Understand This One Point For Better Bank Fee Setting

Pick up almost any survey, from Pew to JD Power and you will find that deposit account fees are a significant driver of customer satisfaction. Often it is a major factor in choosing or leaving a bank. Unfortunately, many banks set their fees according to where their competitors are. If your bank does this understand that it is based on the fact that your competitors know what they are doing. The logic also presupposes that you are exactly like your competitor in terms of customer, geography, goals and strategy. Both underlying assumptions are rarely true which is why most banks make a huge mistake when they price their bank products solely based on where their competitors are. Today, we look at when banks can and can’t rely on their competitors to set pricing.

Know The Coefficient Of Variation

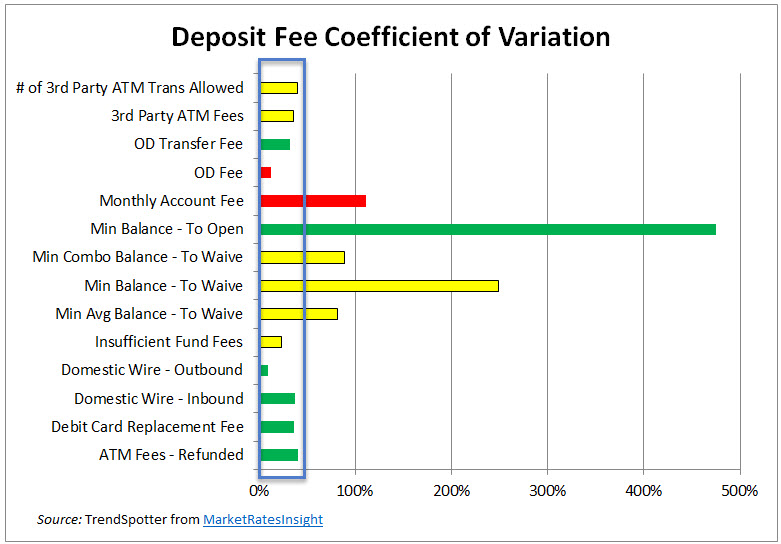

Understanding the deposit fee coefficient of variation is a much-overlooked calculation when it comes to fee setting. While that sounds complicated, it is not, but it doesn’t matter as we are going to do it for you. While it may be different for your particular market, it is rare that we have seen those differences be meaningful to the decision process. After doing this for hundreds of markets, the below chart can likely be used by almost any bank.

For any given product, banks set fees. If you look at the distribution of those fees and look at how wide or narrow they are you come up with a standard deviation. This is where you need a fee survey of not only banks in the area, but other alternatives such as credit unions, internet banks, mobile-only banks, and investment-driven banks such as Schwab or Fidelity. Here, this is where subscribing to a tool like Fee Builder from MarketRates Insight (which we do) or leveraging a consultant (we use Informa and also like Financial Shop Solutions) can save you valuable time and cost (not to mention gain you accuracy). You can also mystery shop to gather the information yourself if you are so inclined.

By recording where your competitors are pricing a given product, you can then calculate the standard deviation. Some deposit account attributes such as the minimum balance to open an account are wide, while some, like overdraft (OD) fees, are extremely narrow. By dividing the standard deviation by the mean of each fee level by-product, you get a ratio called the coefficient of variation. This allows different fees to be compared to each other.

How To Use The Coefficient Of Variation

In general, the higher percentage of the coefficient of variation to more dispersed a bank fees are and the more room you have to set your fees. Looked at the other way, setting your fees wrong, will have less of an impact. As a rule of thumb, a coefficient of over 50% (see the boxed area above) and you are generally safe to set your pricing against your competitors.

Then Add Elasticity

Of course, the above rule of thumb is just a general rule. Some customers are highly sensitive to certain fees or certain attributes (like minimum balance requirements) – your monthly account fees, for instance. If you want to upset a large number of customers the fastest, raise your monthly fees. Conversely, few customers will care if you raise your minimum open balance.

In general, when elasticities are 1.15 or greater, tread carefully. That is to say, when you increase your fees by 1% you sell 0.15% less (or lose customers) you are in fairly elastic territory and customers will react to small price changes.

Putting It All Together

Overlaying the coefficient of variation and elasticity you can see what products require more pricing attention. These are colored red and are a combination of a low coefficient and high elasticity. OD fees and monthly service charges are products where banks price in a relatively narrow range (more OD fees than monthly service charges) that have fee price sensitivity or elasticity. For these areas, banks need to do additional homework (a subject of a future blog). For categories that are green and for many of the yellow categories, it will make little difference if a bank gets its pricing wrong so setting these off your competitors is probably fine.

Since fees are so important, knowing when and when not to use your competitor’s pricing structure can save your bank from unintentionally hurting profitability (and customer satisfaction), while saving valuable resources when it doesn’t matter.