When To Advise A Borrower To Refinance Their Loan

The most common question we hear from borrowers is, “Should I refinance my debt?” This can be a difficult question for lenders to answer, but as a trusted advisor, every lender should understand the strategy, and the process to answer that question for every client. We will address the knowledge that commercial lenders must have to answer the loan refinance question and provide a free Excel model for lenders to use to help their clients make informed refinancing decisions.

Why You Want To Sacrifice Short-term Margins for the Customer Experience

First, we need to address the elephant in the room. Do you really want your lenders hurting margins and proactively suggesting a borrower refinance – even when not prompted?

The answer is almost always – YES. Helping a borrower lower their rate and refinance their loan is good banking for three very good reasons.

Customers Over Assets and Liabilities: For starters, banks should NOT be in the business of collecting loans or deposits, but customers. The cumulative value on a customer is more than three times more than the cumulative value on any single loan or deposit. When it comes to long term franchise value building, keeping that loan on the books pales in comparison to the mutual value created by keeping that customer on the balance sheet and happy.

Culture: A bank that doesn’t place the best interest of the customer above its own best interest sends a message to the staff that customer well-being has a price. If you can’t be a trusted advisor to the most basic economic analysis a bank gets involved with, do you really expect your customer to trust you with other advice?

Mutual Economics: While refinancing a loan to better terms and conditions is a clear win for the customer, at the loan level, it may still be a good deal for the bank. A higher-interest loan comes with a shorter average life if it doesn’t have existing prepayment penalties. Another way to say this is that if you are not discussing refinancing opportunities, your competitors likely are. In this day and age, banks above $1B in size often have UCC databases available to them that lets them know every borrower (and contact information) that has a loan in a given area PLUS they can easily purchase data that estimates the value of the customer. It is not uncommon for a bank to have a list of customers that can be refinanced right now ranked by order of value to the new bank.

Maybe your bank really does offer better service and have better loyalty than the next bank, but if you lose 25% of your good customers it is not worth it for the small amount of additional margin you would retain. Considering it costs the average community bank $6k to $14k to book a new commercial loan, but only about $2k to $4k to modify or amend an existing commercial loan, and a bank has to forgo three to thirty months of interest and fees while it looks for that new customer, letting good customers go can destroy profitability.

It is almost always preferable to be proactive in discussing refinancing options with existing customers to retain an existing relationship rather than: a) lose the customer or b) play defensive and have to respond to an existing customer’s competing offer.

Lenders must understand the variables that may cause borrowers to consider refinancing options. These variables include the following:

- Any dissatisfaction expressed by the client. We witness bankers surprised that the customer left the bank, but that same customer grumbled for months about the advance rate on the loan, or the interest rate charged, or the structure of the credit.

- Loans that mature within the next few years. Historically, borrowers would not seriously consider refinancing until the debt became current (contractual maturity within 12 months). However, with credit spreads at all-time lows and base rates still only marginally above pandemic lows, more sophisticated borrowers are refinancing two, three, or even four years before their debt matures to secure favorable terms today.

- Clients paying above-market rates. This variable is a tricky one – if your customer is not rate-sensitive (there are not many of those) and is not being courted by other banks (there are even fewer captive bankable customers), then cutting spread is detrimental to the bank. However, if your customer is rate sensitive or has other banking options, knowing where the market is for similar credits and relationships is important, and pricing to market is crucial.

- Borrowers with no, or weak, prepayment penalties. We have written at length about how banks should build prepayment provisions to create one form of switching costs and the current banking environment is showing how important and profitable these provisions are to lenders.

- Customers with loan structures that do not match their asset-liability position. It is important that bankers have the right structure, payment terms, conditions, and maturities for the specific borrower and their personal situation and business needs. Many borrowers will not know or even ask if their loan is the right match for their cash flows, and the liability and assets are appropriately matched for their business.

- Borrowers with low switching costs (no treasury management, wealth management, or investment management services). Customers with only one product with the bank or low service usage are transactional customers and typically refinance more readily.

- Borrowers seeking certainty. During market inflections points, when interest rates and credit spreads are expected to widen in the future, conservative borrowers tend to refinance. This key variable forces borrowers to abandon existing debt and take advantage of market conditions that they perceive to be transitory. We will consider how lenders should approach this variable below.

