10 Themes From Money 2020 USA

The spectacle that is Money 20/20 (Money 2020 or M2020) went down last week, and it did not disappoint. Money 2020 is likely the conference with the lowest conference-attendee-to-session-attendee ratio in the industry. While the sessions were interesting, the heart of the conference is all about sales, partnerships, and deal-making. In this respect, 2024 was right at baseline. This year was less exuberant than 2022 (and equal to last year) but more strategic than any year we can remember in the past. It was less shiny objects and more about thoughtful execution of current initiatives. We breakdown our top 10 U.S. banking-focused trends that we saw at the conference.

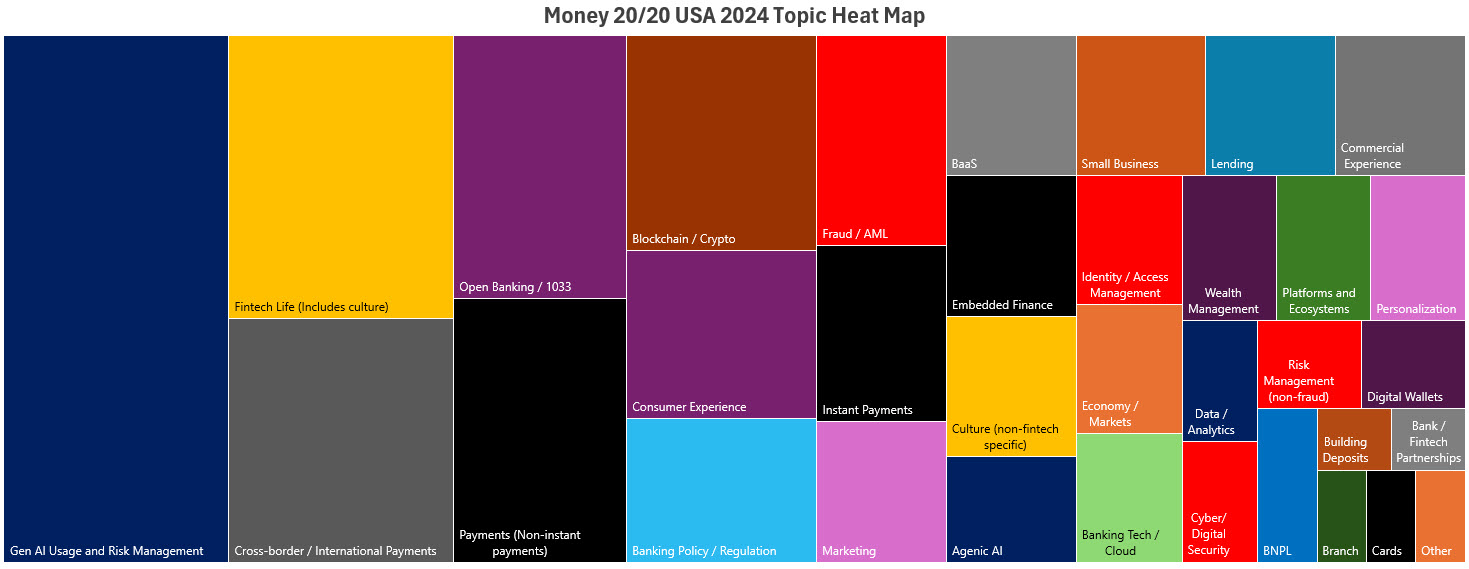

Money 2020 Sessions.

Let’s start with a breakdown of all 184 sessions, less the demos and sales pitches. As can be seen below, the sessions around AI doubled from last year and mostly centered around gen AI. The fintech culture, cross-border payments, open banking (with a new emphasis on Section 1033), and of course, all forms of payments, including crypto, took center stage. Largely absent were sessions on NFTs, cannabis banking, student debt, and environmental/social/governance (ESG), which was a departure from previous years. It should be noted that with the potential of a Trump Administration, crypto had much more of a buzz than last year. Conversations around Stripe’s acquisition of Bridge (incorporating a stablecoin in payments) and Robinhood’s launch of a stablecoin network both created buzz making banks question if this topic should be back for strategic consideration in 2025.

Our Top 10 Insights From Money 2020

From these sessions and announcements, we pulled out ten of our most important takeaways, each impacting bank operations in the coming year. In order of our perceived importance, here is our breakdown:

10. Mature Conversations: The overarching theme at Money 2020 was more “adult” conversations. Except for Section 1033 and speakers still calling themselves “payment nerds” (a trend that should stop), you could sense the evolution of thought. “Out” was the exuberance around banking-as-a-service (BaaS) and the giddiness of gen AI. “In” was the practical reality of where to go from here. Topics around identity, payments, card issuance/acquiring, leadership, and fraud were all more helpful than in years past. The conversations were less aspirational and more about building incrementally.

