10 Lessons From The Small Business Banking Conference

Recently, the American Banker hosted their annual Small Business Banking Conference in Nashville, and as always, it was one of the better banking conferences of the year. This conference is crucial because it provides insight into small business banking and has a good mix of essential banking-focused topics with a heavy emphasis on the customer experience. The real reason that this conference makes our favorites list is that this is one of the few conferences where we can learn what the largest and most progressive banks are doing in the market. In two days, you can hear from Chase, US Bank, Capital One, BMO, M&T, PNC, Citizens, Truist, Huntington, and more, a feat that can only be done at a conference of this caliber.

We sat through almost every presentation and took pages of notes. Below, we break down what we think are the 10 most important lessons when it comes to small business banking:

-

Not Falling Into the Recency Trap to Build Deposit Balances

While we wrote in depth about it HERE, the conference was a good reminder about the importance of marketing to customers within seven months after opening an account or purchasing a material product such as wealth management, a mortgage, or a line of credit to build deposit balances and increase profitability. After the seventh-month mark, conversion rates sharply decline. Strike early and often to keep the customer building their relationship with your bank.

-

Every Bank Has a Certain Level of Small Business Banking Channel Confusion

While few said it, almost every major bank implied some level of channel confusion with small business banking as it overlaps with retail, commercial, and specialty lines of business. We asked ten banks how they define small business and where it reports and got different answers. Where there is no correct answer, the takeaway was that the most successful banks have a clearly communicated definition and often meet with their retail, commercial, and specialty counterparts to manage issues and conflicts.

Many banks expressed frustration over keeping small business banking housed within the retail bank channel. However, this was the most common structure. Because the small business segment is smaller and more complex than general retail, banks that house small businesses within retail often find the small business segment under-resourced.

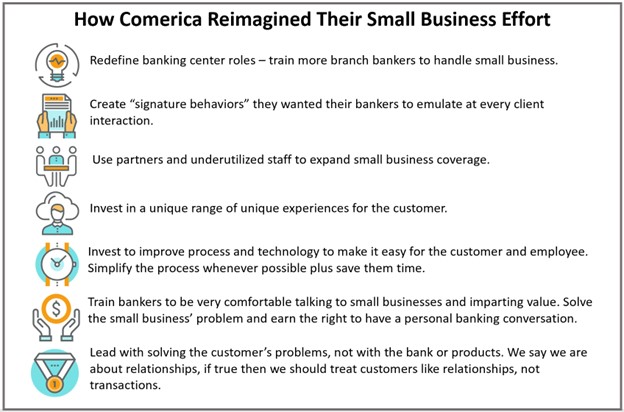

Comerica successfully “reimagined” its small business effort alongside its retail organization by taking the steps below.

-

Small Business Preferences for Choosing a Bank Are Changing

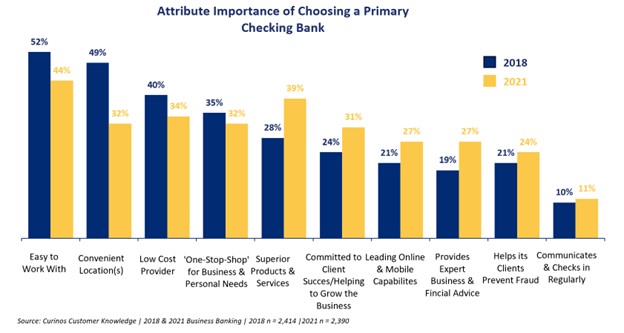

Curinos presented some interesting data about the changing face of small business preferences when opening a transaction account. While being easy to work with, having a low-cost model and having a nearby location remains important, it is less so than it has been historically (below). In recent years, product selection, advisory, technology, and a commitment to help support growth have jumped up in importance.

A critical takeaway from the conference was the changing nature of small business needs and the changing nature of the small bank persona. Now, the average small business owner is 63 years old. This means that the small business owner is nearing an exit and has a unique set of needs that banks must understand and be prepared to meet.

-

Generative AI Will Be Critical to Growing Small Business Relationships

Because of the importance of education and advisory, as noted above, AI and Generative AI, were deemed critical by almost every major bank to support the small business at scale. Retail customers need less advisory, while commercial customers are large enough, profitable enough, and complicated enough to require a human-first approach to managing the relationship. However, because of the needs and scale of small businesses, delivering quality AI was a high priority for every large bank at the conference.