Seeking Certainty and Market Inflections For The Loan Refinance Decision

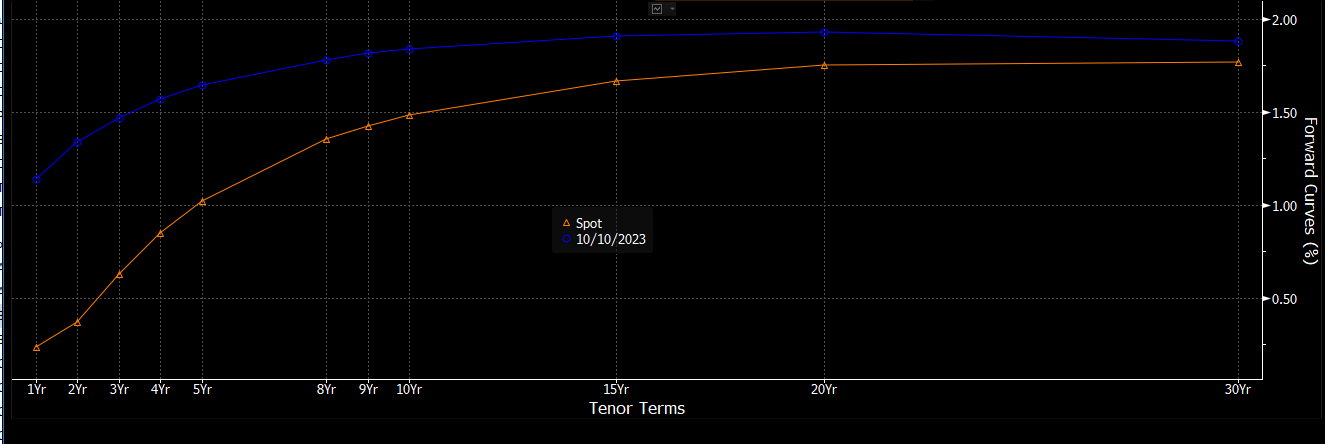

The graph below shows in the orange line the current base rates (SOFR swap rates) from one year out to 30 years. It shows in the blue line where the market expects these same base rates to be in two years. The key takeaway is that while interest rates are low today, the market expects interest rates to increase by almost 100 bps in the next two years at the shorter end of the curve and 65bps in the five-year part of the curve.

Most borrowers do not follow forecasts and do not have direct access to graphs like the one above. But borrowers do follow the news and appreciate that the Federal Reserve is in the process of unwinding monetary stimulus. And, most importantly, other lenders are calling your borrowers and presenting the same information.

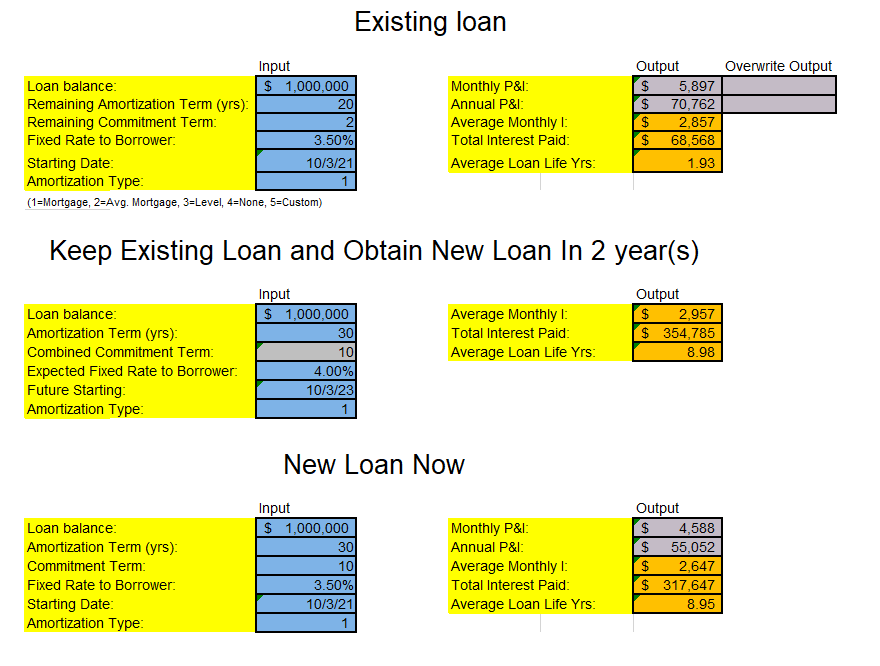

It is paramount that lenders have access to tools that allow them to calculate and easily demonstrate to borrowers the pros and cons of refinancing. Lenders should be able to provide borrowers the calculations to compare interest rates, monthly P&I payments, and total interest paid among various refinancing options and keeping the existing loan and renewing in the future. We have created a simple model that allows bankers to run what-if scenarios to compare refinancing now versus in the future.

The model calculates various output variables such as monthly and annual P&I payments, monthly and total interest payments, and average loan life. The lender can compare the output variables based on the existing debt structure and the market’s expectation for future rates when the existing debt matures versus refinancing now at a known rate.

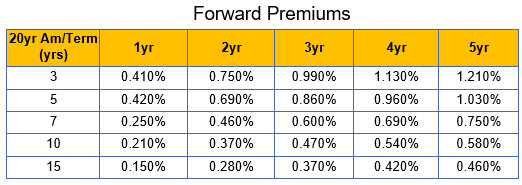

We ran various scenarios through the model using current market-priced forward term premiums (as demonstrated in the table below), and we applied our model using common average community bank loan pricing and structures. As demonstrated in the table below, shorter-term loans have the most sensitivity to forward premiums.

We conclude that many borrowers will be receptive to loan refinancing over the next 12 months as the Federal Reserve decreases bond purchases and proceeds to increase short-term rates. In most geographic regions, for quality credits, and loans over $1mm, our modeling shows that borrowers who have debt with less than three years to maturity or coupons greater than 3.75% are prime candidates to refinance their debt.

Application to Community Banks

Our model (with the outputs shown below) has the ability to run scenarios to compare the borrower’s cost of retaining existing debt and financing in the future based on assumed market rates or refinancing today at known base rates and credit spreads. If your borrower is not getting this analysis from you, they will likely get something similar from a competing institution. We urge lenders to get comfortable having this type of discussion with their clients, and our model is available without charge to any community banker that would like to use it. Let us know via email if you would like the model and we are happy to send it to you.