What We Learned from AI Trained on Treasury Management

It was back in 2014 when researchers at DeepMind directed their nascent artificial intelligence application to the game Breakout. Instead of programming DeepMind on how to play the game, the researchers programmed DeepMind to learn about learning to play the game. That is a meta-level that isn’t normally programmed, but the result of that effort, combined with many others, was in the back of our mind when we turned some artificial intelligent tools towards customer data. Like the 1980’s arcade game, the result was surprising and lays the construct of how bankers and machines will collaborate in the future.

Getting The Last Brick

The technology conference was called The First Day of Tomorrow, and DeepMind (subsequently bought by Google) demonstrated their creation. The program took control of the video game’s paddle and randomly shifted it around, hoping that it would connect to the square ball on the screen. If the ball hit the paddle, it would then bounce up to a brick above, and the brick would disappear. Each brick represented a point, and the goal was to try to eliminate all the bricks and make it to a faster-moving level. Of course, hope and randomness are human traits and were attributes given by the audience to make sense of what this alien intelligence was doing. DeepMind was beyond that.

DeepMind tested each position on the screen and, within a couple of minutes, hit its first ball. The crowd went crazy.

After 30 minutes, around its 200th game, DeepMind was still missing the ball three out of four times. This was a learning curve that was much shallower than your average teenager trying out Call of Duty for the first time. However, after an hour of playing, DeepMind was just getting going and then never missed the ball.

During that hour, DeepMind was also processing in parallel the optimal way to take out each brick. While most players start by taking out layer after horizontal layer, DeepMind would work the sides of the wall focusing its efforts in a vertical breakthrough. By the end of hour three, almost all the human knowledge as it pertains to Breakout was now learned by DeepMind. The program was now teaching humans how to play as onlookers learned that the left side of the wall is weaker than the right due to a programming flaw. DeepMind wasn’t done.

The program then took its Breakout knowledge and applied it to the other 49 Atari video games, quickly beating humans in more than half of them. As a learning process, hope and randomness were both vanquished.

The Deeper Meaning Of DeepMind

Now playing the perfect Breakout game may not seem like an achievement, especially when you consider IBM’s Deep Blue past success in chess, but it is. Where Deep Blue achieved its victory over Grandmaster Garry Kasparov by computational brute strength, DeepMind mastered Atari games by intellectual elegance. What it learned from Breakout, it applied to Fishing Derby and then to Centipede. Where Deep Blue was specialized, DeepMind handled a variety of games. DeepMind developed problem solving ability more akin to human intelligence.

Ironically, it was Ms. Pac Man and Gravitar, two games easily mastered by a ten-year-old, that DeepMind struggled with due to the sheer number of potential outcomes that eclipsed the program’s historic learning horizon. However, a couple of years later an updated version of DeepMind, Alpha Go, combined DeepMind’s learning ability with Deep Blue’s computational engine and time horizon and soundly defeated Lee Sedol, one of the best players in the world at one of mankind’s hardest games – Go.

Onto AI in Treasury Management

Unsupervised machine learning, like the game changers before it – mechanical leverage and electricity – will be applied to one endeavor after another. Already surpassing static algorithms, reinforced machine learning (similar to DeepMind) and neural networks are already protecting banks when it comes to fraud and cybersecurity protection.

After testing artificially intelligent “robo advisors” for wealth management, we were impressed not only with the sum of knowledge contained in these programs, the ability for these programs to learn current market conditions but to learn about our evolving goals. Where a good financial advisor likes to update their client’s goals once a year, modern-day robo advisors are constantly both updating and validating their client’s goals.

We wanted to take these same machine learning techniques and apply them to the problem of how we can make our customers smarter.

Smarter Cash Management

While machine learning has been successful in fraud detection, cybersecurity, and credit for almost a decade helping businesses manage their cash balances is a relatively new effort in banking.

Banks can now easily purchase artificial intelligence on a pay-per-use basis akin to warehouse space, electricity, or digital storage. While banks can purchase standalone programs, they can also subscribe to a “platform as a service” vendor such as Amazon, Microsoft, to Google. At $100 to $1,000 per month (based on transactions analyzed and computational time), these applications are relatively inexpensive and moderately easy to use, requiring little programming knowledge.

Loading in several years’ worth of monthly financial statements yielded interesting results. Largely, short-term assets and liabilities are not being actively managed for the average small business. By applying machine learning to cash inflows and outflows, we learned that a business could increase its cash balances by an average of 15% and probably closer to 30%. In a low-interest-rate environment, this may not much matter, but for a growing business that investment alternatives include having enough excess cash to invest in more revenue-producing assets like machines, human capital, and real estate; those excess cash balances can save a business from raising more expensive equity capital.

