How To Adjust Your Bank’s Behavior For Inflation

We have published multiple articles, economic bulletins, and podcasts on inflation (including here and here). In this article, we will not make a case for or against the market’s expectation of inflation. We will assume current gauges such as CPI and PCE accurately reflect the current inflation environment (many arguments can be made for why they are not). We will also assume that the market’s expectation of future inflation is an appropriate input to use for financial modeling (and again, many arguments can be made for the irrational nature of the market forecasts). We posit that based on current economic measures and rational future expectations, there will be a significant transfer of wealth and capital from certain lenders to borrowers.

Current Inflation Measures

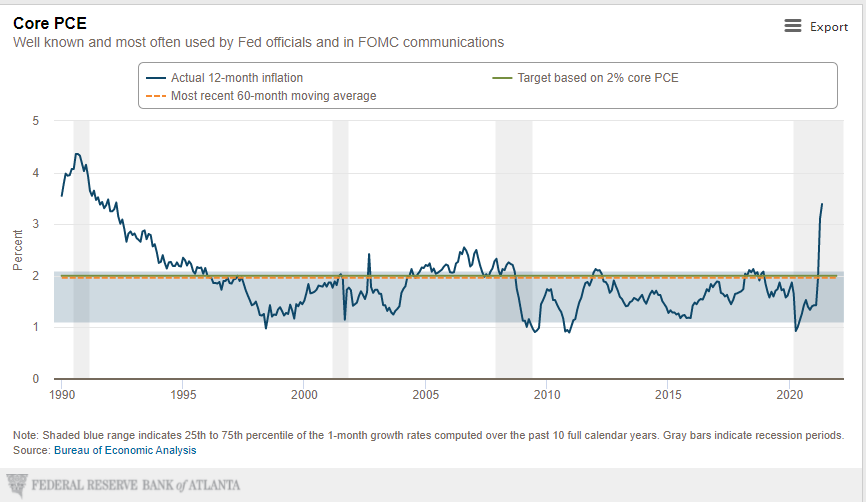

Below is a graph from the Federal Reserve Bank of Atlanta showing the FOMC’s most common measure of inflation – core PCE. The current rate of inflation is well above the recent historical average and is trending up. While some will argue that the current inflation spike and the expectation of higher inflation are temporary, we make note that everything in life is temporary, and a two to five-year period of rising inflation can have a profound impact on many community banks.

Effects of Inflation on Lenders

Lenders must measure real yields on their balance sheets. Inflation decreases real return for lenders, especially on fixed-rate loans. Real yields are equal to nominal yields minus the expected inflation for that period. For example, currently, a 5% yield in USD Treasuries is very attractive, but a 1,000% yield on the Venezuelan bolivar is not attractive given that inflation is expected to be over 5,000%.

