Interest Rate Risk and Your Fixed-to-Floating Rate Mix

For decades community banks have structured fixed-rate loans with adjustable features – the most popular structure is a ten-year fixed-rate loan with a five-year reprice. With short-term interest rates expected to rise through 2022, many community banks are reconsidering their ALCO strategies. What percentage of a community bank loan portfolio should be fixed-rate, and what fixed rate term is optimal for a loan portfolio? In 2022, national banks are especially active in managing interest rate risk by booking floating rate loans and mandating that borrowers fix their rates through a loan hedging program. Community banks must understand the pros and cons of such programs to formulate an effective strategy and retain their competitive advantages.

National Bank Strategies For Interest Rate Risk Management

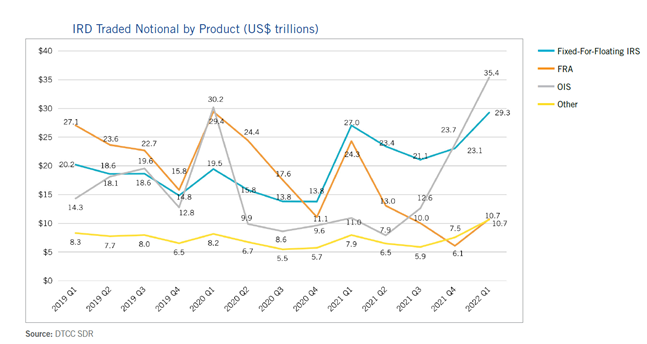

In the first quarter of 2022, domestic interest rate notional and trade count grew substantially (by about 23% over Q1’21). The majority of these trades are related to banks using swaps to convert fixed-rate loan payments to floating. The graph below shows this trend in the OIS (overnight index swap) and Fixed-for-Float trading volume (the blue and gray lines).

The advantage to using a loan hedging program is that it allows lenders to manage their balance sheet independently of how borrowers manage their payment risks. Banks that use these products do not need to pit borrowers’ interests against the interest of the bank’s balance sheet.

Currently, banks are managing net interest margin (NIM) in a rapidly rising interest rate environment. However, at some point in the future, interest rates may fall. When rates are rising, a fixed-rate loan may not be optimal. However, when interest rates are falling, a floating rate loan is not the most desirable for many banks’ balance sheets. Further, a bank may want a short-term fixed-rate loan – possibly one to three years, but borrowers may desire longer commitment terms.

The advantage of a loan hedging program is that a bank can create an optimal duration for its balance sheet, and still make the loan appealing to the borrower. For example, a bank can offer a long-term fixed-rate structure for the borrower but recognize an initial floating rate (an advantage when interest rates are rising), followed by a fixed-rate (an advantage when interest rates are falling).

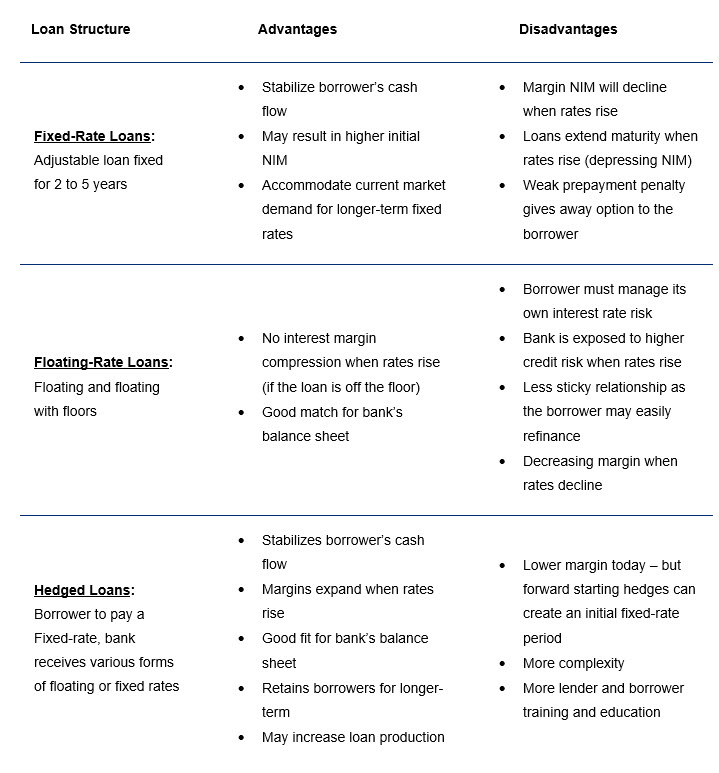

The table below summarizes the advantages and disadvantages of floating, fixed, and hedged loans.

How to Apply to Your Bank

Each bank has a unique balance sheet position and customer demand profile. But community banks should not have to rely strictly on fixed or floating-rate loans and should incorporate some loan hedging strategies in the mix. With bank-friendly loan hedging programs, like the ARC Program that we use at SouthState, community banks can create solutions that work for both the borrower and the bank’s balance sheet and effectively compete against national banks. With interest rates at an inflection point, community banks need to consider innovating their lending programs to manage risks and effectively compete against the national banks.