5 Lessons Using Bank Customer Lifetime Value Data

Banks don’t respect the power of understanding customer lifetime value (CLV). It is the one performance metric with the highest correlation to long-term bank profitability, around 88%. It is more important than margin, cost of funds, non-interest income, and loan profitability COMBINED. Not only do few banks calculate it, but many banks also spend resources destroying CLV without knowing it. This article looks at five ways to use customer lifetime value data to make an immediate difference in bank performance.

What Is Customer Lifetime Value and How To Calculate It

Customer Lifetime Value predicts how much value an individual customer will bring to your bank over time. We have discussed the importance of the CLV metric HERE, or bankers can look up our favorite academic paper on the topic “Counting Your Customers Research Paper 2004” by Fader, Hardie, and Lee at Wharton.

Any bank with an intern and a spreadsheet can get started on CLV. While getting a good data set is different for different industries, for banking, the minimum requirement is to pull transaction data for about 5,000 customers over the course of at least two years. Bankers can start with revenue and just one product, like loans over time, or they can use pricing products like our Loan Command to aggregate a variety of products and calculate the risk-adjusted profitability. This will dramatically improve the model’s fit and power to the point that it will place you in the top 5% of banks for accuracy.

Just having this data in a spreadsheet can provide bankers material insight, but to go further, bankers can append all sorts of other data to the data set and then apply machine learning to it either by using languages like R BTYDplus or Python Lifetimes if someone knows how to code or by using an open-source package such as FoCVS (called “Focus”). It takes about 15 minutes to set up by answering basic questions about the data and then running the model.

Once you have individual values, we like to split them into quantile buckets of 20% so that you now have five quintiles to analyze. This is granular enough to provide actionable insight to immediately impact profitability while not being so granular that it slows down calculation and analysis.

Of course, bankers can pay one of the many consultants running around that can assist with deriving a profitability breakdown. Whatever the method, the first step is to start somewhere and then improve on your methodology. Understanding what customers are the most and least profitable opens up a world of strategies and tactics.

From there, banks can leverage the data to help drive their long-term strategic focus to acquire the people they need to create products and product attributes that grow profitability. Meanwhile, the data can also be used to turn your attention outwards and execute marketing campaigns within specific channels and adjust pricing to meet your short-term goals efficiently.

While customer lifetime value data can unlock hundreds of strategies and tactics, below are five common ones that occur at most banks.

Lesson 1: Better Optimize Your Marketing Dollars For Cumulative Lifetime Value

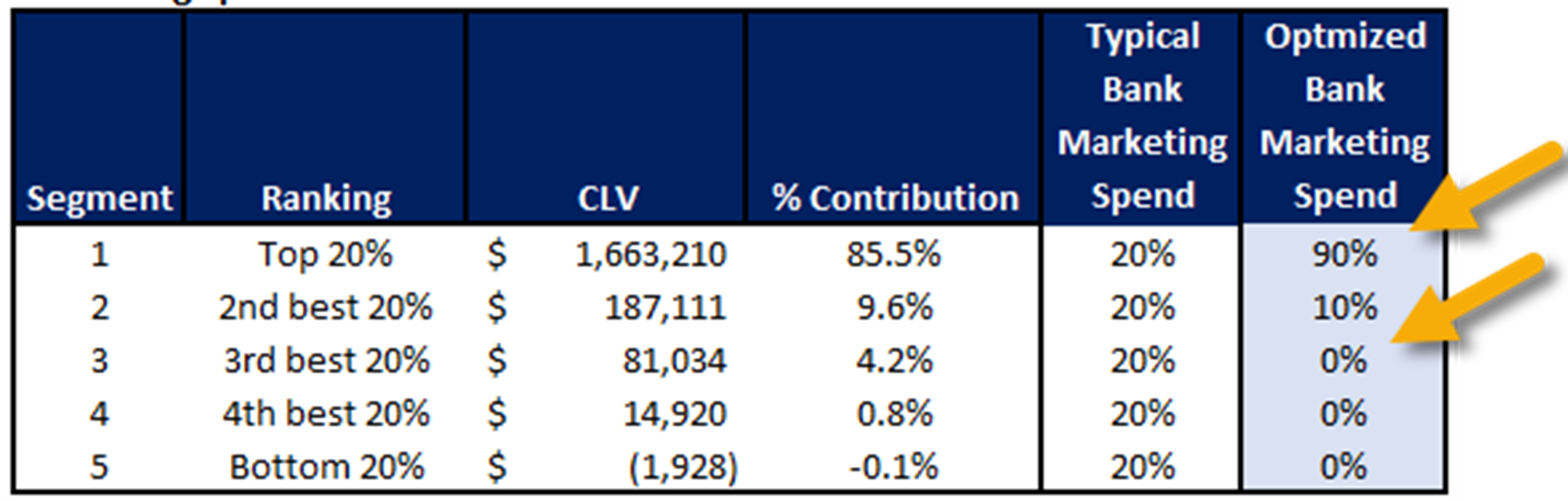

A typical bank spreads its marketing dollars without regard to what its most profitable clients look like. As a result, their dollars get spread evenly, attracting some very profitable customers and attracting some not-so-profitable customers. It is crazy for banks to spend money attracting customers that will detract from value. Yet, it happens every day.

