoditized industries.

Community Bank Relationship Business Model

Relationship banking requires a focus on the customers’ lives. Also, because the rate of digital banking adoption has doubled during the pandemic, community banks must use digital channels to solve specific customer needs in the most efficient way possible. Community banks need to attract bankers with industry, technology expertise, and relationship management skills. To survive, community banks will also need to minimize capital-intensive risk-for-pay business models and focus on retaining, cross-selling and engaging customers. To become top-performing institutions, banks will also need to generate more services and earn more fee income rather than rely predominantly on net interest margin.

While community banks almost universally promote relationship banking, the model is not easy to deliver effectively. Banks will need to find the right talent, promote education, create the product mix customers require, and rapidly adapt their offering as customers’ needs change.

Conclusion

The banking industry needs to change its paradigm from pay-for-risk to relationship building. While no bank can eliminate all risk in commercial and consumer operations, community banks need to minimize the amount of risk they take and embrace relationship banking to achieve higher long-term ROA. Banks that survive and thrive view their lending business model as a consultative service, and capital is cherished and shared only with the highest credit quality borrowers (and with commensurate lower returns). The traditional view of banking as a pay-for-risk industry will be the most significant driver of bank consolidation in the coming years.