How To Take Advantage of the FOMC Meeting

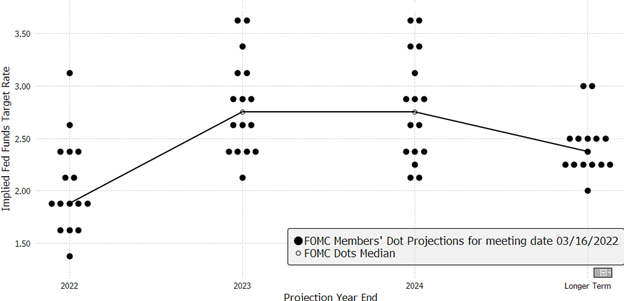

Last week’s FOMC Meeting resulted in an increase in short-term interest rates by 25 basis points (bps) and projected seven rate hikes in 2022 and another four hikes in 2023. The FOMC projects the Fed Funds rate to reach 1.875% by the end of the year and 2.75% next year (see DOT plot below). However, these published projections may misrepresent the members’ forecasts, and short-term rates may be substantially higher than current thinking. The FOMC seems to underestimate the stubbornness of price pressures and will likely need to push borrowing costs higher than inflation to tame it. Banks should not be surprised to see short-term rates at 4 to 5%.

More to Rate Hikes To Come From The FOMC

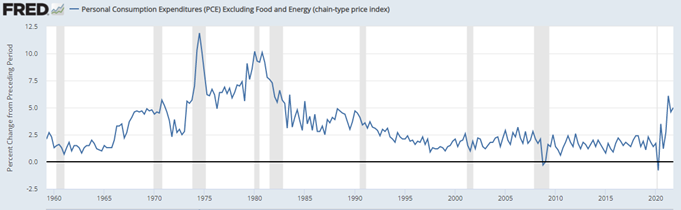

The FOMC can no longer assume that inflation will fade in time, and members recognize that they are behind the monetary curve and far too accommodative. Two members stated publicly that they would raise interest rates in half percentage-point steps but for the geopolitical landscape. Governor Christopher Waller and St. Louis Fed President James Bullard (who dissented in favor of a 50bps move last week) argued for some half-point hikes in 2022. To impact inflation, the FOMC is expected to continue to raise rates until inflation approaches its long-term target of 2.00%. The core Personal Consumption Expenditures (PCE) index (the FOMC’s favorite gauge of inflation) is shown below and is at the highest level in 40 years. The last core PCE reading was 5.20% and is expected to hit 5.50% at the end of this month.

Implications for Community Banks

Interest Rate Pressures

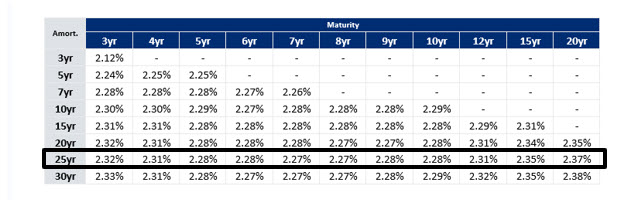

The yield curve is flat and is expected to flatten further or invert as the FOMC increases rates. Below are commercial hedge rates showing the nominal interest rate difference between 3 and 20-year fixed rates on a 25-year am. There currently is no difference between a 5-year fixed-rate and a 10-year fixed rate.

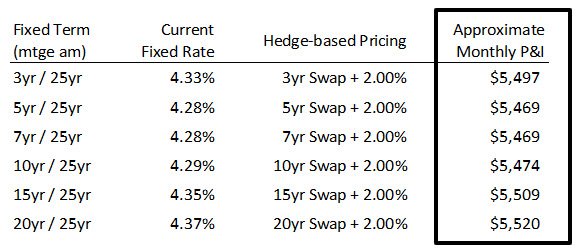

Despite the FOMC meeting move, long-term interest rates are still low by historical standards, and long-term rates are also highly accommodative – meaning that real interest rates are below zero across the entire yield curve (nominal rate minus inflation rate is negative). Below is a quote sheet showing monthly P&I payments for a $1mm loan for various loan maturities. More commercial borrowers will favor fixing rates for as long as possible, and community banks must be able to respond with viable products in order to keep good customers.

Credit Risk Pressures From The FOMC

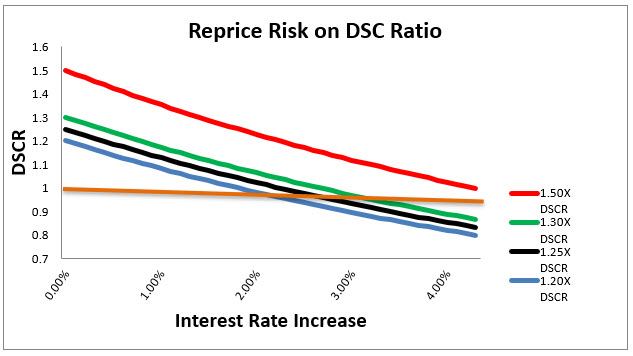

Community banks must pay attention to loans that re-price in the next two or three years. There is substantial refinance risk to borrowers and potential credit risk to lenders. Loans that balloon or re-price in the next few years will do so in a rising interest rate environment. These loans may cause stress to the primary repayment capacity (cash flow).

The graph below shows DSCR for four loans and charts the impact of rising rates on DSCR assuming an increasing interest rate environment. Most banks’ minimum DSCR by credit policy is 1.20X, and under that assumption, a credit that starts at 1.20X DSCR falls below 1.0X cash flow if the loan rate increases by 2.10%. With a starting 1.30X DSCR (the average community bank RE credit), the credit falls under 1.0X cash flow if the loan rate increases by 3.0%. It would take a minimum of 1.50X starting DSCR for a credit to withstand a 4.00% loan rate increase to still cash flow above 1.0X.

Conclusion

For the last 40 years, community banks have competed in a declining interest rate environment. The next few years may look very different for lenders as the FOMC tackles inflation. Community banks should be developing commercial loan products that work well when the yield curve is flat, and interest rates are rising.