9. Platform-as-a-Service: The platform providers remain a strong contingent at the show. All were working hard on building scale. Ayden, Stripe, PayPal, Modern Treasury, Treasury Prime, Unit, and others were out in force attempting to disintermediate banks at some level, either directly or indirectly. Many were talking up new features (virtual cards, AI, risk scoring, request-for-payment, analytics, etc.), expanded APIs, better integrations, more white-label user interface components, and multi-cloud strategies. One new feature that caught our attention was the ability to automate bank account closing via API.

8. BNPL: Last year, buy-now-pay-later had the buzz. This year, there were only two sessions on the topic, and it rarely came up in conversation. Where last year, providers and platforms were quick to point out that delinquencies were running half of their credit card counterparts and customer satisfaction was high, no one, it seemed, wanted to disclose the current level or even talk about the level of delinquencies and defaults.

While the general BNPL conversation was largely subdued, the buzz was around Marqeta’s introduction of its “Flex” payment card that can incorporate multiple BNPL providers in a single workflow. Instead of delivering the BNPL choice at checkout, the Flex card can be delivered to the consumer within the payment workflow. Marqeta follows a similar product from Visa that combines debit, credit, and BNPL to provide the needed funds in the cheapest way possible.

7. Instant Payments: FedNow and The Clearing House had to be on more panels than anyone outside JP Morgan Chase. Sure, volume continues to grow, and more banks are coming on. There was very little talk about whether you must get on the instant payment rails and much more about sending, request-for-payment, risk, and product development. More banks were talking about developing products such as pay-by-bank, earned wage access, emergency payment distribution, leveraging directories, and dispute resolution than in the past. More vendors now have robust datasets of instant payments, so there were more options for banks and a better handle on limiting false positives. A common topic of sending banks was around how to better take advantage of The Clearing House’s new 5.0 messaging format to improve the customer experience and limit fraud.

6. AI in Payments: There were sessions around AI and the use of AI agents in almost every part of the payment workflow – onboarding, providing help with originating transactions, orchestration, managing fraud, projecting cash flow, reporting, and providing post-transaction support to customers. One of the coolest developments we saw is “smart invoice payments,” which scans your accounting application and your email in order to rate the probability that the invoice is accurate and ready for payment. The agent looks for evidence that past payments were made, subscriptions were agreed to, goods were delivered, or contracts were signed.

5. Instant Payment Products: This was the first conference where there has been a substantive discussion about how banks will replace wire and check fees using instant payments. Banks started talking about the better use of data for safer transactions for their customers while working on both consumer and commercial customer interfaces. Finally, there were in-depth discussions about the best interface for request-for-payment notifications and whether banks will do this wholly in-app or on a hybrid basis utilizing email and SMS. Banks also talked more about offering earned wage access, dispute resolution, embedded instant payments, cash flow scheduling, pay-by-bank, and industry-specific applications such as residential real estate, healthcare, shipping, and supply chain.

4. Apple Intelligence: While there was no session per se (surprising) at Money 2020, how to leverage Apple Intelligence in banking and payments was a hot topic. Apple’s integration of ChatGPT into Siri and the privacy contained in the device could be important because the AI processor is powerful enough to provide low latency to the user. If Apple can pull this off, then a host of use cases and operations would be born out of Siri, banking/fintech app, and task integration. Better bill payment, bill presentment, loan integration, credit card rewards optimization, and account opening were popular use cases under discussion.

Already, large action models like Rabbit R1 can allow you to pull up a house and get a mortgage quote or take funds out of your transaction account and invest in the highest six-month certificates of deposits at banks with automatic account opening. Apple will now likely build on these capabilities and take them to its 1.4 billion user base.

3. BaaS: As expected, BaaS is being retooled. Last year, Money 2020 fell after the first wave of consent orders was issued. This year, while the industry is waiting on more consent orders, the issues are now ringfenced. As such, the BaaS movement is in the third inning of a restructuring.

The fintechs were all looking to acquire a more diverse set of bank partners while the traditional BaaS banks (now fewer) were working on a combination of client retention and improved risk management. More transparency, better subaccounting, a higher level of daily monitoring, having a program exit plan and better due diligence around for-the-benefit-of (FBO) accounts were common topics both in sessions and at cocktail hour.

Newline (Fifth Third Bank) was the princess of the Ball in the shadow of the belle, JP Morgan. Wells Fargo and Citi were treading carefully, and Silicon Valley Bank was being opportunistic. All these banks were dictating terms, some seemingly too onerous, which was often the subject of cocktail chatter. The rest of the BaaS banks that were not under orders were keeping a low profile, with most deciding not to pick up any new partners. The non-traditional BaaS banks that play in this space were choosing their partners carefully and on a limited basis.