Banks with profitability data can look at their top 20% of customers and ask themselves, “what do they look like?” By understanding a “lookalike audience,” bank marketers can go after them.

Some of the most profitable customers in banking are customers that are legacy businesses where that are family-owned, and they want to pass the business on to the next generation. Some companies are law firms in state capitals that handle political money, some are franchises, while others are businesses that grow revenue and hire in lock step over multiple years. Profitability markers abound, and banks should consider getting more focused on applying their marketing dollars and sales efforts to those specific segments.

Practically, this might mean that when you A/B test a landing page, email marketing campaign, or paid search effort, you look at your overall statistics of what tactic performed better and what tactic performed better for the customer quintile you want to attract.

Banks that can better align marketing dollars to profitability, like the example above, can see their return on investment for marketing go up 2x to 6x.

Lesson 2: Your Message Matters How You Collect Profitable Customers

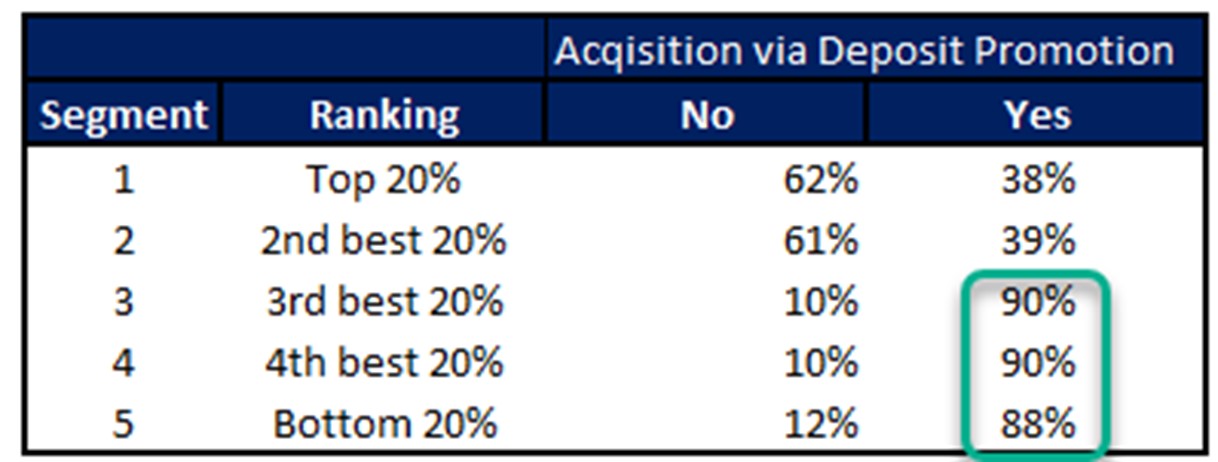

Some banks market without ever looking at the data around if the campaign is effective. Different marketing messages and tactics result in different outcomes. The most common example of this is banks that market for deposits using rates. You might get profitable customers from the promotion, but the odds are against you. Ironically, the odds are for you to attract unprofitable customers per the example below. Thus, if your message is about high-rate deposits, chances are you will grow deposits but not profit.

A bank in New York has displayed deposit promotions online and on the windows of their branches for the last seven years. When you hear their management talk, they pride themselves on their growth. The problem is that they have yet to figure out that they are growing in unprofitable ways. They pride themselves on service, but they have a portfolio of unprofitable customers that they are delivering a high level of service that they cannot afford. As a result, they don’t have enough profit to reinvest in technology to cut costs, and their efficiency ratio is greater than 80%. This bank is on a strategic death spiral as they consistently produce under a 9% return on equity or under their cost of capital. They are growing themselves right out of business with little way out until they change their strategy.

On the other hand, run a promotion on payments, treasury management, sustainability, estate planning, and your campaign would likely skew towards attracting profitable customers.

