What COVID-19 Might Mean For Your Branch Strategy

Chances are you were already reducing the number of your branches. Between the interest rate environment over the past several years, the increase in digital spend, and the quest for greater operating leverage, banks can no longer afford large branch structures and still return their cost of capital. Recent studies now suggest a lower probability of a COVID-19 vaccine and a much lower probability of achieving herd immunity, at least over the next three to five years. As such, most every bank will be forced to rethink its branch strategy.

Recent Vaccine Data and A Thought Experiment

Last week, a study from King’s College of London of 90 patients found antibody levels peaked three weeks after symptom onset and then declined. In the first month, 60% of the patients maintained antibodies after four weeks, which dropped to 17% three months later. A June 18th released Chinese study of 74 patients out of Chongquing University, a branch of the Chinese CDC, showed 90% of patients showed a sharp decline in antibodies after three months.

It is important to keep in mind that all the success to date in early trials has been to answer the questions – Is the drug safe and does it confer antibodies. At present, no vaccine has completed Phase 3 trials to help answer that question (we track it HERE).

While both studies are far from definitive and our experience with Covid-19 is to new to conclude anything, if true, these studies point to a lower probability of coming up with a vaccine and a lower likelihood of achieving any herd immunity.

As an intellectual thought experiment, you have to ask yourself now – what happens if we never come up with vaccines and therapeutics to lessen the impact of the infection are also delayed? What would the world look like, and what probability should be assigned to this scenario?

We are guessing here, but if the probability of both coming up with a vaccine and/or achieving herd immunity within five years was 90% before, given these studies, that probability has likely decreased to 80%.

Banking in A Non-Vaccine World

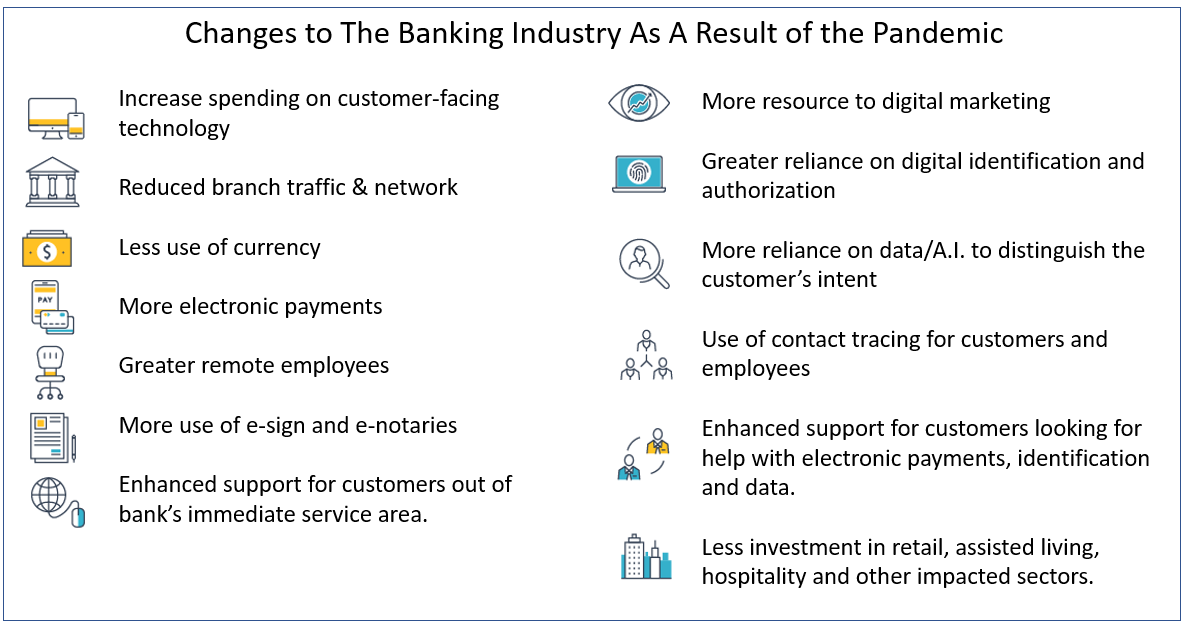

If life, as we used to know it, is permanently changed, what would it look like for banks? It is a unanimous assertion that the current pandemic has sped the adoption of financial technology by both banks and customers. The longer the pandemic goes on, the more this trend is accelerated, so by next year, almost every bank in the nation would have increased their customer-facing technology spend to protect their business model.

Of course, there will be many other changes, including fewer payments, more working from home, more middle office technology to support the customer and bank processes, plus more help for our clients to adjust. Most of these changes add up to a more agile and digital world.

These changes also mean that we need fewer physical branches and less square footage than we thought before the pandemic.

Fewer Branches Than Before

Several years ago, many banks had a goal of consolidating branches to achieve $100mm in deposits in each. Now, with rates low and the yield curve flat, banks are having to rethink that rule of thumb and go back to trying to achieve an 11% risk-adjusted return on equity or higher at each branch. Below that, and a bank’s capital should be deployed elsewhere or at least returned to the shareholders. The more branches a bank has below 11%, the faster they go out of business and be forced to be sold.

The real problem comes up in that as of last year, of the approximate 87,000 branches in our industry, only half of them produced over an 11% risk-adjusted return at a time when risk was lower. If you remove credit card, mortgage-centric, and specialty banks, only about 40% of banks produced over that amount.

Now, if you take our current lower rates, the dramatic increase in credit risk, and the reduced expected branch traffic going forward, our projections show that only about 31% will produce over the cost of capital. The average risk-adjusted profitability of a branch will likely fall below 3.35% for the next year. If this pandemic does not abate, that level of profitability could be the new normal for the next several years.

Putting This Into Action

Now, we can’t see the future and have no idea what will happen over the next several years. However, most every industry expert will agree there is at least some material probability that interest rates remain low, credit risk high, and branch traffic depressed. If you don’t like our number, we encourage you to come up with your estimate, but our point here is that it is now a materially enough probability where banks have to start drawing up contingency plans.

If we are right and the average branch only produces a 3.35% risk-adjusted return, then it means our industry needs a whole lot fewer branches to the tune of about 60% less. Fewer branches mean more scale and less operating cost, thereby restoring your bank to an equilibrium where your growth can continue to attract the capital it needs.

There is also the aspect that you don’t want to be the last bank selling its branches as the market price of branch real estate will likely be trending down for the next several years. Real estate price weakness will probably also be at a time when the regulatory requirements of selling a branch in a new Presidential administration will likely be increased.

As you start on your strategic plan this quarter, take a look at your branching strategy with a jaundiced eye. Even if you think a vaccine and therapeutics will be here by the first half of 2021 and all will return to normal, there is significant evidence that branch profitability will not.