Inflation and Managing Loan Duration

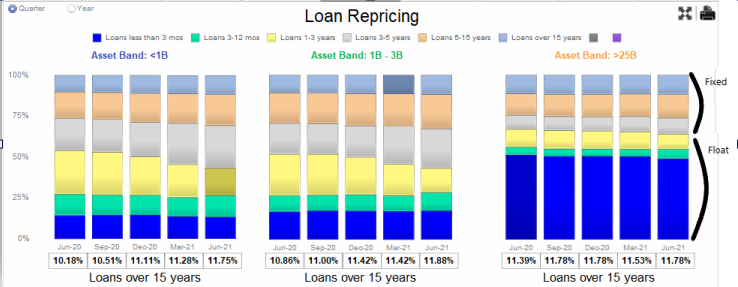

The graph below demonstrates loan repricing changes quarter-over-quarter from June 2020 to June 2021 for banks in three asset bands (under $1B, $1-3B, and over $25B). The top three stacks of the bars show fixed-rate loans that reprice 3-5 years, 5-15 years, and over 15 years. The bottom three stacks show floating and adjustable-rate loans. Smaller banks have been expanding fixed-rate loans as a percentage of all loans over the last four quarters. Larger banks have been keeping fixed-rate loans constant as a percentage of all loans over that same period.

We believe that smaller banks have changed loan repricing composition (increased loan duration) because of a number of factors that include: borrower demand, competition, and reach for NIM. The question is, why are larger banks not showing that same loan repricing composition as their smaller competitors?

Inflation and Managing Duration

We believe that larger banks have not increased loan duration primarily because of risk aversion, especially in anticipation of rising inflation and rising interest rates. Since 1992, the banking industry has enjoyed stable and relatively low levels of inflation. Banks have always been attuned to managing interest rate risk, and that has meant keeping loan payments correlated to COF in order to stabilize NIM. But inflation adds another risk element that many bankers have not needed to consider for the last 30 years.

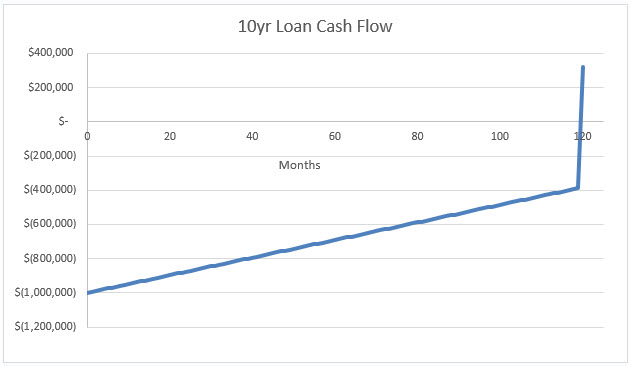

Banks typically transfer cash to borrowers at the inception of the loan and receive interest and principal over the term of the credit. Because borrowers are paying back the P and I in nominal dollars, the borrower pays back the same nominal dollar amount they borrowed, but that dollar has less value in the future than today. The nominal cash flow of a $1mm, 10-year loan is demonstrated in the graph below.

The bank shows a negative $1mm cash outflow at the inception of the loan and slowly and gradually receives the principal and interest over time (positive cash flow). The majority of the positive cash flow to the bank occurs very late in the life of the loan. For this 10-year loan, the balloon payment of $708k in year 10 equals 54% of all cash flow that the borrower pays the bank. In fact, a 25 due 10 loan at a 3.70% interest rate has an average life of 8.63 years (the cash flow is balanced on either side of the loan at 8.63 years). That means that inflation has many years to decrease the value of the loan to the lender.

Quantifying the Impact of Duration on Banks

We ran our model to show the revenue to lenders on a $1mm loan using 5, 7, and 10-years, and at market rates. We calculated the NPV of revenue on these loans assuming inflation averages the current market expected rate, and if inflation is higher than the market expects.

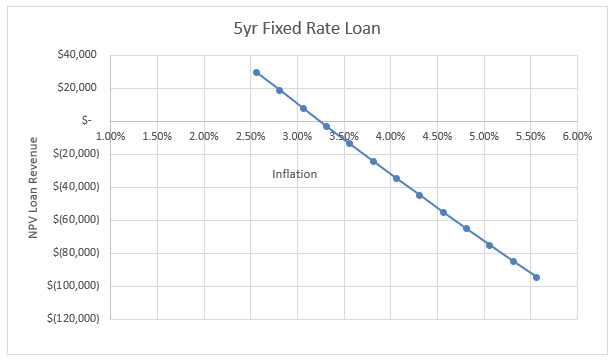

The graph below shows a typical 5-year fixed-rate loan, 25-year amortization, priced at a 3.25% fixed rate. Inflation expectation for 5 years was 2.56% at the time we ran our model. If inflation behaves as expected, the bank’s NPV of revenue for the loan is $29.8k. If inflation is higher than expected by just 68 basis points, the bank earns zero NPV of revenue. Meaning that if inflation averages 3.24% over the five-year period (which is lower than the current rate of inflation), then the value of the loan to the bank is zero.

We ran our model for 7 and 10-year loans, and we were surprised by the sensitivity of loan revenue and loan profitability to future inflation. This sensitivity is high because of the low starting interest rates, tight prevailing loan margins, long duration of term loans, and the pernicious effects of inflation on long-duration assets.

Takeaway for Bankers

It has been a long time since bankers dealt with unexpected inflation, and the muscle memory for that phenomenon is not there. In a rising inflation and interest rate environment, not only do fixed-rate loans become less profitable, but deposit costs rise, and LTD ratios increase, borrowers do not repay their loans as fast, and duration on assets extends. Bankers need to pay attention to the potential for inflation to redistribute wealth and capital from lenders to borrowers, and now is not the right time for banks to extend loan duration.