Helping Borrowers Quantify Volatility Risk

In a recent article (Here), we discussed how lenders might help borrowers decide if and when to refinance debt and why lenders, as trusted advisors, should have a borrower’s best interests as their primary objective. We also addressed how lenders should compare a borrower’s refinancing costs now versus waiting, and we shared an Excel model that allows lenders to calculate the financing costs of each option. While many bankers agree that interest rates are heading higher, a few lenders pointed out that refinancing debt today eliminates the uncertainty of where interest rates will be in the future and the possibility that they will be higher than where the market expects. This article will explain how to quantify the volatility risk that borrowers bear if they do not refinance their debt in the current environment.

Composition of Loan Costs, Including Volatility Risk

Borrowers credit costs are the sum of two components: a) the base rate or the lender’s cost of funding that debt, and b) the spread that lenders require to compensate them for all other costs (credit risk, operational risk, market risk) and to earn a profit.

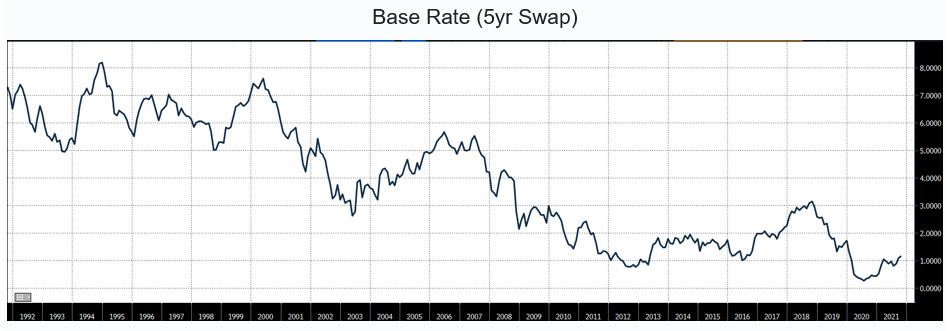

The base rate is best represented by the swap rate, and the 5-year swap rate for the last 30 years is shown below. That rate is currently just over 1.00% and is the lowest it has been over the last 30 years except for the period at the start of the pandemic.

The spread that lenders require to compensate for costs and to earn a profit is determined by individual institutions based on customer relationships, credit quality, profit hurdle, competitive pressures, and many other inputs. However, the best proxy to use for banks’ credit spread is the non-investment grade average spread over the equivalent Treasury yield. That spread, for the last 30 years, is shown in the graph below. It is currently 2.54% (only 34bps higher than the all-time low) and has averaged 2.94% over the 30 year period.

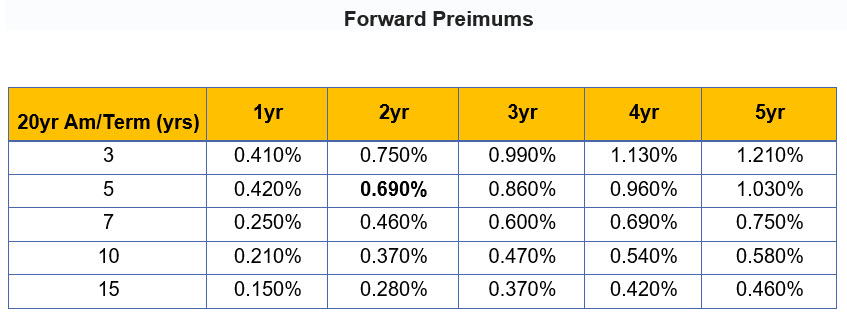

Based on historical averages, both the base rate and spread are extremely skewed to the borrower’s advantage today. The market also expects the base rate to rise over the coming years. The table from the previous blog (copied below for ease of reference) shows where the market expects base rates to rise over the next five years. For example, the market expects that the base rate for a 20-year due 5-year loan to be 69bps higher in two years.

However, while the above table shows the market’s expectation, rates may be substantially higher or lower versus what the market expects. This is where bankers can help borrowers quantify volatility risk. Borrowers that do not refinance now before not just the cost of the expected increase in the future, but also the potential unexpected spike in interest rates.

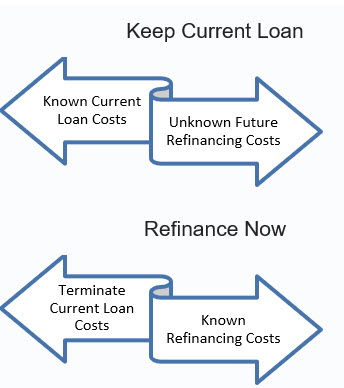

We can measure the possible path of future interest rates by measuring the volatility around the expected mean. That way, we can quantify the borrower’s cost of financing in the future based on the market expected rate and if rates move higher by 1, 2, or 3 standard deviations. Graphically, the borrower’s trade-offs are shown below.

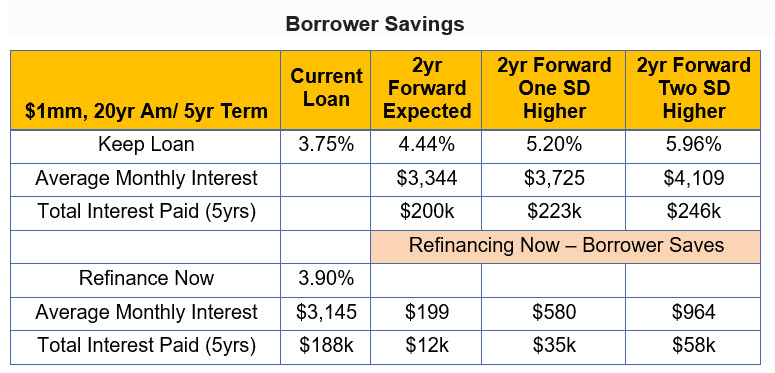

Therefore, while the market expects the base rate for 20 due 5 loan to be 69bps higher in two years, the standard deviation around that expectation is 76bps. Borrowers with two years left on their loan commitment would pay 1.45% higher coupon if interest rates move up just one standard deviation above the expected rate, and those borrowers would pay 2.21% higher coupon if interest rates move higher by two standard deviations. By using this volatility measure for forward interest rates, we can produce the table below to show borrowers the risk of waiting to refinance in the future versus locking in certainty today at historically low rates.

Our modeling shows that borrowers who have debt with less than three years to maturity or coupons greater than 3.75% are prime candidates to refinance their debt. However, borrowers who are rate sensitive, or have minimal excess cash flow to service their debt, would want to avoid the unknown future path of interest rates and lock in their borrowing costs with certainty today – lenders would have a similar motivation.

Application to Community Banks

Using our model and our online pricing app allows lenders to run simple what-if scenarios to show their borrowers where future financing costs may be and how to quantify volatility risk around interest rate movement. While the expected path of interest rates favors refinancing now for most borrowers, the possibility of an unexpected spike in rates could be an important consideration for certain rate-sensitive and cash flow-challenged borrowers.