Increase Deposits The Easy Way and Get a 150%+ Return

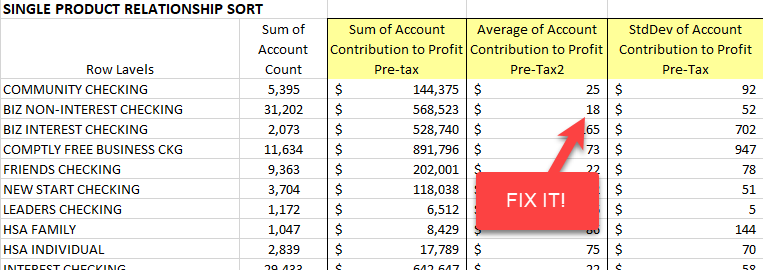

When you are a banker, sometimes your workload doesn’t come in neat memos or emails. A lot of stuff just gets dropped off on your desk with notes to “Fix This” (like below) or solve that. Fortunately, a lot of these problems are easy to solve. In fact, one of the most popular strategic initiatives among community banks right now is the nebulous “Need to increase profitability,” which for more than half the estimated banks is an easy one to solve. It also happens to be that the first quarter is an ideal time for this customer campaign in terms of responsiveness, which is why we wanted to highlight this tactic.

Many banks are unfocused in marketing and weak in the leveraging data. In this article, we will step you through how to improve both to drive dollars to the bottom line this year. Most likely, if you are an average community bank, your greatest area of stored value are those deposit customers that only have one product with the bank. This pertains to both business and retail, as the fix is the same. However, today we will focus on business customers as they tend to be more profitable and can move the needle faster.

The ”Thanks, But” Campaign

We call this the “Thanks, but” campaign, as internally we think about thanking the customer, but asking them for more business. This campaign is targeting existing customers since it is much cheaper and more effective than acquiring new ones. This tactic also holds the advantage of increasing retention and lifetime value regardless of what the customer does. It is likely that for your bank, 10% of your customers produce 85%+ of your profits, which is why this campaign focuses on the top 20% of your customers, as this is the most fertile territory to increase profits.

Here is a four-step process that will fix many of the above problems and is a road map of how to increase profitability.

Step 1 – Get the Data

No need for “Big Data” – it is all about bite-sized information. Here, pull all the customers with just a single product with the bank. Next, sort by balance and then isolate those customers with above-average balances. While these figures vary by geography and bank, for retail non-interest checking, this is most likely a balance above $9,000, and for businesses, it could be north of $30,000. Also, check those customers with a larger-than-average sized CD. You now have a list of customers that: a) Like the bank (otherwise they wouldn’t be there); b) Are likely to have above-average household profitability (as evidenced by the above-average balances; and, c) Only have a fraction of their banking relationship with you (otherwise they may have more than one product).

Step 2 – Contact Them

The sample email/letter, has been tested, and has about an 18% open rate, which is above average (bank average is about 14%). If you can funnel everyone to an online application and marketing landing page, you should get about a 6% click rate (which is also above average). This tends to be higher than if you take the application over the phone or in a branch, but whatever channel this campaign will likely be more effective than your average effort. Overall for this program, conversions should average about 1.1% giving you a healthy ROE of about 50% just on the effort. If you can market to 12,000 business customers, for example, you could pick up 132 of them for almost $10 million in credit. Assuming a 20% usage rate and a 3.5% risk-adjusted margin, that is an extra $70k to the bottom line on what is likely about $40k in the effort (including processing and boarding). That is over a 150% return, but the magic doesn’t stop there.

Step 3 – Profitability and Tactical Line of Credit Use

The reality is that a business line of credit isn’t all that profitable. The maintenance required and the fact that it’s asymmetric in credit risk really hurt profitability. Borrowers tend to draw on the line when credit risk increases and not use the line when credit risk is low. As such, it is not a great product if used the wrong way, but it does have several strong advantages.

One such advantage is that if it is a single product deposit customer (and most are likely to be) a line of credit increases your customer’s lifetime value while in many cases also serving to increase deposit balances as more operating account activity gets added to the bank.

More importantly, you now have the authority and reason to pull the other banking relationships and see other financings. This is an invaluable way to capture information and gives you multiple other campaigns for the future. Of those 132 customers that convert during this campaign, about 40% of these will likely have a banking relationship that is replaceable in the next year. Another 20% are likely to need new financings in the coming year. Thus, Step 3 is to now capture this information in your customer relationship management system (CRM) and design campaigns around it. Chances are these secondary campaigns that will also yield valuable information, further increasing your return on your marketing effort.

It is also worth pointing out that having a credit line and a term facility reduces your overall credit risk so it is worth laying the foundation now. The credit line gives you an early warning system for any term loan outstanding which in turn reduces both your probability of default and decreases your loss given default. We have written more about this, but the net result is lower overall relationship risk and higher profitability.

Step 4 – Review, Analyze and Improve

The final step, of course, is to review, analyze, and evaluate all of the above to refine for the future. If this campaign is executed correctly, the bank should see an increase in products per customer, an increase in operating account balances and an increase in fee income associated with the future renewal of the credit line.

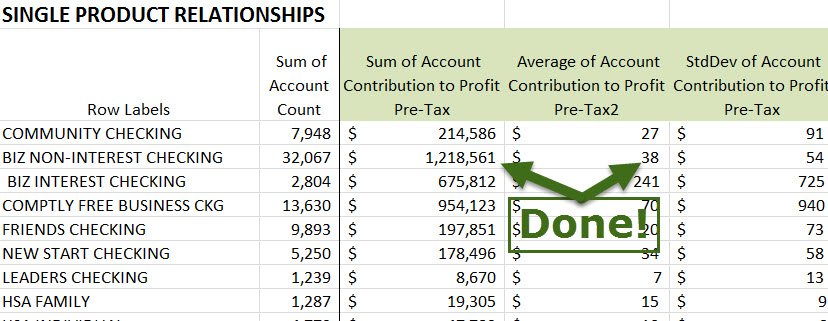

Top performance in banking is doing a lot of little things right. While this is just one idea, a successful marketing program requires multiple campaigns a year in a sustained and consistent effort. This campaign is one of the most effective we have found and combines a smart combination of products, easy to access data, and an efficient marketing channel. Hopefully, the next time the CEO throws some random chicken scratch on your desk and tells you to fix it, you can utilize a campaign like this and respond, “Done!”