Lesson 3: Sometimes the Data Doesn’t Tell You Anything, Which Is a Problem

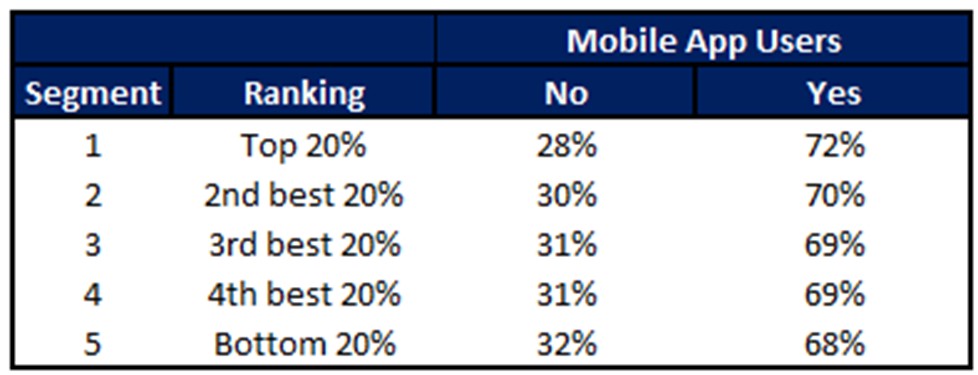

Sometimes you pull data, and where you should find a skew towards profitable customers, you don’t. This should be a tip-off that something is amiss. The most common occurrence is when you look at a bank’s mobile app users. The distribution of profitable customers often looks like the below bank.

A bank with a good mobile banking app should attract more profitable customers to the channel. Why? With a branch in your hand, push notifications, in-app messaging, increased data to the bank vs. other channels, one-touch access to contact information, and your always present brand increases engagement for the average customer, which results in lower customer churn, longer customer lifetime value, and greater profitability.

A well-designed mobile banking app should be used by about 90% of profitable customers that are in the top two quintiles. If you have an even distribution, chances are your app isn’t appealing or engaging enough to your most profitable customers.

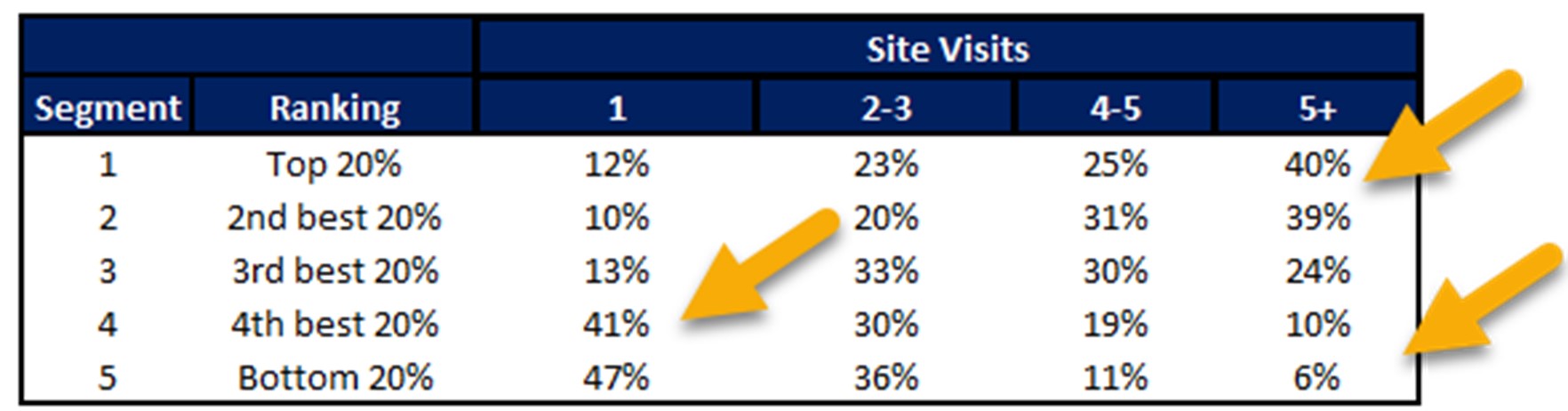

Lesson 4: Site Visits Can Be A Predictor of Customer Lifetime Value

We often say our job is not to gather loans or deposits but to collect customers that care about banking. No matter if it is food, sports, or community involvement, the more you care about a subject the likely, the more valuable you are to that organization. Caring as a marker of profitability is true in banking, and that core concept often goes unheralded.

While there are many ways to find out how passionate a customer is about banking and finance, one starting point is their need to research their bank and products. As a general rule, the more visits, page views, and time-on-page that is spent, the more likely they are to be a profitable customer (below).

The takeaway here is twofold. One, banks need to have rich content, graphics, product information, pricing, and functionality on their website. Otherwise, the data will look more evenly distributed as it did in Lesson 3. The outcome is that those potentially profitable customers will likely migrate to another bank’s (or fintech’s) website for their research.

The second takeaway here is that once a person comes to the website, you can now track them and serve them retargeted ads. You can also provide some value on the website, such as an e-book or white paper, get their email address, and now you know exactly how to get to them actively compared to the passive retargeting approach.