-

Banks are Investing in Core Modernization

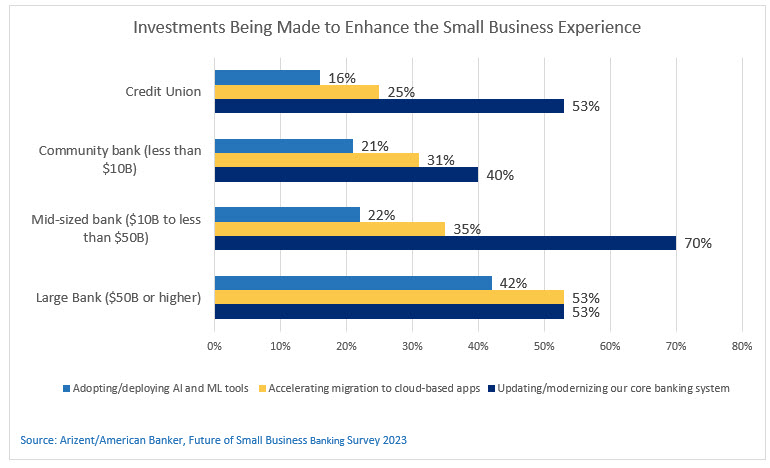

The amount of discussion and investment in upgrading and modernizing the core systems of financial institutions is picking up steam, as evidenced by the data below. The need to reduce cost, the move to instant payments, and the need to deliver more unique products and services are all driving this effort at credit unions, community banks, and mid-sized banks.

-

Areas Where Community Banks Need to Improve

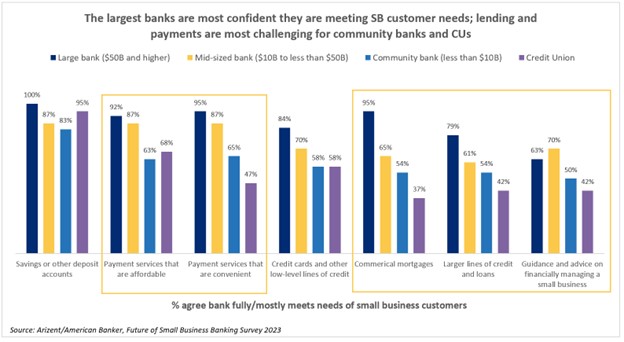

Community banks said they would like to improve payments, credit, and delivery advice, and their confidence in their current product offering is far less than that of national and mid-sized banks (below).

-

Investment in Small Business Banking Technology

One common debate at the conference is whether bankers should support the bank’s technology or if the bank’s technology should support its bankers. The argument is both philosophical and nuanced, but it is critical to understand when deciding on a small business delivery strategy.

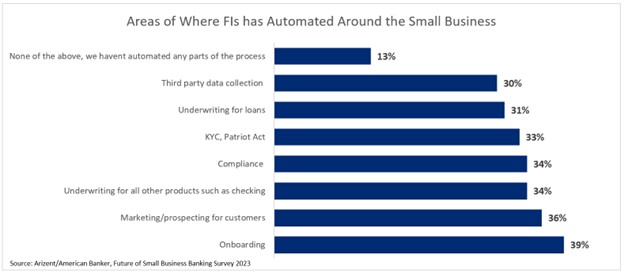

Increasing lifetime value was a common discussion with every bank. However, banks differed in how to get there. Many banks were looking to install more automation to lower operating costs. Other banks focused on the customer experience, while others looked at technology that enhanced cross-selling.

Leveraging technology to solve the Rule 1071 data collection problem was an extensive discussion at the conference, as was how to leverage that data to generate more insights.

-

Whole Banking is a Function of Team Banking

Selling, servicing, and marketing small business banking is expensive because of the complexity. Gaining operating leverage is critical to produce above-average profitability in banking. Suppose a bank creates a successful program to deliver value to the small business. In that case, it should be in an ideal position to capture the owner’s personal business, attempt to reach the employees using a banking-at-work program, and ask for the business from the owner’s family. This “whole banking” approach is popular at larger banks and critical to jumping lifetime value.

To succeed in whole banking, banks need to ensure alignment on channel delivery, marketing, communication, and especially compensation. Making the team accountable not just for segment profitability but for customer success and whole relationship profitability is another best practice at top-performing banks in this area.

When constructing a team approach, most banks find it easy to get small business referrals and engagement from personal bankers. The success factor lies in getting the small business banker engaged and motivated to cultivate the personal business the bank needs to capture.

Currently, many banks miss out on not only the personal banking business but also the opportunity to build a high-performance team of cross-functional bankers and a refined playbook where a bank can routinely successfully go after the whole banking relationship.

-

Traditional Small Business Banking Margins Are Only Going One Way

Small business margins will continue to shrink in traditional products. A bank can build a brand that will slow margin shrinkage down, but it will not stop it. The same goes for technology. Technology will likely boost engagement and cut costs, but other banks will follow, and margins will continue to shrink.