As such, many fintech hopes were dashed by the end of the conference and will have to wait until better standards/guidance emerge (2025), infrastructure emerges (available), and the regulators get comfortable (likely one to two years). Do not worry; there is enough energy, profitability, and innovation to have this party go well into the future. It is just a question of the correct balance of capital allocation, risk, and growth. As Adam Aspes of Jam Fintop points out, banks like Pathward Bank, which received an order in 2011, ended up getting it right and becoming one of the top-performing banks in the country (2024 YTD return on average equity of 45.7%).

2. 1033: Now that we know the details of 1033 (background HERE), this topic was a significant pillar of conversation. Money 2020’s “Sunday Night Live” started off with a standing room only interview with the CFPB’s Rohit Chopra. In response to a question about all the lawsuits being filed around 1033, particularly one from JP Morgan, the Director provided the money line of the conference – “I didn’t read their lawsuit yet and I don’t think they read the rule yet either.” The level of snark brought down the house.

It was confusing to hear that some of these large banks rail against 1033 yet have strategies around open banking, such as embedded finance and pay-by-bank. It was also confusing to hear Director Chopra talk about whether banks could afford to pay Fed funds on transaction accounts or whether the credit bureaus were not serving their purpose. 1033 will create more competition, but the landscape will not look much different. The cost of 1033 alone will further eat into the bank’s already thin operating margin. Most banks do not produce a risk-adjusted ROE above their cost of capital, so it’s not like the industry can afford to get much more competitive.

1. Gen AI Implementation and Agentic AI: Gen AI composed at least 20% of the conversations and 14% of the sessions at Money 2020. Gen AI was everywhere, but we are hard-pressed to call it overhyped. We saw impressive AI in fraud detection that was unlocked by gen AI. We saw graph technology put to practical use, mapping enterprise fraud activity, borrower relationships, and customer wealth.

Agentic AI or intelligent agents, are now the vanguard (more HERE). These bots combine AI, data, gen AI, and the ability to leverage applications through a variety of connections to take action on behalf of the bank or customer. Humans can remain “in the loop” to control the process or “on the loop” to monitor the process. We saw intelligent agents monitor bank earnings calls to pull out critical macro trends, we saw another one pared with accounts payable at clients highlighting transaction volumes that can be moved to a card or other designated payment channel, and we saw another agent that monitored over 1,000 small businesses and suggested lending opportunities in real-time. Anyone who sees this technology will be convinced that the future of banking will be the real-time data connection to clients with these agentic AI bots monitoring risk, credit, payments, and opportunities thousands of times a day.

But it is more than that. ChatGPT released last week their ChatGPT Search that will give Google fits and make banks that conduct keyword paid advertising rethink their strategies. While this was a common conversation starter, many conversations at Money 2020 then turned to how the latest version of ChatGPT o1 (also called “strawberry) will drive these agentic bots. ChatGPT o1 now has the ability to reason with its “chain-of-thought” technique. This is the same application that solved 83% of the Int’l Math Olympiad problems correctly compared to the previous version of ChatGPT that solved 13%.

The implications of this new model are vast. The chain-of-thought technique rewards domain-specific knowledge. Previously, banks were thinking about their gen AI strategy horizontally, deploying a large language model for general purposes. Now, with the ability to reason, banks need to think in terms of “cognitive architectures,” or using a bot that reasons for specific banking purposes.

A bank is a series of processes, data files and specific applications to accomplish a focused tasked such as account opening or loan origination. Each application is painstakingly integrated, tested and put into production. With agentic bots, there is now a layer of cognitive architecture that can accomplish tasks within a set of policies, guidance and requirements dictated by humans in natural language. Banks will no longer need multiple account opening applications or loan origination platforms.

A set of bots will be flexible enough, due to reasoning, to be able to solve an unlimited number of derivations of a use case. An identity bot will grab a KYC bot that can grab a lending bot that will grab a credit bot that will then connect with an onboarding bot. Scale in banking will now increase at a faster rate for all sized banks with this technology that is far cheaper than what is available today.

This conference was also notable in that the gen AI conversation evolved. Very few sessions were on the “wow factor” of gen AI, and there were four different sessions and many conversations about how to govern gen AI on a long-term basis. Compared to last year, there were substantive discussions around how banks should handle ongoing monitoring (some suggested weekly), what a governance platform looks like, and what level of testing needs to be done by banks both at the introduction and then on an ongoing basis.

Unfortunately, we have a way to go and still at the top of the first inning. Many of the gen AI applications we saw felt rushed and lacked support. For example, our most considerable disappointment was these platforms and vendors that incorporate gen AI but do not expose the gen AI engine to an API. Without an API, testing becomes largely manual, which is close to being unworkable for banks. Few platforms also have a notification workflow to alert banks of changes in their model or processing. Without notifications, banks will have to test weekly, which is also unworkable.

Summary

Our summary of the Money 2020 is that gen AI and agentic agents are still underhyped, 1033 is one of the banking industry’s steepest challenges and opportunities, BaaS will be back, and instant payments have yet to hit their stride.

Mark your calendars for next year!