This marketing technique is well-known if you are a fintech or technology company and is central to many of the most successful company’s growth strategies. Despite the data, many banks still don’t invest enough in their website and don’t bother to go after profitable customers that are hanging outside your virtual door thinking about coming in.

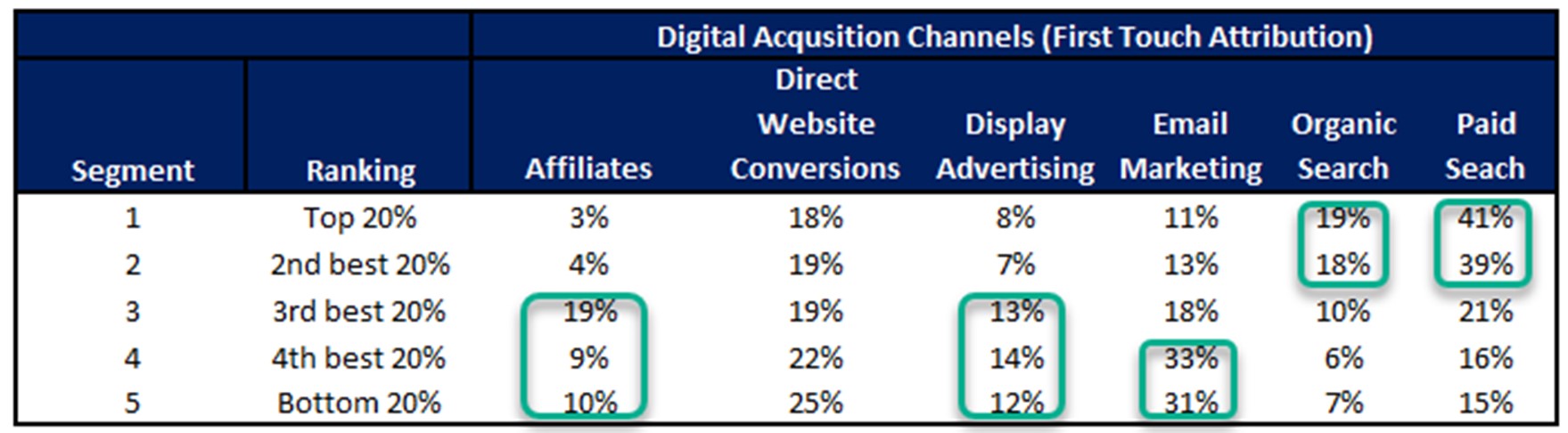

Lesson 5: Your Channels Matter

How you acquire customers tends to matter in banking. A person walking off the street into a branch for products and services tends not to develop into a bank’s most profitable customers. As a rule of thumb, banks need to get prospects with above-average customer lifetime value profiles proactively.

For example, banks can easily track where they get their customer prospect leads through digital channels. Many banks utilize Google Analytics which easily assigns an attribute to the digital channel where the customer first came to know about the bank. Banks often have a profile like the one below when the data is analyzed.

Here, as can be seen, paid search often outperforms other digital channels for the most profitable customers. Paid search can be micro-targeted to attributes that the bank already knows, resulting in above-average profitability. Banks can also personalize the message to attract the most profitable customers. These customers already have intent in that they are in the act of looking for a better banking relationship.

Combining those three factors often makes paid search an ideal tactic for quickly acquiring customers with above-average profitability profiles. In analogous fashion in the analog world, referrals from customers who have known high profitability often result in acquiring a customer with a lifetime value in the top 20%.

Conversely, specific strategies and tactics often result in a higher mix of customers with lower-than-average customer lifetime values. Referrals from partners or affiliates, display advertising, and email marketing all are likely to skew toward attracting lower value customers.

By having this data and knowing this insight, banks can better allocate marketing resources to enhance their mix of profitable customers.

Putting This Into Action

If banks don’t have customer lifetime profitability data, they should start simply and build up their methodology over time. Any data, even if it is just revenue, can be used to identify attributes of your best and worst customers. In due course, banks can add other products, take into account cost, then risk, and then work up to a fully allocated funds transfer pricing model.

Once the data is gathered, banks can start making incremental changes to both improve the quality of customers that are acquired and use product and channel design to make unprofitable customers more profitable. For example, the bank can be more diligent at adding a prepayment provision to its loans, start utilizing a referral program or create a sweep program to automatically repay line of credit draws.

Over time, banks can refine their predictions from the data and customer profiles for enhanced performance. Banks that tend to measure transaction profitability tend to be more transactional focus. Banks that focus on customer lifetime value tend to make long-term decisions concerning customer acquisition, retention, pricing, and client management to build relationship value for all parties.