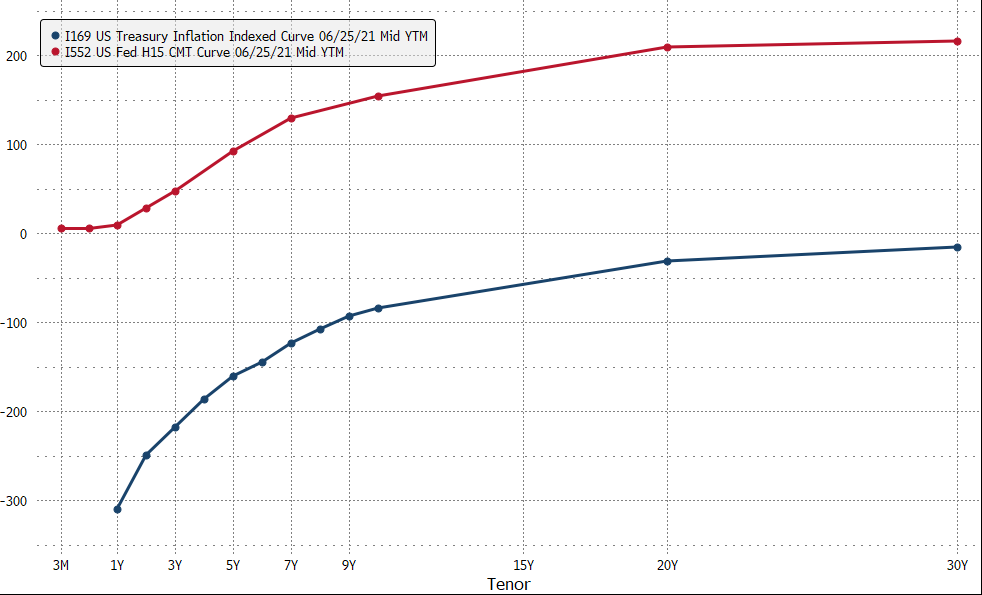

The graph below shows the US constant maturity treasury yield curve in the red line and the real yield based on Treasury Inflation-Protected Security yield in the blue line. The real yield for all tenors is negative, but it is especially negative for the short end of the curve.

This real yield indicates that holders of Treasuries are expected to recognize negative real yields. Now, community banks do not hold a substantial volume of Treasuries, but many loans are directly or implicitly indexed to the Treasury curve. Since the average spread for term loans is only 2.00 to 2.25% over Treasuries, and the average community bank loan is approximately four years duration, the average community bank is expecting to earn a yield of 15 to 40 basis points on a term loan when adjusted for inflation. This is the simple math of the following input variables: 1) a fixed-rate yield that does not adjust for interest rate and inflation movements, 2) higher inflation expectations, and 3) decreasing credit margins. Effectively, banks are pricing their credit far below their cost of capital.

Cost of Inflation to Borrowers

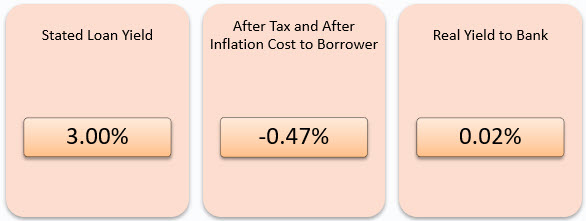

While inflation hurts lenders, it helps borrowers. Borrowers typically obtain funds from the bank at the inception of the credit facility and pay interest and principal over the term of the credit. Because borrowers are paying back the P and the I in nominal dollars, the borrower pays back the same nominal dollar amount they borrowed, but that dollar is worth less in the future than it is today. For example, assume a $1mm loan, amortized over 25 years, with a five-year term, at a 3.00% interest rate (roughly 2.10% over the 5-year Treasury rate), and the current five-year inflation expectation is 2.57%. In simple terms, the cost to carry the loan is 3.00% per year. But this is not the economic cost of the $1mm loan to the borrower. For the following reasons:

- Borrowers are able to deduct interest payments from taxes. Assuming a 30% effective tax rate (between corporate and individual), then the 3.00% stated loan rate is effective after-tax rate of 2.10% (3.00% * (1 – tax rate)).

- Borrowers make P&I payments in the future when the dollar is worth less than it is today. The 2.10% after-tax rate must be adjusted for inflation, and this results in a carrying cost of debt of negative 0.47%.

In summary, the borrower’s cost of debt carry is negative. The borrower in our example is getting paid, in real economic terms, to hold the bank’s funds for five years.

Inflation’s Yield Impact To Banks

In our loan example above, the bank hands over $1mm of cash to the borrower today, and the borrower makes small principal payments and a final balloon payment at the end of the loan. The bank expects to receive its capital of $1mm returned without any inflation adjustment. However, inflation over the next five years is expected to average 2.57%, and this lowers the bank’s real return substantially. While the borrower returns the entire $1mm of the borrowed funds to the bank, the value of the $1mm returned is actually $870k in present dollars (the net present value of principal repaid). The bank has lost $130k in real economic value on this loan.

The bank will earn interest on the loan to offset the cost of inflation, credit risk, operating risk, marketing costs, etc. The entire interest charged on this loan is $141k. But those interest payments are also made in the future when the dollar is worth less, and the present value of those interest payments is only $131k. The bank’s expected real yield is only 0.02% per year – only $1k for the entire term of the loan.

The graph below summarizes the example loan for the bank and the borrower.

Summary

It has been four decades since banks have needed to adjust behavior for the effects of inflation. If lenders do not adjust their behavior, then inflation can redistribute wealth and capital from lenders to borrowers. Inflation is typically a friend to borrowers but a foe to lenders. The easiest way for lenders to avoid the economic erosion of inflation is to minimize fixed-rate lending.