Using Swaps, Caps, Floors, and Collars in Lending – Part I

The Federal Reserve is rapidly changing the interest rate environment to fight inflation. The Fed’s actions are forcing lenders and borrowers to consider ways to protect cash flow, credit, liquidity, and interest rate risks. Many borrowers ask lenders how they can use swaps, caps, floors, and collars to protect their businesses and lower borrowing costs. In this two-part series, we will review the fundamentals of these hedging instruments and consider the right environment to apply them to commercial loans.

Definitions

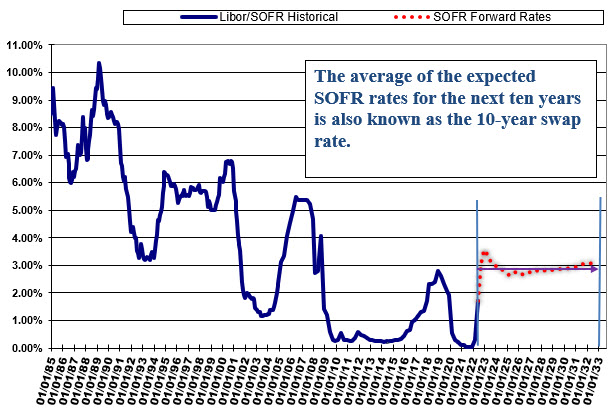

An interest rate swap is an exchange of cash flows between an entity that pays a fixed rate and a second entity that pays a stream of short-term rates. At the inception of the swap, both parties expect to receive and pay equivalent economic value. The swap rate is determined by the markets’ expectation of where short-term rates will be over the life of the swap. A similar concept applies in the Treasury market – the yield on the ten-year Treasury is the markets’ average expectation of the yield on the next 40 consecutive three-month Treasury Bill yields. The graph below shows historical short-term rates, the markets’ expectation of short-term rates for the next ten years, and the corresponding swap rate.

Borrowers generally do not pay a fee to fix the rate on their loans, and the swap market is efficient for commercial loans as small as $250k. A swap may be used to fix a loan rate to eliminate the variability of payments for borrowers or to stabilize credit quality for lenders.

A cap is an instrument that limits how high-interest rates can rise, for example, on variable rate debt. A floor is an instrument that determines how low interest rates can fall. A collar is the combined use of both a floor and cap. Typically collars are structured so that a user buys a cap and sells a floor to reduce the cost of that cap.

Four input variables dictate the price of caps and floors, as follows:

- Term of the cap or floor – the longer the term, the more valuable the instrument because of the higher possibility of payout in the future and more payout periods. The market for caps and floors is liquid for up to five years and somewhat liquid for ten years. All else equal, the longer the instrument, the more value it provides.

- Strike level – the lower the floor rate, the cheaper the floor, and the higher the cap rate, the cheaper the cap. However, the relationship is not linear since well out-of-the-money instruments are dear to brokers who may be asked to pay large sums on rare occasions. Therefore, even floors and cap strike levels that are five standard deviations from interest rate expectation levels have value.

- Volatility – more volatility increases the value of caps and floors. Another way of stating this is that the payout on these instruments becomes more likely as each standard deviation becomes wider. Unlike swaps, the value of caps, floors, and collars is driven by volatility.

- Size of the cap or floor as measured in basis points. For example, if the cost of the cap or floor is 1%, the buyer would pay $10k for a $1mm protection and $20k for a $2mm protection. But this is a textbook notion. In reality, there are substantial friction and transaction costs to buying these instruments in the market, and the cost of the cap or floor (stated as a percentage) increases sharply when the protection amount is small. Therefore, while a $100mm floor may cost 1%, the exact same floor for $1mm may cost 2%.

Intrinsic vs. Time Value of Caps and Floors

The value of a swap is known with certainty at inception. However, the value of caps and floors behave differently from swaps. The value of caps and floors is divided into intrinsic value and time value. The difference is significant and dictates how and when borrowers and lenders should use these instruments.

The intrinsic value of the cap is created when the strike level is lower than the implied forward curve (similarly, the intrinsic value of the floor is created when the strike level is higher than the implied forward curve). Let us consider a cap purchased today for five years with a strike level of 2.00% on SOFR. This cap has a high intrinsic value because we expect SOFR to be well above 2.00% for the majority of the next five years – in fact, SOFR is currently above 2.00%. Consider the graph above and the red dots, which show the market’s expected SOFR levels for the next ten years – all of the dots are above 2.00%.

The time value of the cap or floor is created by the possibility that rates in the future may go higher than the current implied forward curve predicts. For example, a cap purchased today for five years with a strike level of 5.00% on SOFR would have zero intrinsic value (we do not expect SOFR to reach 5.00% within the next five years). However, this cap is not worthless because there is some chance, however small, that SOFR may exceed 5.00% within five years. The time value represents the possibility that the implied forward curve will change over time as the market changes its view of future rates.

Why Use Swaps, Caps, Floors, and Collars in Lending

Borrowers and lenders typically use swaps to eliminate variability. The variability of payment or variability of net interest margin. But volatility instruments such as caps, floors, and collars are not a substitute for swaps. Caps and floors are not generally purchased by market participants based on the expectation of payout. The purchaser of a cap or floor is always better off from the intrinsic value of the instrument if the cap or floor never pays – if interest rates never reach the strike level of protection purchased. In other words, there is no economic benefit to buying caps for their intrinsic value. Outside of speculating, caps and floors are not purchased for their intrinsic value; they are purchased for their time value.

A cap, floor, or collar is purchased as an insurance policy that is better not used. Just like a homeowner may be relieved but not happy to have to claim on a home fire policy, a cap or floor purchaser is always economically ahead if the cap or floor expires worthless. This is very different from a swap, where the borrower or lender recognizes the economic benefit of the instrument for the duration of the contract. This is why our borrowers choose our ARC Program about 98% of the time.

How to Apply

Next week’s article will consider how lenders should position, price, and compare swaps, caps, floors, and collars for their borrowers. We will also look at current market volatility and interest rate expectations to compare the relative value of swaps, caps, floors, and collars. We will present how larger banks position their hedges for borrowers and what hedging structures resonate with borrowers in this business environment.