The Biggest Lesson – Cash Flow at a Higher Level

By far, the largest lesson learned in analyzing the output of artificially intelligent data analysis was the true cost of payroll. Most businesses have never questioned processing payroll on the first and fifteenth of each month. This creates huge artificial spikes in cash outflows for most businesses, and by smoothing payroll out, intelligent cash management applications can better match sales, receivables, and payables to create a more stable cash flow stream.

For example, the application starts to learn cash collection cycle times for each sale so it can recommend a discount within a pricing strategy to increase cash. For businesses that are largely labor based, these discounts are minimal, as by paying certain people at different times throughout the month, discounts can be minimized except when certain situations occur. When a lump sum cash payment is required, maybe a single-day discount can be applied to increase projected cash balances in order to make certain lump sum payroll days.

Combining AI Cash Management with AI-driven Payroll

Within the next year, banks will be able to influence both a business’s cash management and payroll. The bank will be able to optimize both for the commercial customer to achieve the greatest cash flow at the lowest discount. As physical checks often don’t have to be generated, the intelligent payroll application can now understand the requirements from each employee and set their payroll times accordingly. The result is often an increase in satisfaction for both the business and the employee.

Of course, there is more than just payroll to consider (although that was the dominant expense for a majority of the business we analyzed). Similar to discounting the sales side, receivables can also be dynamically discounted so that collections can occur faster than the maximum terms might allow.

For different seasons, different months, different goals, and different industries, cash management monitoring and optimization allows for the personalization and customization of each organization’s cash flow. In testing, municipalities would gain some of the largest benefit from AI cash flow monitoring.

More Accurate Budgeting Through Machine Learning

Artificial intelligence not only helps in re-optimize the appropriate discounts and premiums to solve for maximizing free cash flow but will soon be able to influence marketing so that certain customers can receive more payment reminders, bills, or “pay early for a discount” suggestions. Using this data, banks will then be able to adjust and optimize term loans and lines of credit with the goal of reducing a firm’s cost of capital.

Using all the above data, modern treasury management applications can then ask questions each year to get input from management to then be in a position to automate the generation of budget and cash flow projections to aid in strategic planning. This is can now all be down in a fraction of the time as traditional manual spreadsheet methods and often more than twice as accurate.

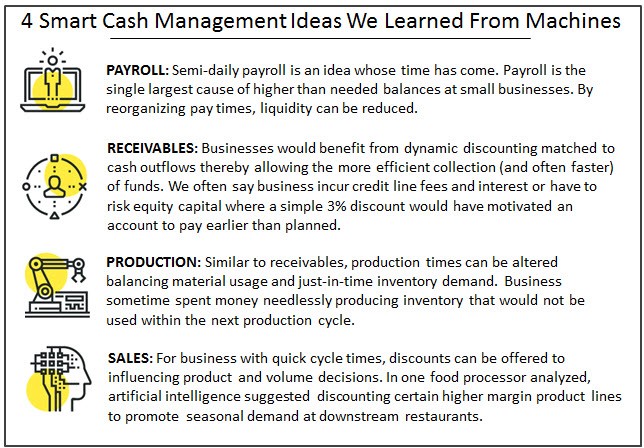

Above is an infographic of four things that consistently came out in the data we analyzed. Of course, our machine learning tools were basic, the time series limited (two years), and the number of businesses (ten) in no way is a representative sample, but the output was conclusive enough to prove the benefits of an application of artificial intelligence as applied to cash management.

As can be seen, managing so many variables on a real-time basis is an effort perfectly designed for machine learning. Not only is the cash flow fingerprint different for every business, but new factors and their relationships to one another constantly change. The influence of gasoline purchasing for product delivery may be a dominant factor influencing cash flow one month, but as we saw in our data, as the cost of energy changed, the importance was decreased over time. The nodes within the machine learning algorithm were then rearranged so that the cost of materials was more heavily weighted.

The Rise Of Machines Plus Bankers

Just like this analysis made us smarter in looking at the cycle times of cash flows, we envision a day that an application can do this with clear recommendations. This is an effort that is currently overlooked by all but the most diligent bankers and thus represents a clear path where artificial intelligence will require a new position within banking to interpret the output and to advise the business on both cash flow and capital.

Banks are in an ideal position to execute on this business model, and we are just a year away from this becoming a reality for the benefit of all small and mid-sized businesses. Banks with this technology will have a clear advantage over banks that don’t and will be able to more easily garner the ever so valuable C&I business with its large cash balances and ability to generate fees from treasury services.

Just as DeepMind learned to master the learning of arcade games, DeepMind, and similar applications can help bankers master all aspects of a complicated business. Artificial intelligence will soon be the single biggest game-changer banks have ever seen. It will reshape all facets of the bank business model from customer advisory, customer management, investments, credit decisions, credit management, pricing, and strategy. It will touch every line of business, and both bankers and customers will be better off because of it.