Segmenting the customer base is a successful way to lower acquisition costs while targeting customers with higher profitability. Healthcare and professional firms are the most common customer segments for small businesses. Still, several banks have been successful at going after hospitality, the trades, transportation, realtors, and many others (look for an article on this shortly). Some banks also segment customers along affinity lines such as veteran, woman, or minority-owned businesses.

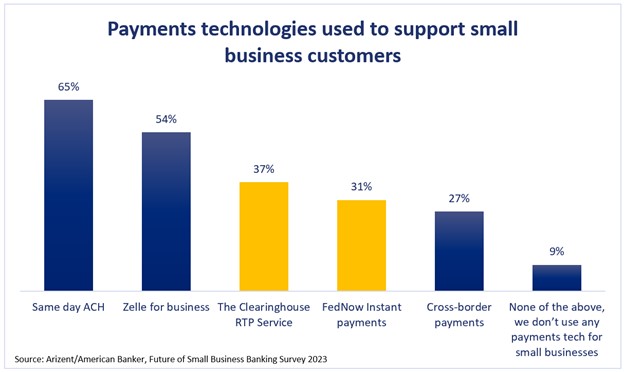

Of course, the way around margin compression is to create successful new products and services that drive engagement and help expand margins. Instant payments, for example, are products that will save the customer time and money while allowing the customer to attach an invoice or receipt to the payment. Electronic lockbox, split payments, requests for payment, managing subaccounts, and the ability to attach electronic invoices/receipts to payments will all generate better margins than checks, and ACH does now.

Bankers need to plan for margin compression in the short term while architecting their bank in such a way as to be able to produce new product offerings quickly and cheaply. This is why so many banks have or will consider a core modernization product.

-

Creating a Compelling Value Proposition

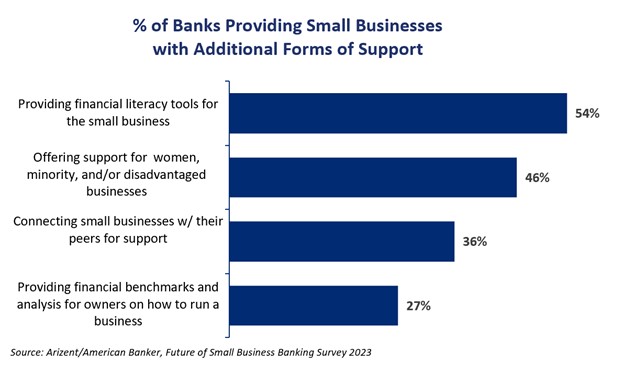

One of the major takeaways of the conference revolved around banks putting more energy into creating and honing more of a unique value proposition for small business. The first job of every small business banker is to build trust with the client. The second job is to impart enough value so the client places the bank and banker in an advisory position. If the business has a problem, will your bank be one of the first three calls ranking up there with their attorney and accountant?

Traditionally, helping with the basics, as outlined below, has been common.

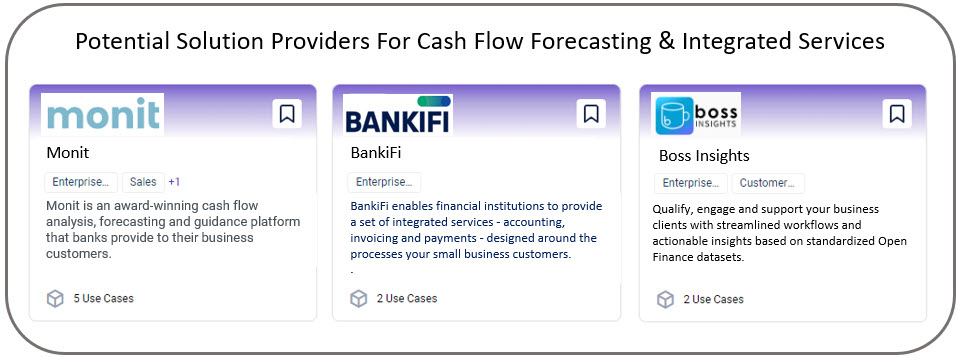

Helping small businesses with their cash flow is currently the most significant arms race in banking. Large and regional banks are now all striving to deliver better analytics and insight to help increase cash flow and help small business optimize their spending timing up to a year in the future.

Chase is imparting an environment focus, Comerica has its small business co-working space, and several banks have advanced integrations into ERP and accounting systems. Several large banks, such as Wells and Bank of America, set themselves apart by being a “one-stop-shop” providing insurance, payroll, and other services.

The future of small business banking is bright, and the majority of the banking industry is just beginning to “reimagine” what small business banking could look like and how to deliver a compelling value proposition.