Use This Lending Tool For More Loans

Because competition is intense and every lender is looking for a competitive advantage, at SouthState Bank, we strive to develop lending tools to help our bankers win more loans. A better product, faster service, or insightful advice can translate into additional loans, better credit spreads, or additional fee income. In this article, we explore our lending tool to help lenders create marketing collateral that drives business.

We notice that many community banks do not have graphic-rich and uniform leave behind materials or professionally formatted term sheets. We have enhanced our website to be a marketing resource for our lenders, and we make it available to all community bankers. Our online proposal generator is an easy-to-use tool that allows lenders to create, save, update, print, and share standard formatted PDF presentations with borrowers. Lenders can also view proposals generated by colleagues to understand market pricing. If you like the idea of an online proposal generator but do not want to use ours, we can also share with you best practices on how to develop your own.

How Our Lending Tool Works

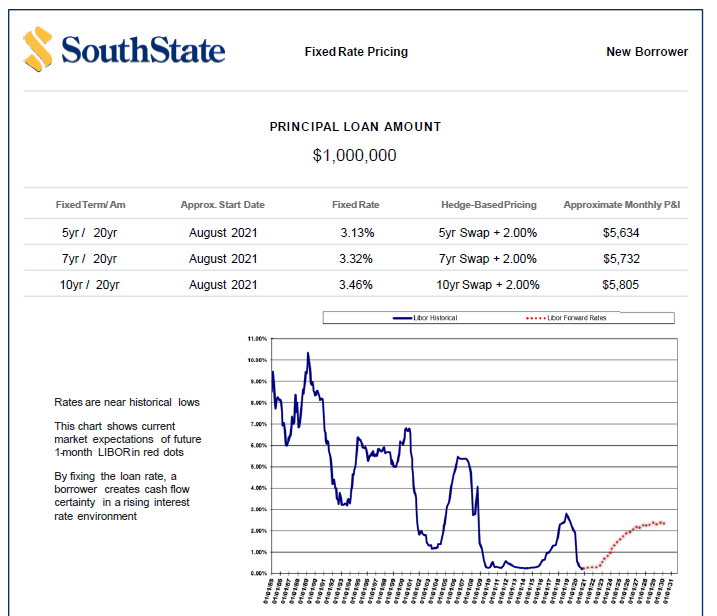

We have created a customizable and downloadable presentation that lenders can use as a marketing and lending tool that can be used with a term sheet or letter of interest. This customized presentation shows pricing options, prepayment scenarios, historical rates, and the market’s expectation of future rates. The customized presentation can be tailored to specific borrowers, loan amounts, amortizations, and terms. It can also be used to show forward starting rates (for construction through the term, or locking in a forward-starting loan). All of this is presented in a professional and succinct format with your bank’s logo on each page.

We chose to create FAQs at the end of each presentation geared at the lender rather than the borrower. The FAQs are not presented to the borrower but create a refresher or learning opportunity for the lenders.

Lenders can save loan opportunities, update pricing in the future, save, send, and share presentations. Each presentation has up to six loan structuring options and various graphs. The one that we built for our ARC program can be found here: https://southstatecorrespondent.com/. A portion of a presentation for our own bank is shown below.

The proposal generator is easy to use. The lender needs to input the loan amount, pricing requirements, structure, starting date, and borrower’s name. With a click of a button, a customized presentation is either emailed or downloaded for the lender to share with the borrower. Rates are updated daily, and the banker can even calculate hedge fees (an excellent way to drive non-interest income).

When it Comes to Lending Tools, Proposals Work

Touchpoints are very important in sales, including loan sales. Every time a lender contacts the borrower, the contact creates an opportunity to demonstrate superior service, impart market information, offer expert advice, or increase mindshare. But borrowers do not typically want to see pages and pages of print. Borrowers want to know where general interest rates are, the bank’s pricing structure, a bank’s loan amortization, and fixed-rate term, where the market expects rates to be in the future, and all of this is best presented graphically. Our customized presentation in PDF format is graphic-rich and straight to the point. A lender can re-generate the presentation as often as needed and share with the borrower (or keep it as a learning tool and store it to file).

Research shows that borrowers find graphics 70% more persuasive than typed information. This means that even when a lender talks to a borrower and presents a written LOI, the chances of a successful sale go up substantially if the lender can deliver a graph-rich PDF presentation with the bank’s logo and customized to the borrower’s name and lending needs. Therefore, having the PDF presentation at the banker’s fingertips anytime they want to generate it and share it with as many borrowers as possible increases loan production.

Conclusion

One of the least costly lending tools your bank can offer lenders is an online loan proposal generator. It is easy to develop, and the ROI is immense. Our customized online proposal generator is available to bankers to use, and we will even train your lending team on how to use it. However, if you decide to create your own, we are available to discuss how we went about creating ours. Community banks should want to see their lenders have access to compelling and professionally constructed presentation material because it leads to a more profitable loan business.